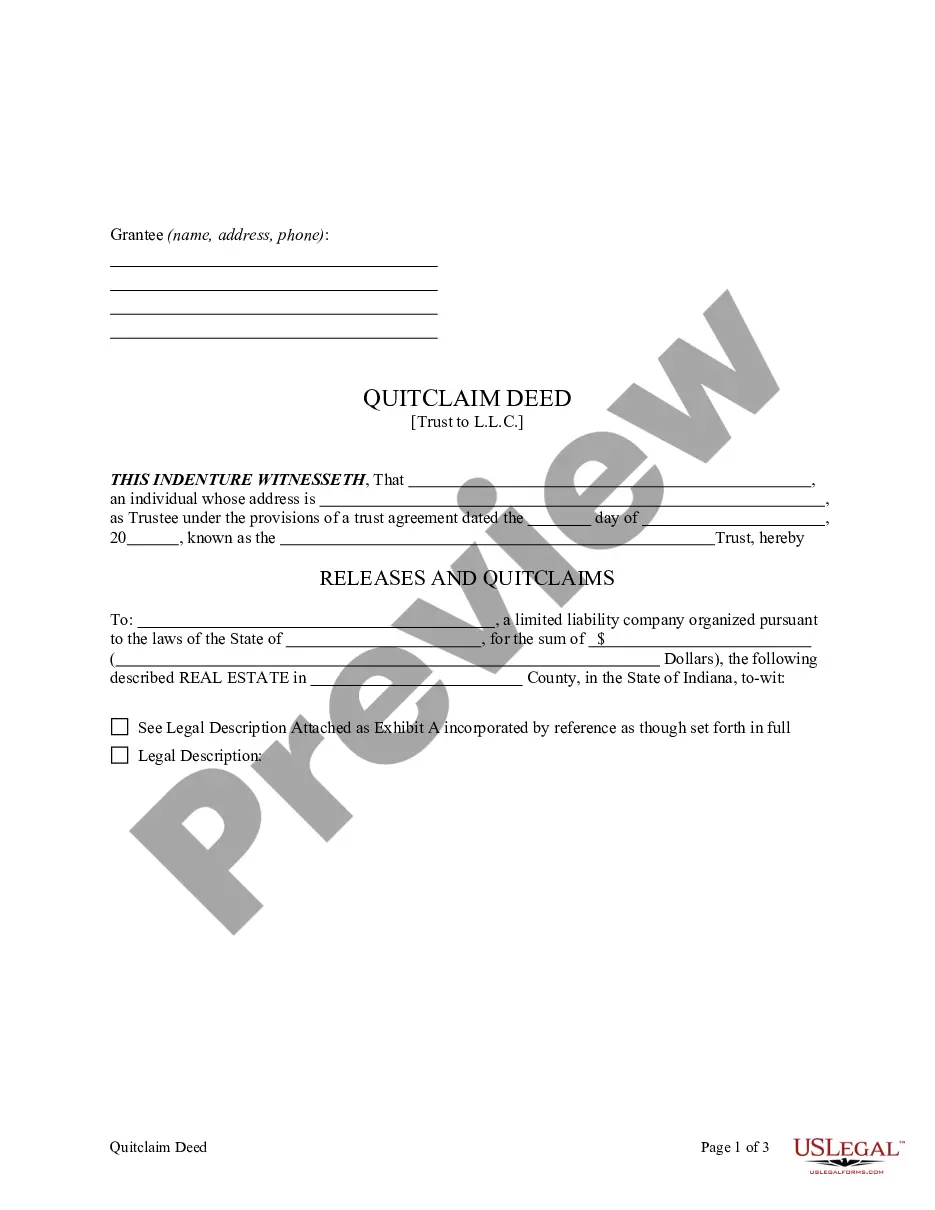

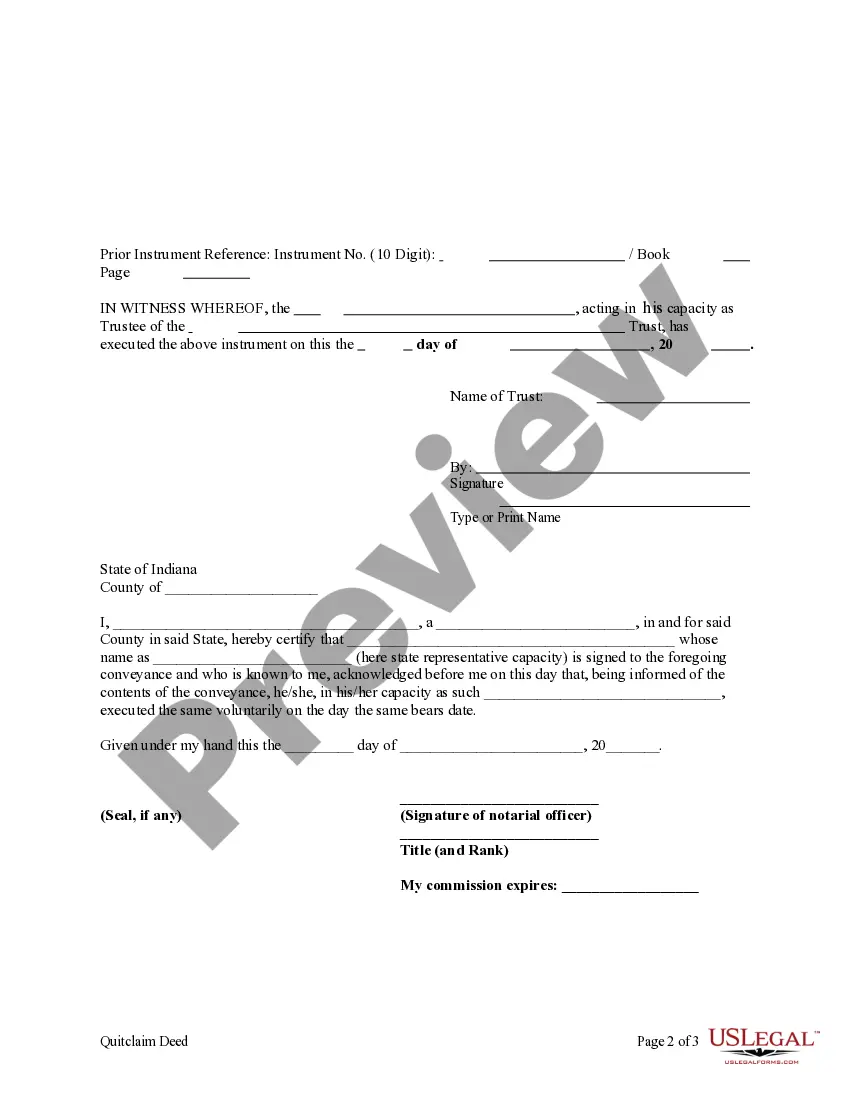

This form is a Quitclaim Deed where the Grantor is a Trust acting by and through a named Trustee and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Carmel Indiana Quitclaim Deed from a Trust to a Limited Liability Company is a legal document that facilitates the transfer of ownership from a trust to an LLC in the city of Carmel, Indiana. This type of deed is commonly used to transfer property or real estate assets held by a trust to a limited liability company for various legal and business purposes. In Carmel, Indiana, there are a few different types of Quitclaim Deeds from a Trust to a Limited Liability Company, each serving unique purposes. These include: 1. Conveyance of Trust Property to an LLC: This type of Quitclaim Deed is used when a property owned by a trust needs to be transferred to a limited liability company. This often occurs when the owners of the trust want to reorganize their assets, separate personal and business interests, or protect their personal liability. 2. Estate Planning: In some cases, a person may transfer property held in a trust to an LLC as part of their estate planning strategy. This allows for more flexible management and distribution of assets among beneficiaries, while ensuring the protection of the trust’s assets. 3. Business Structure Change: When a trust holds property or assets that are going to be actively used for business purposes, the property can be transferred to an LLC. This allows for better management of the assets and provides liability protection for the owners. 4. Tax Planning and Optimization: Transferring property from a trust to an LLC can also have tax advantages. The LLC structure may offer more favorable tax treatment or allow for more efficient tax planning strategies, depending on the specific circumstances of the trust and its beneficiaries. It's important to note that each Quitclaim Deed from a Trust to a Limited Liability Company should be prepared and executed by qualified legal professionals experienced in Indiana real estate laws. The specific process and requirements may vary depending on the nature of the property, the trust, and the LLC. In conclusion, a Carmel Indiana Quitclaim Deed from a Trust to a Limited Liability Company is a legal instrument utilized to transfer ownership of property from a trust to an LLC for various legal, business, and estate planning purposes. Seeking guidance from a knowledgeable attorney is crucial to ensure the smooth and lawful execution of such transactions in Carmel, Indiana.A Carmel Indiana Quitclaim Deed from a Trust to a Limited Liability Company is a legal document that facilitates the transfer of ownership from a trust to an LLC in the city of Carmel, Indiana. This type of deed is commonly used to transfer property or real estate assets held by a trust to a limited liability company for various legal and business purposes. In Carmel, Indiana, there are a few different types of Quitclaim Deeds from a Trust to a Limited Liability Company, each serving unique purposes. These include: 1. Conveyance of Trust Property to an LLC: This type of Quitclaim Deed is used when a property owned by a trust needs to be transferred to a limited liability company. This often occurs when the owners of the trust want to reorganize their assets, separate personal and business interests, or protect their personal liability. 2. Estate Planning: In some cases, a person may transfer property held in a trust to an LLC as part of their estate planning strategy. This allows for more flexible management and distribution of assets among beneficiaries, while ensuring the protection of the trust’s assets. 3. Business Structure Change: When a trust holds property or assets that are going to be actively used for business purposes, the property can be transferred to an LLC. This allows for better management of the assets and provides liability protection for the owners. 4. Tax Planning and Optimization: Transferring property from a trust to an LLC can also have tax advantages. The LLC structure may offer more favorable tax treatment or allow for more efficient tax planning strategies, depending on the specific circumstances of the trust and its beneficiaries. It's important to note that each Quitclaim Deed from a Trust to a Limited Liability Company should be prepared and executed by qualified legal professionals experienced in Indiana real estate laws. The specific process and requirements may vary depending on the nature of the property, the trust, and the LLC. In conclusion, a Carmel Indiana Quitclaim Deed from a Trust to a Limited Liability Company is a legal instrument utilized to transfer ownership of property from a trust to an LLC for various legal, business, and estate planning purposes. Seeking guidance from a knowledgeable attorney is crucial to ensure the smooth and lawful execution of such transactions in Carmel, Indiana.