Elgin Illinois Public Sale of Real Estate for Non-Payment of Taxes: A Comprehensive Overview The Elgin Illinois Public Sale of Real Estate for Non-Payment of Taxes is a legal process utilized by the local government to recover delinquent property taxes. When property owners fail to pay their tax obligations within the prescribed timeframe, the taxing authority has the right to sell the property at a public auction to recoup the outstanding debts. This process is crucial in maintaining the financial stability of the local municipality and ensuring the equitable distribution of tax burdens. The Elgin Illinois Public Sale of Real Estate for Non-Payment of Taxes is typically conducted by the county or municipal treasurer's office. The auction is open to the public, providing an opportunity for interested buyers to acquire properties at potentially favorable rates. The proceeds generated from the sale are then used to settle the delinquent tax bills and any additional fees or penalties associated with the process. There are a few different types of Elgin Illinois Public Sale of Real Estate for Non-Payment of Taxes, each catering to specific circumstances: 1. Annual Tax Sale: This type of auction occurs once a year and includes properties for which taxes have been delinquent for a specified period. It is the primary avenue through which the government can recoup unpaid taxes and remove the burden from its books. 2. Scavenger Sale: In cases where properties did not sell during the annual tax sale, they may be included in a subsequent scavenger sale. This sale seeks to dispose of properties that have accrued multiple years of unpaid taxes. 3. Certificate of Purchase or Tax Lien Sale: In some instances, instead of selling the property outright, the government may sell a tax lien or certificate of purchase. This allows interested buyers to pay the delinquent taxes on behalf of the property owner and acquire a legal claim against the property. These certificates often incur interest and provide an investment opportunity for interested individuals. It is important to note that purchasing a property through the Elgin Illinois Public Sale of Real Estate for Non-Payment of Taxes requires thorough due diligence. Prospective buyers must assess the condition and potential value of the property, understand any liens or encumbrances, and be prepared to handle any eviction or outstanding legal issues. In conclusion, the Elgin Illinois Public Sale of Real Estate for Non-Payment of Taxes is an essential process to ensure the collection of delinquent taxes and maintain financial stability within the local community. The auctions provide an opportunity for interested buyers to acquire properties at potentially favorable rates, though proper research and understanding of the auction process are crucial. By participating in these sales, buyers can not only help resolve tax defaults but also potentially secure valuable real estate assets.

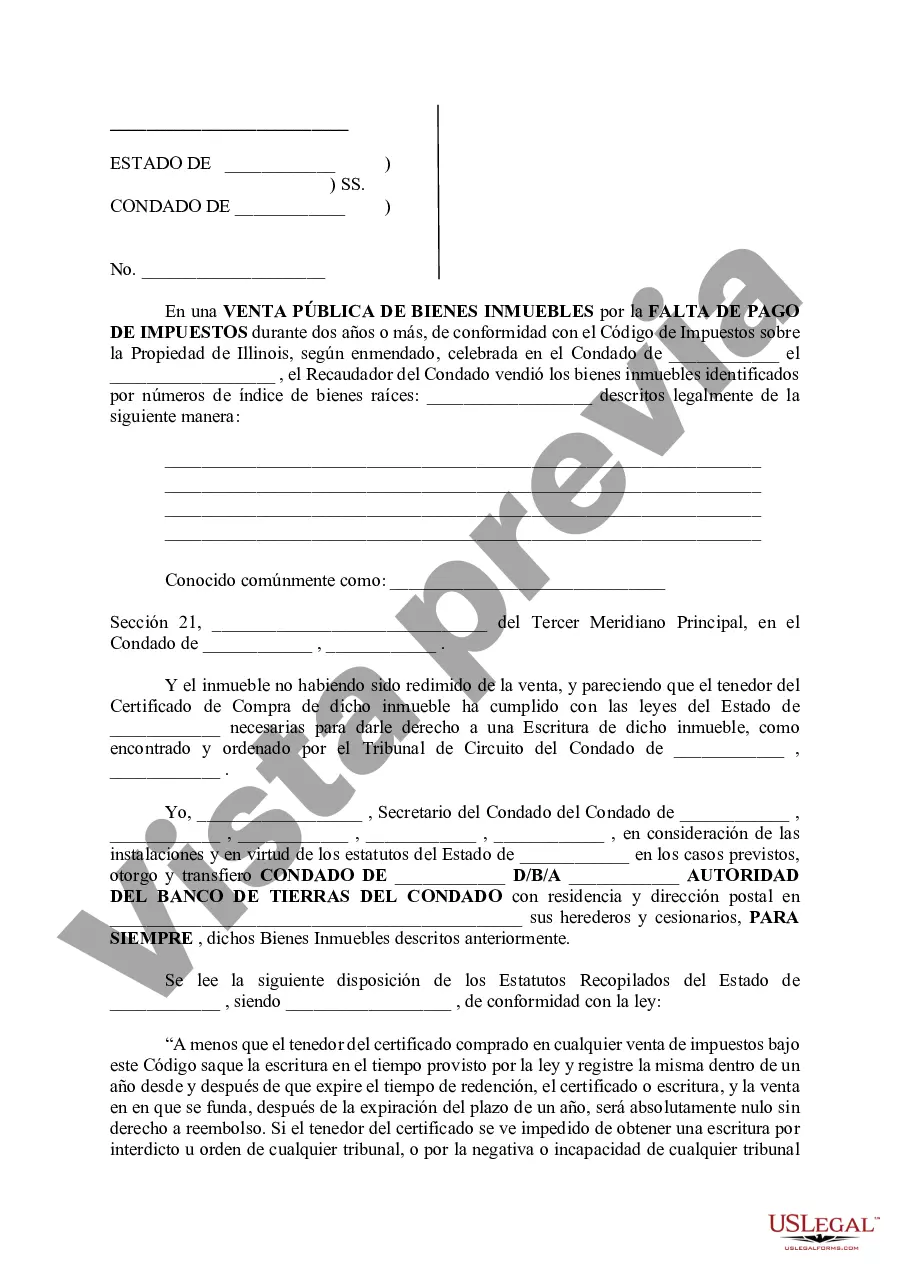

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Elgin Illinois Venta Pública de Bienes Inmuebles para el No Pago de Impuestos - Illinois Public Sale of Real Estate for the Non - Payment of Taxes

Description

How to fill out Elgin Illinois Venta Pública De Bienes Inmuebles Para El No Pago De Impuestos?

Take advantage of the US Legal Forms and obtain instant access to any form template you require. Our useful website with a large number of document templates makes it easy to find and get virtually any document sample you want. It is possible to export, fill, and certify the Elgin Illinois Public Sale of Real Estate for the Non – Payment of Taxes in just a few minutes instead of surfing the Net for many hours attempting to find a proper template.

Using our collection is a wonderful way to improve the safety of your record submissions. Our professional legal professionals regularly review all the documents to make sure that the templates are appropriate for a particular region and compliant with new laws and polices.

How do you obtain the Elgin Illinois Public Sale of Real Estate for the Non – Payment of Taxes? If you already have a subscription, just log in to the account. The Download option will be enabled on all the documents you look at. Furthermore, you can find all the previously saved documents in the My Forms menu.

If you don’t have an account yet, follow the instructions below:

- Open the page with the form you require. Make certain that it is the form you were looking for: verify its name and description, and make use of the Preview option when it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Start the saving procedure. Select Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and process your order using a credit card or PayPal.

- Export the document. Indicate the format to obtain the Elgin Illinois Public Sale of Real Estate for the Non – Payment of Taxes and change and fill, or sign it for your needs.

US Legal Forms is probably the most significant and trustworthy template libraries on the internet. Our company is always happy to help you in any legal case, even if it is just downloading the Elgin Illinois Public Sale of Real Estate for the Non – Payment of Taxes.

Feel free to take full advantage of our service and make your document experience as straightforward as possible!