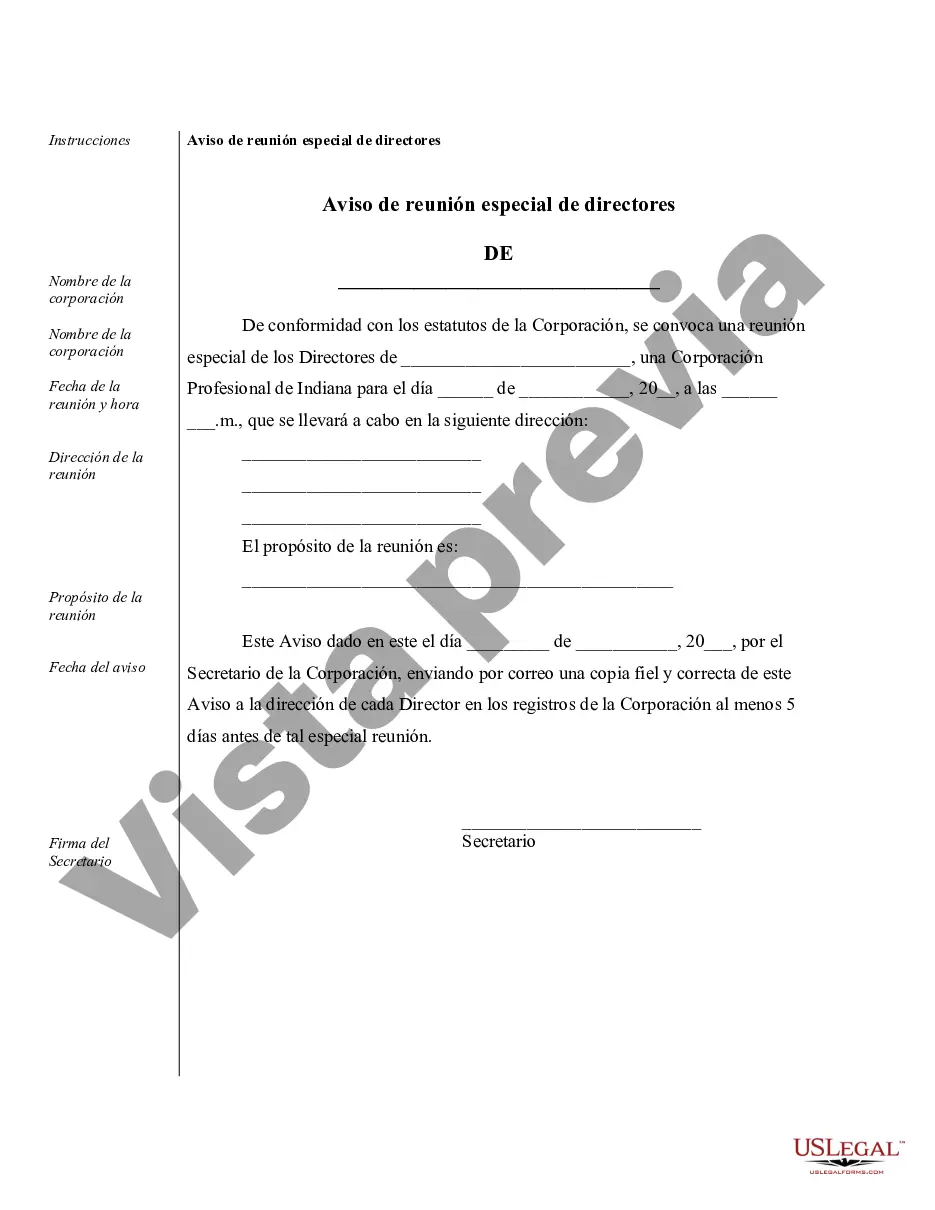

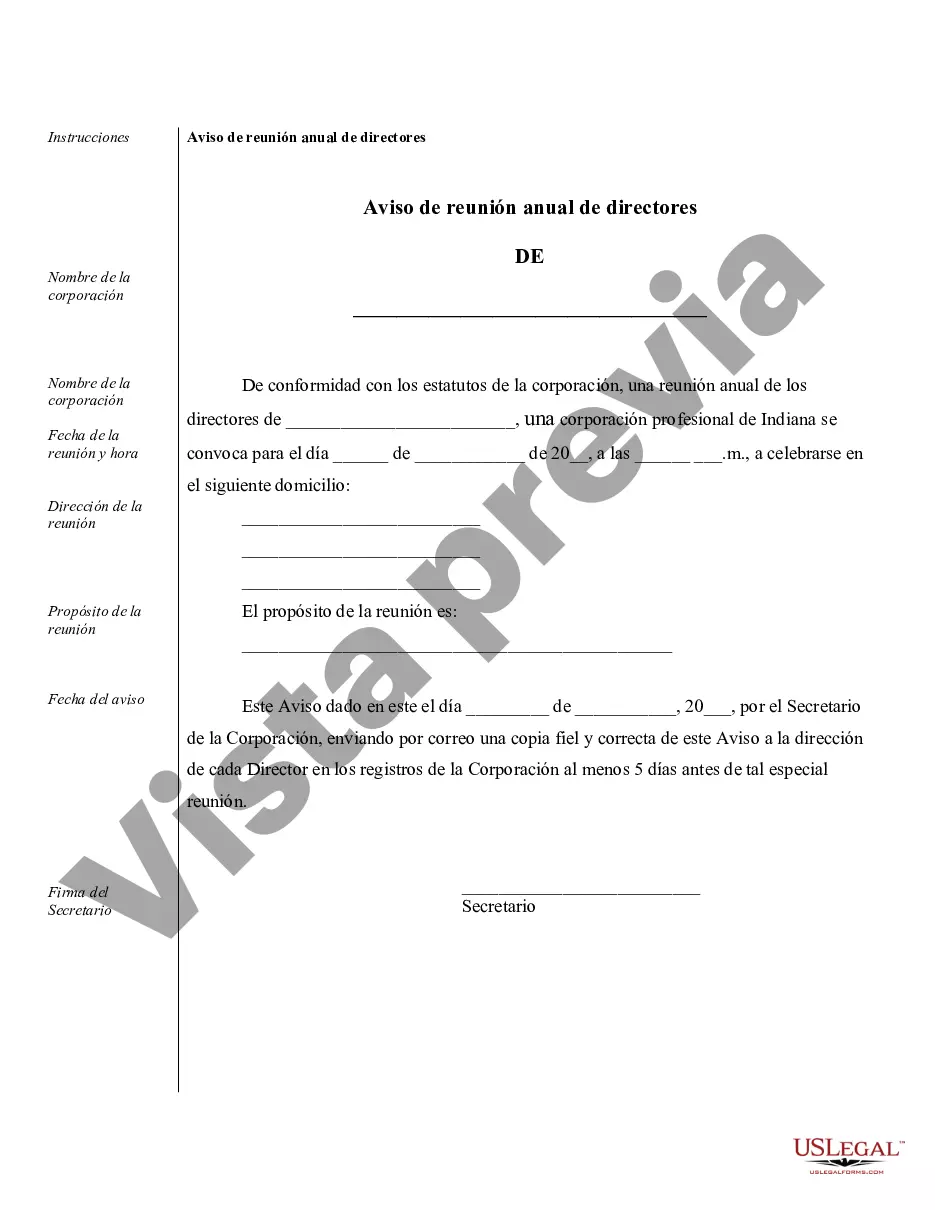

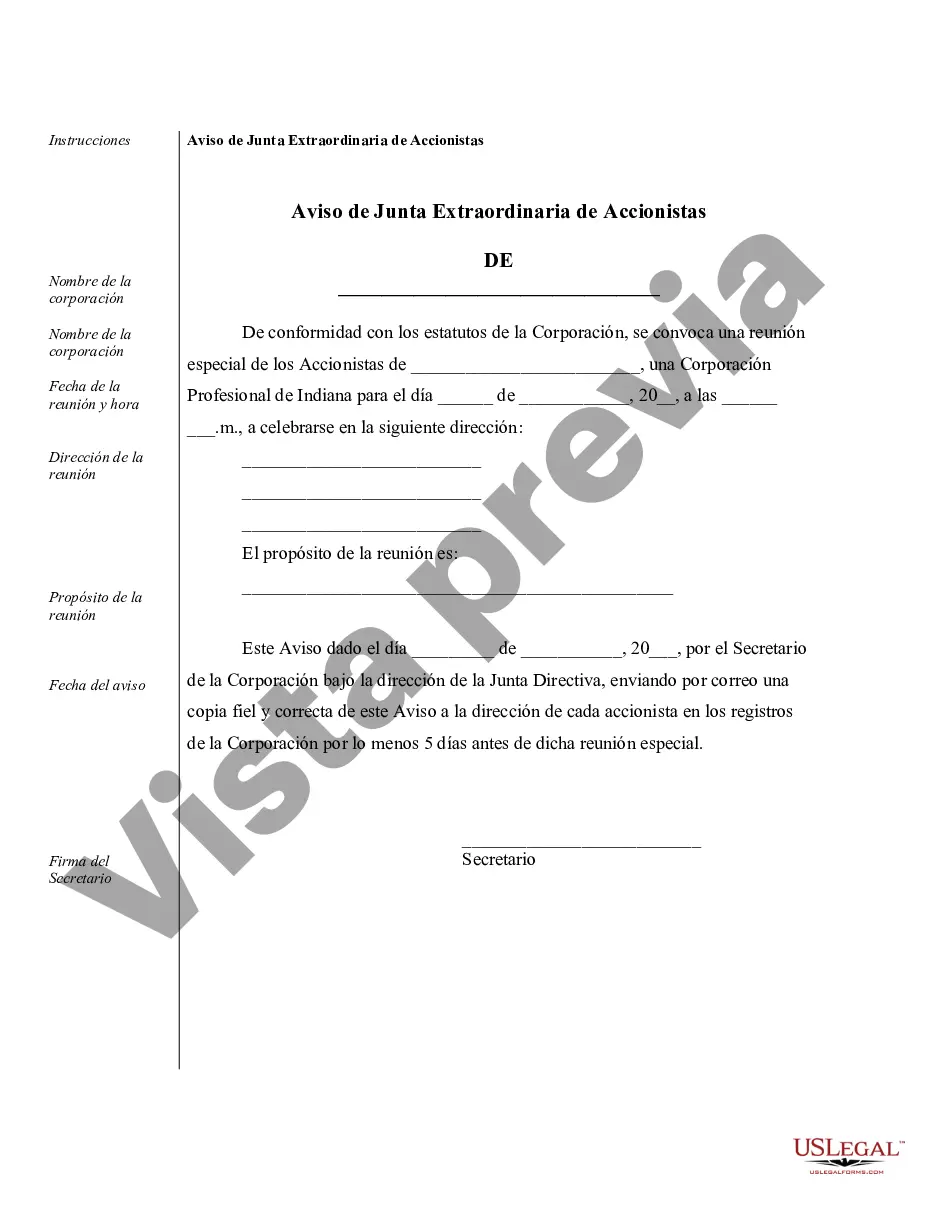

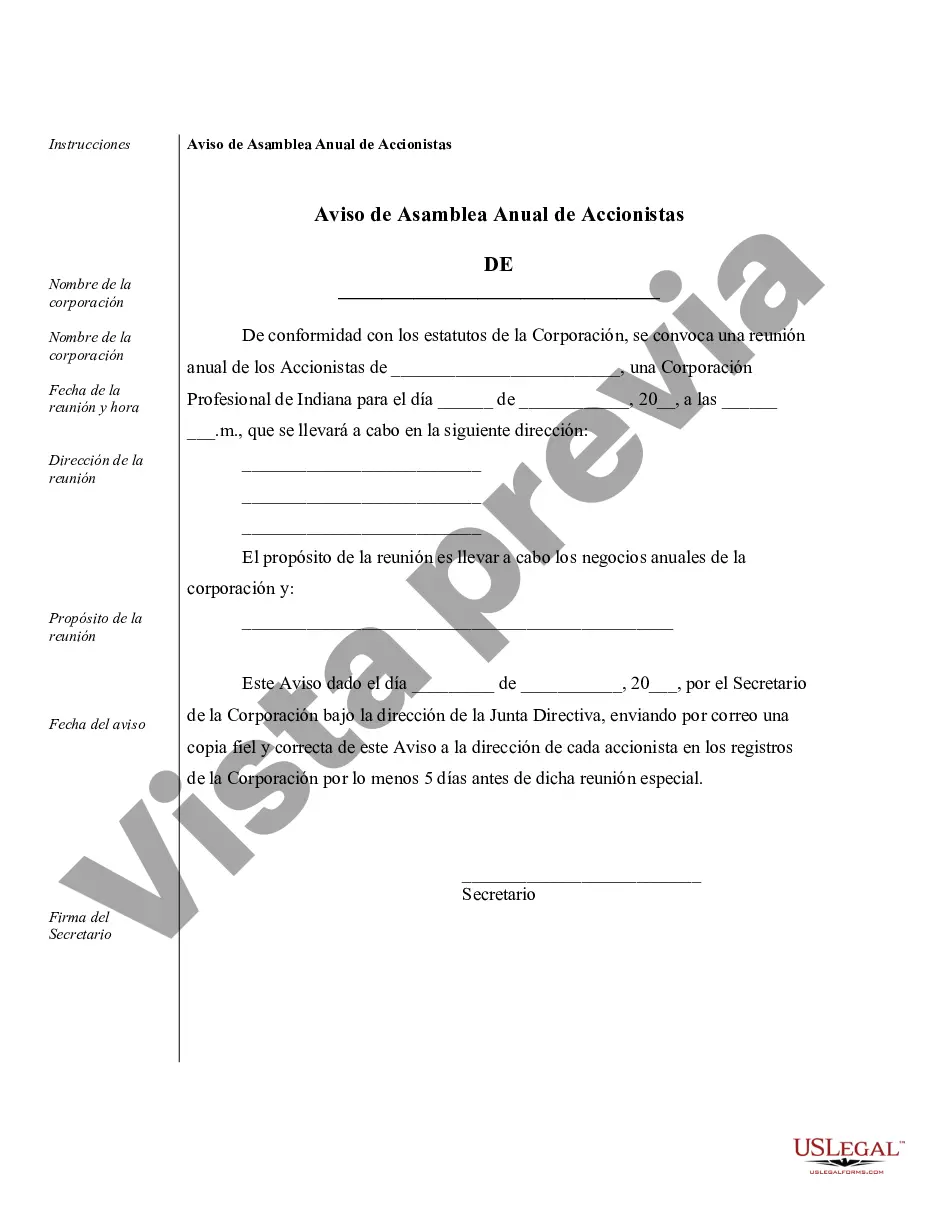

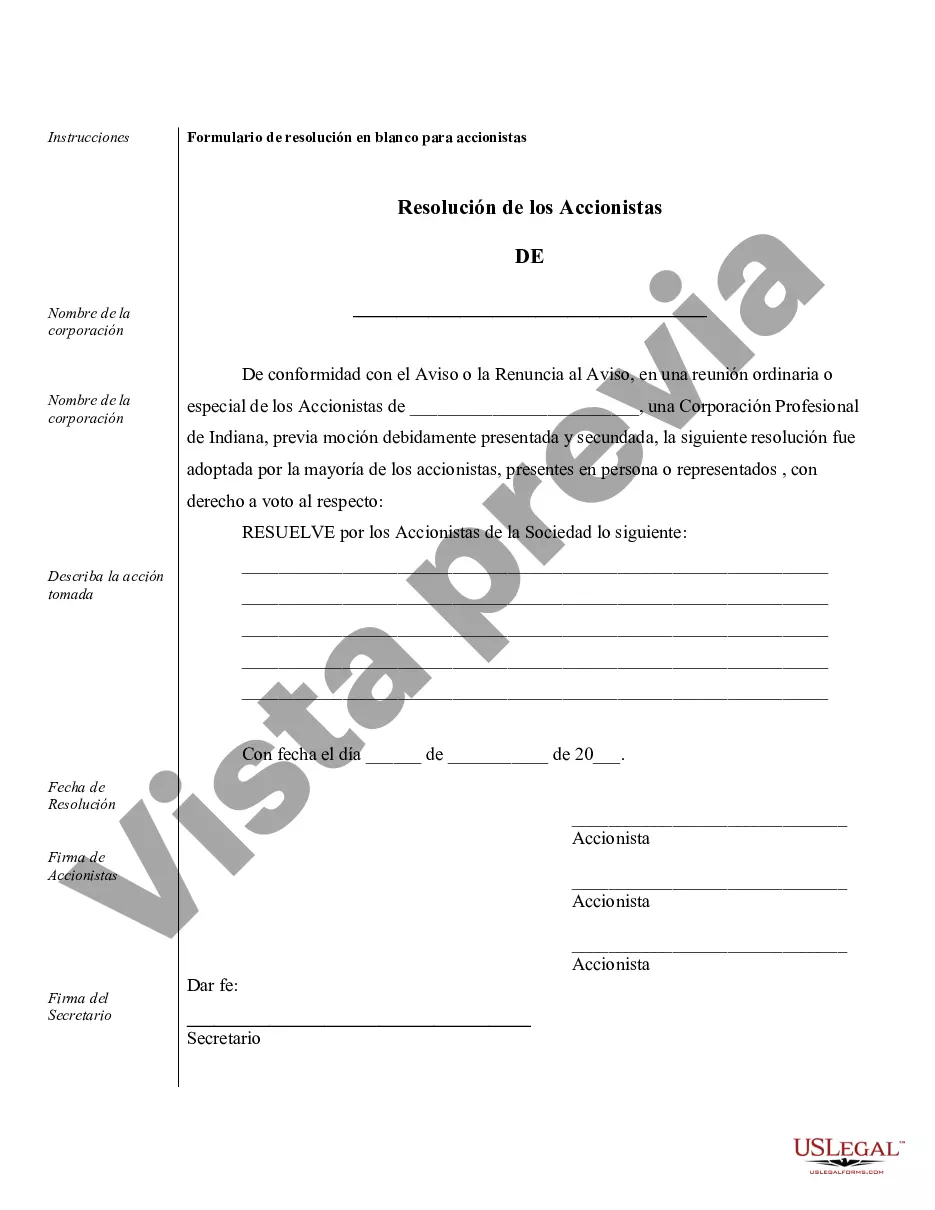

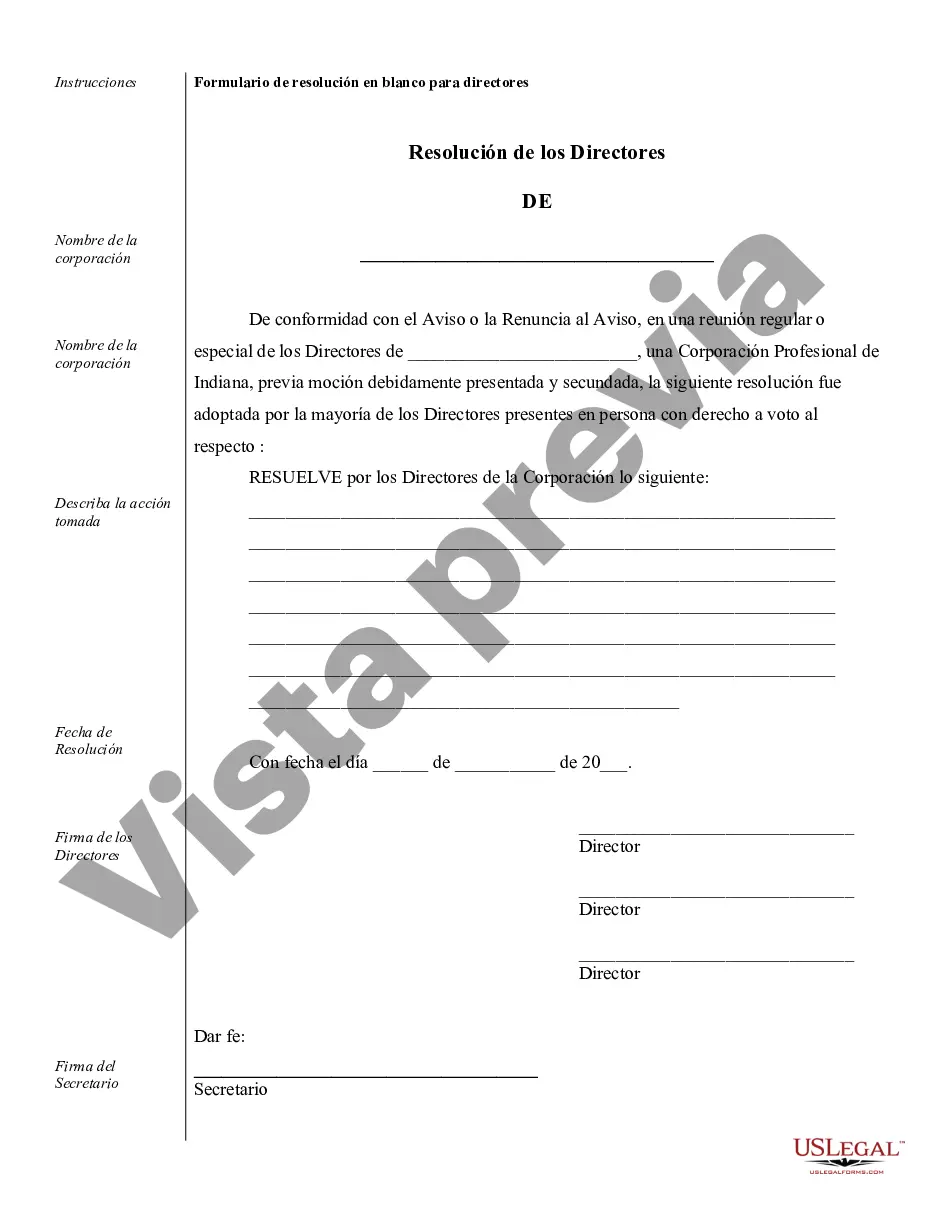

Fort Wayne Sample Corporate Records for an Indiana Professional Corporation serve as comprehensive documentation of critical information related to the formation, governance, and maintenance of the corporation. These records are essential for ensuring legal compliance, transparency, and accountability for any Indiana Professional Corporation established in Fort Wayne. Below are the types of corporate records commonly maintained by such corporations: 1. Articles of Incorporation: This document outlines important details concerning the corporation's name, purpose, registered agent, duration, and capital structure. It serves as the corporation's foundational document and must be filed with the Indiana Secretary of State. 2. Bylaws: These are internal rules and regulations that guide the corporation's governance and management. Bylaws include information about officers, board meetings, voting procedures, and other significant corporate operations. 3. Organizational Minutes: These records capture the proceedings and decisions made during the corporation's initial organizational meeting. Topics covered may include the appointment of officers and directors, adoption of bylaws, issuance of stock, and other key organizational steps. 4. Shareholders' Meeting Minutes: These minutes document discussions, resolutions, and actions taken during the corporation's regular or special shareholders' meetings. Topics covered often include the election of directors, approval of financial statements, and any other matters put to a vote by the shareholders. 5. Directors' Meeting Minutes: These records detail the deliberations and outcomes of the corporation's board of directors' meetings. Discussions pertaining to strategic planning, financial matters, major contracts, and policy decisions are typically recorded here. 6. Stock Ledgers: Stock ledgers maintain a record of the corporation's shareholders, including their names, addresses, share certificates, and the number of shares they hold. These ledgers should be updated whenever there are transfers or changes in ownership. 7. Financial Statements: Corporations should maintain accurate and up-to-date financial statements, including balance sheets, income statements, and cash flow statements. These records provide a snapshot of the corporation's financial health and are vital for assessing its performance, filing taxes, and complying with regulatory requirements. 8. Annual Report: Indiana Professional Corporations are required to file an annual report with the Secretary of State. This report includes information about the corporation's officers, directors, registered agent, and principal office address. It also confirms the corporation's continued existence and good standing. 9. Resolutions: Resolutions represent formal decisions made by the shareholders or directors of the corporation. These records demonstrate the corporation's compliance with legal requirements and highlight significant actions taken regarding dividends, stock issuance, officer appointments, or mergers and acquisitions. By diligently maintaining these Fort Wayne Sample Corporate Records for an Indiana Professional Corporation, businesses can ensure legal compliance, facilitate audits, enable effective decision-making, and demonstrate transparency to stakeholders and regulatory bodies.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fort Wayne Ejemplos de registros corporativos para una corporación profesional de Indiana - Sample Corporate Records for an Indiana Professional Corporation

Description

How to fill out Fort Wayne Ejemplos De Registros Corporativos Para Una Corporación Profesional De Indiana?

Locating verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Fort Wayne Sample Corporate Records for an Indiana Professional Corporation gets as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, obtaining the Fort Wayne Sample Corporate Records for an Indiana Professional Corporation takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a couple of more steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve picked the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Fort Wayne Sample Corporate Records for an Indiana Professional Corporation. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!