Evansville Indiana Living Trust for Husband and Wife with One Child: A Comprehensive Guide Living trusts have gained widespread popularity as an effective estate planning tool, offering numerous benefits and flexibility for individuals and families alike. In Evansville, Indiana, couples with one child can ensure the protection and efficient management of their assets through an Evansville Indiana Living Trust for Husband and Wife with One Child. This type of trust provides a solid foundation for preserving and distributing assets and minimizing estate taxes for generations to come. Keywords: Evansville Indiana, living trust, husband and wife, one child, estate planning, assets, protection, management, minimizing estate taxes. 1. Overview of an Evansville Indiana Living Trust: An Evansville Indiana Living Trust serves as a legal entity that holds and manages assets during a person's lifetime and provides for their efficient distribution after death. It allows couples to retain control over their assets while ensuring a smooth transfer of wealth to their beneficiaries. 2. Importance of a Living Trust: By setting up a living trust, couples can avoid the probate process, which can be time-consuming and costly. Additionally, this type of trust helps maintain privacy, ensures asset protection for their child, and enables the efficient distribution of assets without unnecessary delays. 3. Revocable Living Trust: One common type of Evansville Indiana Living Trust for Husband and Wife with One Child is the revocable living trust. As the name suggests, this trust can be modified or revoked during the couple's lifetime, providing them with flexibility and control over their assets. 4. Irrevocable Living Trust: Another option available to couples is the irrevocable living trust. Unlike a revocable trust, an irrevocable trust cannot be changed or revoked once established. This type of trust offers specific advantages, such as asset protection and potential tax benefits. 5. Customized Estate Planning: With Evansville Indiana Living Trusts for Husband and Wife with One Child, couples can tailor their estate plans to meet their unique needs and goals. They can determine how their assets should be managed, identify the beneficiaries, and establish specific guidelines for their child's financial security. 6. Minimizing Estate Taxes: Utilizing an Evansville Indiana Living Trust can help minimize estate taxes, ensuring that the maximum amount of wealth is passed on to the child. By properly structuring the trust, couples can explore tax-saving strategies and protect their family's financial future. 7. Fiduciary Roles and Responsibilities: In a living trust, couples must appoint trustees and successor trustees, who will be responsible for managing and distributing the assets according to their wishes. It is crucial to choose reliable individuals or professional fiduciaries who understand the unique requirements of an Evansville Indiana Living Trust. 8. Ongoing Trust Administration: An Evansville Indiana Living Trust requires diligent administration even after it is established. Trustees must adhere to legal requirements, regularly review and manage trust assets, and ensure that the child's financial well-being is safeguarded. Remember, it is always advisable to consult with an experienced estate planning attorney specialized in Evansville, Indiana laws to create a customized living trust that addresses your specific circumstances and protects your family's interests. By choosing an Evansville Indiana Living Trust for Husband and Wife with One Child, couples can have peace of mind knowing that their assets are protected, their child's needs are provided for, and their legacy will endure for future generations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Evansville Indiana Fideicomiso en vida para esposo y esposa con un hijo - Indiana Living Trust for Husband and Wife with One Child

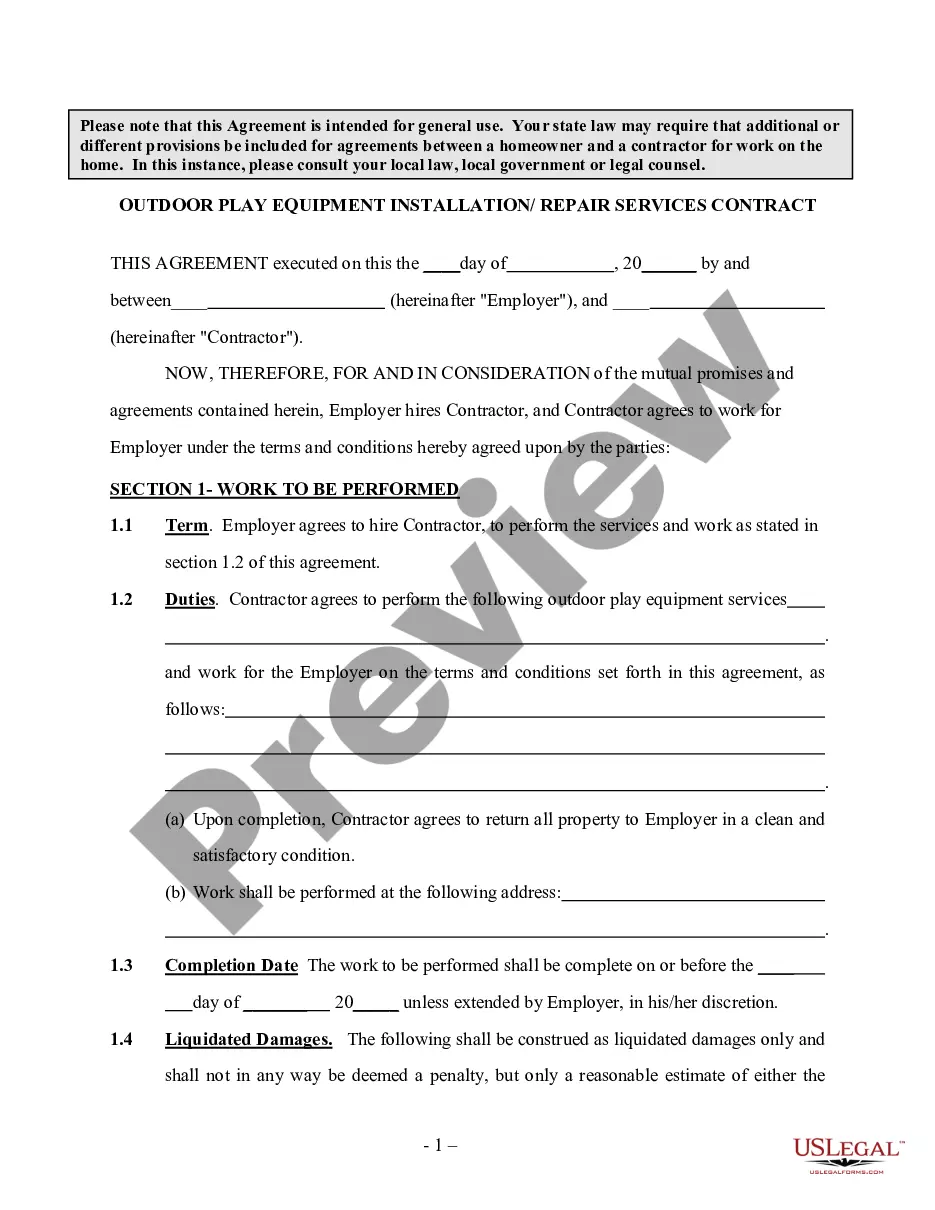

Description

How to fill out Evansville Indiana Fideicomiso En Vida Para Esposo Y Esposa Con Un Hijo?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for a person without any legal background to draft this sort of papers cfrom the ground up, mainly due to the convoluted jargon and legal nuances they involve. This is where US Legal Forms comes in handy. Our service provides a huge catalog with over 85,000 ready-to-use state-specific documents that work for pretty much any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time using our DYI forms.

Whether you require the Evansville Indiana Living Trust for Husband and Wife with One Child or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Evansville Indiana Living Trust for Husband and Wife with One Child quickly employing our reliable service. If you are already an existing customer, you can go on and log in to your account to get the appropriate form.

However, in case you are unfamiliar with our library, make sure to follow these steps before downloading the Evansville Indiana Living Trust for Husband and Wife with One Child:

- Ensure the form you have found is specific to your area since the rules of one state or county do not work for another state or county.

- Preview the document and go through a brief description (if provided) of cases the paper can be used for.

- In case the one you selected doesn’t meet your requirements, you can start again and look for the necessary form.

- Click Buy now and choose the subscription option that suits you the best.

- with your login information or create one from scratch.

- Select the payment method and proceed to download the Evansville Indiana Living Trust for Husband and Wife with One Child once the payment is through.

You’re all set! Now you can go on and print out the document or fill it out online. If you have any problems getting your purchased documents, you can easily access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.