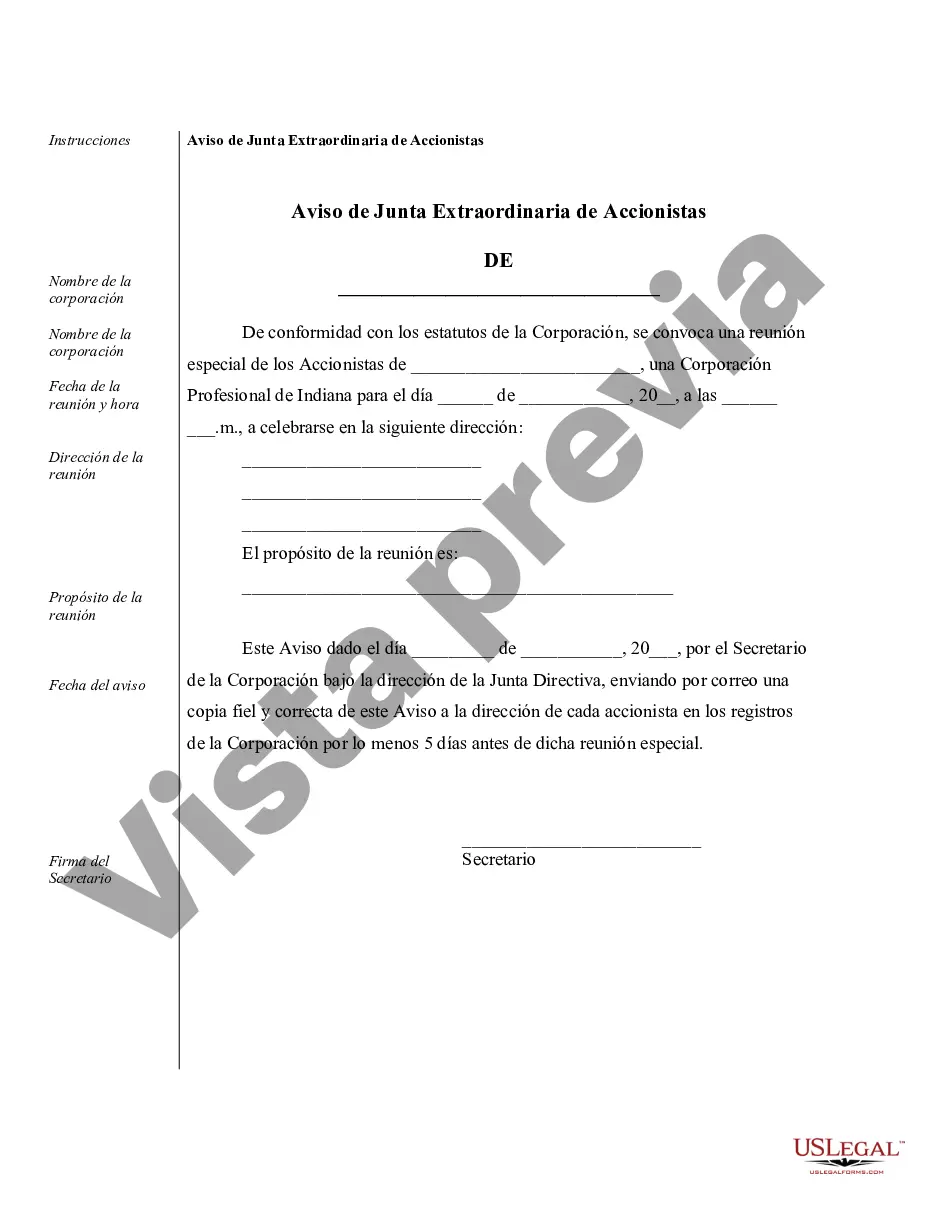

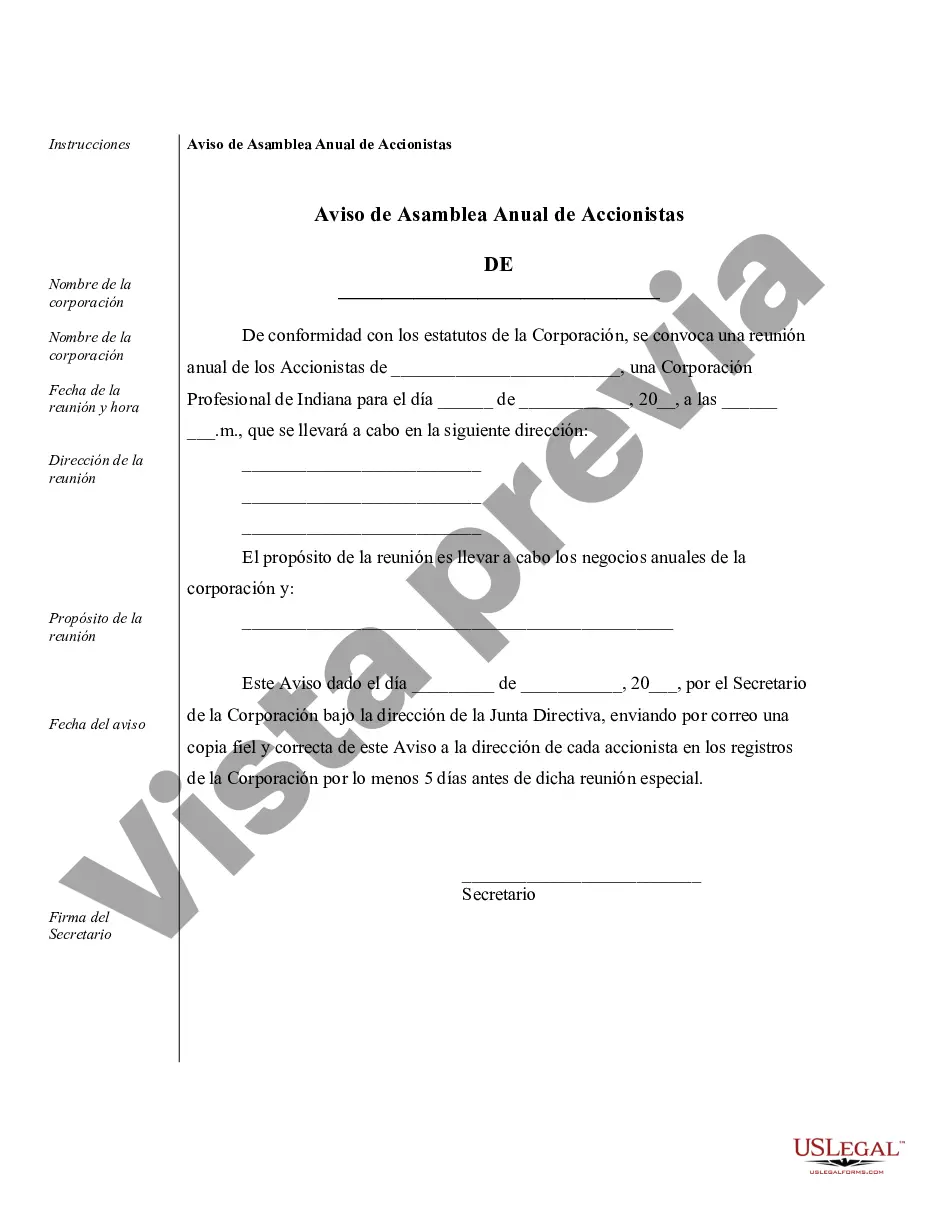

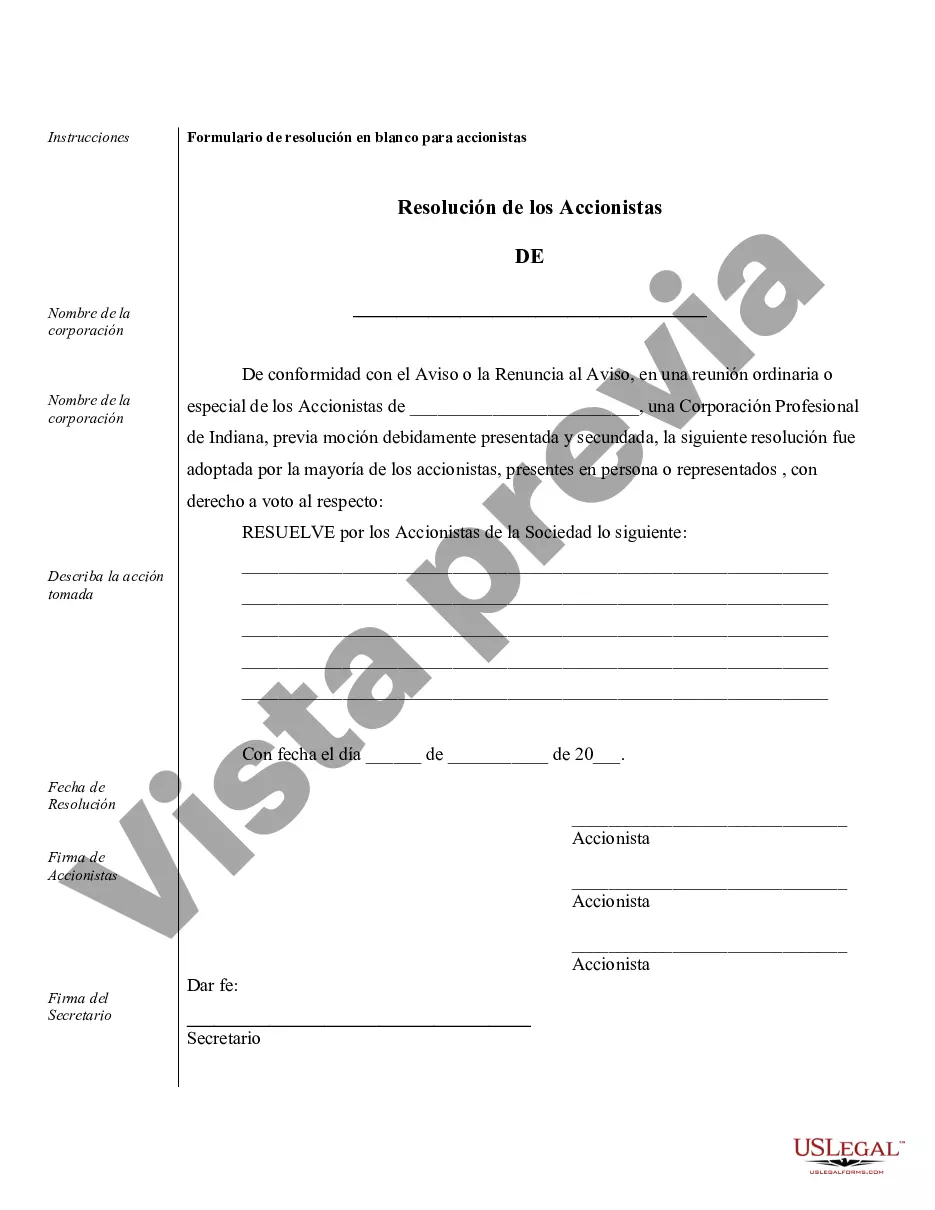

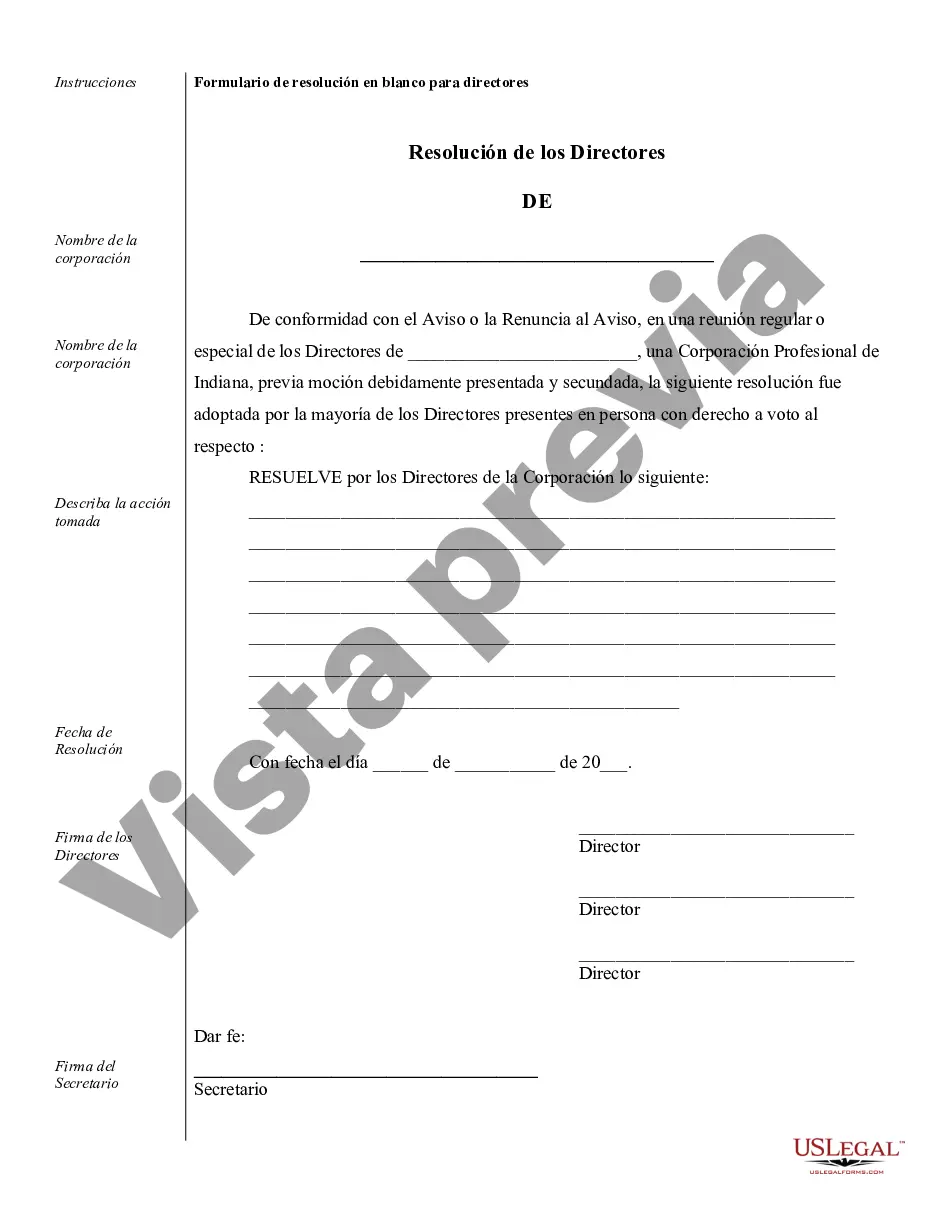

Carmel Sample Corporate Records for an Indiana Professional Corporation serve as the official documents and records maintained by the corporation, providing a comprehensive account of its operations, financial activities, and legal obligations. These records prove invaluable in ensuring compliance with state and federal regulations and maintaining transparency and accountability. Here are the different types of Carmel Sample Corporate Records commonly maintained for an Indiana Professional Corporation: 1. Articles of Incorporation: These documents outline the corporation's identity and purpose, including its name, duration, registered agent, and business objectives. 2. Bylaws: This detailed set of rules and regulations governs the corporation's internal affairs, such as the roles and responsibilities of directors, officers, and shareholders, meeting procedures, and voting protocols. 3. Minutes of Meetings: Detailed minutes are kept for all meetings, such as board of directors meetings, shareholders' meetings, and committee meetings. These records document discussions, decisions, and resolutions put forth during these gatherings. 4. Stock Ledger: A stock ledger serves as a record of all issued and outstanding shares of the corporation's stock, including details like shareholders' names, addresses, share classes, and voting rights. 5. Annual Reports: Corporations in Indiana are required to file annual reports with the Secretary of State. These reports provide an overview of the corporation's current status, including its principal address, registered agent, officers' names, and details of any significant changes. 6. Financial Statements: Carmel Sample Corporate Records should include financial statements, such as balance sheets, income statements, and cash flow statements, which present the corporation's financial performance, assets, and liabilities. 7. Tax Filings: Records related to various tax filings, including federal, state, and local tax returns, should be maintained by the corporation to meet its tax obligations. 8. Contracts and Agreements: Any contracts, agreements, or legal documents entered into by the corporation, such as leases, employment contracts, and vendor agreements, should be kept as part of the corporate records. 9. Licenses and Permits: Documents related to permits, licenses, and certifications obtained by the corporation, such as professional licenses or permits required for specific industries, should be included in the records. 10. Resolutions and Amendments: Any official resolutions passed by the board of directors or shareholders and amendments made to the articles of incorporation or bylaws should be documented and maintained. By diligently maintaining these Carmel Sample Corporate Records for an Indiana Professional Corporation, the entity can demonstrate its compliance with legal and regulatory requirements, ensure effective governance, and provide a clear historical record of its operations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Carmel Ejemplos de registros corporativos para una corporación profesional de Indiana - Sample Corporate Records for an Indiana Professional Corporation

Description

How to fill out Carmel Ejemplos De Registros Corporativos Para Una Corporación Profesional De Indiana?

If you are searching for a valid form template, it’s impossible to choose a better service than the US Legal Forms website – one of the most extensive online libraries. Here you can get thousands of document samples for business and personal purposes by types and regions, or keywords. With the advanced search option, discovering the most up-to-date Carmel Sample Corporate Records for an Indiana Professional Corporation is as easy as 1-2-3. Additionally, the relevance of each record is confirmed by a group of skilled lawyers that regularly review the templates on our platform and update them according to the newest state and county requirements.

If you already know about our system and have a registered account, all you should do to get the Carmel Sample Corporate Records for an Indiana Professional Corporation is to log in to your profile and click the Download button.

If you use US Legal Forms the very first time, just follow the instructions below:

- Make sure you have chosen the sample you need. Look at its description and utilize the Preview option (if available) to check its content. If it doesn’t suit your needs, utilize the Search field at the top of the screen to discover the needed record.

- Confirm your choice. Click the Buy now button. Following that, select the preferred pricing plan and provide credentials to sign up for an account.

- Make the financial transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Receive the form. Pick the format and download it on your device.

- Make adjustments. Fill out, revise, print, and sign the acquired Carmel Sample Corporate Records for an Indiana Professional Corporation.

Each and every form you add to your profile has no expiration date and is yours permanently. You can easily gain access to them via the My Forms menu, so if you want to get an additional duplicate for modifying or creating a hard copy, feel free to return and download it once more at any moment.

Take advantage of the US Legal Forms professional catalogue to gain access to the Carmel Sample Corporate Records for an Indiana Professional Corporation you were seeking and thousands of other professional and state-specific samples on one platform!