The Chicago Illinois Notice of Default and Foreclosure Sale is a legal document issued by the lender to a borrower in order to notify them of their default on a mortgage loan, thus initiating the foreclosure process. This notice serves as a formal warning that the borrower has fallen behind on their mortgage payments, allowing them a final opportunity to resolve the issue before a foreclosure sale occurs. The Notice of Default is typically sent to the borrower after they have missed a certain number of payments, as specified in the mortgage agreement. It contains important information such as the outstanding loan amount, the amount of payments in arrears, the due date for the overdue payment, and the steps that need to be taken to cure the default. In Chicago, Illinois, there are a few types of Notice of Default and Foreclosure Sale: 1. Judicial Foreclosure: This type of foreclosure requires the lender to file a lawsuit against the borrower to obtain a court order to sell the property. Here, the lender must provide a Notice of Default and Foreclosure Sale to the borrower, giving them an opportunity to bring the loan current or face a foreclosure sale. 2. Non-judicial Foreclosure: This type of foreclosure does not require court involvement, and instead, the lender follows the procedures outlined in the mortgage or deed of trust. In Illinois, non-judicial foreclosure is not commonly used. The notice period given to the borrower in the Notice of Default is crucial. It provides a certain time frame, usually 30 days, for the borrower to bring the loan current by making all missed payments, including any fees or penalties. This period is known as the reinstatement period. If the borrower fails to cure the default within the given notice period, the lender proceeds with the foreclosure sale. The Notice of Foreclosure Sale informs the borrower of the upcoming public auction where the property will be sold to recover the outstanding debt. This notice includes details such as the date, time, and location of the auction, as well as the minimum bid required. It is important for borrowers to take the Notice of Default and Foreclosure Sale seriously, as failing to respond or take appropriate action can result in the loss of their property. Seeking legal advice and exploring options such as loan modification, short sale, or deed in lieu of foreclosure may help borrowers avoid foreclosure and its potential consequences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Aviso de Incumplimiento y Venta de Ejecución Hipotecaria - Illinois Notice of Default and Foreclosure Sale

State:

Illinois

City:

Chicago

Control #:

IL-LR078T

Format:

Word

Instant download

Description

This Notice is to facilitate greater communication between borrowers and lenders by requiring mortgage servicers to provide certain notices to defaulted borrowers prior to commencing a foreclosure action

The Chicago Illinois Notice of Default and Foreclosure Sale is a legal document issued by the lender to a borrower in order to notify them of their default on a mortgage loan, thus initiating the foreclosure process. This notice serves as a formal warning that the borrower has fallen behind on their mortgage payments, allowing them a final opportunity to resolve the issue before a foreclosure sale occurs. The Notice of Default is typically sent to the borrower after they have missed a certain number of payments, as specified in the mortgage agreement. It contains important information such as the outstanding loan amount, the amount of payments in arrears, the due date for the overdue payment, and the steps that need to be taken to cure the default. In Chicago, Illinois, there are a few types of Notice of Default and Foreclosure Sale: 1. Judicial Foreclosure: This type of foreclosure requires the lender to file a lawsuit against the borrower to obtain a court order to sell the property. Here, the lender must provide a Notice of Default and Foreclosure Sale to the borrower, giving them an opportunity to bring the loan current or face a foreclosure sale. 2. Non-judicial Foreclosure: This type of foreclosure does not require court involvement, and instead, the lender follows the procedures outlined in the mortgage or deed of trust. In Illinois, non-judicial foreclosure is not commonly used. The notice period given to the borrower in the Notice of Default is crucial. It provides a certain time frame, usually 30 days, for the borrower to bring the loan current by making all missed payments, including any fees or penalties. This period is known as the reinstatement period. If the borrower fails to cure the default within the given notice period, the lender proceeds with the foreclosure sale. The Notice of Foreclosure Sale informs the borrower of the upcoming public auction where the property will be sold to recover the outstanding debt. This notice includes details such as the date, time, and location of the auction, as well as the minimum bid required. It is important for borrowers to take the Notice of Default and Foreclosure Sale seriously, as failing to respond or take appropriate action can result in the loss of their property. Seeking legal advice and exploring options such as loan modification, short sale, or deed in lieu of foreclosure may help borrowers avoid foreclosure and its potential consequences.

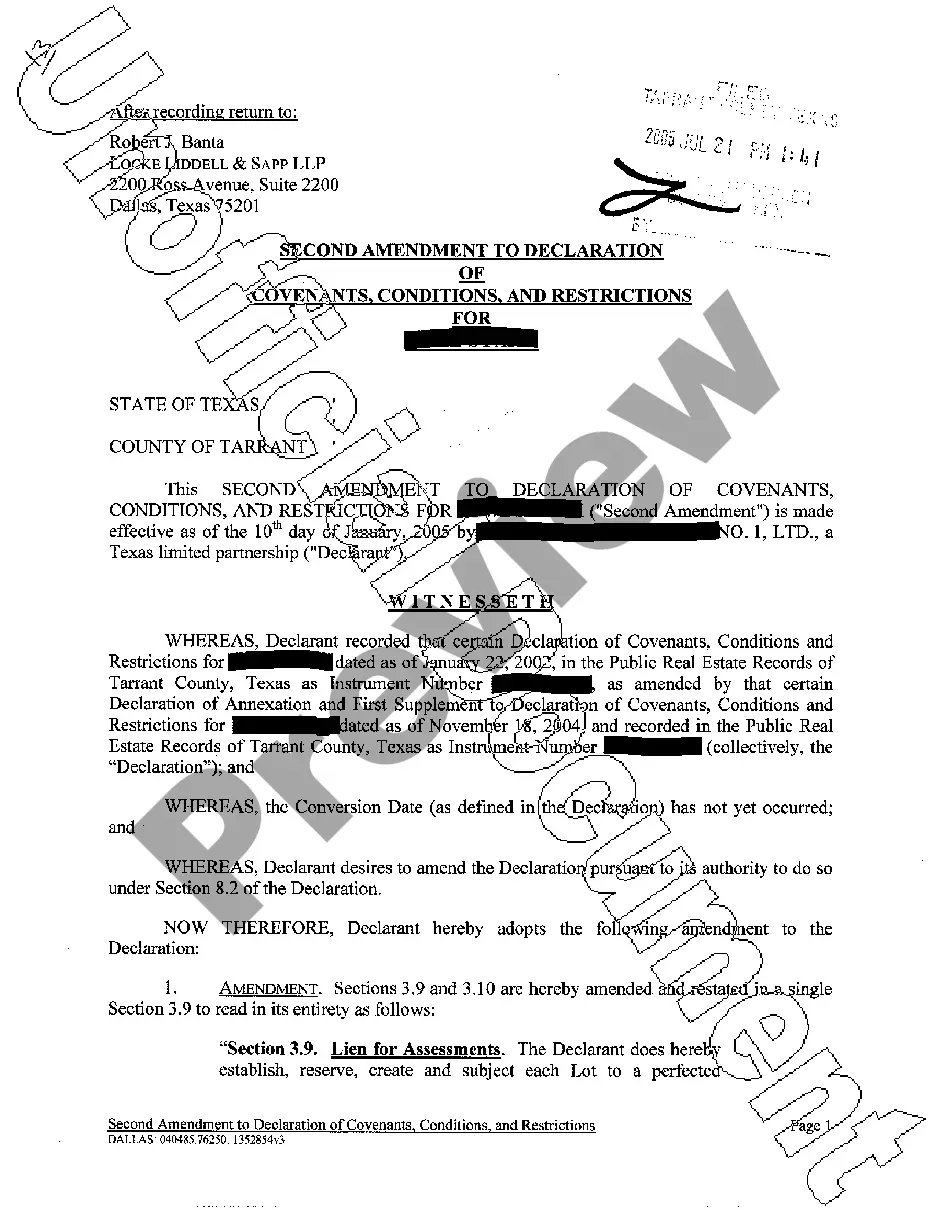

Free preview

How to fill out Chicago Illinois Aviso De Incumplimiento Y Venta De Ejecución Hipotecaria?

If you’ve already utilized our service before, log in to your account and download the Chicago Illinois Notice of Default and Foreclosure Sale on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Make certain you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Chicago Illinois Notice of Default and Foreclosure Sale. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!