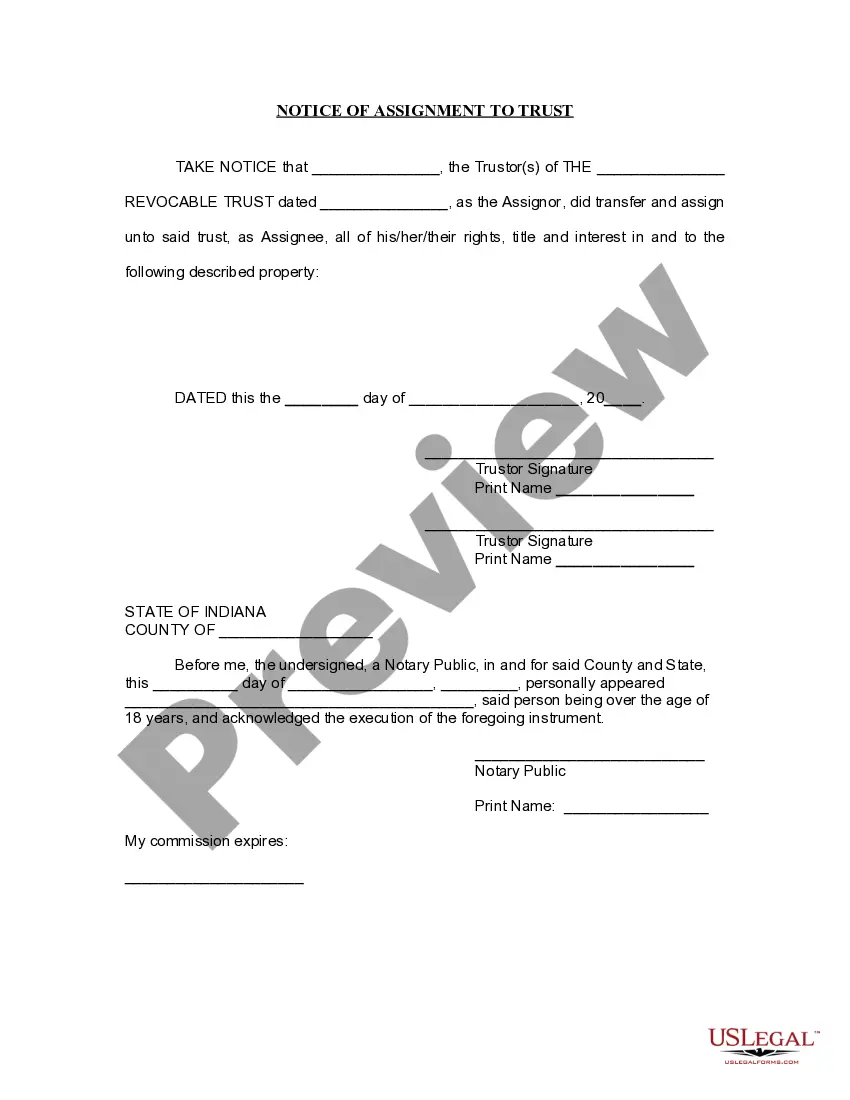

This is a Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form is a form of notification to the lienholders that certain property has been transferred to a living trust and serves as notice that the trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust. Use one form per property transferred.

The Indianapolis Indiana Notice of Assignment to Living Trust is a legal document that is utilized to transfer ownership of assets into a living trust. This notice serves as an official notification that the designated assets will now be held and managed by the living trust. The notice typically includes pertinent information such as the name of the trust, the date of the assignment, the name of the trustee, and a detailed list of the assets being transferred. These assets may consist of real estate properties, bank accounts, stocks, bonds, business interests, intellectual property, and other valuable items. The purpose of assigning assets to a living trust is to ensure proper management and distribution of the estate upon the granter's passing, while also potentially avoiding the probate process. By placing assets in a living trust, the granter retains control over them during their lifetime and designates a successor trustee to handle the assets after their death or incapacity. There are various types of Indianapolis Indiana Notice of Assignment to Living Trust that may be used, depending on the specific circumstances and assets involved. Some common types include: 1. Real Estate Assignment: This type of notice is used when transferring ownership of residential or commercial properties into the living trust. It includes detailed descriptions of the properties, their addresses, and legal descriptions. 2. Financial Account Assignment: This notice is used to transfer ownership of bank accounts, investment accounts, retirement accounts, and other financial assets into the living trust. It includes the name and account number of each account being assigned. 3. Personal Property Assignment: This type of notice is used for transferring ownership of tangible personal property, such as vehicles, jewelry, artwork, furniture, and other valuable items. It includes detailed descriptions of each item being assigned. 4. Business Interest Assignment: If the granter owns shares or an interest in a business or partnership, this notice is used to transfer those ownership rights into the living trust. It typically includes the name of the business, the percentage of ownership, and any related documentation. It is important to consult with an attorney or estate planning professional when creating and executing an Indianapolis Indiana Notice of Assignment to Living Trust to ensure that all legal requirements are met and that the document accurately reflects the granter's intentions.