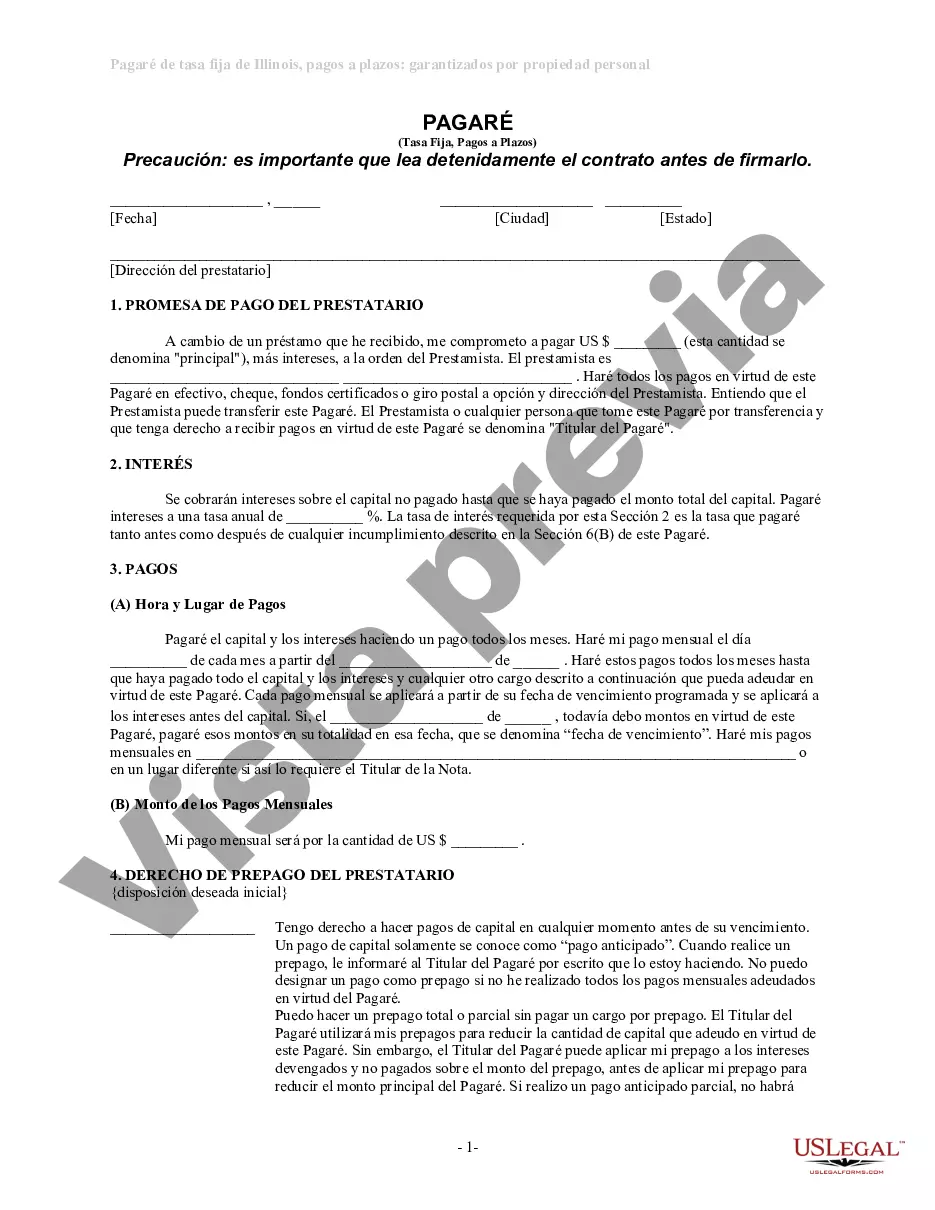

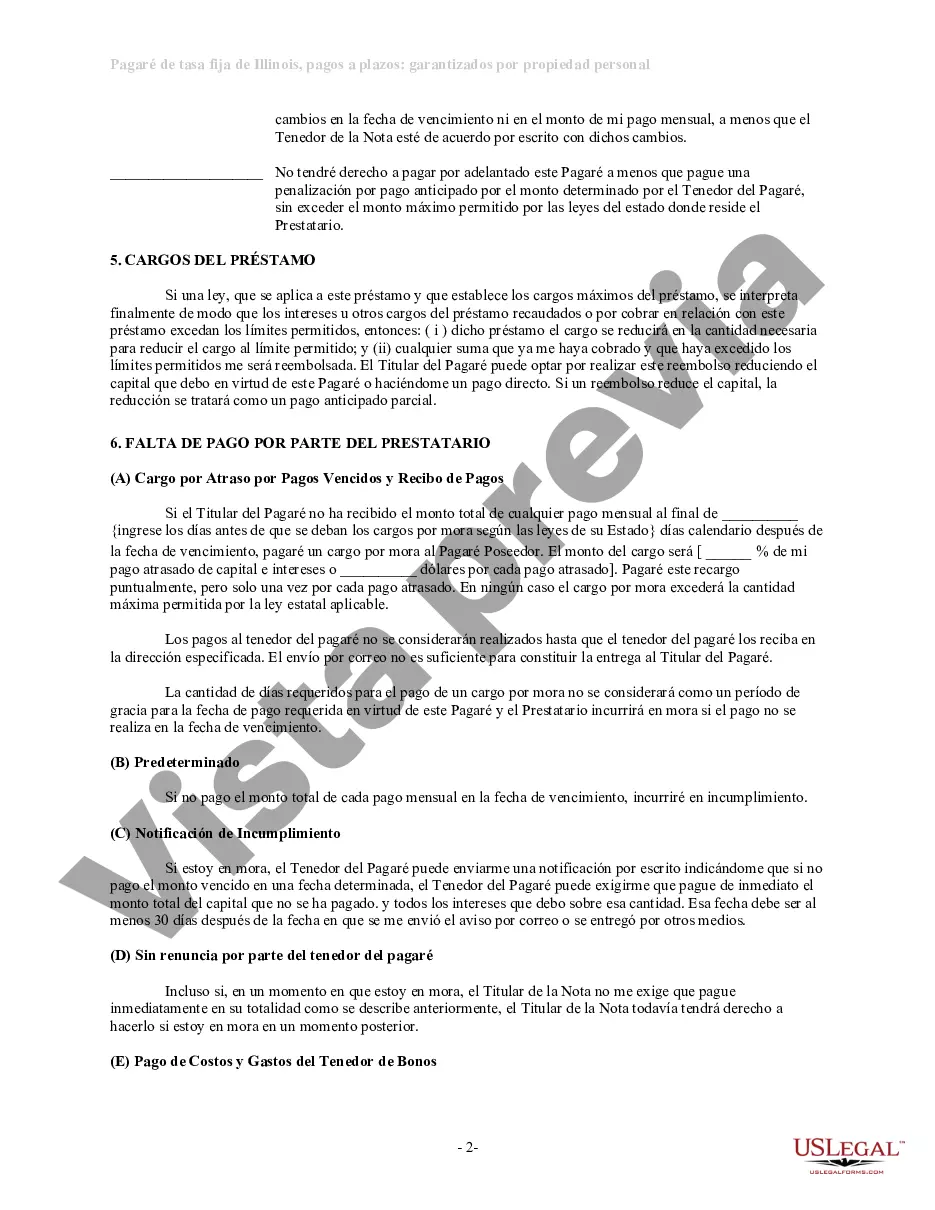

A Chicago Illinois Installments Fixed Rate Promissory Note Secured by Personal Property is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in Chicago, Illinois. This type of promissory note is specifically intended for installment payments and features a fixed interest rate. Additionally, the loan is further secured by personal property that the borrower possesses, which will serve as collateral in case of default. The purpose of this promissory note is to establish a clear and binding agreement between the borrower and the lender, detailing the amount of the loan, the interest rate, payment terms, and the consequences of default. The document identifies both parties involved, their contact information, and other relevant identification details. A key element of the Chicago Illinois Installments Fixed Rate Promissory Note Secured by Personal Property is the inclusion of specific clauses related to the collateral. These clauses detail the property being used as collateral, its value, and how it will be secured throughout the loan term. It also outlines the rights and responsibilities of both parties in relation to the collateral, including potential remedies in case of default. Furthermore, certain variations or subtypes of Chicago Illinois Installments Fixed Rate Promissory Note Secured by Personal Property may exist, each with its own unique features. Some potential variations could include: 1. Secured by Real Estate: In this case, the promissory note is secured by real property, such as land or a house, owned by the borrower. The collateral's value and details would be specified, similar to the Promissory Note Secured by Personal Property. 2. Secured by Vehicles: This subtype focuses on securing the loan with one or more vehicles owned by the borrower. The make, model, year, and Vehicle Identification Number (VIN) would be specified as collateral. 3. Secured by Valuables: Here, the borrower's valuable possessions like jewelry, artwork, or other valuable assets serve as collateral, with their description and estimated value mentioned. 4. Secured by Business Assets: In some cases, a promissory note may be secured by assets owned by a business, including equipment, machinery, or inventory. This type of promissory note would outline the specific assets and their respective values. Overall, a Chicago Illinois Installments Fixed Rate Promissory Note Secured by Personal Property is a legally binding document that formalizes a loan agreement in the context of installment payments, with collateral provided by the borrower. It ensures transparency, protects the interests of both parties, and provides a clear roadmap for the repayment of the loan.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Pagaré de tasa fija a plazos de Illinois garantizado por propiedad personal - Illinois Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out Chicago Pagaré De Tasa Fija A Plazos De Illinois Garantizado Por Propiedad Personal?

Utilize the US Legal Forms to gain instant access to any form sample you require. Our advantageous platform with a plethora of document templates makes it easy to locate and acquire nearly any document sample you need.

You can save, fill out, and authenticate the Chicago Illinois Installments Fixed Rate Promissory Note Secured by Personal Property in only a few minutes instead of browsing the internet for hours in search of the suitable template.

Leveraging our collection is an excellent way to enhance the security of your document filing. Our skilled attorneys frequently review all the documents to ensure that the forms are suitable for a specific region and adhere to new laws and regulations.

How can you access the Chicago Illinois Installments Fixed Rate Promissory Note Secured by Personal Property? If you have an account, simply Log In to your account. The Download option will appear on all the samples you view. Additionally, you can find all your previously saved documents in the My documents menu.

US Legal Forms is one of the largest and most reliable document libraries on the internet. We are always ready to assist you in any legal matter, even if it is just downloading the Chicago Illinois Installments Fixed Rate Promissory Note Secured by Personal Property.

Feel free to take advantage of our service and simplify your document experience as much as possible!

- Open the page with the form you need. Verify that it is the template you were looking for: check its title and description, and utilize the Preview option when it is available. Otherwise, use the Search field to find the correct one.

- Initiate the saving process. Click Buy Now and choose the pricing plan you prefer. Then, create an account and complete your order using a credit card or PayPal.

- Download the document. Choose the format to obtain the Chicago Illinois Installments Fixed Rate Promissory Note Secured by Personal Property and edit and complete, or sign it according to your needs.

Form popularity

FAQ

Requisitos para comprar una casa ITIN. Estado de cuenta. Declaracion de impuestos. Talonarios de pago. Identificacion con foto (ID municipal). Recibo de renta. Recibo de agua, luz o telefono. Acta o certificado de matrimonio.

Un refinanciamiento suele tardar entre 30 y 45 dias. Sin embargo, puede ser un poco mas corto o mas largo, dependiendo de su situacion y del prestamista con el que trabaja.

Seis bancos con los que puedes comprar una casa este 2021 usando tu ITIN First National Bank of America (FNBA) Credito ITIN de United Mortgage. Credito ITIN de Go Alterra. Prime 1 Bancorp.

La regla general siempre ha sido que es el momento adecuado para refinanciar cuando puede reducir su tasa de interes en un punto porcentual o mas. Dependiendo del tamano de su prestamo, el refinanciamiento puede ser factible incluso si las tasas solo bajan medio por ciento.

Las 5 razones principales para refinanciar y los pros y contras de cada una 1 Pagos mensuales mas bajos.2 Tasa de interes mas baja.3 Cambio a una tasa fija.4 Reduccion del plazo de su prestamo.5 Refinanciamiento con desembolso de dinero en efectivo.

Tres requisitos basicos para solicitar tu credito hipotecario Edad y salario. La edad minima requerida es de 18 anos y la maxima de 64 anos 11 meses.Historial crediticio. Mantener un buen historial crediticio es una de las puertas a futuros prestamos.Capital inicial.

Estas son algunas maneras en que puedes saldar tu hipoteca mas rapido: Refinancia tu hipoteca.Haz mas pagos hipotecarios.Haz un pago hipotecario extra cada ano.Redondea tus pagos hipotecarios.Prueba el plan de un dolar por mes.Usa tus ingresos imprevistos.

Las hipotecas fueron el participante mas destacado en el derbi de tipos mas bajos, cayendo casi un punto porcentual entre enero de 2020 y enero de 2021, de una media del 3,86% al 2,92%.

Por lo general es entre el 3% y el 5% de la cantidad de su prestamo.

Esta es la manera como puede obtener su tarjeta de credito sin un SSN: Solicite un ITIN: visite el sitio web del IRS y siga las instrucciones para solicitar su ITIN. Busque prestamistas: busque los prestamistas que ofrecen tarjetas de credito a personas con un numero ITIN.

Interesting Questions

More info

On-time Payment The number of days in a loan period (usually five) when you make a payment on a loan that is in good standing after your payments are missed regularly (usually two or four times in that time×. Loan Term The length of time a loan is outstanding. Nonrecourse Note A mortgage loan where the borrower has no personal liability. One-Month Payment Period A period of time that a loan is in good standing after any late payments. One-Year Payment Period A period of time that a loan is in good standing after any late payments. Repayment Plan A plan that allows a loan amount to be repaid in increments over a certain period of time. Short Term One or more monthly payments that must be in on-time order due to a scheduled payment date. Monthly Payment Period One time payment that must be in on-time order due to be scheduled for a monthly payment (monthly payment period×. Refunded the same day of the loan closing (if you make a payment the day you receive the loan×.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.