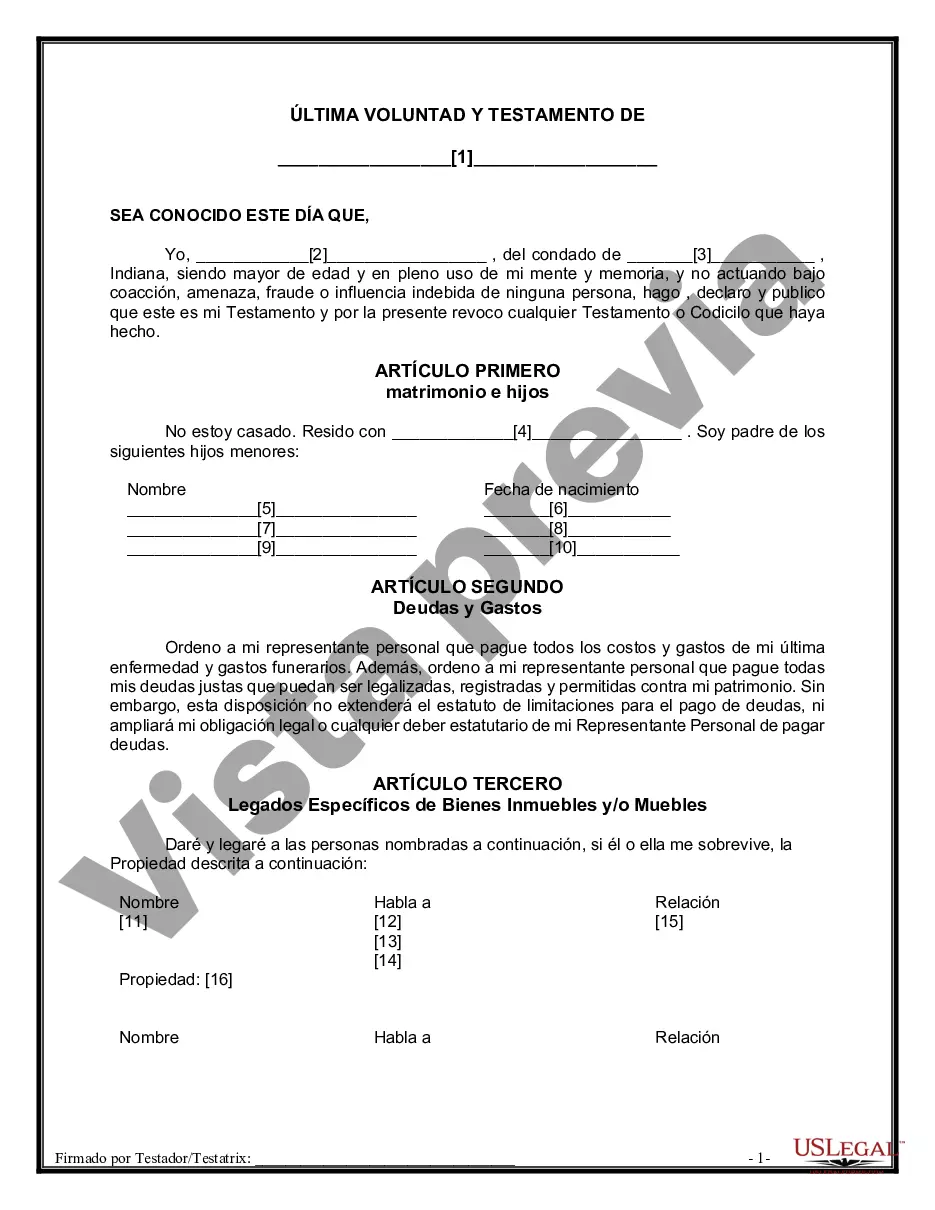

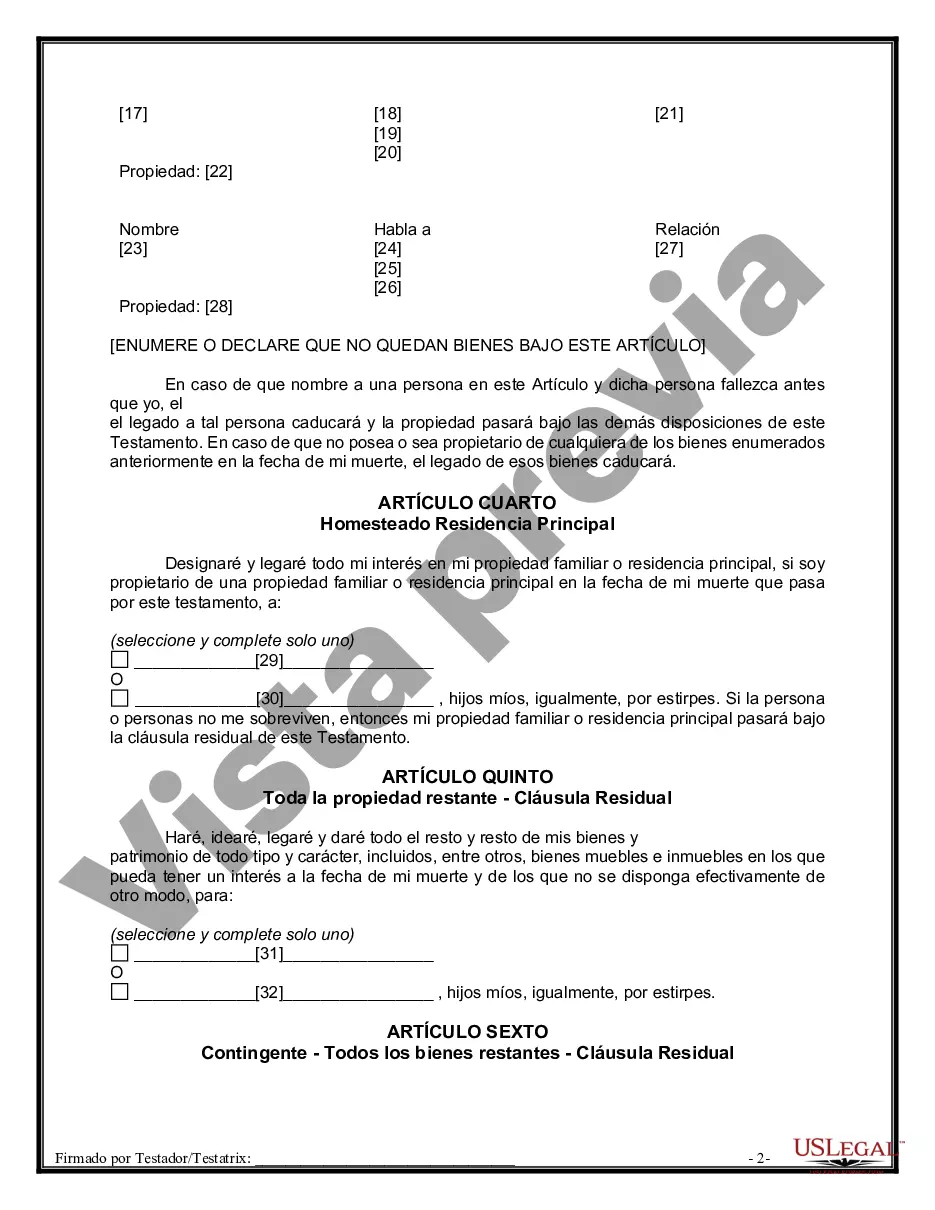

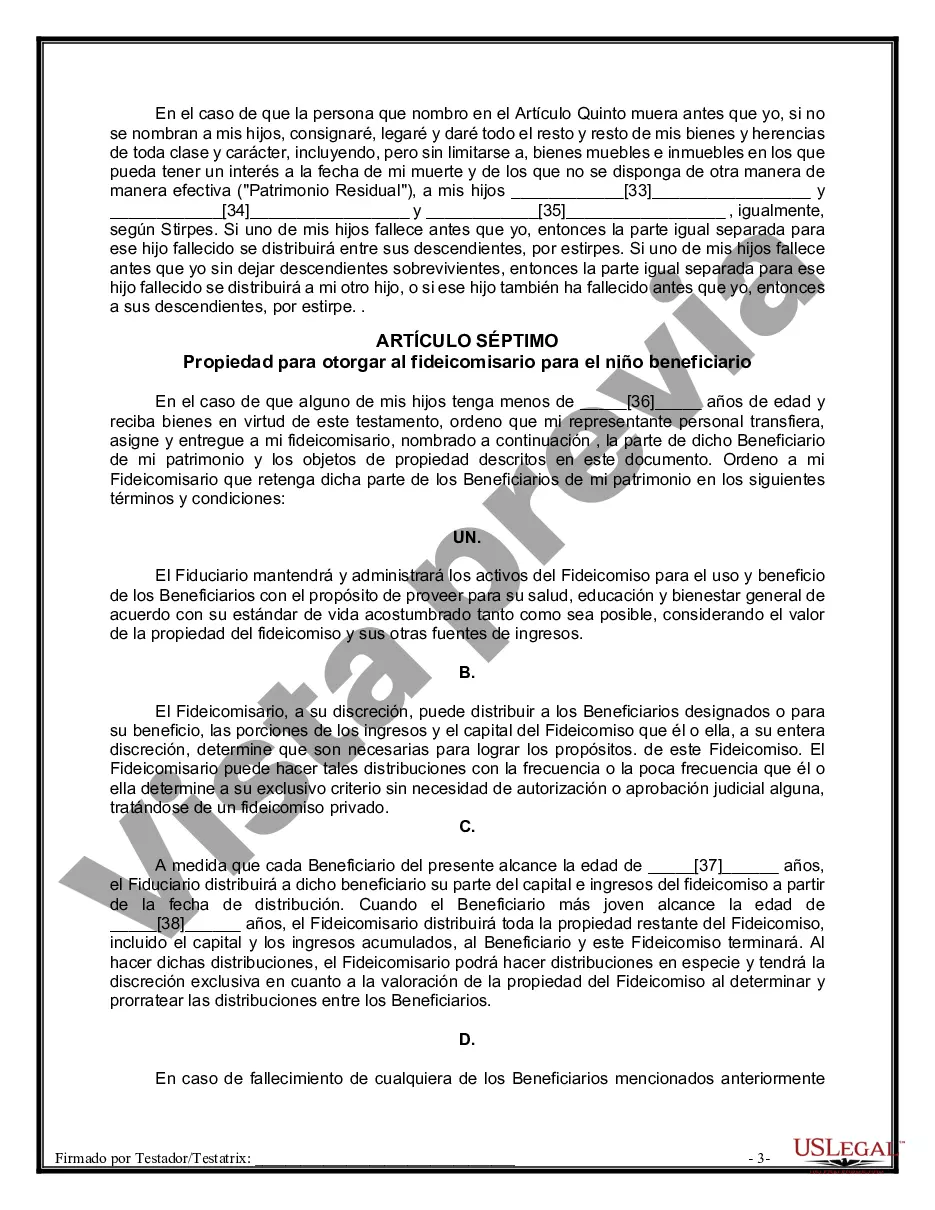

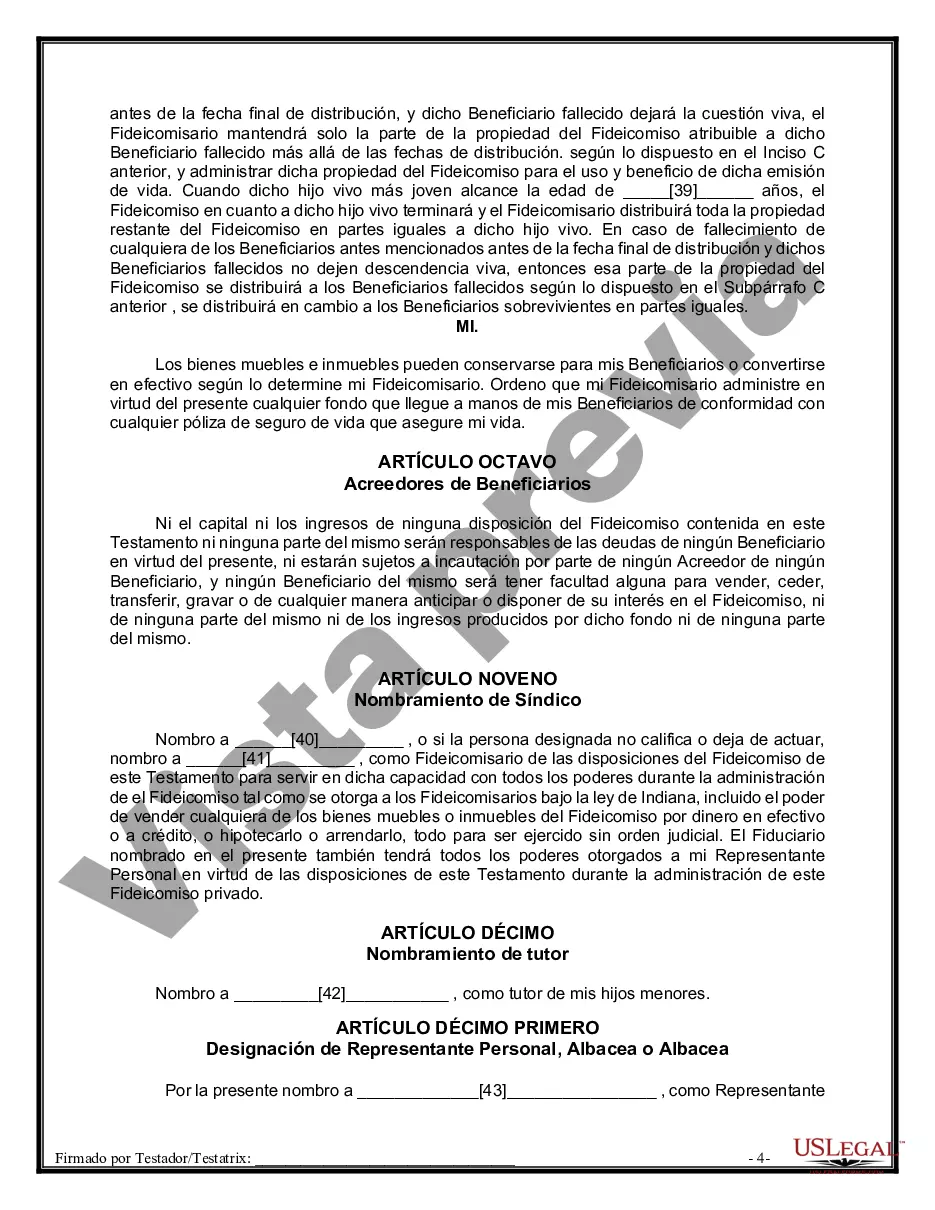

Carmel Indiana Mutual Wills or Last Will and Testaments for Unmarried Persons Living Together with Minor Children are legal documents that unmarried couples in Carmel, Indiana can use to ensure the well-being and protection of their children in the event of their death. These legal instruments outline the distribution of assets, guardianship of the children, and other important matters. In Carmel, Indiana, there may be different types of Mutual Wills or Last Will and Testaments designed specifically for unmarried couples living together with minor children. Some of these variations may include: 1. Mutual Will for Unmarried Couples: This type of will is specifically crafted for unmarried couples who wish to provide for each other and their minor children. It typically includes provisions for asset distribution, guardianship, and the appointment of an executor. 2. Mutual Will with Testamentary Trust: This type of will incorporates the establishment of a testamentary trust. This trust ensures that assets are securely managed for the benefit of the minor children until they reach a certain age or milestone specified by the couple. 3. Last Will and Testament with Guardianship Provisions: This variation focuses primarily on appointing a legal guardian(s) for the couple's minor children in the event of their demise. It clarifies the chosen individual(s) responsible for providing care and making important decisions for the children's well-being. 4. Complex Last Will and Testament for Unmarried Persons Living Together: In some cases, unmarried couples may have more complex financial situations or unique family dynamics. This type of will address specific circumstances such as blended families, trusts, business ownership, or the need to provide for children from previous relationships. Creating a Carmel Indiana Mutual Will or Last Will and Testament for Unmarried Persons living together with Minor Children is a crucial step in ensuring that the couple's wishes are legally recognized and that their children are protected. It is advisable to consult with an experienced estate planning attorney to understand the legal requirements, options, and potential tax implications associated with these different types of wills.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Carmel Indiana Testamentos Mutuos o Últimas Voluntades y Testamentos para Personas Solteras que conviven con Hijos Menores - Indiana Mutual Wills or Last Will and Testaments for Man and Woman living together, not Married with Minor Children

Description

How to fill out Carmel Indiana Testamentos Mutuos O Últimas Voluntades Y Testamentos Para Personas Solteras Que Conviven Con Hijos Menores?

Are you looking for a reliable and inexpensive legal forms supplier to buy the Carmel Indiana Mutual Wills or Last Will and Testaments for Unmarried Persons living together with Minor Children? US Legal Forms is your go-to option.

No matter if you require a simple agreement to set rules for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and frameworked based on the requirements of particular state and county.

To download the form, you need to log in account, locate the required template, and click the Download button next to it. Please remember that you can download your previously purchased document templates at any time in the My Forms tab.

Are you new to our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Carmel Indiana Mutual Wills or Last Will and Testaments for Unmarried Persons living together with Minor Children conforms to the laws of your state and local area.

- Read the form’s details (if available) to find out who and what the form is intended for.

- Start the search over in case the template isn’t suitable for your legal scenario.

Now you can register your account. Then choose the subscription option and proceed to payment. As soon as the payment is done, download the Carmel Indiana Mutual Wills or Last Will and Testaments for Unmarried Persons living together with Minor Children in any available format. You can return to the website when you need and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about spending hours researching legal paperwork online once and for all.