Topeka Kansas Contract for Deed Seller's Annual Accounting Statement serves as a comprehensive document that details the financial transactions and activities between a seller and buyer involved in a contract for deed agreement in Topeka, Kansas. This statement acts as a vital tool for both parties to track and evaluate the financial performance and compliance with the terms of the contract. The Topeka Kansas Contract for Deed Seller's Annual Accounting Statement typically includes various essential components such as: 1. Buyer and Seller Information: This section provides details about the involved parties, including their names, contact information, and the property address associated with the contract for deed transaction. 2. Transaction Summary: Here, a summary of all financial transactions for the specified accounting period is presented. It includes the total amount paid by the buyer, including all principal payments, interest charges, and any other applicable fees or costs. 3. Up-to-date Balance: The statement also presents the current outstanding balance owed by the buyer, reflecting any partial payments made throughout the accounting period. 4. Interest Calculation: If the contract stipulates the inclusion of interest charges, the statement includes an itemized breakdown of the interest calculation for the given period. This typically includes details such as the interest rate, accrual method, and the compounded or simple interest calculation process. 5. Payment History: To ensure transparency, the annual accounting statement includes a comprehensive payment history log. This log outlines the dates and amounts of all payments made by the buyer, allowing for easy verification and reconciliation. 6. Escrow Account Details: If an escrow account is part of the contract for deed agreement, the statement may present an overview of the account's balance, any funds disbursed, and pending disbursements. 7. Insurance and Tax Payments: If the contract places responsibilities for insurance and tax payments on the seller, the annual accounting statement includes details of these payments made during the accounting period. Different types of Topeka Kansas Contract for Deed Seller's Annual Accounting Statements may exist depending on the specific terms and conditions negotiated between the parties. Some variations may include: 1. Basic Accounting Statement: A standard statement that includes the essential elements mentioned above. 2. Detailed Expense Breakdown: In some cases, parties may opt for a more detailed statement that provides a breakdown of expenses, such as maintenance costs, repairs, or property management fees incurred during the accounting period. 3. No-Interest Calculation Statement: If the contract excludes interest charges, the statement reflects this by omitting the interest calculation section entirely. It is important for both the seller and buyer involved in a contract for deed agreement to carefully review and understand the Topeka Kansas Contract for Deed Seller's Annual Accounting Statement to maintain transparency, track progress, and ensure compliance with the agreement's financial obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Topeka Kansas Contrato de Escrituración Estado Contable Anual del Vendedor - Kansas Contract for Deed Seller's Annual Accounting Statement

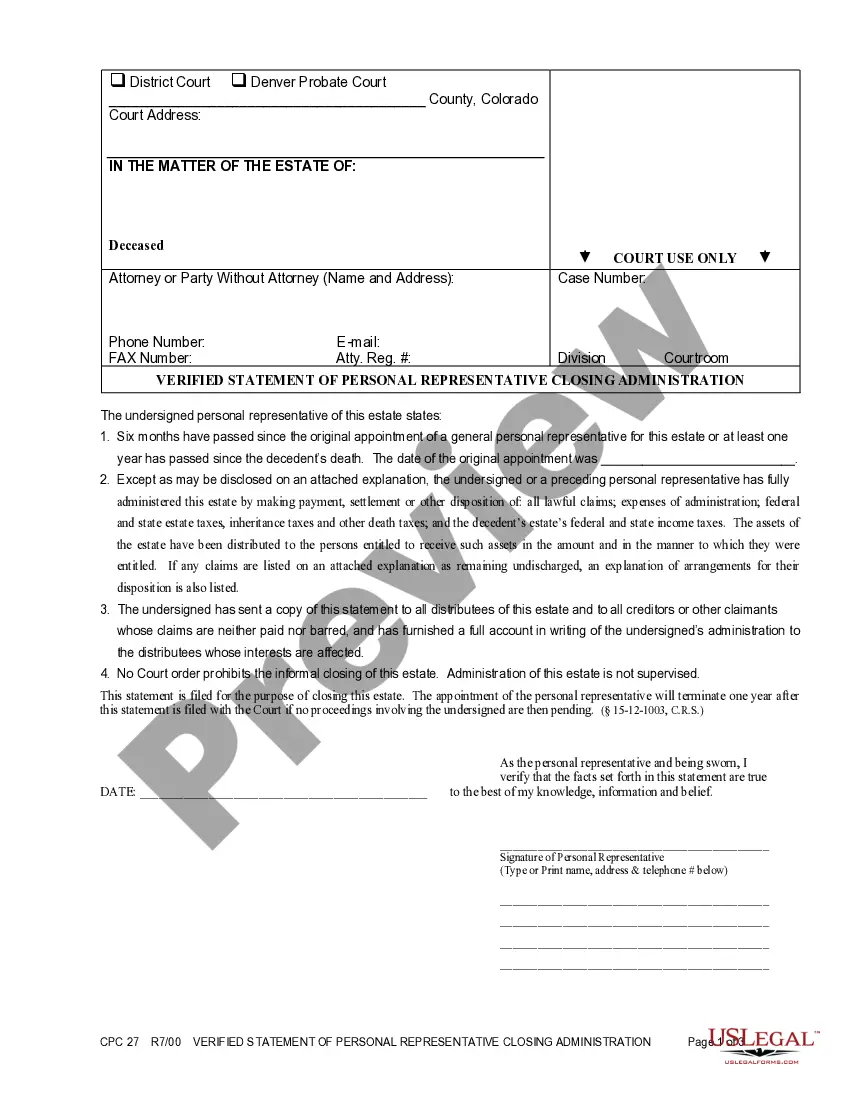

Description

How to fill out Topeka Kansas Contrato De Escrituración Estado Contable Anual Del Vendedor?

We always strive to reduce or prevent legal damage when dealing with nuanced law-related or financial affairs. To do so, we sign up for legal solutions that, usually, are extremely costly. However, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of an attorney. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Topeka Kansas Contract for Deed Seller's Annual Accounting Statement or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again in the My Forms tab.

The process is just as easy if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Topeka Kansas Contract for Deed Seller's Annual Accounting Statement complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Topeka Kansas Contract for Deed Seller's Annual Accounting Statement is suitable for your case, you can pick the subscription plan and make a payment.

- Then you can download the document in any available file format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!