This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

Evansville Indiana Special Durable Power of Attorney for Bank Account Matters is a legal document that grants someone, known as the agent or attorney-in-fact, the authority to act on behalf of an individual, known as the principal, in specific bank account-related matters. This type of power of attorney is designed to provide the agent with the necessary legal power to manage the principal's bank accounts and make financial decisions, even if the principal becomes incapacitated. Some keywords relevant to this topic include: Evansville Indiana, power of attorney, durable power of attorney, bank account, special power of attorney, attorney-in-fact, principal, incapacitated, legal document, financial decisions. There may be different types or variations of the Evansville Indiana Special Durable Power of Attorney for Bank Account Matters, depending on specific circumstances or requirements. Some of the common types that may exist include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney grants the agent limited authority to handle specific bank account-related matters, such as making deposits, withdrawing funds, or transferring money, within a defined timeframe or for a particular purpose. 2. General Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney provides the agent with broad authority to handle all bank account-related matters on behalf of the principal, including managing multiple accounts, initiating and terminating banking relationships, and performing any necessary financial transactions. 3. Healthcare Special Durable Power of Attorney for Bank Account Matters: In some cases, individuals may want to appoint an agent specifically to handle their bank account matters in relation to healthcare expenses. This type of power of attorney allows the agent to access funds from the principal's bank accounts to pay for medical bills, prescription medications, or any healthcare-related costs. 4. Incapacity Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney becomes effective only when the principal becomes incapacitated or unable to manage their bank accounts on their own. It ensures that the agent can step in and make financial decisions on behalf of the principal, ensuring the smooth running of their bank accounts. It is important for individuals in Evansville Indiana to consult with a qualified attorney specializing in estate planning or elder law to understand the specific requirements and options available for creating a Special Durable Power of Attorney for Bank Account Matters that aligns with their unique needs and circumstances.Evansville Indiana Special Durable Power of Attorney for Bank Account Matters is a legal document that grants someone, known as the agent or attorney-in-fact, the authority to act on behalf of an individual, known as the principal, in specific bank account-related matters. This type of power of attorney is designed to provide the agent with the necessary legal power to manage the principal's bank accounts and make financial decisions, even if the principal becomes incapacitated. Some keywords relevant to this topic include: Evansville Indiana, power of attorney, durable power of attorney, bank account, special power of attorney, attorney-in-fact, principal, incapacitated, legal document, financial decisions. There may be different types or variations of the Evansville Indiana Special Durable Power of Attorney for Bank Account Matters, depending on specific circumstances or requirements. Some of the common types that may exist include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney grants the agent limited authority to handle specific bank account-related matters, such as making deposits, withdrawing funds, or transferring money, within a defined timeframe or for a particular purpose. 2. General Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney provides the agent with broad authority to handle all bank account-related matters on behalf of the principal, including managing multiple accounts, initiating and terminating banking relationships, and performing any necessary financial transactions. 3. Healthcare Special Durable Power of Attorney for Bank Account Matters: In some cases, individuals may want to appoint an agent specifically to handle their bank account matters in relation to healthcare expenses. This type of power of attorney allows the agent to access funds from the principal's bank accounts to pay for medical bills, prescription medications, or any healthcare-related costs. 4. Incapacity Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney becomes effective only when the principal becomes incapacitated or unable to manage their bank accounts on their own. It ensures that the agent can step in and make financial decisions on behalf of the principal, ensuring the smooth running of their bank accounts. It is important for individuals in Evansville Indiana to consult with a qualified attorney specializing in estate planning or elder law to understand the specific requirements and options available for creating a Special Durable Power of Attorney for Bank Account Matters that aligns with their unique needs and circumstances.

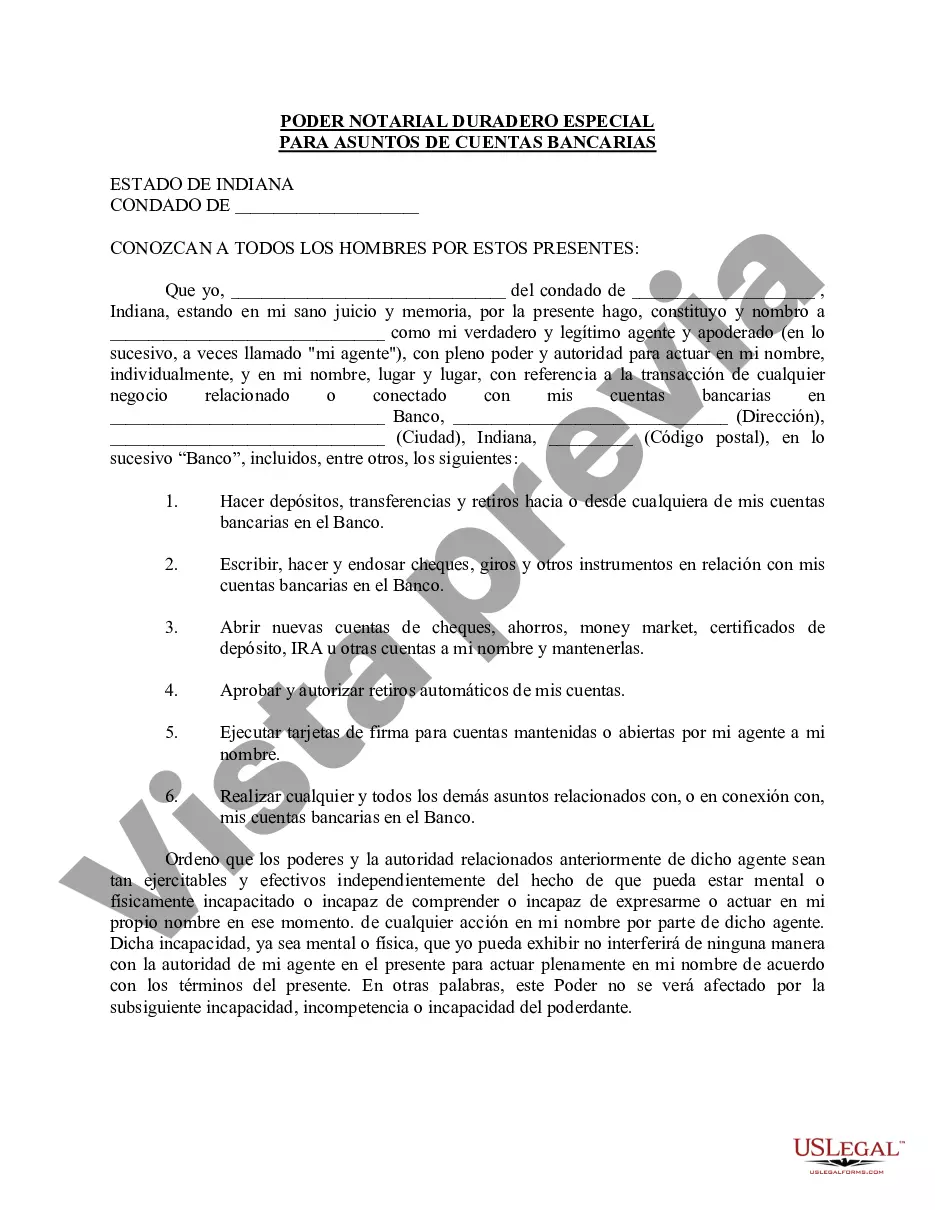

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.