Naperville Illinois Estate Planning Questionnaire and Worksheets

Description

How to fill out Illinois Estate Planning Questionnaire And Worksheets?

Regardless of one's societal or occupational position, filling out legal documents is a regrettable requirement in today’s society.

Frequently, it is nearly unfeasible for an individual without legal training to generate such paperwork independently, primarily due to the intricate terminology and legal nuances involved.

This is where US Legal Forms can be a game-changer. Our platform offers a vast collection of over 85,000 state-specific forms that cater to virtually any legal circumstance.

If the document you have chosen does not fulfill your requirements, you can restart the search for the appropriate form.

Select Buy now and choose the subscription plan that best fits your needs. Log In with your account details or register a new account. Choose your payment method and proceed to download the Naperville Illinois Estate Planning Questionnaire and Worksheets once the payment is completed.

- Whether you need the Naperville Illinois Estate Planning Questionnaire and Worksheets or any other document relevant to your state or county, US Legal Forms has everything readily available.

- Here’s how you can acquire the Naperville Illinois Estate Planning Questionnaire and Worksheets in just a few minutes using our reliable service.

- If you are already a customer, you can simply Log In to your account and download the required form.

- However, if you are new to our platform, make sure to follow these instructions before downloading the Naperville Illinois Estate Planning Questionnaire and Worksheets.

- Verify the form you have selected is applicable for your area, as the regulations of one state or county may not apply to another.

- Review the document and check a brief description (if available) of the situations for which the document can be utilized.

Form popularity

FAQ

The 5 by 5 rule allows a beneficiary of a trust to withdraw a limited amount from the trust without tax penalties. Specifically, it permits the beneficiary to take up to the greater of $5,000 or 5% of the trust's value each year. This rule can be complex, so referencing the Naperville Illinois Estate Planning Questionnaire and Worksheets can clarify its application, helping you make informed decisions about trust management.

In Illinois, essential documents for estate planning include a will, a power of attorney for property, and a power of attorney for healthcare. Additionally, creating a living trust can simplify the distribution of assets. Utilizing the Naperville Illinois Estate Planning Questionnaire and Worksheets provides a comprehensive overview of these documents, guiding you through the necessary steps to ensure your estate plan is fully prepared.

One of the most significant mistakes parents make when setting up a trust fund is not specifying clear terms for how the assets should be used and distributed. Without guidelines, the trust may lead to confusion and conflicts among beneficiaries. Using resources like the Naperville Illinois Estate Planning Questionnaire and Worksheets can help parents articulate their wishes clearly, ensuring that their assets are managed according to their intentions.

The 5 by 5 rule permits a beneficiary to withdraw up to $5,000 each year from a trust without facing tax penalties, providing additional accessibility to funds. This method can make your estate planning more flexible and responsive to the needs of your beneficiaries. Referencing the Naperville Illinois Estate Planning Questionnaire and Worksheets can help clarify how this rule integrates into your overall planning strategy.

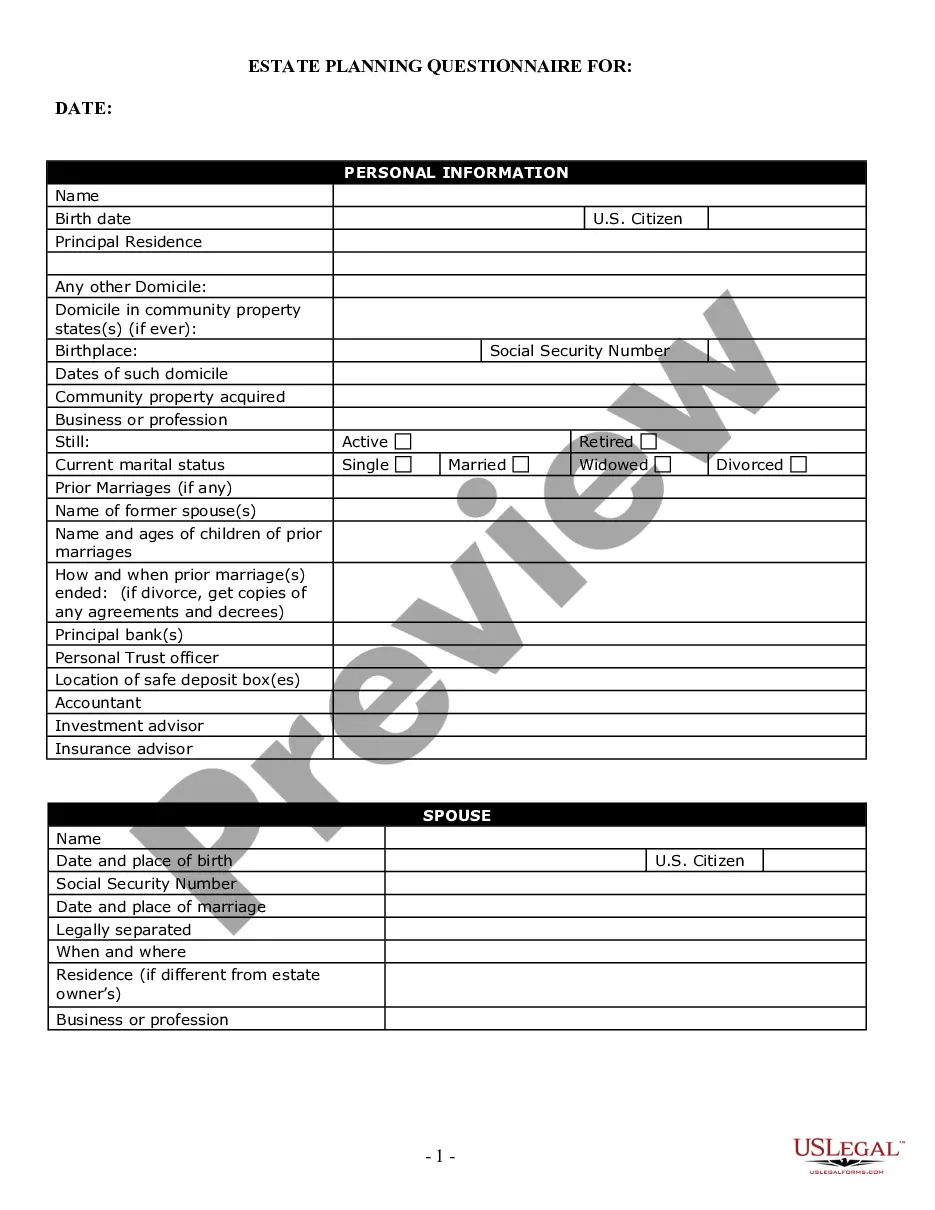

An estate planning questionnaire is a tool that helps you gather and organize vital information about your assets, liabilities, and desired distributions. It serves as a blueprint for your estate plan, guiding discussions with your legal advisor. Using the Naperville Illinois Estate Planning Questionnaire and Worksheets simplifies this process, ensuring you capture all essential details.

Filling out an estate planning questionnaire involves providing accurate information about your assets, debts, and beneficiaries. Take your time to consider each question, as this form serves as a foundation for your estate planning. The Naperville Illinois Estate Planning Questionnaire and Worksheets can assist you in detailing your wishes clearly and comprehensively.

The seven steps in the estate planning process include assessing your needs, determining your goals, gathering necessary documents, choosing beneficiaries, employing legal tools like wills or trusts, reviewing your plan regularly, and communicating your plans with those involved. Following these steps carefully ensures you address all aspects of your estate effectively. Consider using the Naperville Illinois Estate Planning Questionnaire and Worksheets as a practical guide for each step.

To prepare for your estate planning appointment, gather important documents like titles, bank statements, and insurance policies. It helps to think about your desired beneficiaries and any specific wishes for your assets. Completing the Naperville Illinois Estate Planning Questionnaire and Worksheets in advance can streamline this process, ensuring you cover all key points during your meeting.

Certain assets do not belong in a will, such as property held in joint tenancy, assets in a living trust, and retirement accounts with designated beneficiaries. Additionally, life insurance policies typically pass directly to the named beneficiaries outside of the will. Understanding these distinctions through the Naperville Illinois Estate Planning Questionnaire and Worksheets can help you organize your assets effectively.

Choosing between a will and a trust in Illinois depends on your unique situation. A will is straightforward and directs how your property will be distributed, while a trust can offer benefits like avoiding probate and providing privacy. The Naperville Illinois Estate Planning Questionnaire and Worksheets can help you analyze your needs and objectives, allowing you to make an informed decision. Ultimately, a trust may be more beneficial for those seeking long-term asset management.