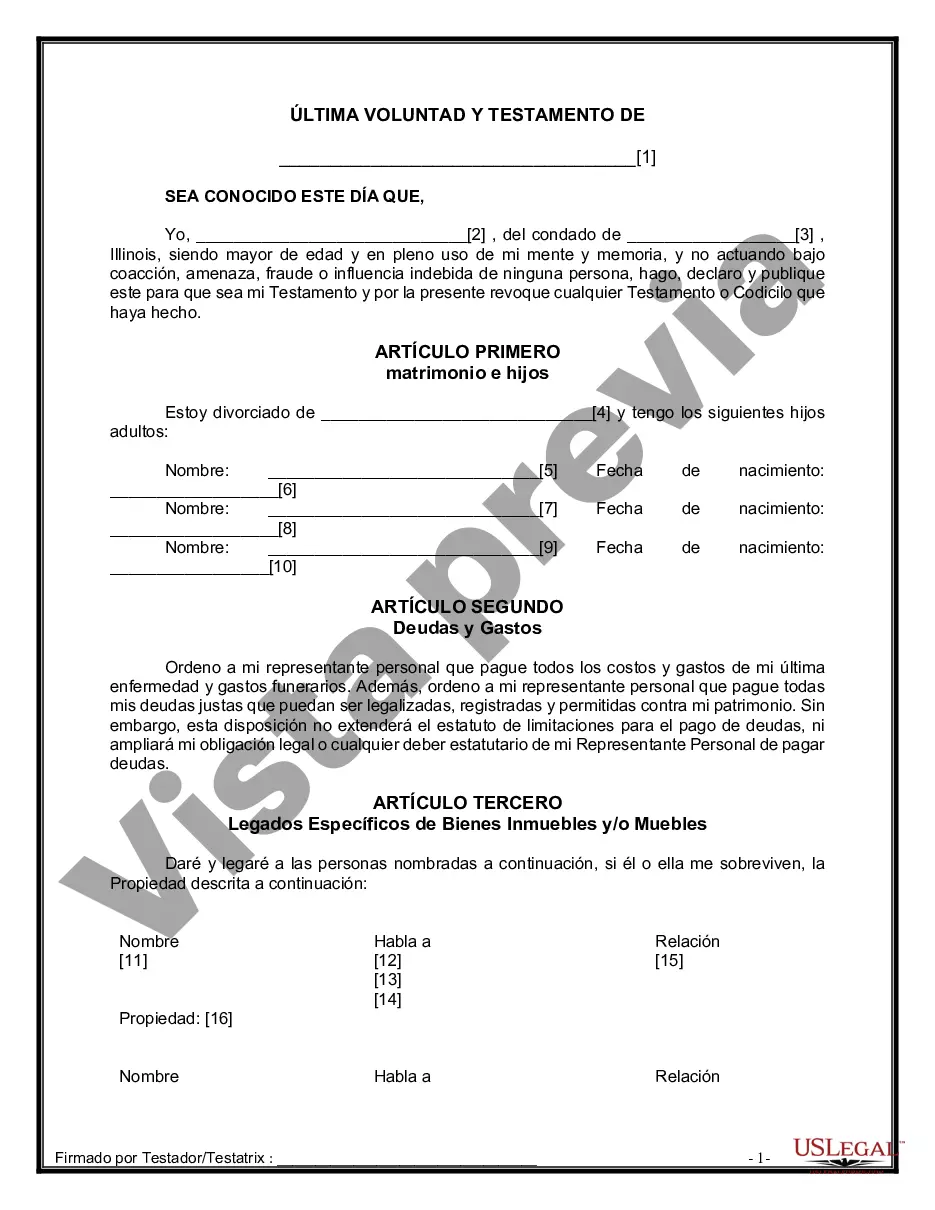

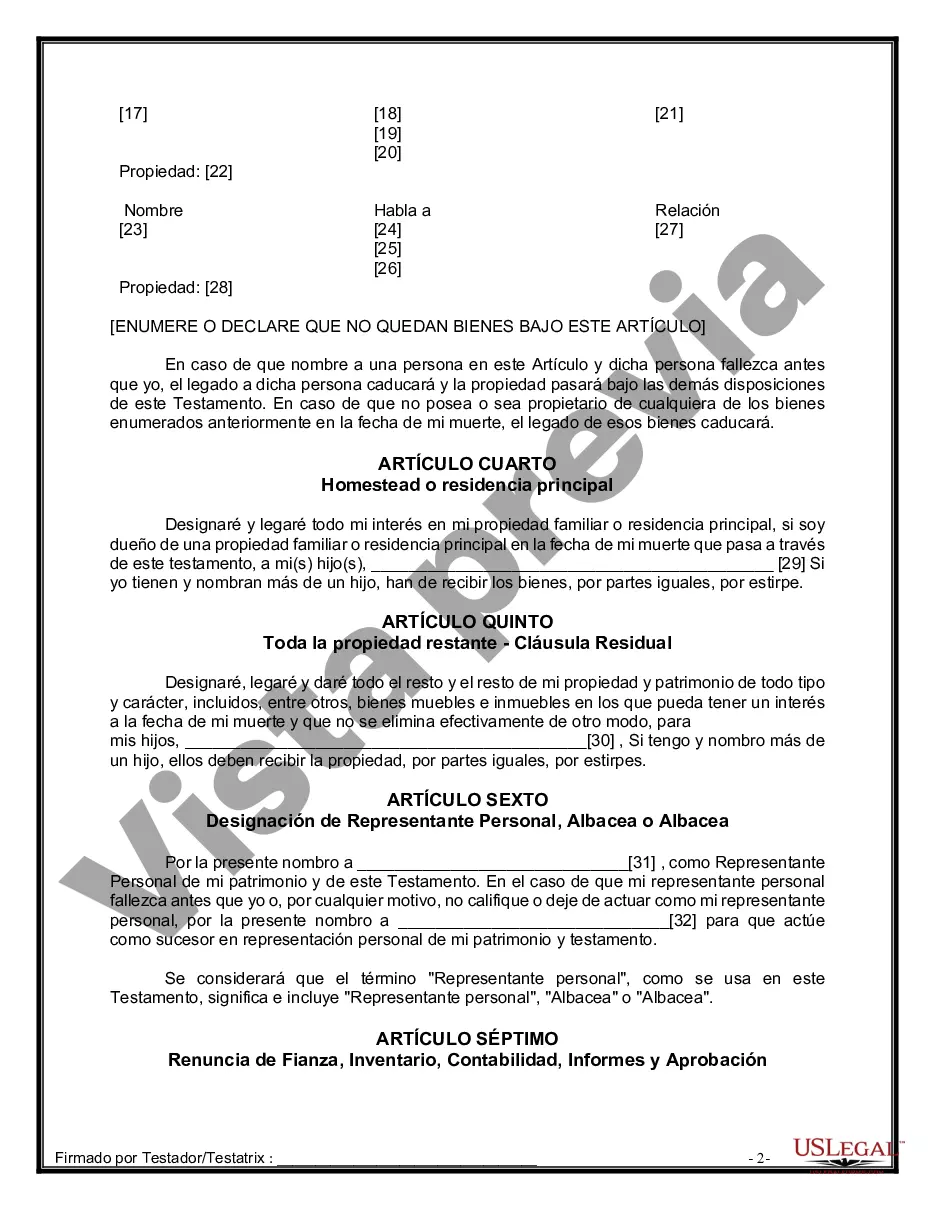

The Chicago Illinois Legal Last Will and Testament Form for Divorced person not Remarried with Adult Children is a legal document that outlines how the assets and properties of a divorced individual will be distributed upon their death. This form is specifically designed for individuals who have gone through a divorce but have not remarried and have adult children. The purpose of this form is to ensure that the wishes of the deceased are carried out according to their instructions, providing clarity and avoiding potential disputes among family members. It allows the person creating the will, commonly referred to as the testator, to specify the beneficiaries who will receive their assets. In this particular form, different types may include: 1. Simple Will: This is a basic type of will and is suitable for individuals with straightforward assets and distribution preferences. It outlines who will be the executor of the will, and how the estate will be divided among the adult children. 2. Testamentary Trust Will: In cases where the testator wishes to establish a trust to manage and distribute their assets after their death, they can choose this type of will. The trust may have specific guidelines on how and when the assets will be distributed to the adult children. 3. Living Will (Advance Healthcare Directive): While not directly related to the distribution of assets, a living will allows the testator to outline their medical preferences in the event they become incapacitated or unable to communicate their wishes. This document specifies the individual's desires regarding their end-of-life healthcare decisions. In completing the Chicago Illinois Legal Last Will and Testament Form for Divorced person not Remarried with Adult Children, the testator should provide their personal information such as their full legal name, address, and contact details. They will need to appoint an executor, who will be responsible for carrying out the instructions outlined in the will. The testator should clearly specify their wishes regarding the distribution of assets to their adult children, including any specific bequests, such as personal belongings, real estate, or financial accounts. They may also indicate any charitable donations they wish to make. Additionally, the form may include provisions for the appointment of a guardian for any minor children or dependents, although it is specified that this form is intended for individuals with adult children. It is advised to consult an attorney experienced in estate planning to ensure all legal requirements are properly addressed and accurate instructions are provided in the will.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Formulario de última voluntad y testamento legal para personas divorciadas que no se han vuelto a casar con hijos adultos - Illinois Last Will and Testament for Divorced person not Remarried with Adult Children

Description

How to fill out Chicago Illinois Formulario De última Voluntad Y Testamento Legal Para Personas Divorciadas Que No Se Han Vuelto A Casar Con Hijos Adultos?

Take advantage of the US Legal Forms and have instant access to any form you want. Our useful platform with a huge number of templates simplifies the way to find and get virtually any document sample you want. It is possible to export, fill, and certify the Chicago Illinois Legal Last Will and Testament Form for Divorced person not Remarried with Adult Children in a matter of minutes instead of browsing the web for many hours seeking the right template.

Utilizing our catalog is a superb way to improve the safety of your record filing. Our experienced attorneys on a regular basis review all the records to make certain that the forms are appropriate for a particular state and compliant with new acts and polices.

How can you obtain the Chicago Illinois Legal Last Will and Testament Form for Divorced person not Remarried with Adult Children? If you already have a profile, just log in to the account. The Download option will appear on all the documents you look at. Moreover, you can find all the previously saved records in the My Forms menu.

If you don’t have an account yet, stick to the instructions below:

- Find the template you require. Ensure that it is the template you were looking for: verify its name and description, and use the Preview function when it is available. Otherwise, use the Search field to find the needed one.

- Launch the downloading process. Click Buy Now and select the pricing plan you like. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Save the file. Pick the format to obtain the Chicago Illinois Legal Last Will and Testament Form for Divorced person not Remarried with Adult Children and modify and fill, or sign it for your needs.

US Legal Forms is among the most extensive and reliable form libraries on the internet. We are always ready to assist you in any legal process, even if it is just downloading the Chicago Illinois Legal Last Will and Testament Form for Divorced person not Remarried with Adult Children.

Feel free to take full advantage of our form catalog and make your document experience as straightforward as possible!