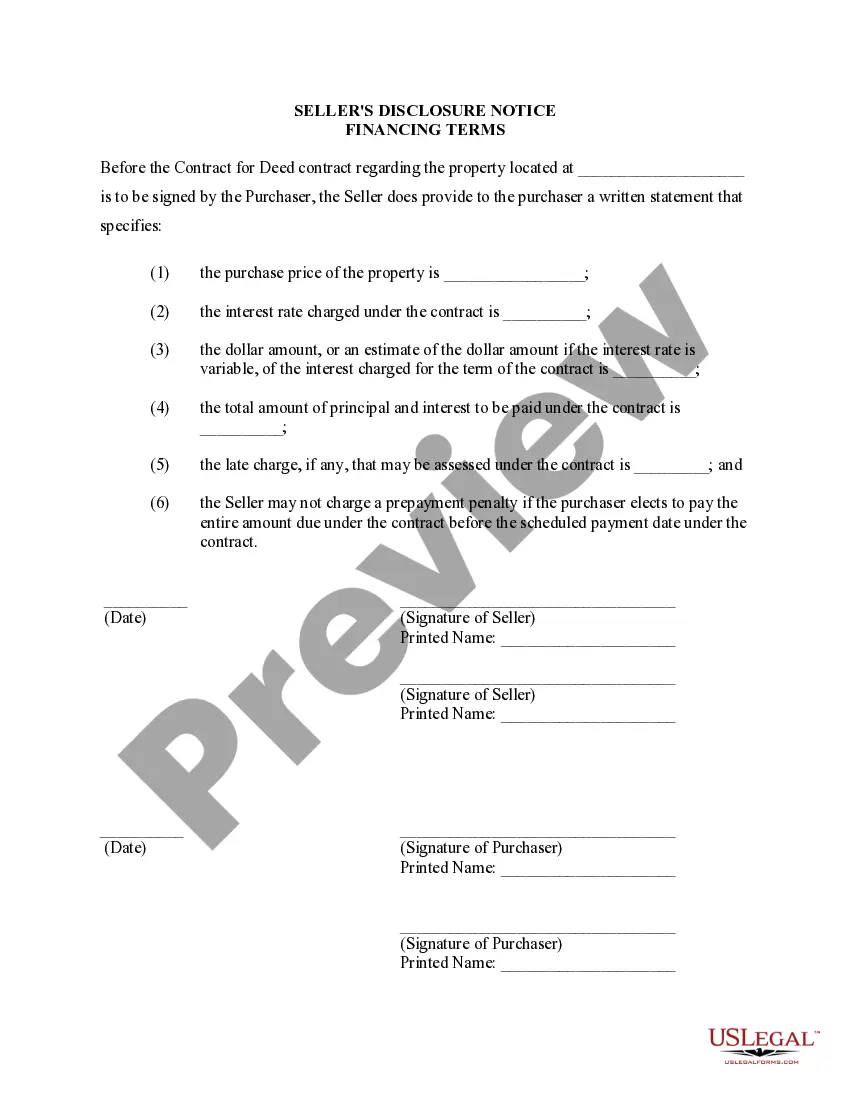

Overland Park Kansas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is a crucial document that outlines the various financial aspects of a property transaction between a seller and a buyer. This disclosure is required by law to ensure transparency and protect the rights of both parties involved in the agreement. Different types of Overland Park Kansas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed may include: 1. Interest Rates and Payment Terms: This disclosure specifies the interest rate and payment schedule agreed upon between the seller and the buyer. It outlines the regular installment amounts, due dates, and any applicable grace periods or late payment fees. 2. Down Payment and Purchase Price: Depending on the terms of the land contract, the seller's disclosure will also state the required down payment and the total purchase price of the property. It may outline any agreed-upon adjustments or credits. 3. Financing Arrangements: This section of the disclosure form details the specific financing arrangements involved in the transaction, such as whether the seller is providing financing directly or if a third-party lender is involved. It may include information on the loan terms, interest rates, and any potential repayment obligations. 4. Taxes, Insurance, and Maintenance: The seller's disclosure will also include information regarding the responsibility for property taxes, insurance premiums, and maintenance costs. It may clarify whether the buyer or the seller is responsible for these expenses during the term of the land contract. 5. Legal Rights and Responsibilities: This section outlines the legal rights and responsibilities of both the seller and the buyer under the land contract. It may include terms related to default, foreclosure, and dispute resolution. 6. Disclosure of Property Conditions: In addition to the financing terms, the seller's disclosure may also include a description of the property's condition and any known defects or issues. This information ensures that the buyer is aware of the property's condition before entering into the land contract. Overall, the Overland Park Kansas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed is a vital document that must be thoroughly reviewed and understood by both parties to avoid any misunderstandings or disputes throughout the transaction. It ensures that the financial terms are clearly defined and agreed upon, providing a solid foundation for a successful land contract agreement.

Overland Park Kansas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Overland Park Kansas Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

If you’ve already used our service before, log in to your account and save the Overland Park Kansas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Ensure you’ve found a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Overland Park Kansas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!