Fort Wayne Indiana Living Trust for Individuals Who are Single, Divorced, Widow or Widower with No Children: A Comprehensive Guide If you are a resident of Fort Wayne, Indiana, and find yourself single, divorced, widowed, or a widower with no children, it is crucial to plan your estate and protect your assets. One effective way to achieve this is by creating a living trust tailored specifically to your unique circumstances. In this comprehensive guide, we will explore the concept of a Fort Wayne Indiana Living Trust for individuals in this particular situation, along with some different types of trusts you may consider. What is a Living Trust? A living trust, also known as a revocable trust, is a legal document that allows an individual, known as the granter or settler, to transfer assets into a trust for the benefit of themselves (the trustee) during their lifetime, and ultimately, their chosen beneficiaries upon their death. Unlike a will, a living trust bypasses the probate process, ensuring your assets are distributed efficiently and privately. Benefits of a Living Trust for Individuals Who are Single, Divorced, Widow, or Widower with No Children: 1. Asset Protection: By placing your assets in a living trust, you can protect them from potential creditors and legal disputes, ensuring your hard-earned wealth is preserved. 2. Privacy: Unlike a will, a living trust allows your estate plan to remain confidential, shielding your personal and financial affairs from public scrutiny. 3. Flexibility: Living trusts offer flexibility in managing and distributing your assets. You can determine the terms of the trust and make changes or amendments whenever necessary. 4. Incapacity Planning: A living trust provides clear guidelines for asset management in the event of incapacity, ensuring someone you trust is empowered to handle your affairs in your best interest. Different Types of Fort Wayne Indiana Living Trust for Individuals Who are Single, Divorced, Widow or Widower with No Children: 1. Basic Individual Living Trust: This type of living trust is suitable for individuals with modest estates and straightforward asset distribution wishes. It allows the granter to retain full control and access over their assets during their lifetime and designate beneficiaries or charitable organizations to receive the assets upon their death. 2. Charitable Living Trust: For individuals with philanthropic inclinations, a charitable living trust lets you allocate a portion or all of your assets to charitable organizations of your choice. This trust also provides potential tax benefits. 3. Supplemental Needs Trust: If you have a disabled loved one who may rely on government benefits, a supplemental needs trust can provide for their care without disqualifying them for assistance programs. This trust ensures their extra needs are met beyond what the government provides. 4. Life Insurance Trust: This trust allows you to designate beneficiaries who will receive the proceeds from a specifically created life insurance policy upon your death, providing financial security to your loved ones or charitable causes. In conclusion, a Fort Wayne Indiana Living Trust for individuals who are single, divorced, widowed, or widower with no children offers numerous benefits and flexibility in estate planning. By choosing the right type of trust to suit your specific needs, you can ensure the protection of your assets, maintain privacy, and provide for your intended beneficiaries. Remember to consult with a qualified estate planning attorney in Fort Wayne to create a living trust that aligns with your goals and safeguards your legacy.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fort Wayne Indiana Fideicomiso en Vida para Individuos Solteros, Divorciados o Viudos o Viudos sin Hijos - Indiana Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children

Description

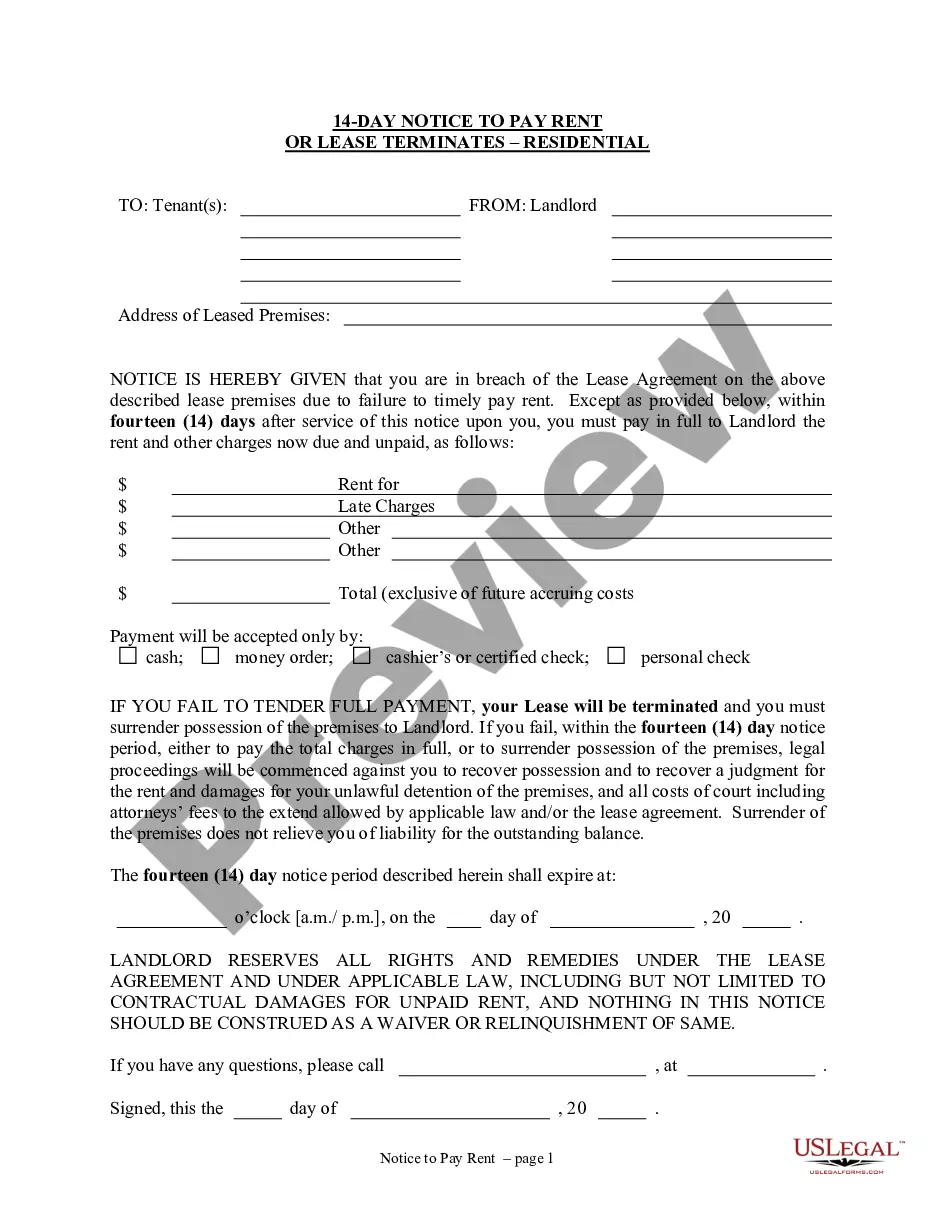

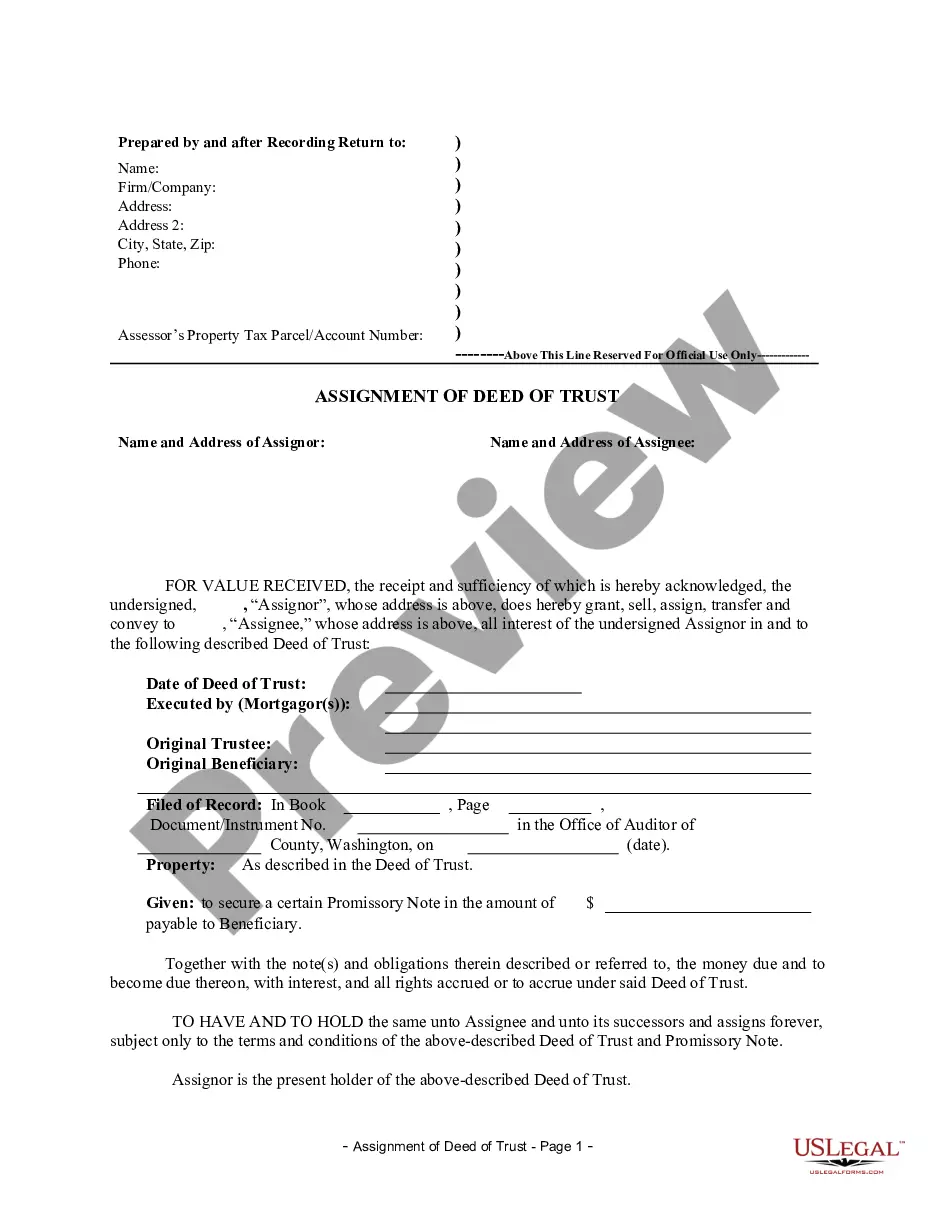

How to fill out Fort Wayne Indiana Fideicomiso En Vida Para Individuos Solteros, Divorciados O Viudos O Viudos Sin Hijos?

If you are searching for a relevant form template, it’s extremely hard to choose a better service than the US Legal Forms site – probably the most comprehensive online libraries. Here you can find a huge number of templates for business and individual purposes by types and regions, or key phrases. With our advanced search function, finding the most up-to-date Fort Wayne Indiana Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children is as easy as 1-2-3. In addition, the relevance of every file is proved by a group of skilled attorneys that regularly review the templates on our platform and update them based on the most recent state and county regulations.

If you already know about our platform and have an account, all you should do to receive the Fort Wayne Indiana Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children is to log in to your user profile and click the Download option.

If you make use of US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have chosen the form you want. Look at its information and utilize the Preview option (if available) to explore its content. If it doesn’t meet your needs, utilize the Search option at the top of the screen to get the appropriate document.

- Affirm your selection. Click the Buy now option. Next, pick the preferred subscription plan and provide credentials to register an account.

- Process the purchase. Make use of your bank card or PayPal account to complete the registration procedure.

- Get the form. Pick the format and download it on your device.

- Make modifications. Fill out, edit, print, and sign the acquired Fort Wayne Indiana Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children.

Every single form you add to your user profile has no expiration date and is yours permanently. You always have the ability to access them via the My Forms menu, so if you need to get an additional version for modifying or creating a hard copy, you can come back and save it once again at any moment.

Take advantage of the US Legal Forms professional catalogue to get access to the Fort Wayne Indiana Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children you were looking for and a huge number of other professional and state-specific samples in a single place!