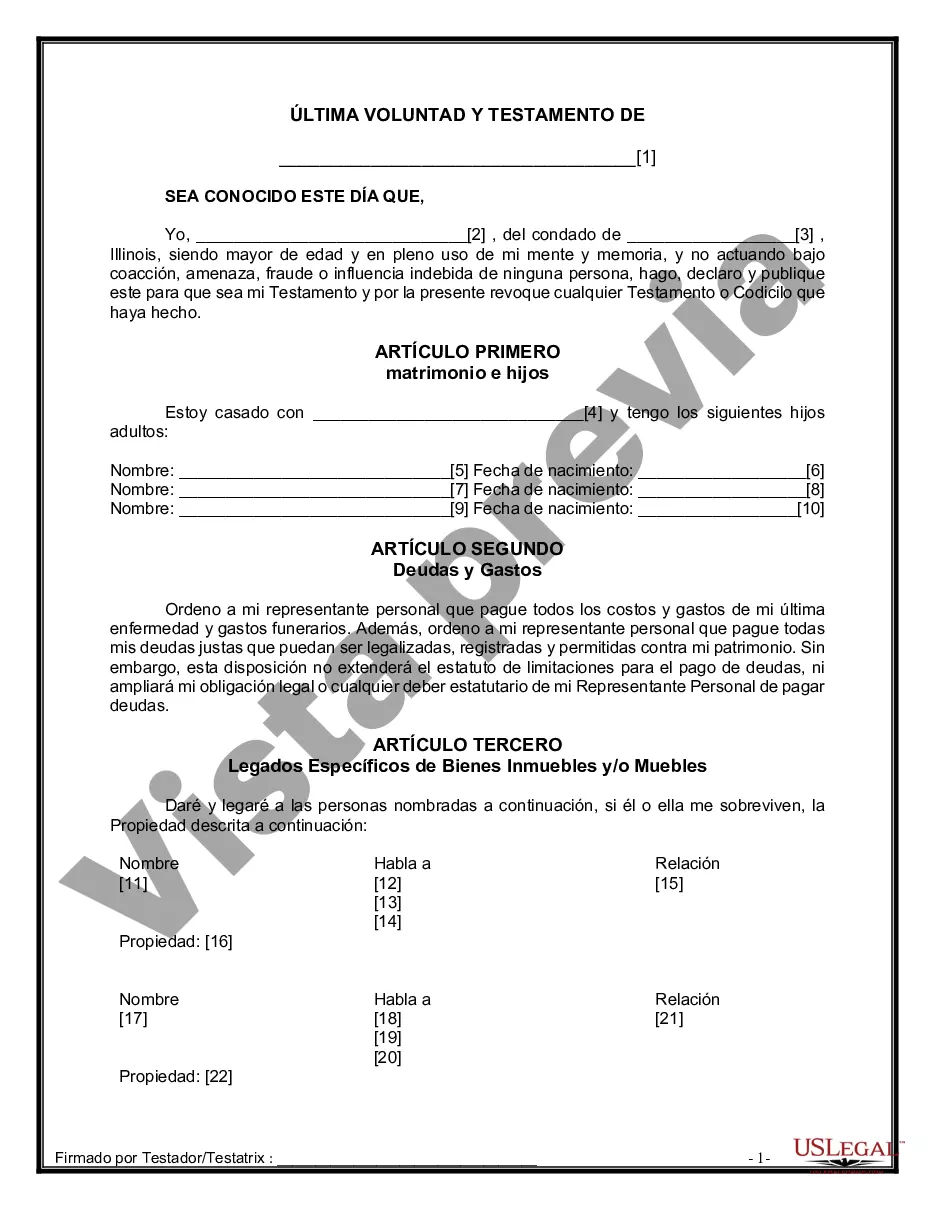

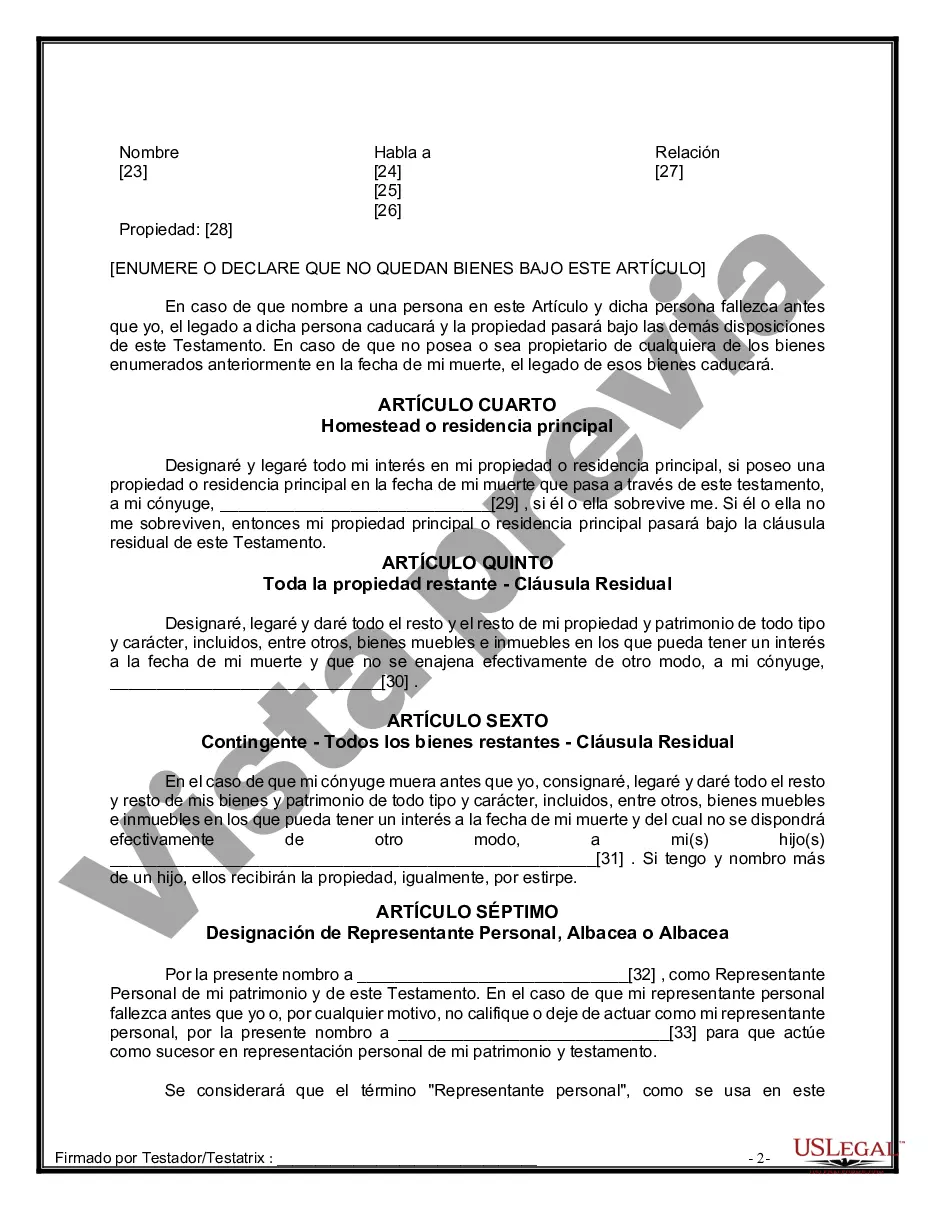

A Rockford Illinois Legal Last Will and Testament Form for Married Person with Adult Children is a legal document that outlines the distribution of assets and the wishes of a married individual with adult children upon their death. It enables individuals to ensure that their estate is passed down to their beneficiaries in accordance with their desires and helps prevent any potential disputes or misunderstandings. The Rockford Illinois Legal Last Will and Testament Form for Married Person with Adult Children allows married individuals who have adult children to designate their beneficiaries, as well as specify what assets or property should be allocated to each beneficiary. This form also allows individuals to name an executor who will be responsible for carrying out the instructions stated in the will. By utilizing this legal document, married individuals with adult children can avoid the intestacy laws which dictate how assets are distributed in the absence of a valid will. Creating a Last Will and Testament is crucial to ensure that their estate is divided as per their wishes, and not subject to the default laws of the state. In Rockford, Illinois, there might be different variations of the Legal Last Will and Testament Form for Married Person with Adult Children, depending on specific requirements or preferences. Some possible types may include: 1. Basic Rockford Illinois Legal Last Will and Testament Form for Married Person with Adult Children: — This form provides a straightforward outline for married persons with adult children, allowing them to specify beneficiaries and allocate assets. 2. Rockford Illinois Legal Last Will and Testament Form with Guardian Provision: — This type of form includes provisions for selecting a guardian for any minor children or dependent adults, ensuring their well-being in the event of the parents' passing. 3. Rockford Illinois Legal Last Will and Testament Form with Trust Provisions: — This form allows individuals to create trusts within their will, ensuring a secure future for beneficiaries by appointing a trustee to manage and distribute the assets as specified. It is essential for married individuals with adult children to consult with a legal professional or estate planning attorney while completing these forms to ensure accuracy, adherence to state laws, and consider any specific circumstances or complexities related to their estate.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Rockford Illinois Formulario Legal de Última Voluntad y Testamento para Persona Casada con Hijos Adultos - Illinois Last Will and Testament for Married Person with Adult Children

Category:

State:

Illinois

City:

Rockford

Control #:

IL-WIL-01429

Format:

Word

Instant download

Description

Descarga en línea en formato Word. Formulario de testamento redactado profesionalmente con instrucciones.

A Rockford Illinois Legal Last Will and Testament Form for Married Person with Adult Children is a legal document that outlines the distribution of assets and the wishes of a married individual with adult children upon their death. It enables individuals to ensure that their estate is passed down to their beneficiaries in accordance with their desires and helps prevent any potential disputes or misunderstandings. The Rockford Illinois Legal Last Will and Testament Form for Married Person with Adult Children allows married individuals who have adult children to designate their beneficiaries, as well as specify what assets or property should be allocated to each beneficiary. This form also allows individuals to name an executor who will be responsible for carrying out the instructions stated in the will. By utilizing this legal document, married individuals with adult children can avoid the intestacy laws which dictate how assets are distributed in the absence of a valid will. Creating a Last Will and Testament is crucial to ensure that their estate is divided as per their wishes, and not subject to the default laws of the state. In Rockford, Illinois, there might be different variations of the Legal Last Will and Testament Form for Married Person with Adult Children, depending on specific requirements or preferences. Some possible types may include: 1. Basic Rockford Illinois Legal Last Will and Testament Form for Married Person with Adult Children: — This form provides a straightforward outline for married persons with adult children, allowing them to specify beneficiaries and allocate assets. 2. Rockford Illinois Legal Last Will and Testament Form with Guardian Provision: — This type of form includes provisions for selecting a guardian for any minor children or dependent adults, ensuring their well-being in the event of the parents' passing. 3. Rockford Illinois Legal Last Will and Testament Form with Trust Provisions: — This form allows individuals to create trusts within their will, ensuring a secure future for beneficiaries by appointing a trustee to manage and distribute the assets as specified. It is essential for married individuals with adult children to consult with a legal professional or estate planning attorney while completing these forms to ensure accuracy, adherence to state laws, and consider any specific circumstances or complexities related to their estate.

Free preview

How to fill out Rockford Illinois Formulario Legal De Última Voluntad Y Testamento Para Persona Casada Con Hijos Adultos?

If you’ve already utilized our service before, log in to your account and save the Rockford Illinois Legal Last Will and Testament Form for Married Person with Adult Children on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Make certain you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Rockford Illinois Legal Last Will and Testament Form for Married Person with Adult Children. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!