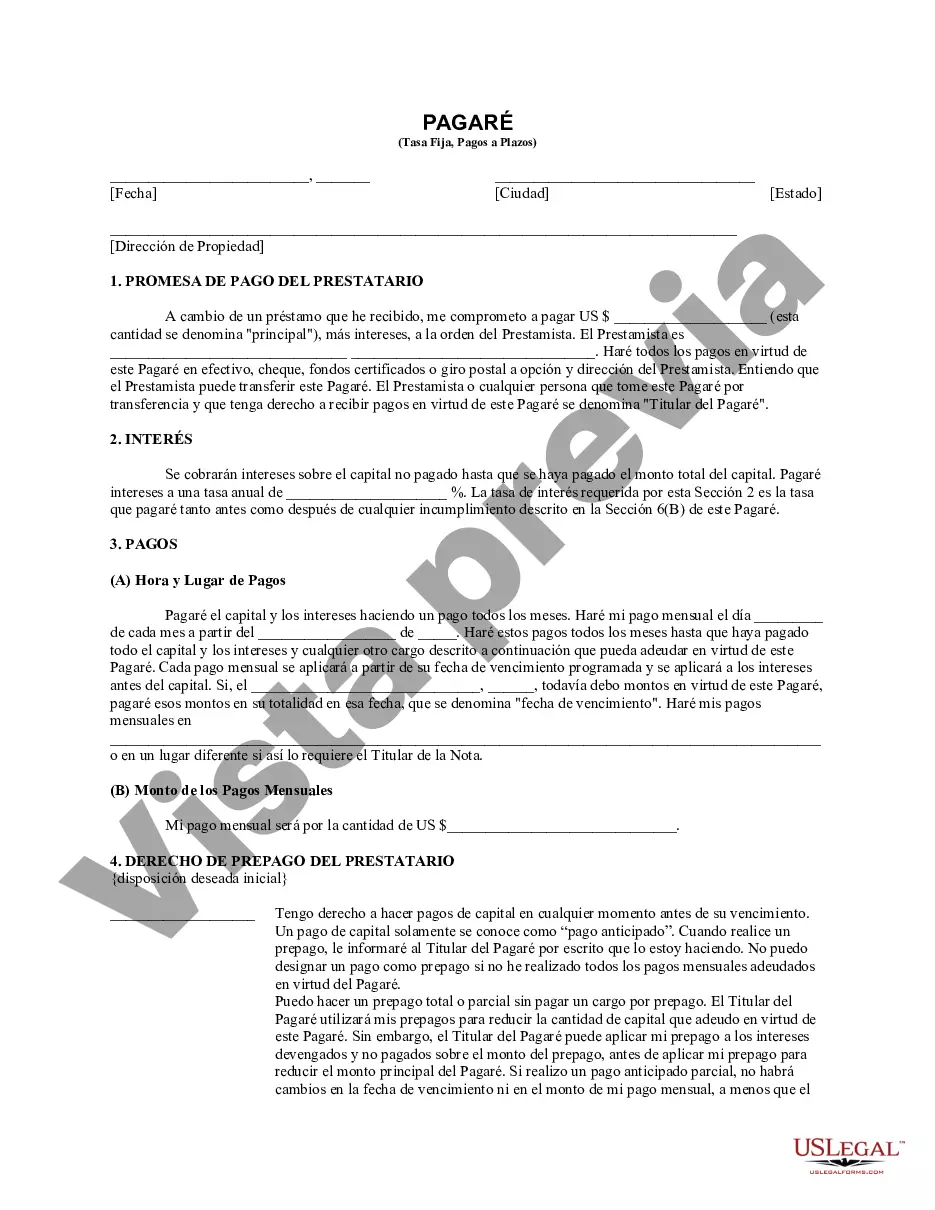

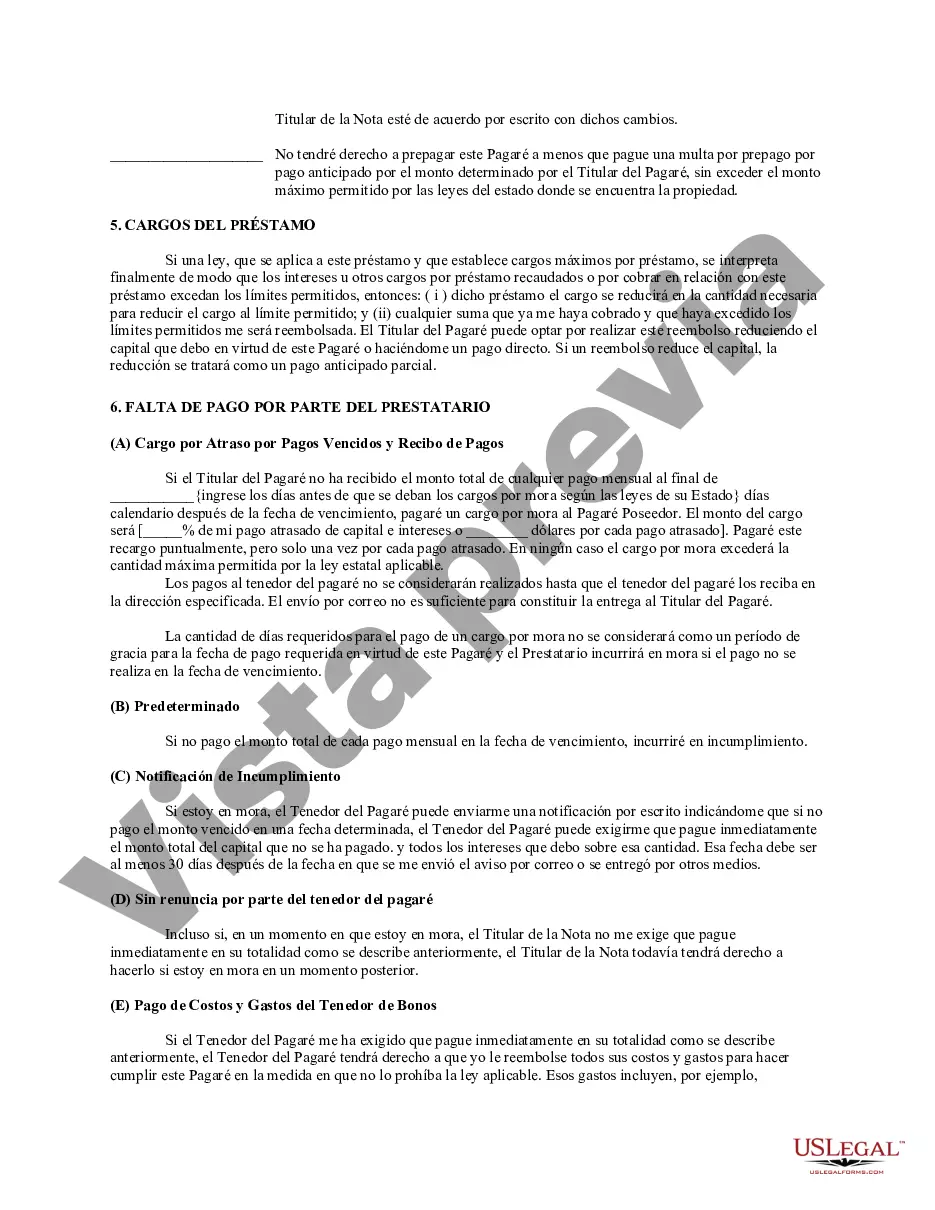

A Cook Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate serves as a legal and financial agreement between a lender and a borrower. This type of promissory note is specifically tied to real estate properties located in Cook County, Illinois. It provides a detailed outline of the terms and conditions under which funds will be borrowed and repaid, while emphasizing the security of the loan through the residential property. The Cook Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate is typically utilized in home financing transactions, allowing borrowers to secure a loan using their residential property as collateral. This note is designed to provide clarity and protection to both parties involved. It establishes the fixed interest rate, installment amounts, payment schedule, and specific provisions related to the secured real estate. Keywords: Cook Illinois, Installments, Fixed Rate Promissory Note, Residential Real Estate, Collateral, Borrower, Lender, Loan, Promissory, Financing, Agreement, Repayment, Interest Rate, Payment Schedule, Terms and Conditions, Security. Different types (if applicable): 1. Cook Illinois Installments Fixed Rate Promissory Note — First Position: This refers to a promissory note secured by residential real estate in Cook County, Illinois, where it holds the first position lien on the property. In case of default, the lender has priority over any subsequent liens or claims on the property. 2. Cook Illinois Installments Fixed Rate Promissory Note — Second Position: This type of promissory note is similar to the first position note but has a secondary lien on the residential property. It means that if the borrower defaults, the lender with the first position note will have priority over the proceeds from the sale of the property. 3. Cook Illinois Installments Fixed Rate Promissory Note — Refinance: This note is used when homeowners in Cook County, Illinois, seek to refinance their existing mortgage by taking out a new loan while using their residential property as security. It outlines the terms and conditions of the refinancing arrangement, providing clarity for both the lender and borrower. 4. Cook Illinois Installments Fixed Rate Promissory Note — Balloon Payment: This type of promissory note involves regular installment payments but includes a larger "balloon payment" due at the end of the loan term. The balloon payment represents the remaining principal balance, and it is typically higher than the regular installments. This option allows borrowers to have lower monthly payments but requires a lump sum payment at the end. Remember, when dealing with legal and financial matters, it is crucial to seek professional advice and consult an attorney or financial advisor for accurate guidance tailored to your specific situation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Pagaré de tasa fija a plazos de Illinois garantizado por bienes raíces residenciales - Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Cook Pagaré De Tasa Fija A Plazos De Illinois Garantizado Por Bienes Raíces Residenciales?

No matter the social or professional status, filling out law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for someone with no legal education to create such papers cfrom the ground up, mostly due to the convoluted jargon and legal subtleties they come with. This is where US Legal Forms comes to the rescue. Our service provides a massive collection with over 85,000 ready-to-use state-specific forms that work for practically any legal scenario. US Legal Forms also is a great resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

No matter if you need the Cook Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Cook Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate in minutes employing our trustworthy service. If you are already a subscriber, you can go ahead and log in to your account to download the needed form.

However, if you are a novice to our platform, ensure that you follow these steps before downloading the Cook Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate:

- Be sure the form you have chosen is specific to your location considering that the regulations of one state or county do not work for another state or county.

- Preview the document and read a short outline (if available) of cases the document can be used for.

- If the form you selected doesn’t meet your needs, you can start again and search for the suitable form.

- Click Buy now and choose the subscription option that suits you the best.

- utilizing your login information or create one from scratch.

- Select the payment method and proceed to download the Cook Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate as soon as the payment is done.

You’re all set! Now you can go ahead and print out the document or fill it out online. Should you have any problems getting your purchased forms, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.

Form popularity

Interesting Questions

More info

Lincolnshire Secured Mortgage Obtain a free securitization note from Lincolnshire Mortgage, you will need to fill the Secured Loan Application form and add the information you wish to securitize. Save it to the cloud or file it locally. Lucky Secured Money Leasing Secured by Real Estate Obtain a securitization notice or form from the UK Legal Forms catalog and save it. Mansion Loan Guarantee Obtain an approval certificate for your mortgage through the Home Loans Authority. Mooresville Secured Mortgage Obtain a notice or form from Mooresville Mortgage and save it to your smartphone and to the cloud. Nashville Secured Money Leasing Obtain a securitization notice from a private mortgage insurer and save it to your iPhone. Newton Secured Mortgage Obtain a Securitization Notice from the UK Legal Forms, you can save this to your smartphone or on the cloud. Oak wood Secured Mortgage Obtain a notice or form from Oak wood Mortgage and save it to your smartphone or on the cloud.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.