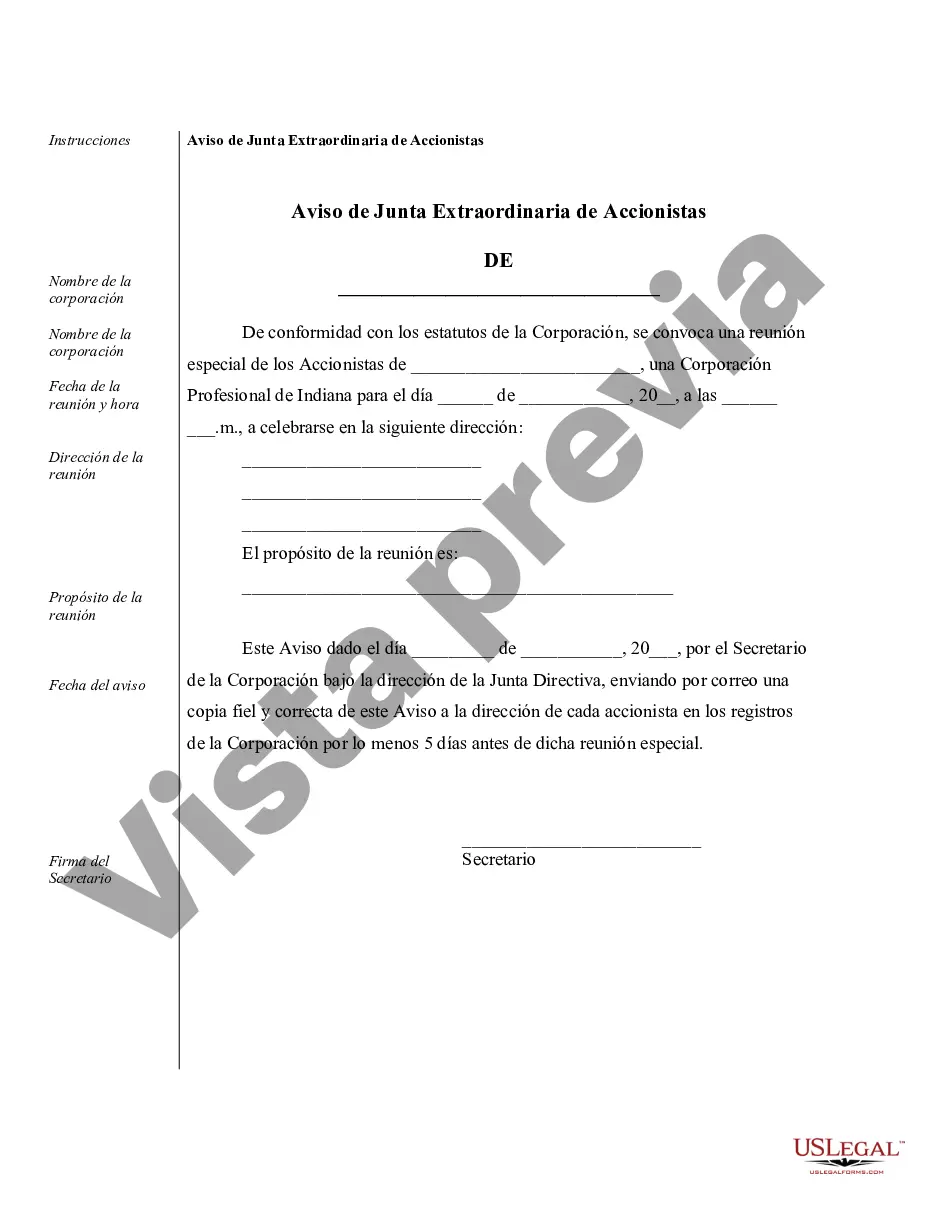

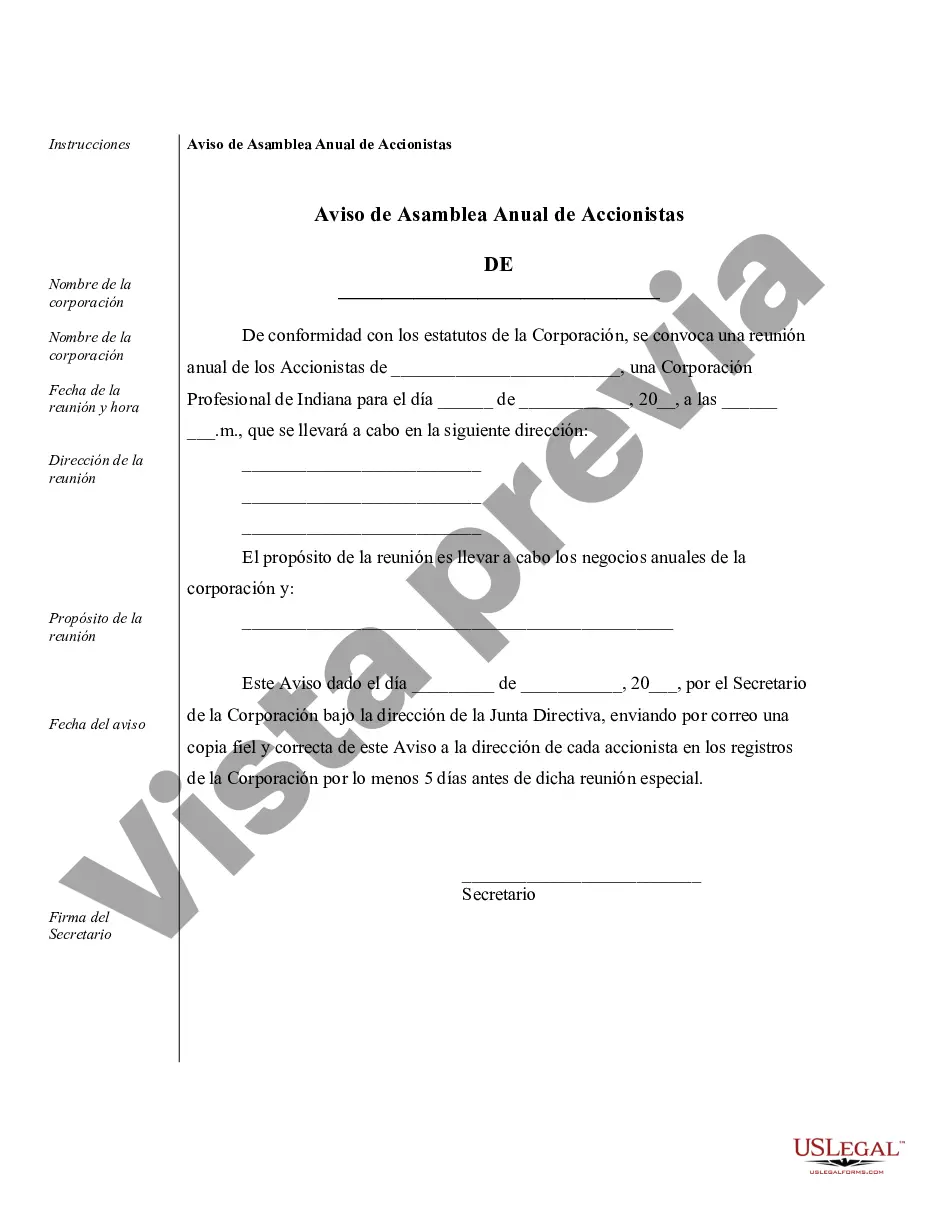

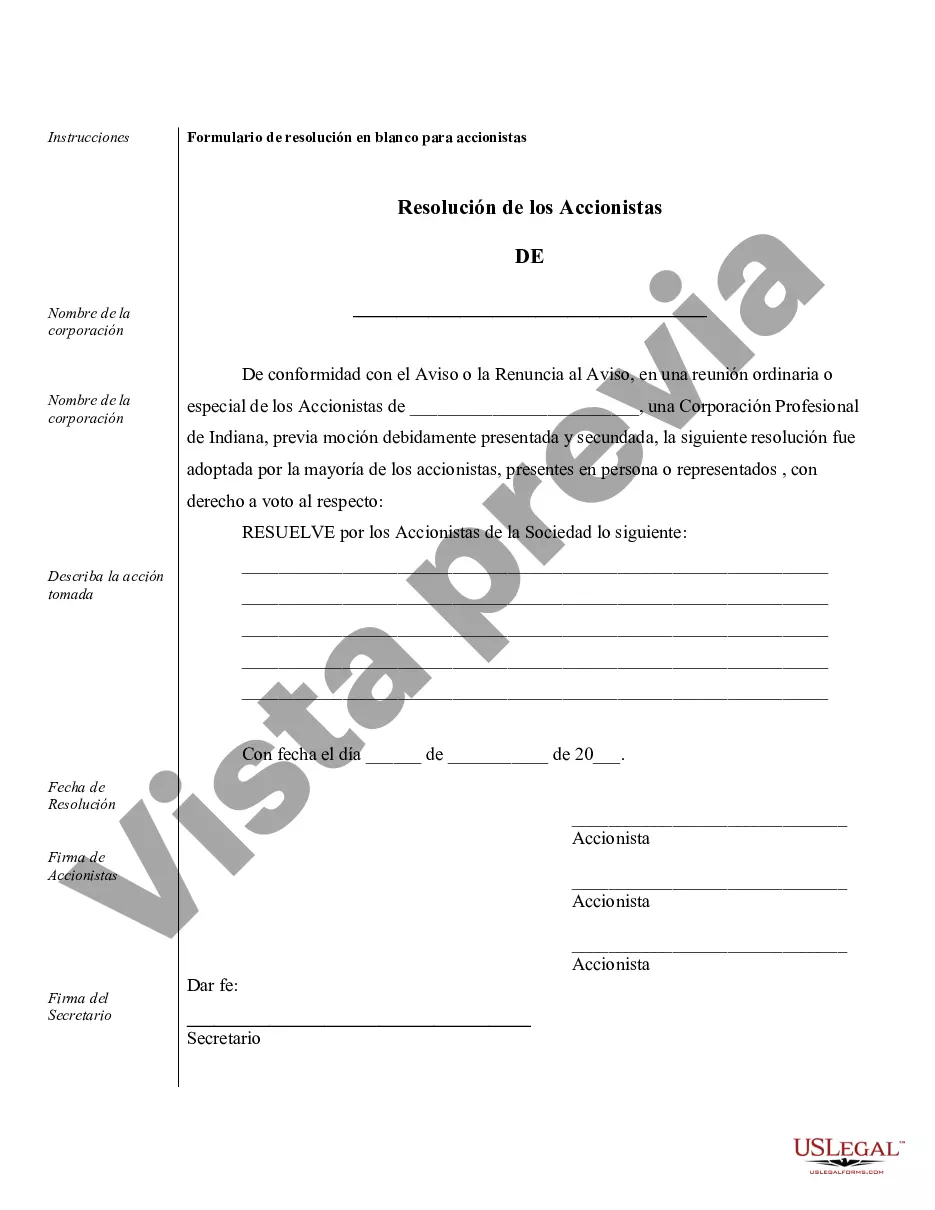

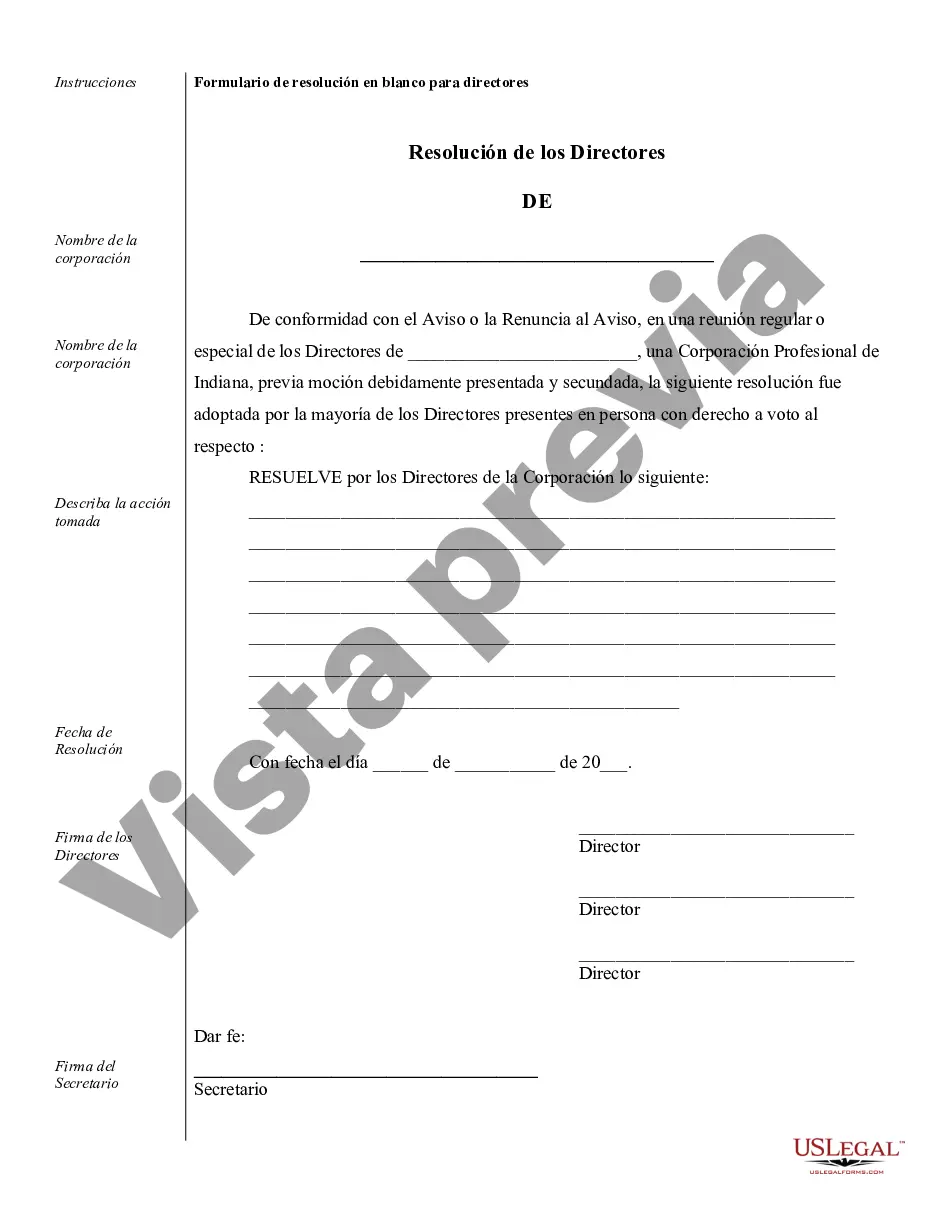

Evansville Sample Corporate Records for an Indiana Professional Corporation play a crucial role in documenting and organizing important business information for professional corporations operating in the state of Indiana. These records serve as an official archive of various legal, financial, and administrative activities undertaken by the corporation. Here are some types of Evansville Sample Corporate Records for an Indiana Professional Corporation: 1. Articles of Incorporation: This document establishes the legal existence of the professional corporation and outlines its purpose, shareholders' details, and basic organizational structure. 2. Bylaws: These records set out the rules and regulations governing the internal operations and management of the professional corporation, including procedures for conducting meetings, voting, and decision-making processes. 3. Shareholder Records: These records maintain details of the corporation's shareholders, including their contact information, share ownership, voting rights, and any changes in shareholdings over time. 4. Board of Directors Records: These records document the composition, appointment, and responsibilities of the corporation's board of directors, including meeting minutes, resolutions, and decisions made by the board. 5. Financial Records: This set of records includes financial statements, such as income statements, balance sheets, and cash flow statements, providing a snapshot of the corporation's financial performance, assets, and liabilities. 6. Meeting Minutes: These records outline the discussions, decisions, and actions taken during board meetings, general meetings, and committee meetings of the corporation, serving as a historical record of the corporation's decision-making process. 7. Shareholder Agreements: These records outline the rights and obligations of shareholders, including restrictions on transferring shares, buy-sell provisions, and dispute resolution mechanisms. 8. Employment and Contracts Records: These records include employment agreements, vendor contracts, and any other legal agreements entered into by the corporation, ensuring proper documentation and compliance with relevant laws. 9. Licenses and Permits: These records maintain copies of all licenses, permits, and certifications required to operate the professional corporation legally in Indiana, ensuring regulatory compliance. 10. Annual Reports: These records summarize the corporation's financial and operational performance over the course of a year, including a review of milestones achieved, future goals, and any significant changes in the corporation's structure or management. By maintaining accurate and up-to-date Evansville Sample Corporate Records for an Indiana Professional Corporation, businesses can demonstrate compliance, enable transparency, and ensure a reliable source of information for internal reference and external stakeholders. These records not only provide a historical account of the corporation's journey but also serve as a valuable resource for future decision-making and due diligence procedures.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Evansville Ejemplos de registros corporativos para una corporación profesional de Indiana - Sample Corporate Records for an Indiana Professional Corporation

Description

How to fill out Evansville Ejemplos De Registros Corporativos Para Una Corporación Profesional De Indiana?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Evansville Sample Corporate Records for an Indiana Professional Corporation gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the Evansville Sample Corporate Records for an Indiana Professional Corporation takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a few additional actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make certain you’ve picked the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Evansville Sample Corporate Records for an Indiana Professional Corporation. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!