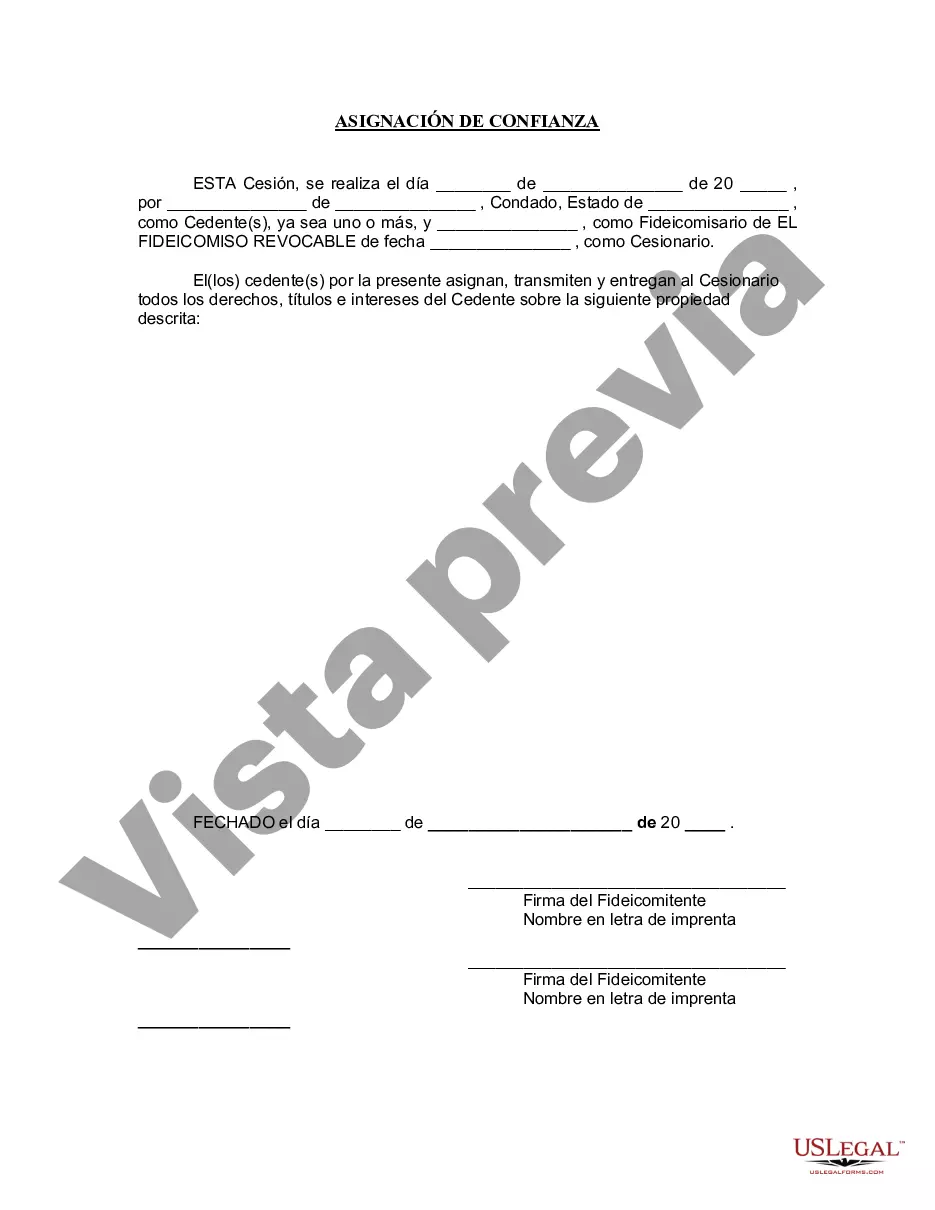

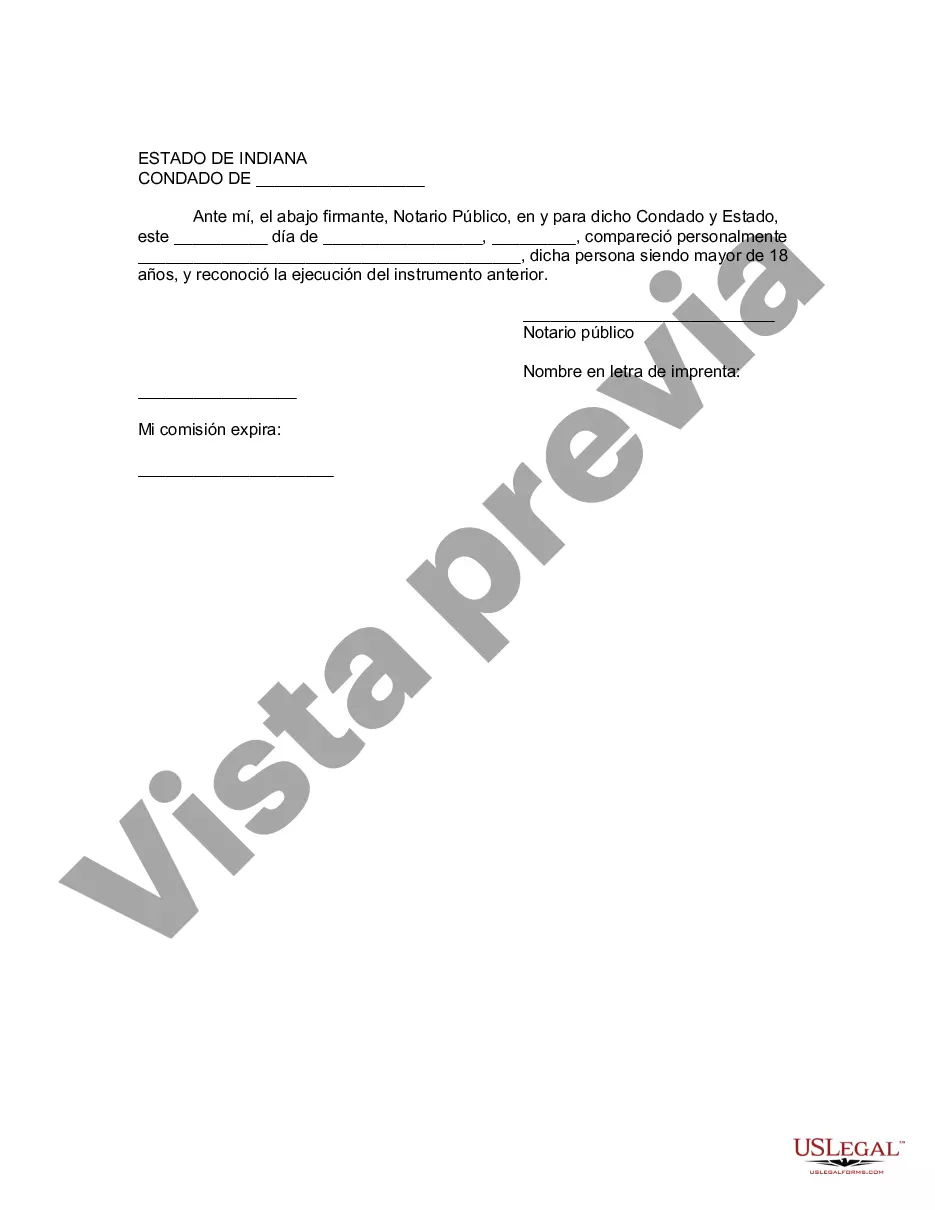

Indianapolis Indiana Assignment to Living Trust is a legal document that ensures the transfer of an individual's assets and property rights to a trust during their lifetime. This type of assignment is specific to the state of Indiana, with Indianapolis being the capital city. An Assignment to Living Trust in Indianapolis Indiana involves the legal transfer of real estate, personal property, financial assets, and investments to a revocable living trust, which is created by the individual, commonly referred to as the granter or trust or. The granter maintains full control and ownership over their assets during their lifetime and can make changes, modifications, or revoke the trust as desired. One type of Indianapolis Indiana Assignment to Living Trust is the revocable living trust. This trust allows the granter to retain control and make changes to the trust while still providing the benefits of avoiding probate upon their death. The revocable living trust allows for the seamless transfer of assets to the designated beneficiaries, avoiding the time-consuming and costly probate process. Another type of Indianapolis Indiana Assignment to Living Trust is the irrevocable living trust. Unlike the revocable living trust, the granter cannot make changes or revoke this trust once it is established. This type of trust is often used for tax planning purposes, asset protection, and Medicaid eligibility. The Indianapolis Indiana Assignment to Living Trust offers several advantages. First and foremost, it allows for the smooth transfer of assets to beneficiaries upon the granter's death, avoiding the probate process. By avoiding probate, the assignment helps maintain privacy as probate records are typically public. Additionally, the living trust can provide asset protection, allowing the granter's beneficiaries to inherit assets while protecting them from potential creditors or legal claims. To establish an Indianapolis Indiana Assignment to Living Trust, one must draft a comprehensive trust agreement outlining the terms and conditions of the trust. It is crucial to consult with an experienced estate planning attorney familiar with Indiana laws to ensure the trust aligns with state-specific regulations. The trust agreement must include detailed information on the trust's purpose, trustees, beneficiaries, and how the assets are to be managed and distributed. Regularly reviewing and updating the trust agreement is recommended to reflect any changes in the granter's life or preferences. This includes significant life events such as marriages, divorces, births, deaths, or changes in financial circumstances. In conclusion, the Indianapolis Indiana Assignment to Living Trust is a legal document that allows for the transfer of assets to a trust during the granter's lifetime. This assignment can take the form of a revocable living trust or an irrevocable living trust. By avoiding probate, providing asset protection, and ensuring a seamless transfer of assets, an Assignment to Living Trust in Indianapolis Indiana can be a valuable estate planning tool.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Indianapolis Indiana Asignación a un fideicomiso en vida - Indiana Assignment to Living Trust

Description

How to fill out Indianapolis Indiana Asignación A Un Fideicomiso En Vida?

Do you need a reliable and affordable legal forms provider to get the Indianapolis Indiana Assignment to Living Trust? US Legal Forms is your go-to choice.

No matter if you require a simple arrangement to set regulations for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked in accordance with the requirements of particular state and county.

To download the form, you need to log in account, find the required template, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Indianapolis Indiana Assignment to Living Trust conforms to the laws of your state and local area.

- Read the form’s description (if provided) to learn who and what the form is good for.

- Start the search over in case the template isn’t suitable for your specific scenario.

Now you can register your account. Then select the subscription option and proceed to payment. Once the payment is completed, download the Indianapolis Indiana Assignment to Living Trust in any provided file format. You can get back to the website when you need and redownload the form free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about wasting your valuable time learning about legal papers online for good.