The Indianapolis Indiana Legal Last Will and Testament Form for a Single Person with Adult Children is a legally binding document that allows an individual who is single and has adult children to outline their final wishes regarding the distribution of their assets and the care of any minor children or dependents upon their death. This form follows the specific legal requirements of the state of Indiana and ensures that the wishes of the person drafting the will are properly documented and respected. Keywords: Indianapolis Indiana, Legal, Last Will and Testament Form, Single Person, Adult Children, Assets, Care, Minor Children, Dependents. This document is designed for individuals who are currently single and have adult children, which means offspring who have reached the age of majority. It is important to note that if the person drafting the will has any minor children (under the age of 18), a separate legal document such as a guardianship form should be completed to specify the appointed guardian(s) who will care for the children in the event of their passing. The Indianapolis Indiana Legal Last Will and Testament Form for a Single Person with Adult Children includes various sections that cover different aspects of an individual's estate planning. These sections may include but are not limited to: 1. Personal Information: This section will require the individual to provide their full name, address, and other identifying details. 2. Appointment of Executor: The individual will name an executor, who will be responsible for handling all the administrative tasks of the estate upon the person's death. The executor is entrusted with tasks such as asset distribution, debt settlement, and final tax filings. 3. Distribution of Assets: The individual can specify how their assets, including real estate, investments, personal belongings, and funds, should be distributed among their adult children. They can allocate specific items or provide general instructions for an equal division among their children. 4. Specific Bequests: This section allows the person writing the will to name specific beneficiaries and allocate certain assets or sums of money to them. These beneficiaries may include family members or charitable organizations. 5. Digital Assets: Given the prevalence of digital assets in today's society, this section enables the person to designate a trusted person to manage and distribute their digital assets, including passwords, social media accounts, or online financial accounts. 6. Residual Estate: The residual estate refers to any remaining assets after specific bequests and distributions. The individual can outline how they want these assets distributed, either equally among their adult children or as per their specific wishes. 7. Funeral and Burial Instructions: This section lets the person express their preferences related to their funeral arrangements, including burial or cremation, burial site, or other specific instructions. It is essential to consult with an attorney or legal professional to ensure that the Indianapolis Indiana Legal Last Will and Testament Form for a Single Person with Adult Children adheres to the state's specific legal requirements. It is also worth noting that there might be variations of this form available depending on the specific needs or circumstances of the individual.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Indianapolis Indiana Formulario Legal de Última Voluntad y Testamento para Persona Soltera con Hijos Adultos - Indiana Last Will and Testament for Single Person with Adult Children

Description

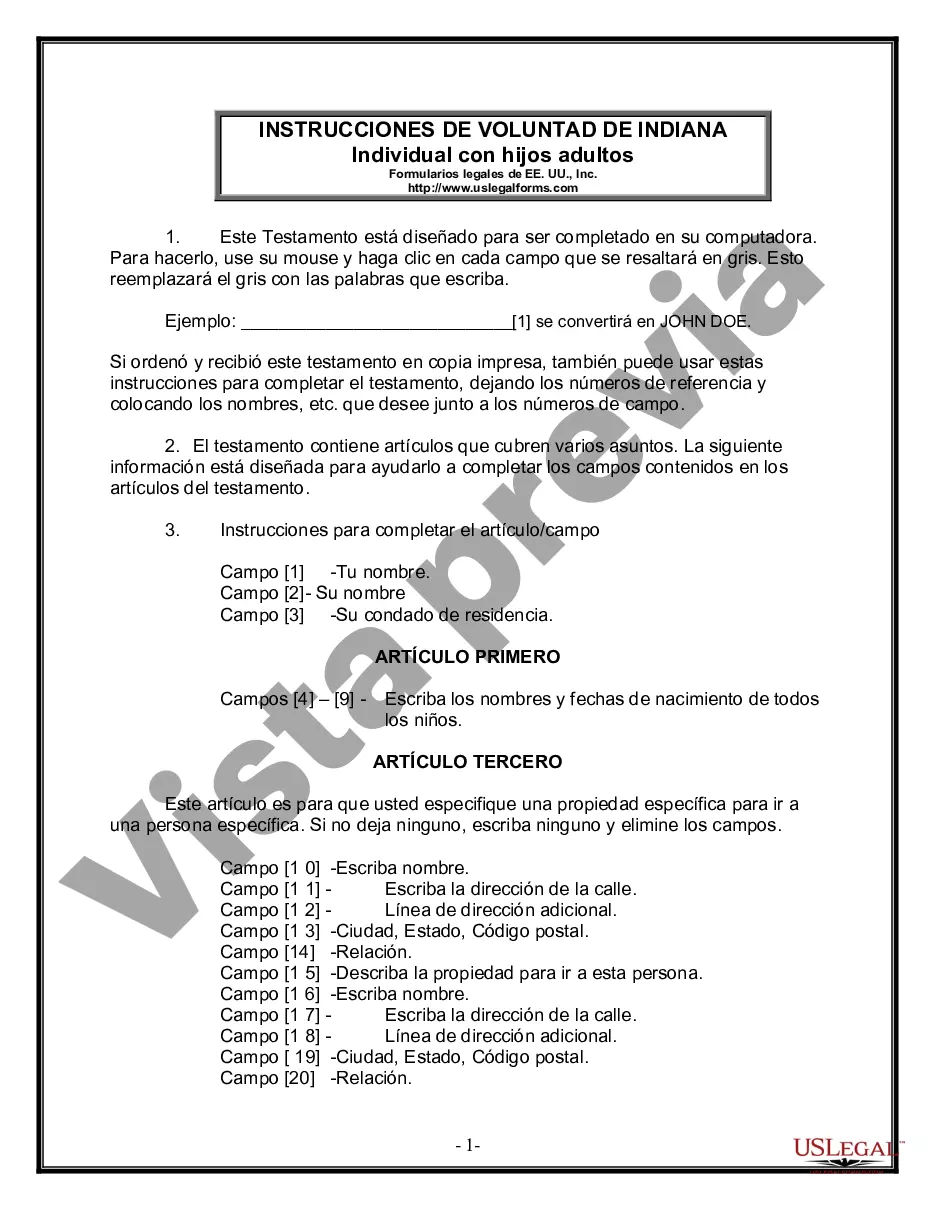

How to fill out Indianapolis Indiana Formulario Legal De Última Voluntad Y Testamento Para Persona Soltera Con Hijos Adultos?

Are you looking for a reliable and affordable legal forms supplier to buy the Indianapolis Indiana Legal Last Will and Testament Form for Single Person with Adult Children? US Legal Forms is your go-to choice.

Whether you require a basic agreement to set rules for cohabitating with your partner or a set of forms to move your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and frameworked in accordance with the requirements of particular state and area.

To download the document, you need to log in account, locate the required form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime in the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Indianapolis Indiana Legal Last Will and Testament Form for Single Person with Adult Children conforms to the laws of your state and local area.

- Go through the form’s description (if available) to find out who and what the document is good for.

- Restart the search in case the form isn’t good for your legal scenario.

Now you can register your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Indianapolis Indiana Legal Last Will and Testament Form for Single Person with Adult Children in any available file format. You can return to the website when you need and redownload the document free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time researching legal papers online once and for all.