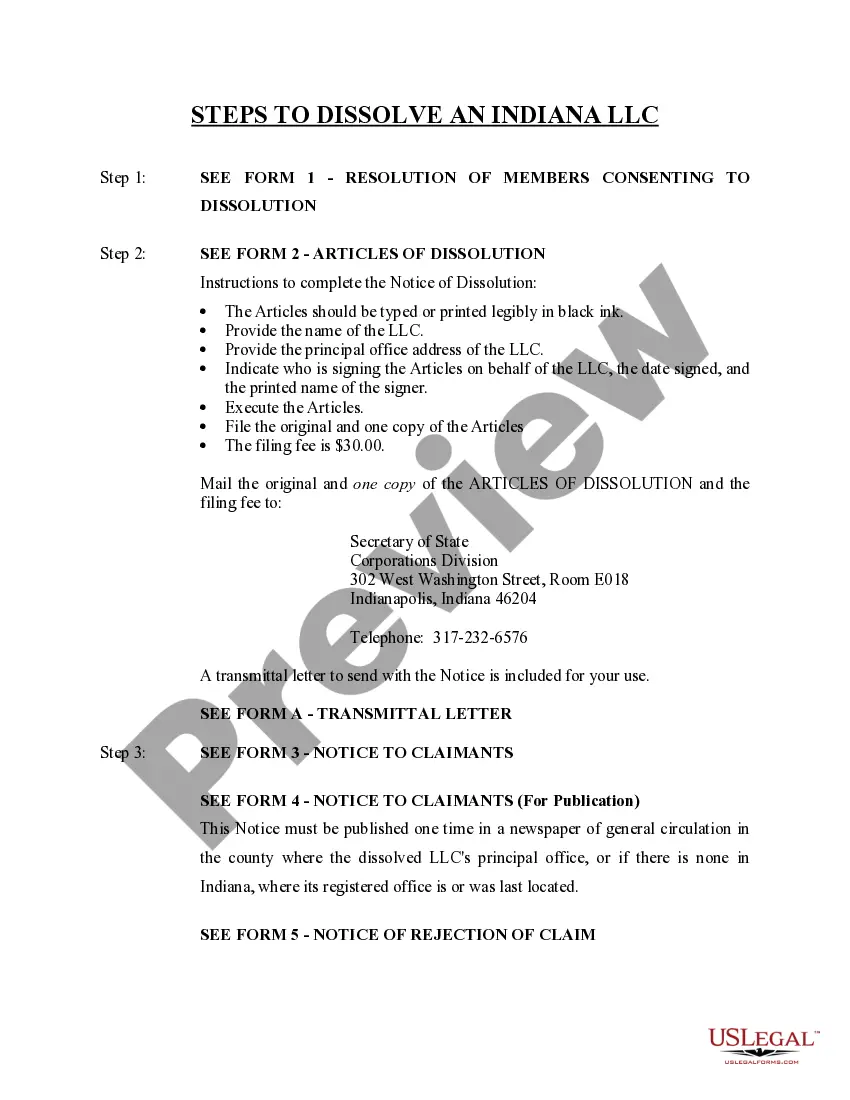

This is a Dissolution Package used to dissolve a Limited Liability Company in the State of Indiana. The package contains all forms necessary in the dissolution of the LLC or PLLC including: step by step instructions, addresses, transmittal letters, and other information.

Indianapolis Indiana Dissolution Package to Dissolve Limited Liability Company LLC - Electronic Version

Description

How to fill out Indiana Dissolution Package To Dissolve Limited Liability Company LLC - Electronic Version?

Locating validated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms database.

It’s an online repository of over 85,000 legal forms catering to both personal and professional requirements along with any real-world circumstances.

All the paperwork is well organized by area of use and jurisdictional regions, making it straightforward and simple to find the Indianapolis Indiana Dissolution Package to Terminate Limited Liability Company LLC - Electronic Version.

By maintaining documents well-organized and compliant with legal regulations, you underscore the significance essential for documentation. Take advantage of the US Legal Forms library to always possess necessary document templates readily available for any requirements!

- Verify the Preview mode and form description.

- Ensure you’ve selected the correct one that fulfills your needs and fully aligns with your local jurisdiction standards.

- Search for another template if necessary.

- If you encounter any discrepancies, use the Search tab above to find the appropriate one. If it meets your criteria, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

To dissolve your LLC in Indiana, submit one original and one copy of the Indiana Articles of Dissolution (Form 49465) to the Indiana Secretary of State (SOS) by mail or in person. Articles of Dissolution can be filed online if you pay using an IN.gov payment account or a MasterCard, Discover or Visa credit card.

By dissolving an LLC properly, it means that the LLC is no longer a legal business entity so you won't be expected to pay any fees or taxes, or file any more documents. Despite no longer operating, it is possible for members to create a new LLC and run it in the same way as the dissolved company.

Termination: All that must be done has been done This document may be called articles of termination, articles of cancellation, or a similar name. In it, the LLC has to state that all debts and liabilities have been paid or provided for and any remaining assets distributed.

To close an LLC completely, you need to file a final tax return with the state and the IRS. Make sure you check the box to show this is the final return for the LLC. Fill out Schedule K-1 and give a copy to each member so that they know what to report on their own personal taxes in terms of losses and gains.

Dissolution: The beginning of the end, not the end itself. What it is and what it isn't. Dissolution is the first step in the termination process is to dissolve the LLC. Although some people confuse dissolution and termination, dissolution does not terminate an LLC's existence.

To formally dissolve, businesses must file with the Indiana Secretary of State first. Please note that closing your business in INBiz will only end your obligations to the Secretary of State's office. You are responsible for properly closing the business with all other agencies in which your business is registered.

The Process of Dissolving a NJ LLC Dissolution is a process in which the LLC begins its legal termination. It is the death of the LLC. It takes place when one or more of its members cease their association with the LLC or an event takes place which so affects the company it is forced to legally dissolve.

Once a member withdraws (or dissociates) from the LLC, the LLC remains in business and does not dissolve. A dissociated member continues to hold an economic interest in the LLC for the same ownership interest percentage as their former membership interest.

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.