This is a Dissolution Package used to dissolve a Limited Liability Company in the State of Indiana. The package contains all forms necessary in the dissolution of the LLC or PLLC including: step by step instructions, addresses, transmittal letters, and other information.

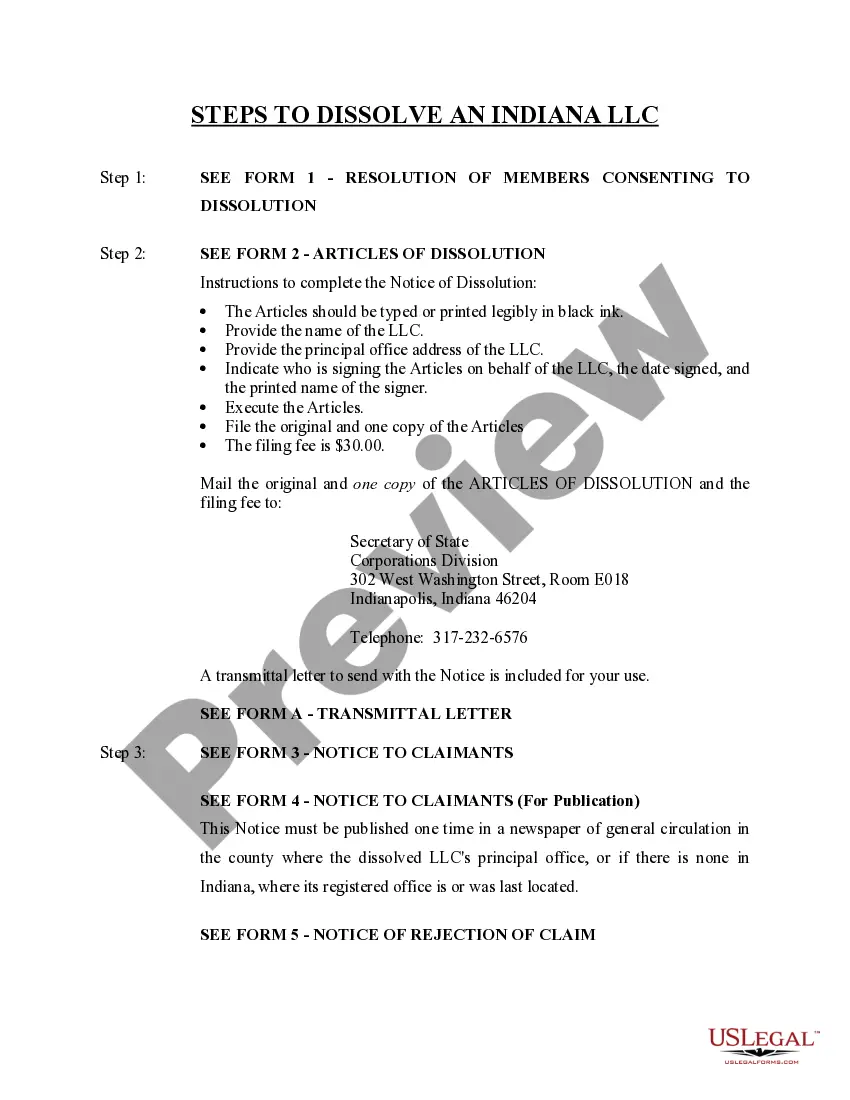

Evansville Indiana Dissolution Package to Dissolve Limited Liability Company LLC — Electronic Version is a comprehensive set of legal documents specifically designed to facilitate the smooth and efficient dissolution of a Limited Liability Company (LLC) in Evansville, Indiana. This electronic package offers a convenient and cost-effective way for business owners to dissolve their LCS without the need for expensive legal consultation. The Evansville Indiana Dissolution Package includes all the necessary forms and instructions required by the state of Indiana to legally dissolve an LLC. The package is tailored to meet the specific requirements and regulations established by the Indiana Secretary of State's office. Key components of the Evansville Indiana Dissolution Package may include: 1. Articles of Dissolution: This document formally notifies the Indiana Secretary of State of the LLC's intent to dissolve. It includes important details such as the name of the LLC, its principal place of business, and the effective date of dissolution. 2. Certificate of Dissolution: Once the Articles of Dissolution are approved by the Indiana Secretary of State, a Certificate of Dissolution is issued. This certificate serves as official proof that the LLC has been dissolved. 3. Notice to Creditors: This document is necessary to inform any outstanding creditors of the LLC about the dissolution process. It outlines the steps creditors need to take in order to make any claims against the company's assets. 4. Tax Clearance Application: In some cases, LCS may be required to obtain tax clearance and settle any outstanding tax obligations before dissolution can be finalized. The package may include instructions and forms necessary to complete this process. 5. Additional Forms and Instructions: The package may also include any other relevant forms and instructions needed to complete the dissolution process, such as requirements for filing final tax returns or transferring assets to members or other entities. Different versions or variations of the Evansville Indiana Dissolution Package may exist, tailored to specific circumstances or preferences. For example: — Expedited Dissolution Package: This version provides an accelerated dissolution process for LCS with fewer assets or liabilities, streamlining the paperwork and requirements. — LLC Dissolution Package with Legal Consultation: This version includes access to legal professionals who can provide guidance and consultation throughout the dissolution process, ensuring compliance with all relevant regulations and resolving any complications that may arise. It's important to note that the specific contents of the Evansville Indiana Dissolution Package may vary depending on the provider or service offering it. It is advisable to thoroughly review the package details and consult professional advisors if needed to ensure compliance with all legal requirements and the unique needs of your LLC.Evansville Indiana Dissolution Package to Dissolve Limited Liability Company LLC — Electronic Version is a comprehensive set of legal documents specifically designed to facilitate the smooth and efficient dissolution of a Limited Liability Company (LLC) in Evansville, Indiana. This electronic package offers a convenient and cost-effective way for business owners to dissolve their LCS without the need for expensive legal consultation. The Evansville Indiana Dissolution Package includes all the necessary forms and instructions required by the state of Indiana to legally dissolve an LLC. The package is tailored to meet the specific requirements and regulations established by the Indiana Secretary of State's office. Key components of the Evansville Indiana Dissolution Package may include: 1. Articles of Dissolution: This document formally notifies the Indiana Secretary of State of the LLC's intent to dissolve. It includes important details such as the name of the LLC, its principal place of business, and the effective date of dissolution. 2. Certificate of Dissolution: Once the Articles of Dissolution are approved by the Indiana Secretary of State, a Certificate of Dissolution is issued. This certificate serves as official proof that the LLC has been dissolved. 3. Notice to Creditors: This document is necessary to inform any outstanding creditors of the LLC about the dissolution process. It outlines the steps creditors need to take in order to make any claims against the company's assets. 4. Tax Clearance Application: In some cases, LCS may be required to obtain tax clearance and settle any outstanding tax obligations before dissolution can be finalized. The package may include instructions and forms necessary to complete this process. 5. Additional Forms and Instructions: The package may also include any other relevant forms and instructions needed to complete the dissolution process, such as requirements for filing final tax returns or transferring assets to members or other entities. Different versions or variations of the Evansville Indiana Dissolution Package may exist, tailored to specific circumstances or preferences. For example: — Expedited Dissolution Package: This version provides an accelerated dissolution process for LCS with fewer assets or liabilities, streamlining the paperwork and requirements. — LLC Dissolution Package with Legal Consultation: This version includes access to legal professionals who can provide guidance and consultation throughout the dissolution process, ensuring compliance with all relevant regulations and resolving any complications that may arise. It's important to note that the specific contents of the Evansville Indiana Dissolution Package may vary depending on the provider or service offering it. It is advisable to thoroughly review the package details and consult professional advisors if needed to ensure compliance with all legal requirements and the unique needs of your LLC.