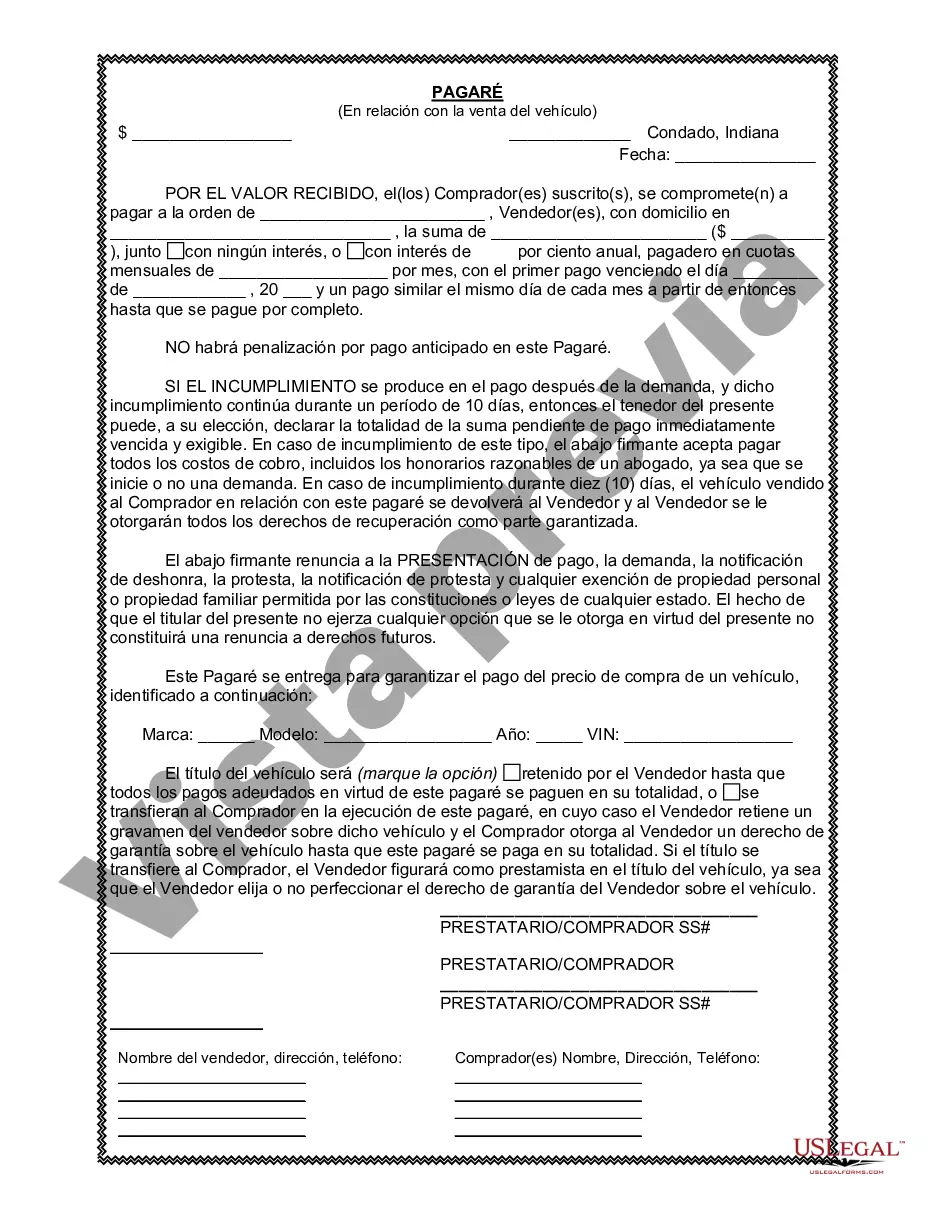

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A promissory note is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower. In the context of Carmel, Indiana, a Carmel Indiana Promissory Note in connection with the sale of a vehicle or automobile is a specific type of promissory note that facilitates the sale of a vehicle on credit. When a seller agrees to sell a vehicle to a buyer on credit, a promissory note is typically used to establish the terms of the loan. This document serves as evidence of the buyer's promise to pay back the loan amount in installments, along with any additional fees or interest that may be applicable. The promissory note includes important details such as the loan amount, interest rate, repayment schedule, consequences of default, and any additional clauses or conditions agreed upon by both parties. Different types of Carmel Indiana Promissory Notes in connection with the sale of a vehicle or automobile may include: 1. Secured Promissory Note: This type of promissory note includes a provision for collateral, where the vehicle being purchased serves as security for the loan. In case of default, the lender has the right to repossess the vehicle to recover their funds. 2. Unsecured Promissory Note: Unlike a secured promissory note, an unsecured promissory note does not involve any collateral. In this case, the lender relies solely on the borrower's promise to pay back the loan. The borrower's creditworthiness and financial history play a crucial role in determining the terms and conditions of an unsecured promissory note. 3. Simple Interest Promissory Note: This type of promissory note specifies that the interest charged on the loan will be calculated using the simple interest method. Simple interest is calculated only on the principal amount and does not calculate interest on interest over time. 4. Compound Interest Promissory Note: Unlike a simple interest promissory note, a compound interest promissory note applies interest on both the principal amount and any interest accumulated over time. This results in a higher overall interest cost for the borrower. 5. Installment Promissory Note: An installment promissory note outlines a specific repayment schedule in which the loan amount, along with any applicable interest and fees, is paid back through a series of equal or varying periodic payments over a defined period. 6. Acceleration Promissory Note: This type of promissory note allows the lender to accelerate the repayment process in case of default by the borrower. It grants the lender the right to demand the full repayment of the outstanding loan balance immediately. In conclusion, a Carmel Indiana Promissory Note in connection with the sale of a vehicle or automobile serves as a crucial legal document that establishes the terms and conditions of a loan agreement for purchasing a vehicle on credit. By naming the different types of promissory notes available, such as secured, unsecured, simple interest, compound interest, installment, and acceleration, this comprehensive description covers the various options that potential borrowers and lenders can consider.A promissory note is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower. In the context of Carmel, Indiana, a Carmel Indiana Promissory Note in connection with the sale of a vehicle or automobile is a specific type of promissory note that facilitates the sale of a vehicle on credit. When a seller agrees to sell a vehicle to a buyer on credit, a promissory note is typically used to establish the terms of the loan. This document serves as evidence of the buyer's promise to pay back the loan amount in installments, along with any additional fees or interest that may be applicable. The promissory note includes important details such as the loan amount, interest rate, repayment schedule, consequences of default, and any additional clauses or conditions agreed upon by both parties. Different types of Carmel Indiana Promissory Notes in connection with the sale of a vehicle or automobile may include: 1. Secured Promissory Note: This type of promissory note includes a provision for collateral, where the vehicle being purchased serves as security for the loan. In case of default, the lender has the right to repossess the vehicle to recover their funds. 2. Unsecured Promissory Note: Unlike a secured promissory note, an unsecured promissory note does not involve any collateral. In this case, the lender relies solely on the borrower's promise to pay back the loan. The borrower's creditworthiness and financial history play a crucial role in determining the terms and conditions of an unsecured promissory note. 3. Simple Interest Promissory Note: This type of promissory note specifies that the interest charged on the loan will be calculated using the simple interest method. Simple interest is calculated only on the principal amount and does not calculate interest on interest over time. 4. Compound Interest Promissory Note: Unlike a simple interest promissory note, a compound interest promissory note applies interest on both the principal amount and any interest accumulated over time. This results in a higher overall interest cost for the borrower. 5. Installment Promissory Note: An installment promissory note outlines a specific repayment schedule in which the loan amount, along with any applicable interest and fees, is paid back through a series of equal or varying periodic payments over a defined period. 6. Acceleration Promissory Note: This type of promissory note allows the lender to accelerate the repayment process in case of default by the borrower. It grants the lender the right to demand the full repayment of the outstanding loan balance immediately. In conclusion, a Carmel Indiana Promissory Note in connection with the sale of a vehicle or automobile serves as a crucial legal document that establishes the terms and conditions of a loan agreement for purchasing a vehicle on credit. By naming the different types of promissory notes available, such as secured, unsecured, simple interest, compound interest, installment, and acceleration, this comprehensive description covers the various options that potential borrowers and lenders can consider.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.