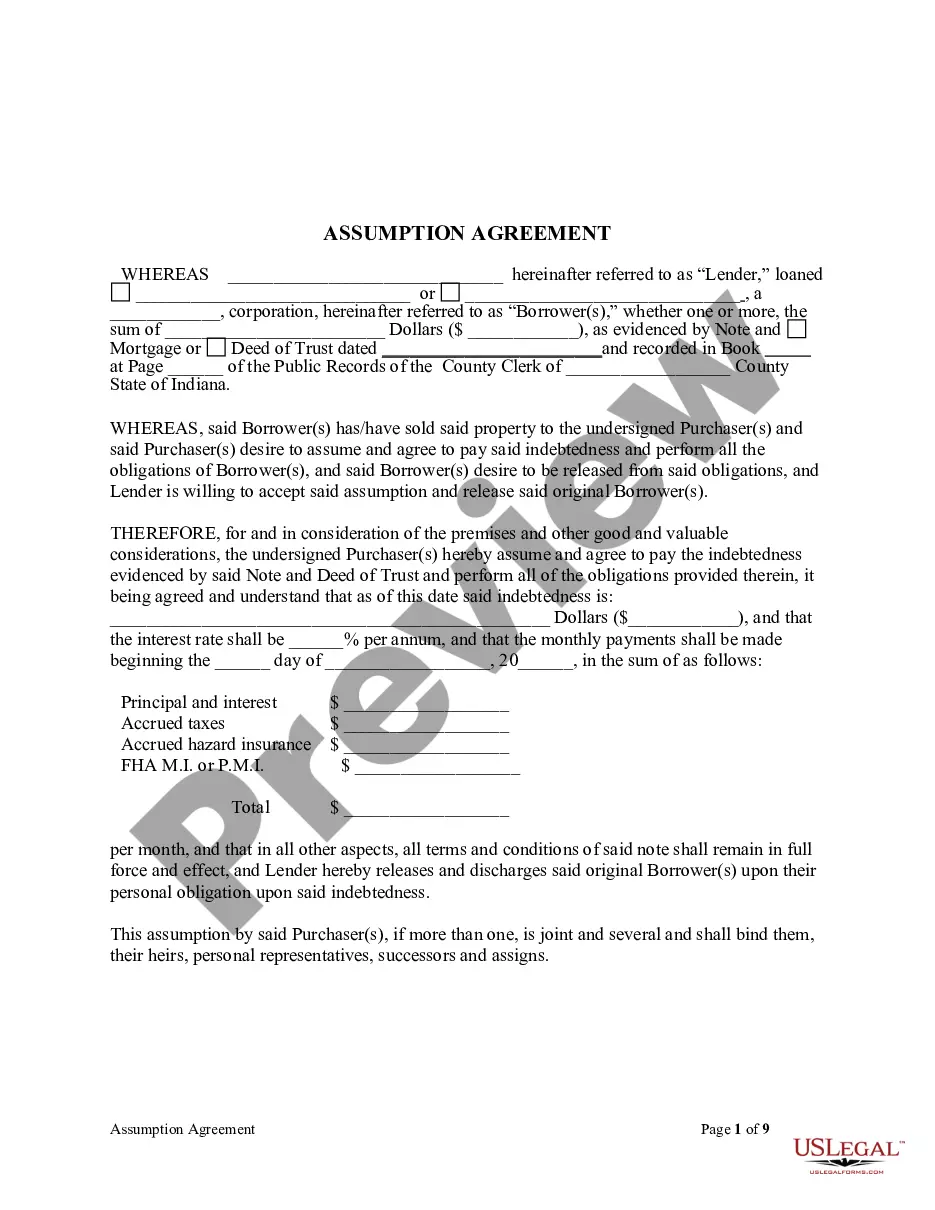

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

The Indianapolis Indiana Assumption Agreement of Mortgage and Release of Original Mortgagors is a legal document that outlines the transfer of a mortgage from the original mortgagor (the party who initially took out the loan) to a new party, known as the assumption. This agreement allows the assumption to assume the responsibilities of the mortgage, including making payments and maintaining the property. The assumption agreement is a critical document in real estate transactions in Indianapolis, Indiana, as it establishes the rights and obligations of both parties involved. It is typically used when the original mortgagor wants to sell their property, but the buyer is willing to take over the existing mortgage instead of obtaining a new one. The agreement will include detailed information about the original mortgage, such as the loan amount, interest rate, and repayment terms. It will also contain the names and addresses of all parties involved, including the original mortgagor, the assumption, and the lender. The Indianapolis Indiana Assumption Agreement of Mortgage and Release of Original Mortgagors may come in different types, depending on the specific circumstances of the transaction. Some common variations include: 1. Simple Assumption Agreement: This type of agreement is used when the assumption agrees to take over the mortgage as-is without making any changes to the terms or conditions. 2. Novation Agreement: In this type of agreement, the original mortgage is discharged, and a new mortgage is created in the name of the assumption. This is often done to change the terms of the original loan, such as the interest rate or repayment period. 3. Qualifying Assumption Agreement: This agreement is used when the lender requires the assumption to meet certain qualification criteria before assuming the mortgage. The new party may need to provide financial documentation or demonstrate their ability to make the mortgage payments. 4. Partial Assumption Agreement: This agreement is used when the assumption agrees to assume only a portion of the original mortgage. This may happen, for example, when the property is being divided between multiple owners, and each party agrees to take over their respective portion of the mortgage. It is essential for all parties involved in an Indianapolis Indiana Assumption Agreement of Mortgage and Release of Original Mortgagors to carefully review and understand the terms before signing. Consulting with a real estate attorney or a mortgage professional is highly recommended ensuring compliance with local laws and to protect the interests of all parties involved.The Indianapolis Indiana Assumption Agreement of Mortgage and Release of Original Mortgagors is a legal document that outlines the transfer of a mortgage from the original mortgagor (the party who initially took out the loan) to a new party, known as the assumption. This agreement allows the assumption to assume the responsibilities of the mortgage, including making payments and maintaining the property. The assumption agreement is a critical document in real estate transactions in Indianapolis, Indiana, as it establishes the rights and obligations of both parties involved. It is typically used when the original mortgagor wants to sell their property, but the buyer is willing to take over the existing mortgage instead of obtaining a new one. The agreement will include detailed information about the original mortgage, such as the loan amount, interest rate, and repayment terms. It will also contain the names and addresses of all parties involved, including the original mortgagor, the assumption, and the lender. The Indianapolis Indiana Assumption Agreement of Mortgage and Release of Original Mortgagors may come in different types, depending on the specific circumstances of the transaction. Some common variations include: 1. Simple Assumption Agreement: This type of agreement is used when the assumption agrees to take over the mortgage as-is without making any changes to the terms or conditions. 2. Novation Agreement: In this type of agreement, the original mortgage is discharged, and a new mortgage is created in the name of the assumption. This is often done to change the terms of the original loan, such as the interest rate or repayment period. 3. Qualifying Assumption Agreement: This agreement is used when the lender requires the assumption to meet certain qualification criteria before assuming the mortgage. The new party may need to provide financial documentation or demonstrate their ability to make the mortgage payments. 4. Partial Assumption Agreement: This agreement is used when the assumption agrees to assume only a portion of the original mortgage. This may happen, for example, when the property is being divided between multiple owners, and each party agrees to take over their respective portion of the mortgage. It is essential for all parties involved in an Indianapolis Indiana Assumption Agreement of Mortgage and Release of Original Mortgagors to carefully review and understand the terms before signing. Consulting with a real estate attorney or a mortgage professional is highly recommended ensuring compliance with local laws and to protect the interests of all parties involved.