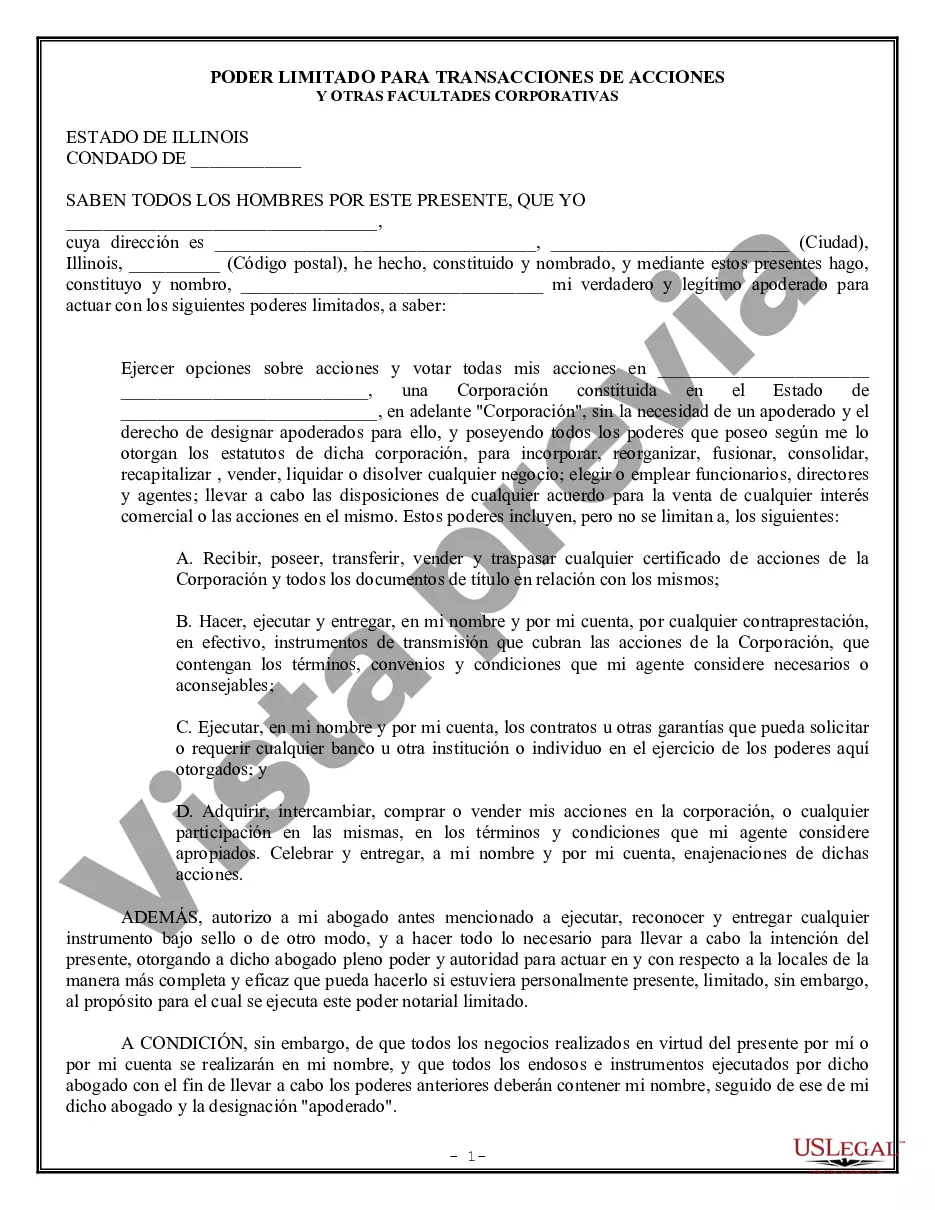

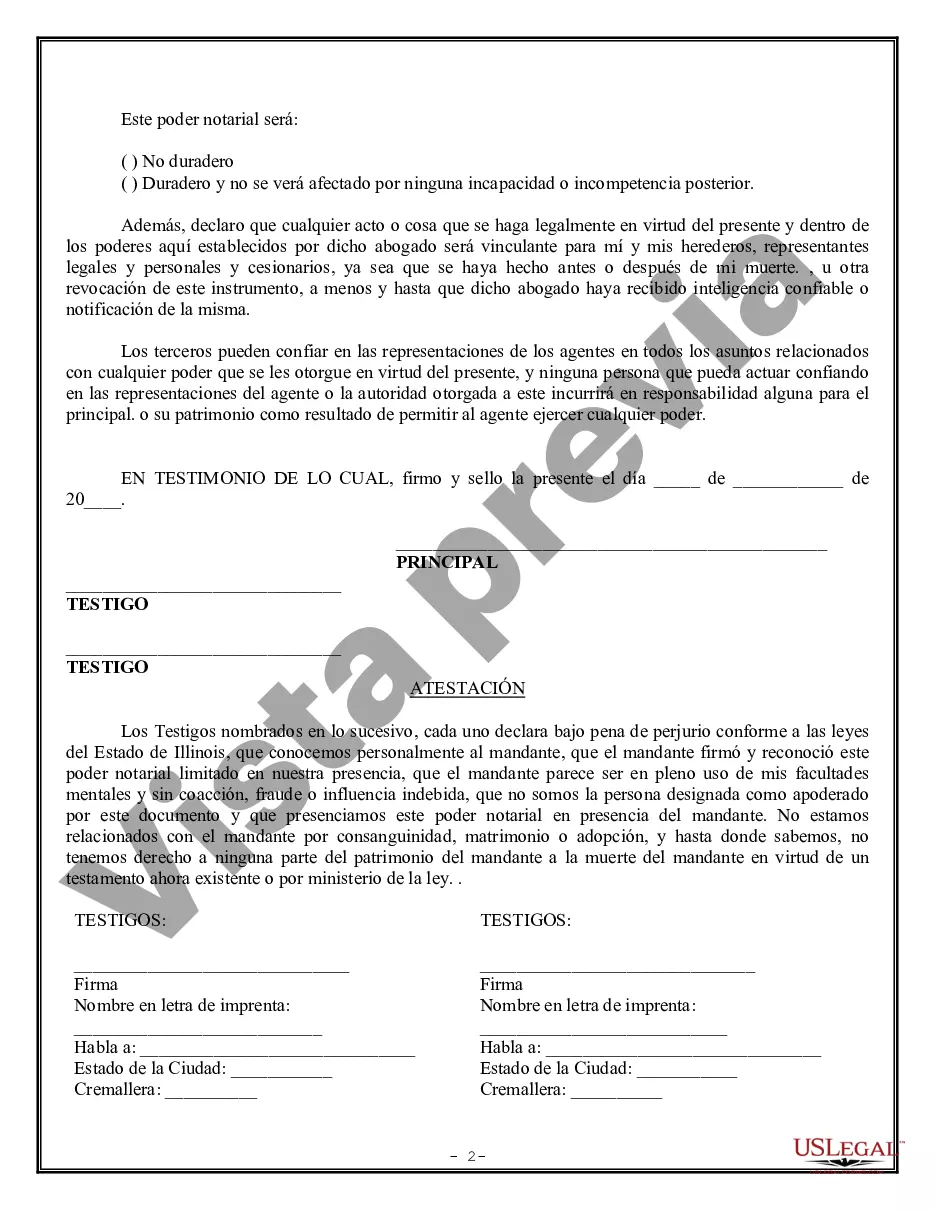

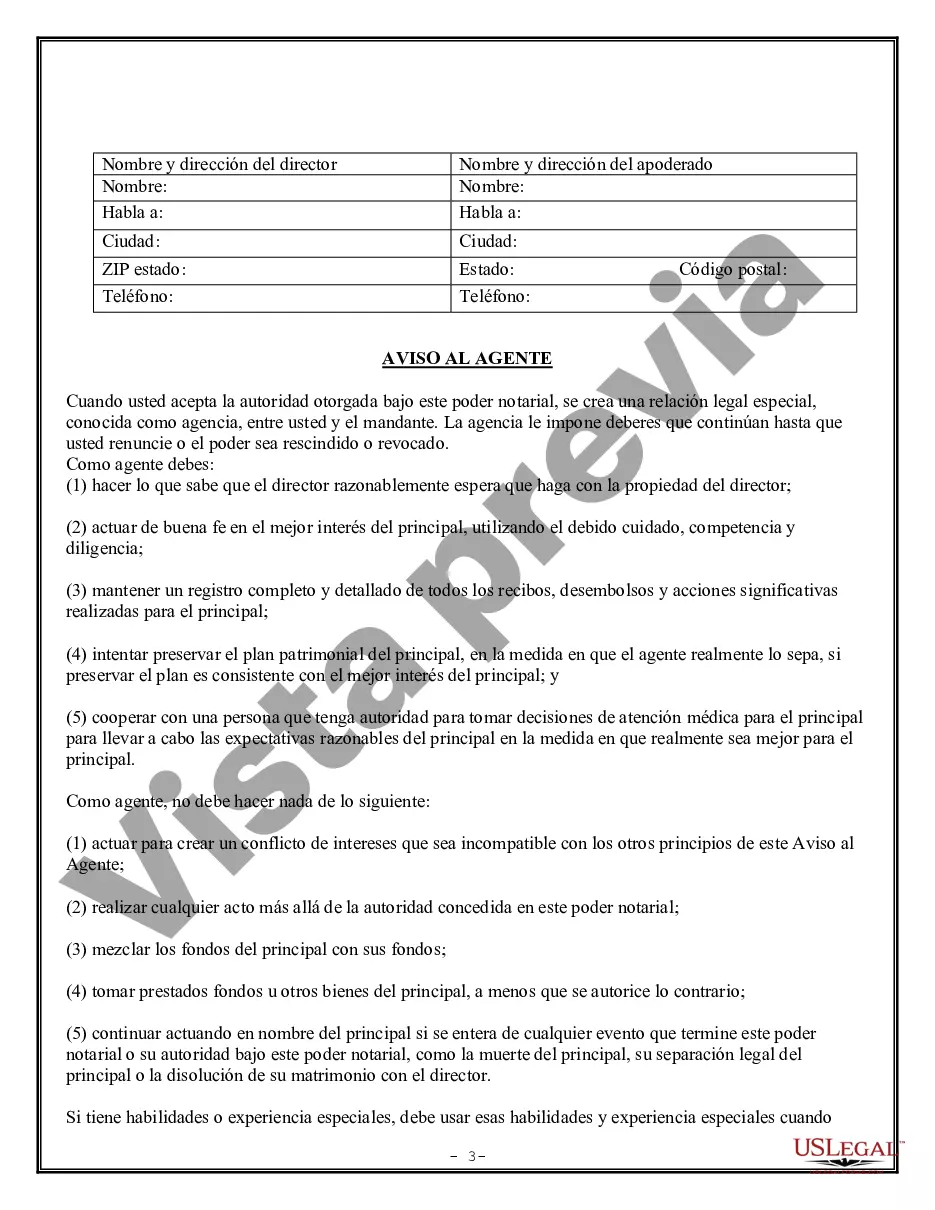

Cook Illinois Limited Power of Attorney for Stock Transactions and Corporate Powers is a legal document that grants an individual, referred to as the "attorney-in-fact," the authority to make decisions and take actions related to stock transactions and corporate matters on behalf of the principal. This power of attorney is specifically designed for individuals residing in Cook County, Illinois. The Cook Illinois Limited Power of Attorney for Stock Transactions and Corporate Powers empowers the attorney-in-fact to engage in a wide range of activities pertaining to stocks and corporate affairs. Some key powers and responsibilities included in this document may include: 1. Stock Transactions: The attorney-in-fact is authorized to buy, sell, transfer, and manage stocks on behalf of the principal. They can execute stock purchase agreements, sell shares, and make investment decisions based on the principal's best interests. This power also extends to dividend reinvestment plans and other stock-related services. 2. Voting Rights: The attorney-in-fact can exercise voting rights attached to the principal's stock holdings. This authority allows them to represent the principal at stockholder meetings, cast votes on various corporate matters, proxy voting, and participate in tender offers and mergers. 3. Corporate Governance: The Power of Attorney enables the attorney-in-fact to act on behalf of the principal in corporate governance matters. This can include attending and participating in board meetings, signing corporate documents, and making decisions related to corporate policies and procedures. 4. Tax and Financial Matters: The attorney-in-fact may have the authority to handle tax-related matters on behalf of the principal. This can involve filing tax returns, responding to tax-related inquiries, and managing the principal's financial matters relating to stocks and corporations. It is essential to note that Cook County may have specific variations or additional types of Limited Power of Attorney for Stock Transactions and Corporate Powers. Some possible variations could be: 1. Cook County Special Limited Power of Attorney for Stock Transactions: This variation may grant limited powers to the attorney-in-fact, specific to certain stock transactions or situations. It could be tailored to meet the principal's unique requirements or time-based transactions. 2. Cook County Limited Power of Attorney for Corporate Governance: This type of Limited Power of Attorney primarily focuses on granting the attorney-in-fact authority to oversee corporate governance matters, such as attending board meetings, signing contracts, and managing corporate affairs. 3. Cook County Limited Power of Attorney for Stock Voting Rights: This specific Power of Attorney is designed to grant authority solely for exercising stock voting rights for shareholders residing in Cook County. It allows the attorney-in-fact to participate in crucial stockholder decisions on behalf of the principal. These variations may emerge based on specific needs and circumstances, adapting the Power of Attorney to cater to individual requirements. However, regardless of the type, a Cook Illinois Limited Power of Attorney for Stock Transactions and Corporate Powers should always be prepared via legal channels to ensure compliance with Cook County laws and regulations. Always consult with a qualified attorney for the precise drafting and execution of such legal documents.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Poder Notarial Limitado para Transacciones de Acciones y Poderes Corporativos - Illinois Limited Power of Attorney for Stock Transactions and Corporate Powers

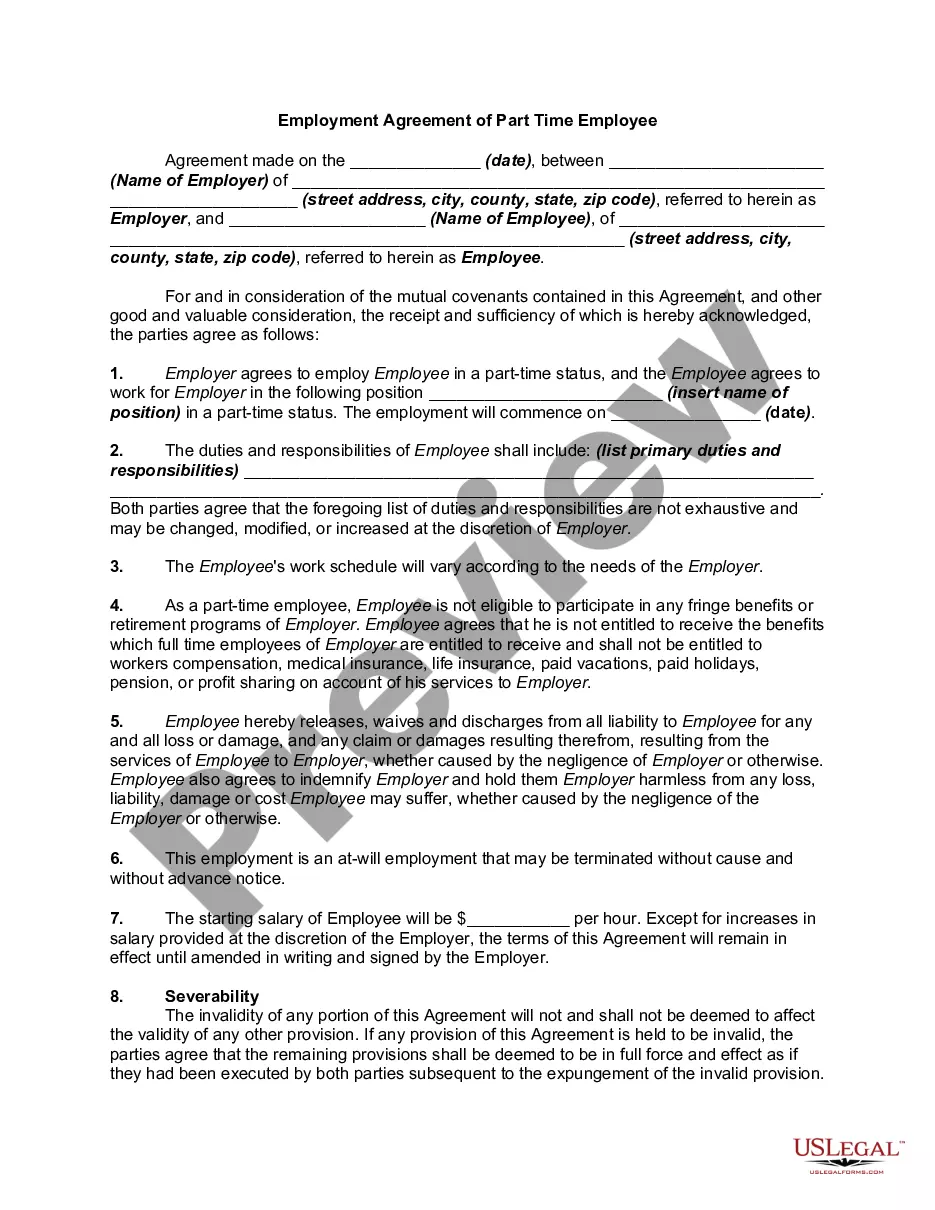

Description

How to fill out Cook Illinois Poder Notarial Limitado Para Transacciones De Acciones Y Poderes Corporativos?

Are you looking for a reliable and inexpensive legal forms provider to buy the Cook Illinois Limited Power of Attorney for Stock Transactions and Corporate Powers? US Legal Forms is your go-to choice.

No matter if you need a simple arrangement to set rules for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and framed based on the requirements of separate state and county.

To download the document, you need to log in account, find the needed form, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Cook Illinois Limited Power of Attorney for Stock Transactions and Corporate Powers conforms to the laws of your state and local area.

- Go through the form’s details (if provided) to learn who and what the document is intended for.

- Start the search over in case the form isn’t suitable for your specific scenario.

Now you can register your account. Then choose the subscription option and proceed to payment. As soon as the payment is done, download the Cook Illinois Limited Power of Attorney for Stock Transactions and Corporate Powers in any provided file format. You can return to the website at any time and redownload the document without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about spending your valuable time researching legal papers online once and for all.