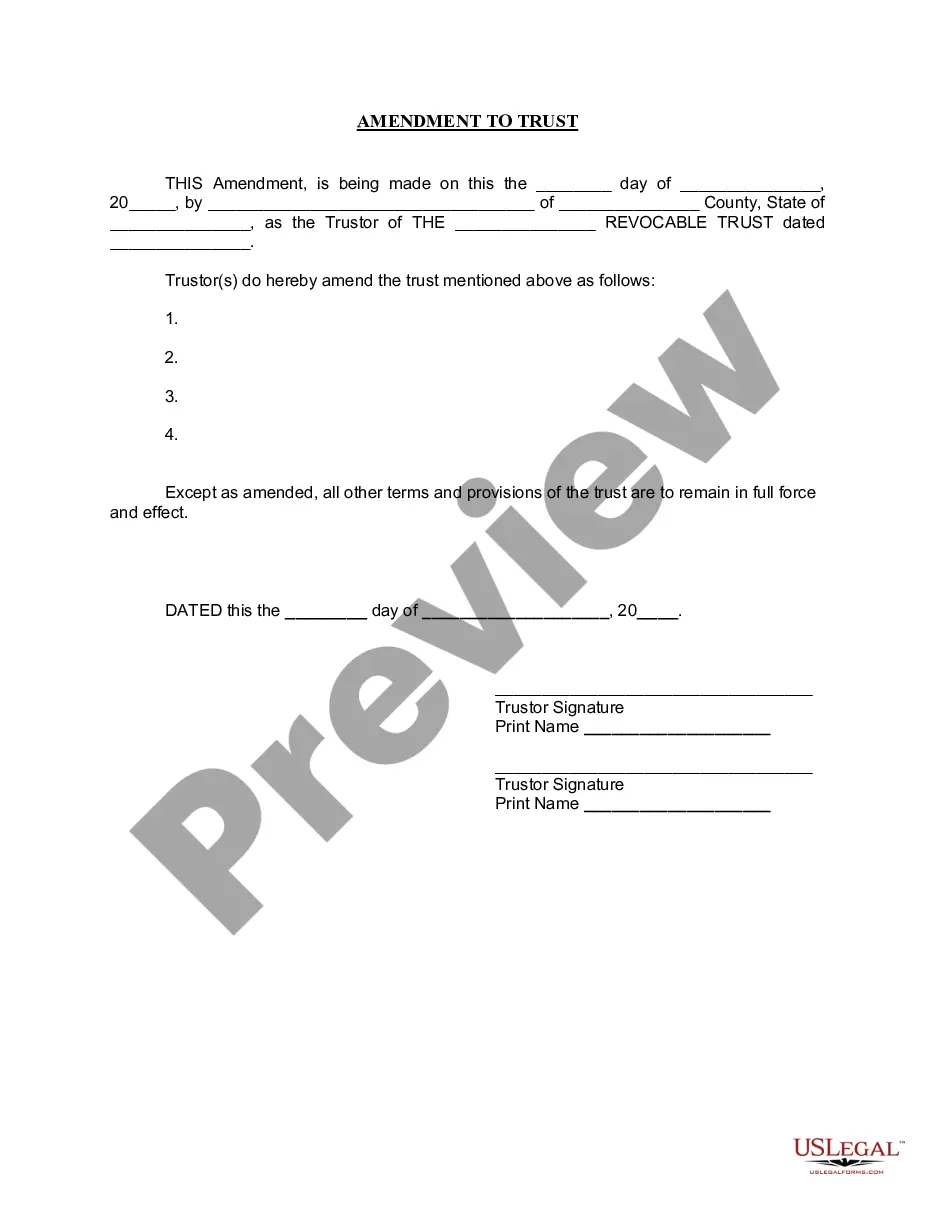

This form is for amending a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form permits the Trustor to amend certain properties of the trust without changing the purpose or nature of the trust. Except for the amended provisions, all other parts of the trust will remain in full force and effect. The Trustor(s) signature(s) is needed, and it must be signed in front of a notary public.

The Indianapolis Indiana Amendment to Living Trust refers to a legal document that is customized to modify or revise certain provisions within an existing living trust based in the state of Indiana, specifically designed to cater to the city of Indianapolis. It provides a systematic and convenient method for individuals to amend or update their living trust without the need to completely rewrite the document. An amendment to a living trust may become necessary due to various reasons such as changes in personal circumstances, financial matters, or changes in estate planning goals. This legal instrument allows the trust's creator, known as the settler or granter, to make specific changes to the trust's provisions while ensuring that the overall trust structure remains intact. The amendment process typically involves the identification of the specific sections or provisions to be amended within the original living trust document. The Indianapolis Indiana Amendment to Living Trust allows individuals to modify critical components, including the beneficiaries, trustees, successor trustees, distribution of assets, and any other specific instructions regarding the management and distribution of the trust estate. It should be noted that there may be different types or variations of the Indianapolis Indiana Amendment to Living Trust based on the specific needs and requirements of the settler. These can include but are not limited to: 1. Beneficiary Amendment: This type of amendment focuses exclusively on altering the beneficiaries or the allocation of assets among the beneficiaries named in the original living trust. It may involve adding or removing beneficiaries, changing their respective shares, or modifying the distribution criteria. 2. Trustee Amendment: This category of amendment allows the settler to change the trustee or successor trustee designated in the original living trust. It may involve removing or adding a new trustee based on various factors like trust administration issues or personal preferences. 3. Asset Distribution Amendment: This type of amendment concentrates on modifying the distribution provisions outlined in the initial living trust. It enables the settler to revise specifics regarding the assets to be distributed, the timing of distributions, or address any other related concerns. 4. Administrative Amendment: This type of amendment deals with administrative matters, such as changing the address of the trust, updating contact information for trustees, or making minor administrative adjustments that do not impact the substantive provisions of the living trust. By utilizing the Indianapolis Indiana Amendment to Living Trust, individuals can ensure their estate plans remain current and in line with their evolving objectives. Consulting an experienced estate planning attorney is crucial to navigate the legal intricacies associated with creating and implementing amendments to living trusts, ensuring compliance with applicable laws and regulations in Indianapolis, Indiana.