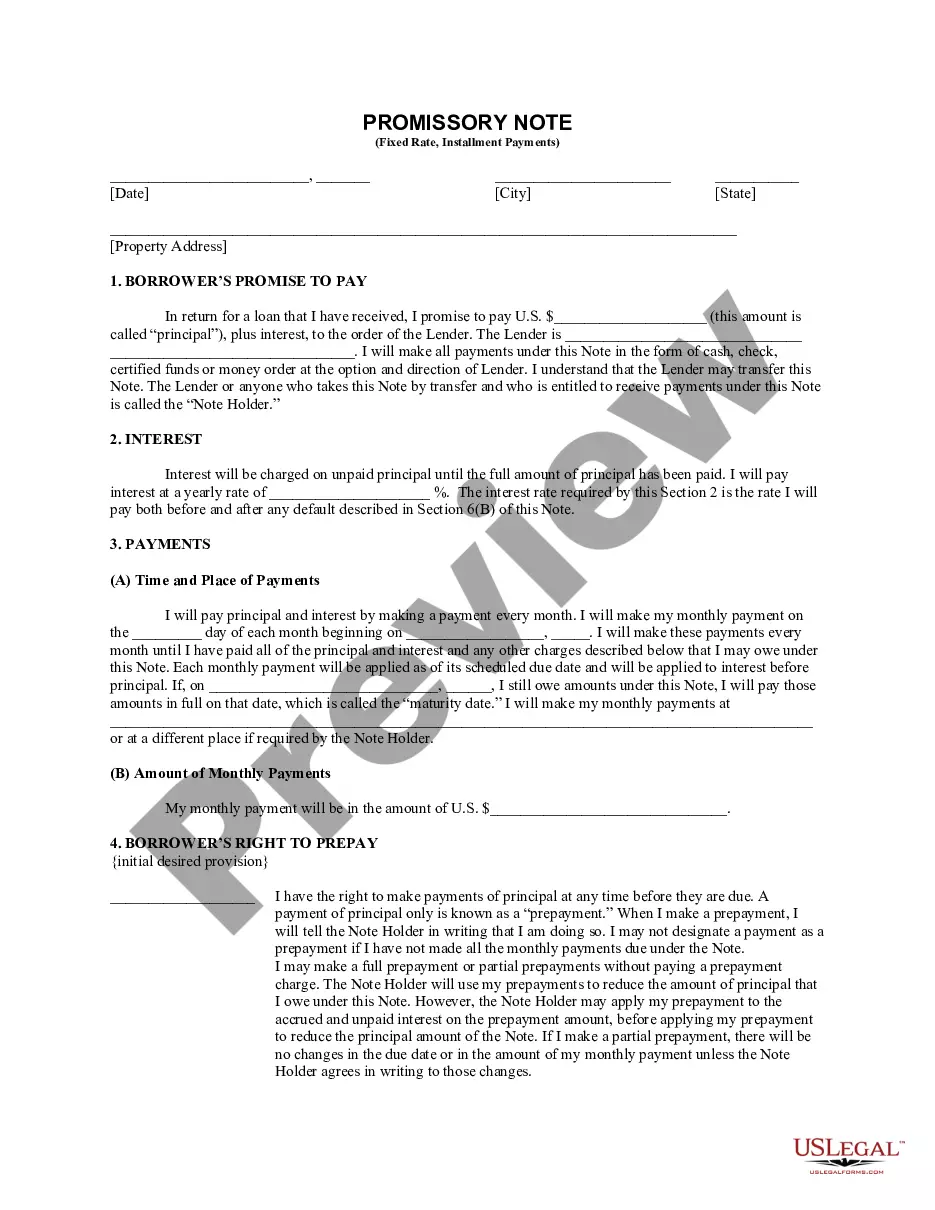

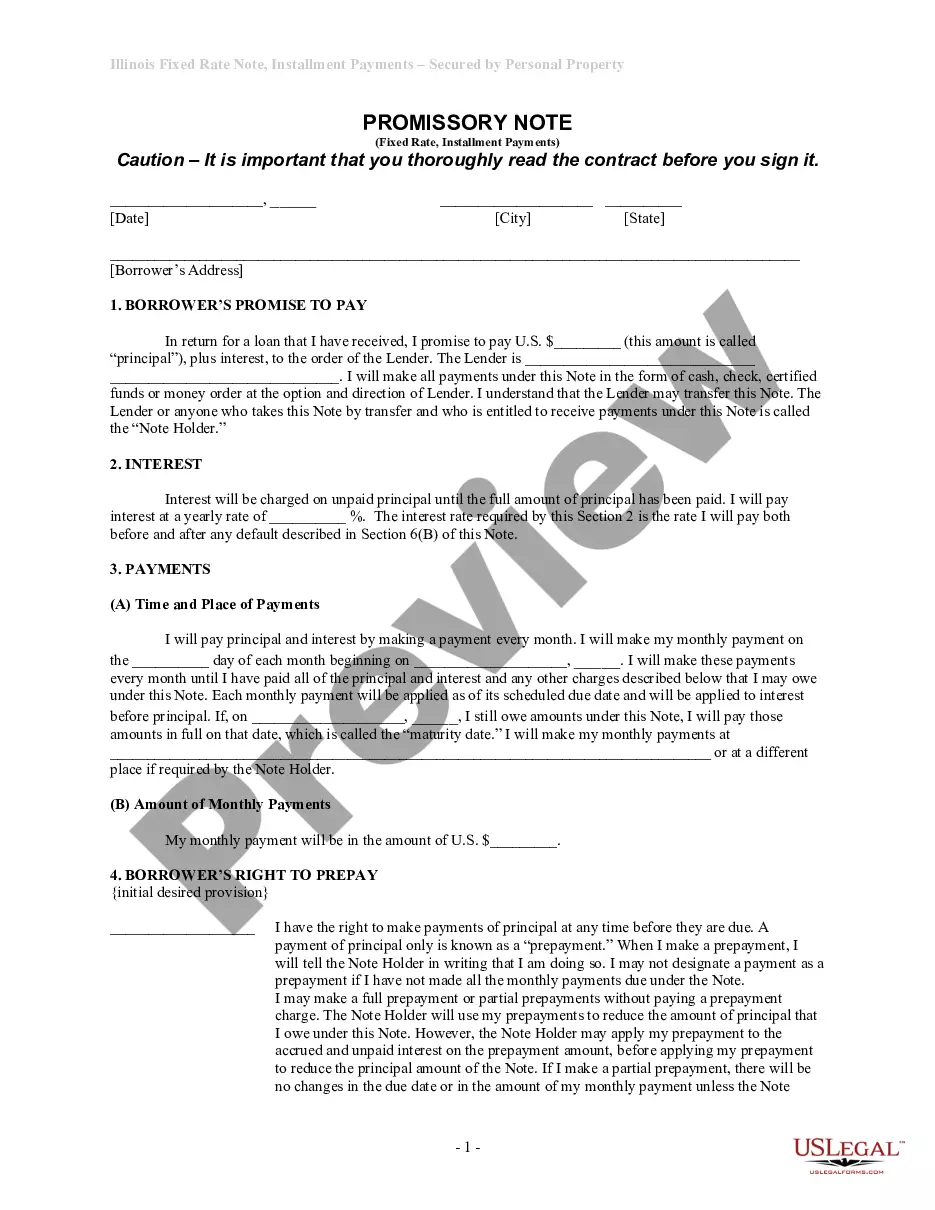

Chicago Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

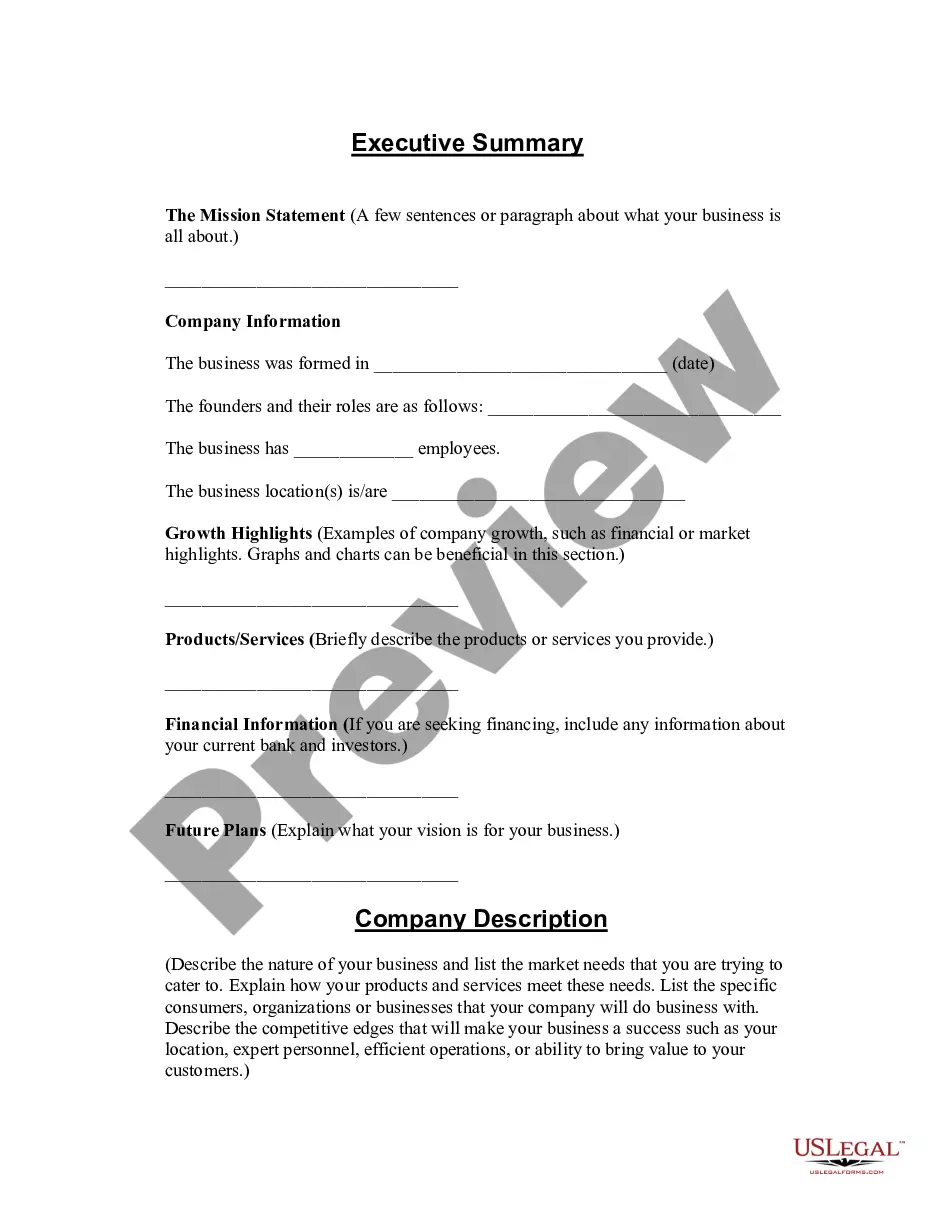

How to fill out Illinois Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

We consistently endeavor to minimize or evade judicial repercussions while addressing intricate legal or financial matters.

To achieve this, we enroll in legal solutions that are generally quite expensive.

Nonetheless, not every legal concern is equally intricate; many of them can be managed independently.

US Legal Forms is an internet repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button adjacent to it. If you misplace the document, you can always re-download it from the My documents tab. The procedure is just as straightforward even if you’re not familiar with the platform! You can establish your account in just a few minutes. Ensure that the Chicago Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate complies with the laws and regulations of your state and region. Additionally, it’s crucial that you review the form’s outline (if accessible), and if you identify any inconsistencies with what you initially required, search for an alternative form. Once you’ve confirmed that the Chicago Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate would be suitable for your situation, you can select the subscription plan and move forward to payment. Then, you can download the document in any appropriate format. For over 24 years of our existence, we’ve assisted millions of individuals by supplying ready-to-customize and up-to-date legal documents. Take advantage of US Legal Forms now to conserve effort and resources!

- Our collection empowers you to manage your affairs without relying on a lawyer's services.

- We offer access to legal form templates that aren't always readily accessible.

- Our templates are tailored to specific states and regions, which greatly eases the search process.

- Utilize US Legal Forms whenever you need to obtain and download the Chicago Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate or any other form swiftly and securely.

Form popularity

FAQ

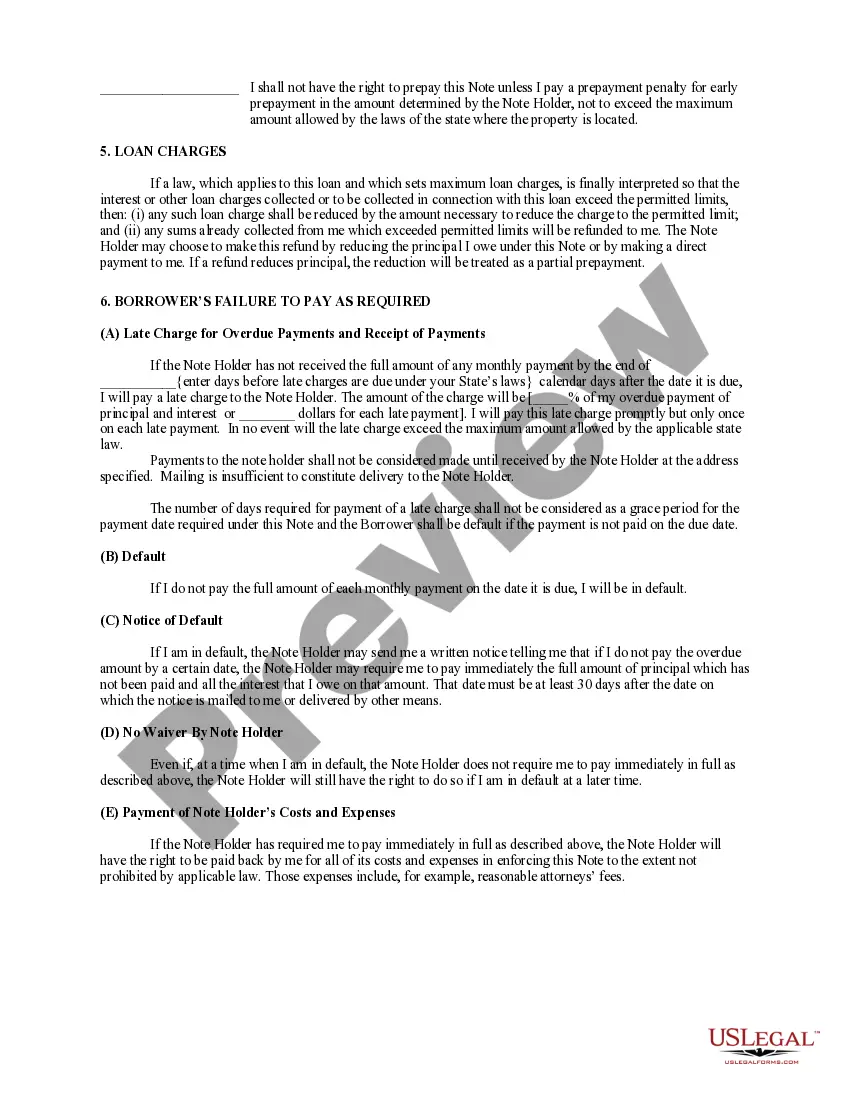

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances ? if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt ? then, the contract becomes null and void.

Dated Signature: In Illinois, both unsecured and secured promissory notes must be signed and dated by the borrower, any co-signer, and the lender. There is no legal requirement for a promissory note to be witnessed or notarized in Illinois.

A valid promissory note only needs the signatures of the participating parties involved in the agreement, not necessitating acknowledgment or being witnessed by a notary public to be legitimate.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A promissory note is a key piece of a home loan application and mortgage agreement, ensuring that a borrower agrees to be indebted to a lender for loan repayment. Ultimately, it serves as a necessary piece of the legal puzzle that helps guarantee that sums are repaid in full and in a timely fashion.

A promissory note is like a written promise or IOU for everything from car loans to loans between family members. Even without a signature from a notary public, it can still be a valid promissory note.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.