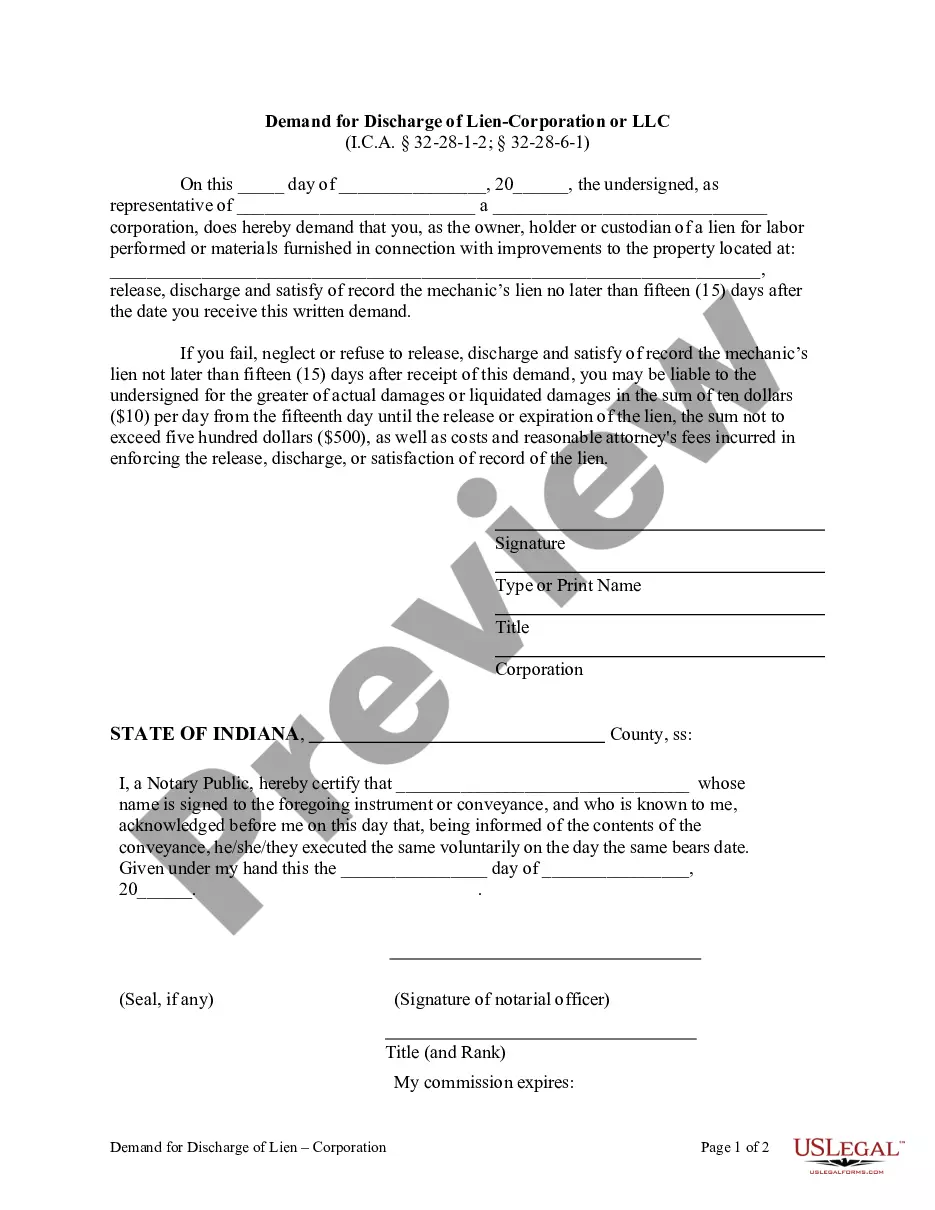

This Demand for Discharge of Lien is for use by a corporation to demand from an owner, holder or custodian of a lien for labor performed or materials furnished in connection with improvements to property to release, discharge and satisfy of record the mechanic's lien no later than 15 days after the date the demand is received.

The Indianapolis Indiana Demand for Discharge of Lien — Corporation or LLC is a legal document specific to the state of Indiana that allows corporations or limited liability companies (LCS) to request the discharge of a lien placed upon their property. This document is essential when a corporation or LLC wishes to clear their property from any encumbrances that may hinder its transfer or financing. The Demand for Discharge of Lien is typically used in situations where a lien has been improperly filed or when the underlying debt or obligation has been satisfied. It is important to note that only corporations and LCS can utilize this document as it pertains only to entities that operate under these legal structures. This demand document must contain various essential elements to be considered valid and enforceable. Firstly, it should identify the party making the demand, which would be the corporation or LLC seeking the discharge of the lien. The document should also include the name and address of the lien holder against whom the demand is made, ensuring proper identification of the relevant parties involved. Furthermore, the Demand for Discharge of Lien should clearly describe the property subject to the lien and provide its legal description or any other identifying information necessary to establish its precise location. This ensures that there is no confusion regarding the property to which the demand relates. Additionally, the document must state the basis for the demand, explicitly outlining the reasons why the corporation or LLC believes the lien should be discharged. This section may specify that the lien was filed in error, that the underlying debt has been satisfied, or any other legally valid grounds for release. Different types of Demand for Discharge of Lien — Corporation or LLC may exist based on the specific circumstances of the lien in question. For instance, there might be variations for different types of liens, such as mechanic's liens, tax liens, or judgment liens. However, regardless of the specific type, all demands for discharge of lien by corporations or LCS serve the common purpose of clearing the encumbrance and asserting the rightful release of the lien. It is important to consult with legal professionals or review the specific guidelines provided by the Indiana state government to ensure the accurate preparation and filing of the Demand for Discharge of Lien — Corporation or LLC. This document plays a crucial role in protecting the property rights of corporations and LCS operating in Indianapolis, Indiana, and serves as a tool to rectify any incorrect or unjust liens imposed on their assets.The Indianapolis Indiana Demand for Discharge of Lien — Corporation or LLC is a legal document specific to the state of Indiana that allows corporations or limited liability companies (LCS) to request the discharge of a lien placed upon their property. This document is essential when a corporation or LLC wishes to clear their property from any encumbrances that may hinder its transfer or financing. The Demand for Discharge of Lien is typically used in situations where a lien has been improperly filed or when the underlying debt or obligation has been satisfied. It is important to note that only corporations and LCS can utilize this document as it pertains only to entities that operate under these legal structures. This demand document must contain various essential elements to be considered valid and enforceable. Firstly, it should identify the party making the demand, which would be the corporation or LLC seeking the discharge of the lien. The document should also include the name and address of the lien holder against whom the demand is made, ensuring proper identification of the relevant parties involved. Furthermore, the Demand for Discharge of Lien should clearly describe the property subject to the lien and provide its legal description or any other identifying information necessary to establish its precise location. This ensures that there is no confusion regarding the property to which the demand relates. Additionally, the document must state the basis for the demand, explicitly outlining the reasons why the corporation or LLC believes the lien should be discharged. This section may specify that the lien was filed in error, that the underlying debt has been satisfied, or any other legally valid grounds for release. Different types of Demand for Discharge of Lien — Corporation or LLC may exist based on the specific circumstances of the lien in question. For instance, there might be variations for different types of liens, such as mechanic's liens, tax liens, or judgment liens. However, regardless of the specific type, all demands for discharge of lien by corporations or LCS serve the common purpose of clearing the encumbrance and asserting the rightful release of the lien. It is important to consult with legal professionals or review the specific guidelines provided by the Indiana state government to ensure the accurate preparation and filing of the Demand for Discharge of Lien — Corporation or LLC. This document plays a crucial role in protecting the property rights of corporations and LCS operating in Indianapolis, Indiana, and serves as a tool to rectify any incorrect or unjust liens imposed on their assets.