Joliet Illinois Financial Account Transfer to Living Trust: A Comprehensive Guide If you reside in Joliet, Illinois, and wish to secure your financial assets for the future, considering a financial account transfer to a living trust is a wise decision. An essential aspect of estate planning, a living trust ensures your financial accounts and assets are protected and can be efficiently transferred to your beneficiaries upon your passing, bypassing probate. Types of Joliet Illinois Financial Account Transfer to Living Trust: 1. Bank Account Transfer: This type of financial account transfer is commonly used to transfer savings and checking accounts to a living trust. By re-titling the account in the trust's name, you retain control while ensuring a seamless transition of ownership upon your passing. 2. Retirement Account Transfer: To ensure a smooth transfer of your individual retirement accounts (IRAs), 401(k)s, or other retirement accounts, you can designate your living trust as the beneficiary. This step not only assists in avoiding probate delays but also allows for the continuity of investment and tax planning strategies set forth in your trust. 3. Investment Account Transfer: By transferring brokerage accounts, stocks, bonds, and other investment vehicles into a living trust, you can maintain control over your investments during your lifetime while providing a clear succession plan for your beneficiaries upon your passing. This type of financial account transfer not only minimizes the burden on your loved ones but also provides opportunities for continued growth and management of your portfolio. 4. Property Transfer: While not directly involving financial accounts, transferring real estate properties to a living trust is also an integral part of comprehensive estate planning. In Joliet, Illinois, you can transfer properties such as your primary residence, vacation home, rental property, or commercial property to your living trust, ensuring efficient distribution and minimizing the chances of probate. The process of a financial account transfer to a living trust in Joliet, Illinois, typically involves a few steps: 1. Consult an Estate Planning Attorney: Seek the guidance of a qualified estate planning attorney experienced in Illinois state laws to discuss your goals and understand the implications of transferring various types of financial accounts to a living trust. 2. Create or Update Your Living Trust: If you haven't already established a living trust, your attorney can assist you in creating one that aligns with your financial goals and preferences. If you already have a living trust, ensure it accurately reflects your current wishes, or make necessary amendments. 3. Fund Your Living Trust: Work with your attorney and financial institutions to initiate the transfer of financial accounts into your living trust. Specific forms and documentation will be required to transfer each type of account, assuring the legal transfer of ownership. 4. Notify Beneficiaries and Financial Institutions: Inform your beneficiaries about the updated estate plan and the transfer of financial accounts to your living trust. Additionally, notify the relevant financial institutions about the trust's existence and provide them with the necessary documentation. Remember, every individual's financial situation and goals are unique. Therefore, it is crucial to consult with an estate planning professional to determine the most appropriate and legally compliant methods for transferring your financial accounts to a living trust. By taking this proactive step, you can enjoy peace of mind, knowing your assets are protected and your loved ones will benefit from a streamlined estate distribution process.

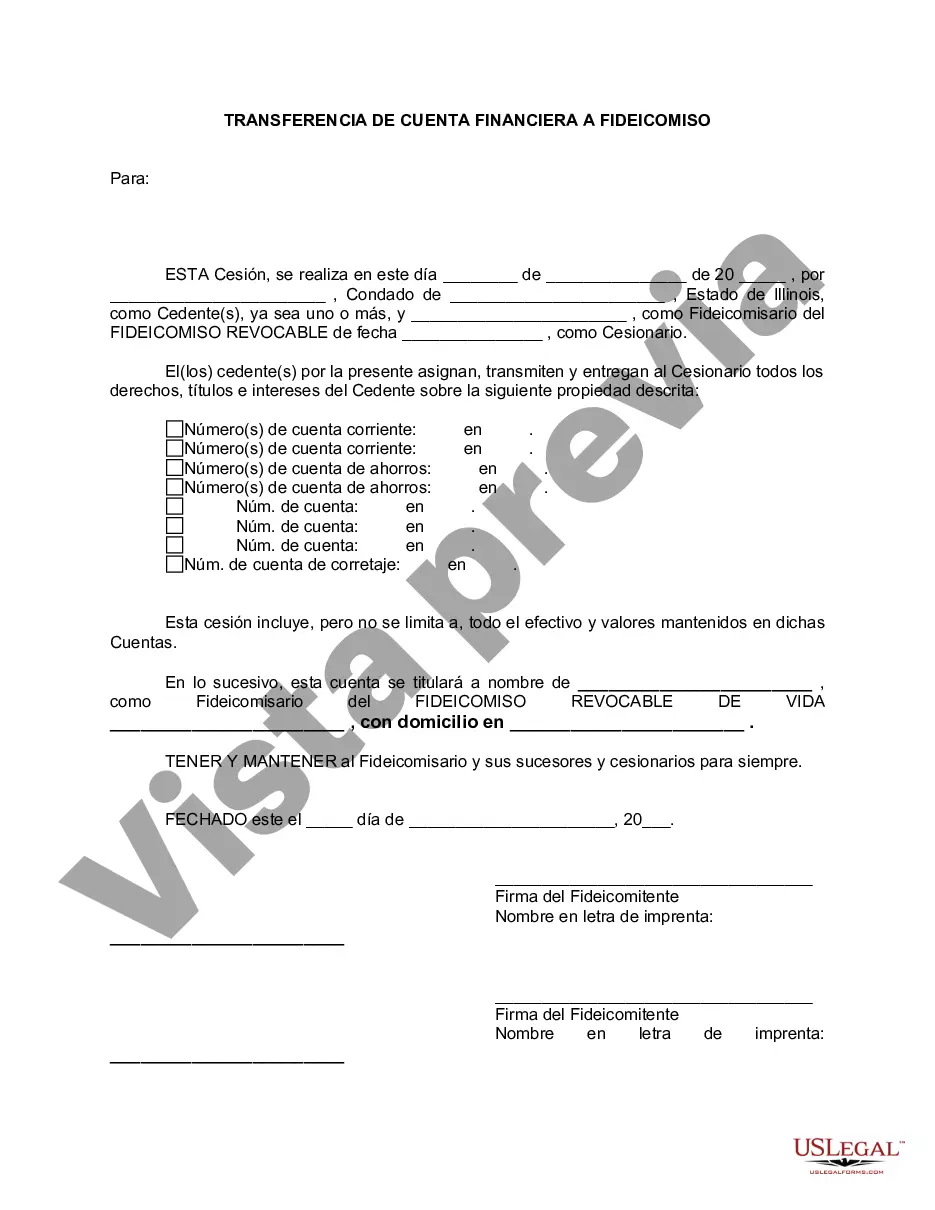

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Joliet Illinois Transferencia de cuenta financiera a fideicomiso en vida - Illinois Financial Account Transfer to Living Trust

Description

How to fill out Joliet Illinois Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Take advantage of the US Legal Forms and have immediate access to any form sample you require. Our useful platform with thousands of templates makes it simple to find and get almost any document sample you require. It is possible to export, complete, and certify the Joliet Illinois Financial Account Transfer to Living Trust in a matter of minutes instead of surfing the Net for several hours seeking an appropriate template.

Utilizing our library is an excellent strategy to raise the safety of your record submissions. Our experienced lawyers on a regular basis review all the documents to make sure that the forms are appropriate for a particular region and compliant with new acts and regulations.

How can you obtain the Joliet Illinois Financial Account Transfer to Living Trust? If you have a subscription, just log in to the account. The Download option will appear on all the documents you view. Moreover, you can get all the previously saved records in the My Forms menu.

If you haven’t registered a profile yet, stick to the instructions listed below:

- Open the page with the form you require. Make sure that it is the template you were seeking: verify its headline and description, and use the Preview feature if it is available. Otherwise, use the Search field to look for the needed one.

- Launch the downloading procedure. Select Buy Now and choose the pricing plan you prefer. Then, create an account and process your order using a credit card or PayPal.

- Save the document. Indicate the format to get the Joliet Illinois Financial Account Transfer to Living Trust and edit and complete, or sign it for your needs.

US Legal Forms is among the most extensive and trustworthy document libraries on the internet. We are always ready to help you in any legal process, even if it is just downloading the Joliet Illinois Financial Account Transfer to Living Trust.

Feel free to benefit from our platform and make your document experience as convenient as possible!