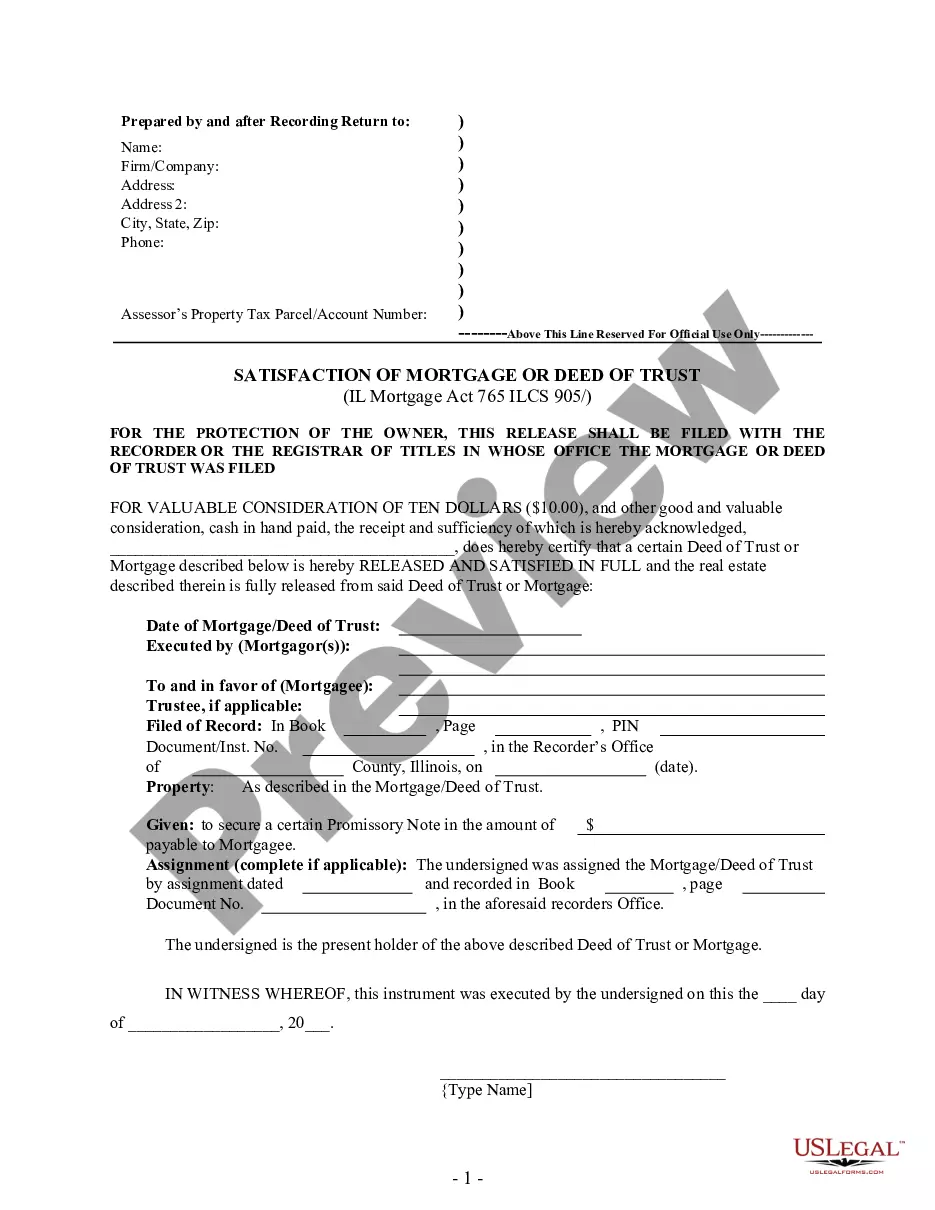

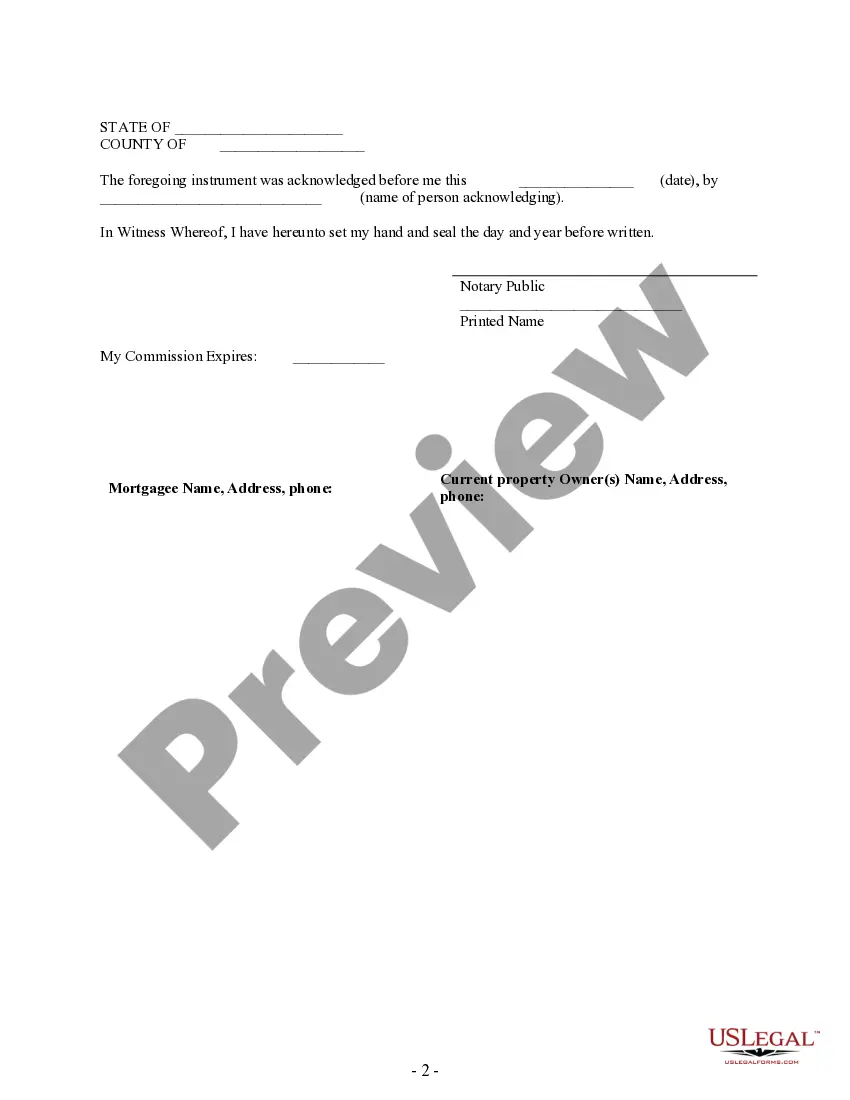

Elgin Illinois Satisfaction, Release or Cancellation of Mortgage by Individual involves the process of legally terminating a mortgage by an individual in Elgin, Illinois. This process provides a satisfaction of mortgage, release, or cancellation, indicating that the mortgage debt has been fully paid off or retired. It is crucial to understand the different types of Satisfaction, Release, or Cancellation of Mortgage by Individual applicable to Elgin, Illinois. 1. Voluntary Satisfaction or Release: A voluntary satisfaction occurs when the individual borrower repays the mortgage in full, typically through regular payments or a lump-sum payment. Once the mortgage is entirely paid off, the borrower must request a satisfaction or release of the mortgage from the lender or mortgage holder. The document confirms that the mortgage debt has been satisfied and the lender no longer holds any rights or claims over the property. 2. Partial Satisfaction: In some cases, the borrower may make partial payments towards the mortgage, reducing the outstanding balance while the mortgage loan remains active. A partial satisfaction document acknowledges the payment made and updates the remaining balance owed, typically recalculating the interest and principal deductions accordingly. 3. Mortgage Cancellation due to Refinance: When an individual chooses to refinance their mortgage, the new loan replaces the existing mortgage. Under this circumstance, the borrower must go through the process of obtaining a satisfaction or release of the original mortgage, cancelling it officially due to the refinancing action. 4. Satisfaction of Mortgage after Foreclosure: In situations where a mortgage holder defaults on loan payments and the lender forecloses on the property, resulting in a public auction or sale, the mortgage may be satisfied or released upon the completion of the foreclosure process. The satisfaction of mortgage document confirms the transfer of ownership, usually from the lender to the highest bidder or buyer. 5. Mortgage Cancellation as per the Mortgage Agreement: Occasionally, mortgage agreements may include provisions for a cancellation of mortgage in specific circumstances, such as prepayment clauses or conditions specified by the lender. These clauses could include options like early payoff buyouts, lien waivers, or mortgage modifications. If the individual borrower fulfills the predefined conditions set forth in the agreement, a satisfaction or release of mortgage is issued. In Elgin, Illinois, the Satisfaction, Release, or Cancellation of Mortgage by Individual requires legal documentation provided by the lender or mortgage holder. It is essential to follow the proper procedures and file the appropriate documents with the relevant authorities to ensure the mortgage is accurately and lawfully discharged. Consulting with a real estate attorney or experienced professional is advisable when engaging in such transactions to ensure compliance with local laws and regulations.

Elgin Illinois Satisfaction, Release or Cancellation of Mortgage by Individual

Description

How to fill out Elgin Illinois Satisfaction, Release Or Cancellation Of Mortgage By Individual?

Regardless of social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for a person without any law background to create this sort of papers from scratch, mainly due to the convoluted jargon and legal nuances they come with. This is where US Legal Forms comes in handy. Our platform offers a massive collection with over 85,000 ready-to-use state-specific forms that work for almost any legal case. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you want the Elgin Illinois Satisfaction, Release or Cancellation of Mortgage by Individual or any other paperwork that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Elgin Illinois Satisfaction, Release or Cancellation of Mortgage by Individual in minutes using our trustworthy platform. In case you are presently a subscriber, you can go on and log in to your account to get the appropriate form.

However, if you are new to our library, make sure to follow these steps before obtaining the Elgin Illinois Satisfaction, Release or Cancellation of Mortgage by Individual:

- Ensure the form you have found is suitable for your location considering that the regulations of one state or area do not work for another state or area.

- Review the document and go through a quick description (if provided) of scenarios the document can be used for.

- If the one you chosen doesn’t meet your needs, you can start over and search for the needed document.

- Click Buy now and pick the subscription plan you prefer the best.

- Access an account {using your login information or create one from scratch.

- Select the payment method and proceed to download the Elgin Illinois Satisfaction, Release or Cancellation of Mortgage by Individual as soon as the payment is through.

You’re good to go! Now you can go on and print the document or fill it out online. In case you have any problems getting your purchased forms, you can quickly access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.