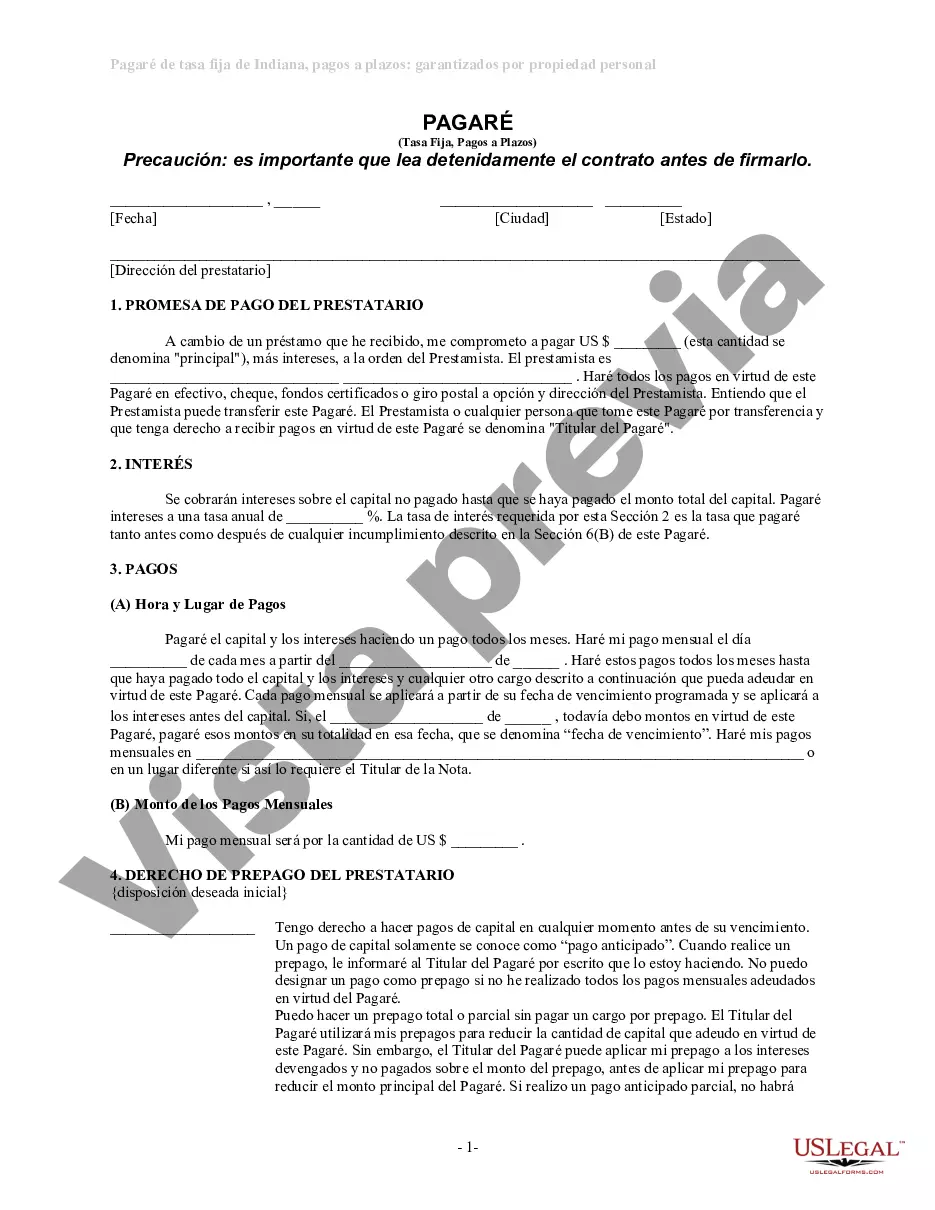

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

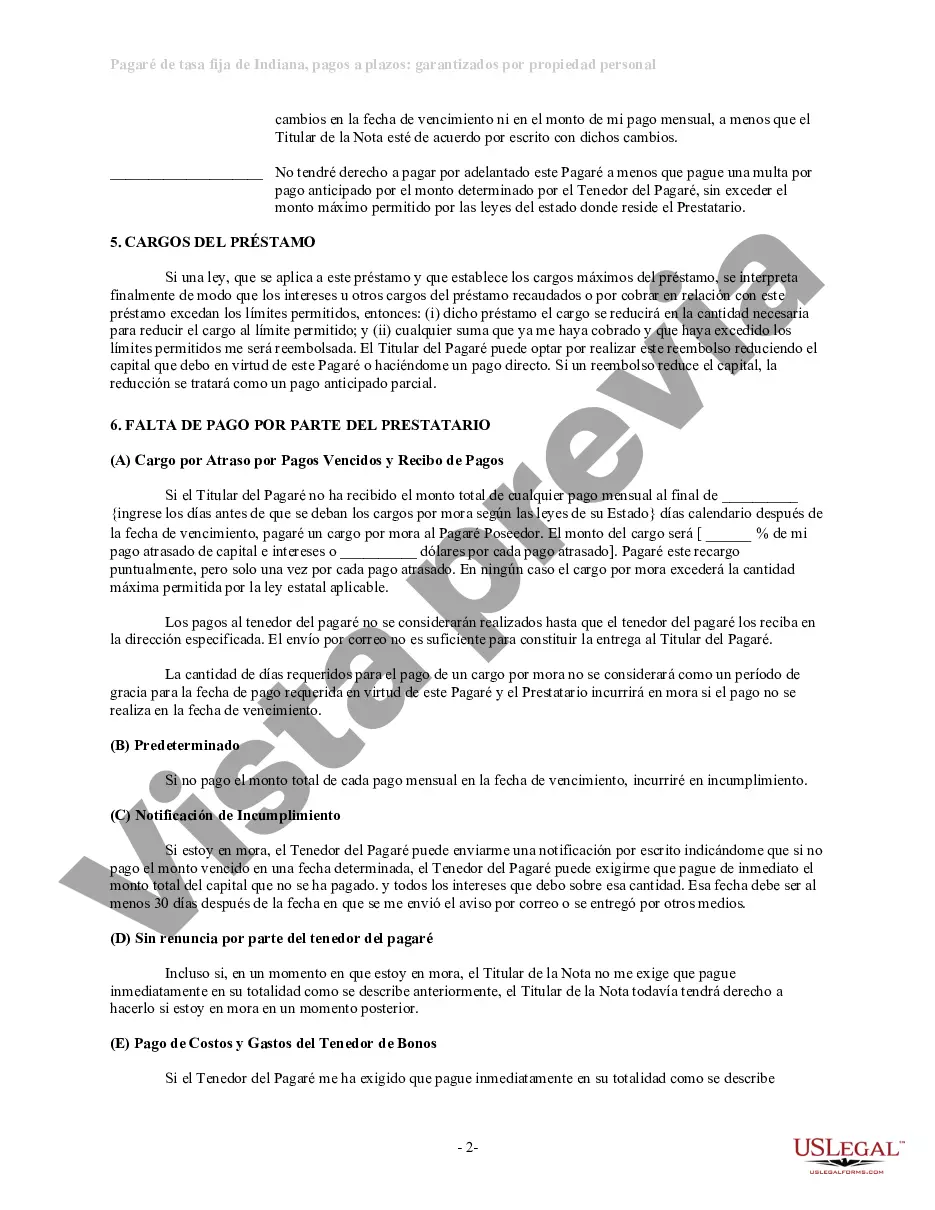

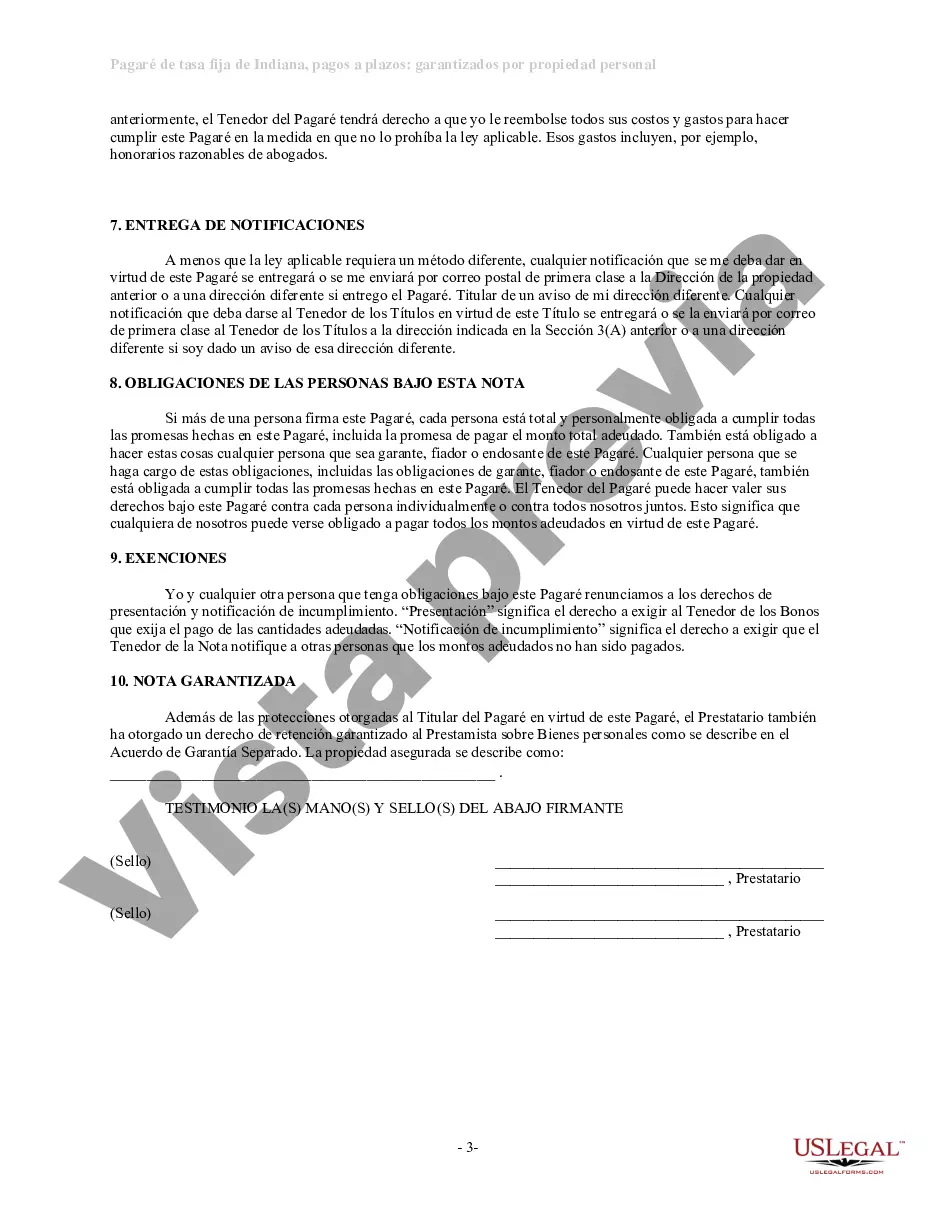

Carmel Indiana Installments Fixed Rate Promissory Note Secured by Personal Property is a legal agreement that outlines the terms and conditions between a lender and a borrower for the repayment of a loan. In this case, the loan is secured by personal property, providing the lender with the right to possess and sell the borrower's personal property in the event of default. The Carmel Indiana Installments Fixed Rate Promissory Note is commonly used in Carmel, Indiana, and serves as a legally binding contract between the lender and the borrower. It provides specific details about the loan, including the principal amount, interest rate, repayment terms, and any other applicable fees or penalties. The "Installments" aspect of this promissory note indicates that the loan will be repaid in regular, fixed payments over a specific period of time. This ensures that the borrower knows exactly how much they owe each month, making it easier to budget and plan for repayment. The "Fixed Rate" feature of the Carmel Indiana Installments Fixed Rate Promissory Note means that the interest rate on the loan remains constant throughout the repayment period. This provides stability for both the lender and the borrower, as the interest rate does not fluctuate with market conditions. As mentioned earlier, this promissory note is secured by personal property. This means that the borrower pledges specific personal assets, such as a vehicle or jewelry, as collateral for the loan. In the event of default, the lender has the right to seize and sell the secured personal property to recover the outstanding amount. Although there may not be different types of Carmel Indiana Installments Fixed Rate Promissory Note Secured by Personal Property, variations can exist based on the specific terms and conditions agreed upon by the lender and borrower. These may include variations in the repayment period, the interest rate, or the types of personal property accepted as collateral. Overall, the Carmel Indiana Installments Fixed Rate Promissory Note Secured by Personal Property is a crucial legal document that protects both the lender and the borrower. It ensures that the terms of the loan are clearly defined and provides security for the lender in case of default.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.