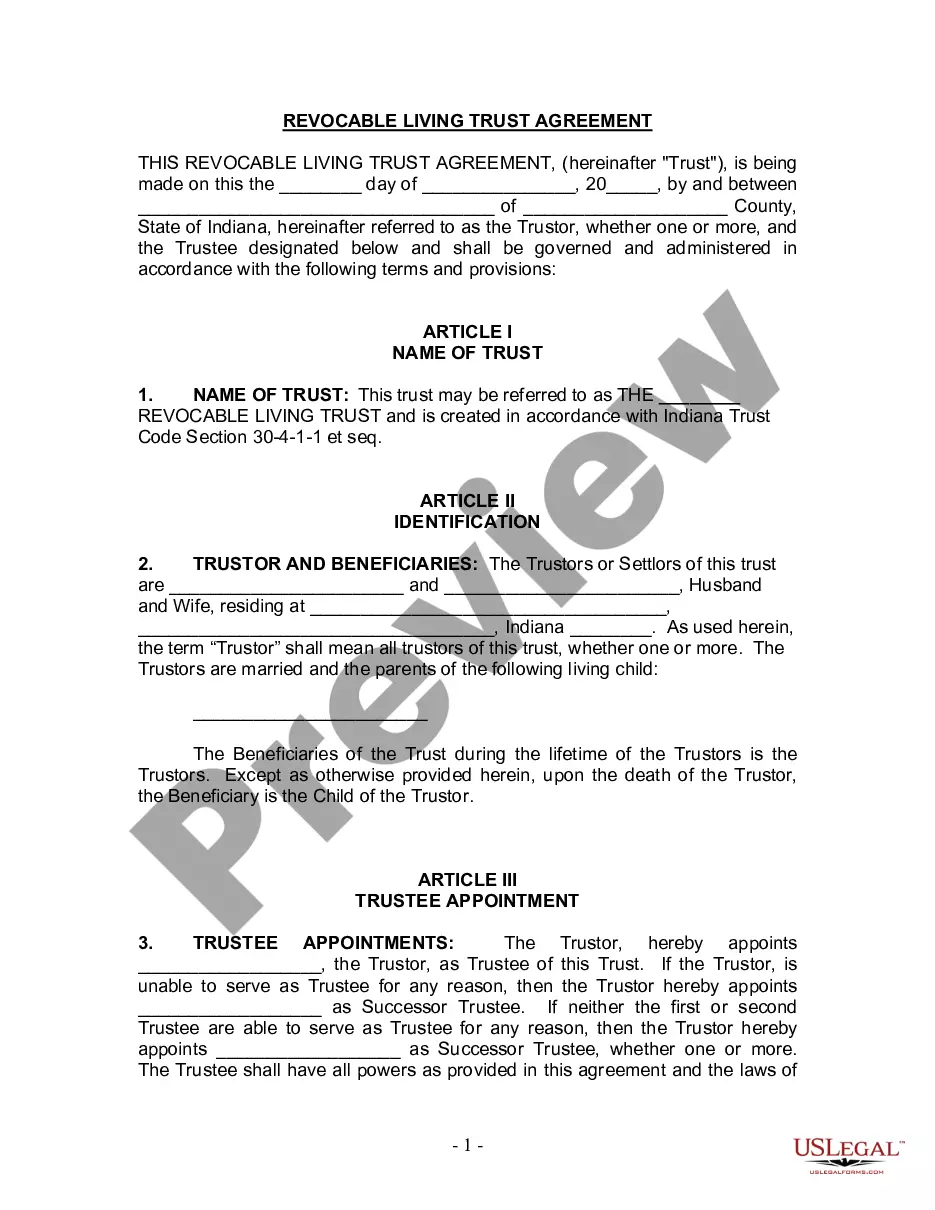

This form is a living trust form prepared for your state. It is for a husband and wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Indianapolis Indiana Living Trust for Husband and Wife with One Child

Description

How to fill out Indiana Living Trust For Husband And Wife With One Child?

Utilize the US Legal Forms to gain instant access to any document you require. Our user-friendly platform boasts thousands of templates, simplifying the process of locating and acquiring nearly any document sample you might need.

You can save, complete, and validate the Indianapolis Indiana Living Trust for Husband and Wife with One Child in mere minutes rather than spending hours searching online for a suitable template.

Using our collection is an excellent way to enhance the security of your form submissions. Our knowledgeable legal experts routinely review all documents to ensure that the templates are suitable for specific states and adhere to the latest regulations and guidelines.

How can you obtain the Indianapolis Indiana Living Trust for Husband and Wife with One Child? If you have an account, simply Log In to your profile. The Download button will appear on all the forms you view. Furthermore, you can access all your previously saved documents in the My documents section.

US Legal Forms stands out as one of the largest and most reliable template repositories on the internet. We are always here to assist you in any legal undertaking, even if it involves merely downloading the Indianapolis Indiana Living Trust for Husband and Wife with One Child.

Feel free to take advantage of our service to make your document experience as streamlined as possible!

- Access the page containing the form you need. Ensure that it is the template you intended to find: examine its title and description, and utilize the Preview option when available. If not, use the Search field to find the right one.

- Initiate the download process. Click Buy Now and select the pricing plan that best fits your needs. Then, create an account and pay for your order using a credit card or PayPal.

- Download the file. Choose the format to receive the Indianapolis Indiana Living Trust for Husband and Wife with One Child and modify and complete it, or sign it according to your requirements.

Form popularity

FAQ

The Joint Trust. Typically, when a married couple utilizes a Revocable Living Trust-based estate plan, each spouse creates and funds his or her own separate Revocable Living Trust. This results in two trusts. However, in the right circumstances, a married couple may be better served by creating a single Joint Trust.

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.

Common Types of Trusts Inter vivos trusts or living trusts: created and active during the lifetime of the grantor. Testamentary trusts: trusts formed after the death of the grantor. Revocable trusts: can be changed or revoked entirely by the grantor.

Joint trusts are easier to manage during a couple's lifetime. Since all assets are held in one trust, ownership mimics how many couples hold their assets - jointly. Both spouses having equal control of the management of joint assets held by the trust.

Lawyers often use hourly fee schedules, and the price associated with creating a living trust is generally at least $1,000. Again, more complex estates may pay even more than that. In particular, make sure you're using an estate planning lawyer that has a specialty in trusts.

To make sure it's done properly, you'll probably want to hire a lawyer, which can put you at least $1,000 out of pocket. For especially large estates, a qualified financial advisor is also essential.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

How Much Does a Trust Cost? If you hire an attorney to build your trust, you'll likely pay in the range of $1,500 to $2,500, depending on whether you are single or married, how complex the trust needs to be and what state you are in.

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.

To make a living trust in Maryland, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.