Title: Understanding Olathe Kansas Renunciation and Disclaimer of Property Received by Intestate Succession Keywords: Olathe Kansas, renunciation, disclaimer, property, intestate succession, inheritance laws, legal process, disclaiming inheritance, estate planning, beneficiaries, types Introduction: In Olathe, Kansas, the process of renouncing or disclaiming property received through intestate succession is an essential legal step for individuals who do not wish to accept their inheritance. This article will provide a detailed understanding of Olathe Kansas Renunciation and Disclaimer of Property received by Intestate Succession, including its importance, legal requirements, and potential implications. Additionally, we will explore different types of renunciation and disclaimer methods available to beneficiaries. 1. Olathe Kansas Renunciation and Disclaimer of Property Received by Intestate Succession Explained: When an individual dies without leaving behind a valid will or estate plan, their assets are distributed among their heirs based on the state's intestate succession laws. However, beneficiaries may choose to renounce or disclaim their share of the inherited property. Renouncing or disclaiming an inheritance means the beneficiary voluntarily gives up their rights to receive the assets, thereby passing them on to other eligible heirs. 2. Importance and Benefits of Renunciation and Disclaimer: Renunciation and disclaimer of property received through intestate succession offer beneficiaries the following benefits: — Avoiding unwanted liabilities: In some cases, an inherited property may have associated debts or legal issues. By renouncing or disclaiming the property, the beneficiary can escape potential financial burdens. — Managing complex estates: Renunciation or disclaimer allows beneficiaries to simplify their estate planning by relinquishing properties or shares that may complicate their existing financial situation. 3. Legal Requirements for Renunciation and Disclaimer: The process of renouncing or disclaiming an inheritance in Olathe, Kansas, involves certain legal requirements. These generally include: — Filing a written renunciation or disclaimer document within a specified timeframe with the appropriate probate or surrogate court. — Ensuring the document explicitly states the beneficiary's intent to renounce or disclaim their share of the inheritance. — The renunciation or disclaimer document must be signed, witnessed, and notarized to be considered valid. 4. Potential Implications of Renunciation and Disclaimer: Beneficiaries of an inherited property should be aware of the possible ramifications before choosing to renounce or disclaim their inheritance. These may include: — The renounced or disclaimed property may pass to alternative beneficiaries as determined by the intestate succession laws. — Tax implications need to be considered, as renouncing or disclaiming the inheritance might trigger different tax treatment compared to accepting it. — Consulting an attorney or estate planning professional is highly recommended to fully understand the implications of renunciation or disclaimer. Types of Renunciation and Disclaimer: In Olathe, Kansas, renunciation and disclaimer methods may vary depending on the nature of the inherited property and the preferences of the beneficiary. Some common types include: 1. Partial Renunciation: Beneficiaries may choose to renounce only certain assets or a portion of their inherited property. 2. Conditional Renunciation: Beneficiaries can renounce their inheritance subject to certain conditions being met, such as tax consequences or other legal obligations. 3. Qualified Disclaimer: This type of disclaimer allows a beneficiary to redirect their inheritance to an alternate beneficiary as specified in the disclaimer document. Conclusion: Olathe Kansas Renunciation and Disclaimer of Property received by Intestate Succession provides beneficiaries with a legally recognized method to forgo their inheritance. Understanding the process, potential implications, and available types of renunciation and disclaimer is crucial when making such decisions. Seeking professional legal advice is advisable to navigate the complex requirements and ensure compliance with laws relevant to Olathe, Kansas.

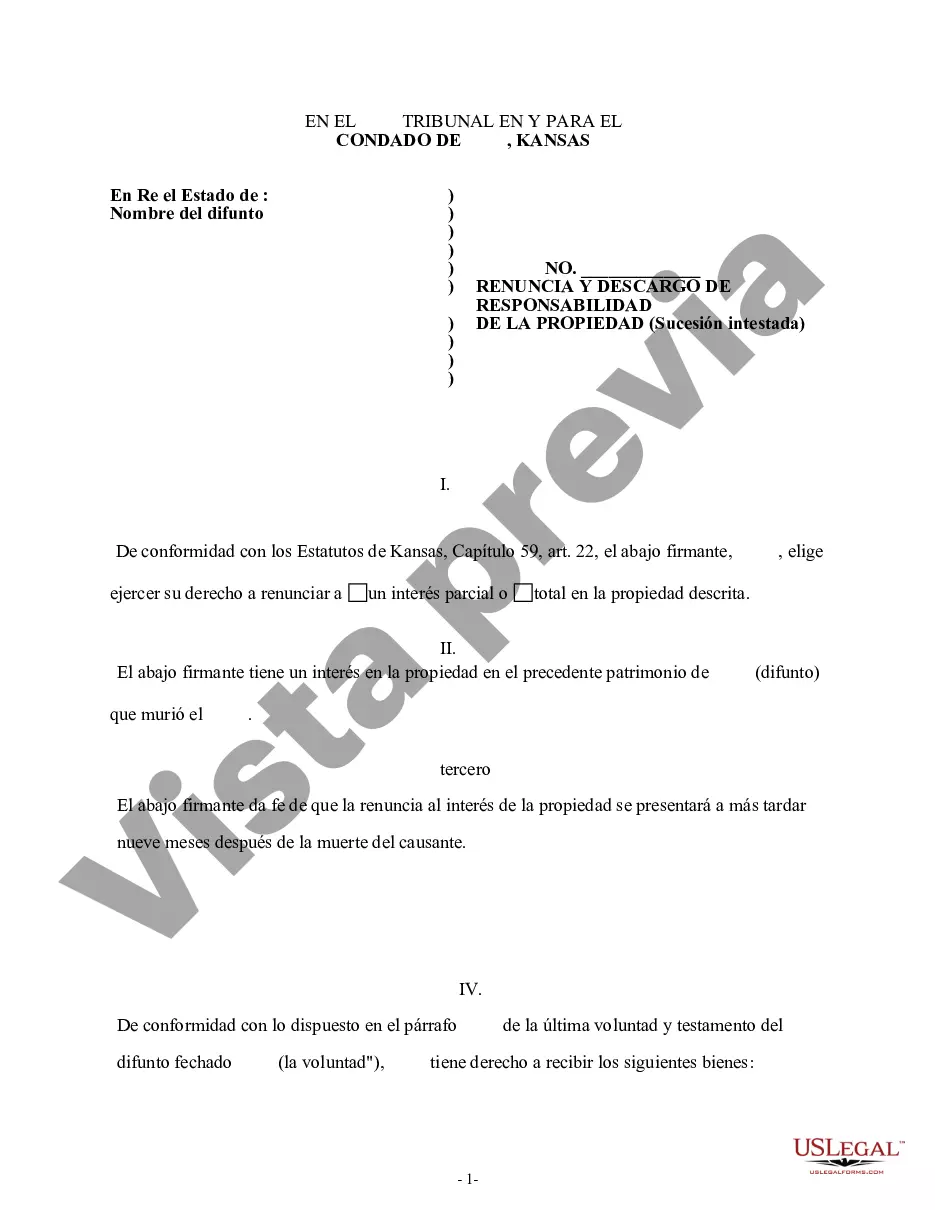

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Olathe Renuncia de Kansas y descargo de responsabilidad de la propiedad recibida por sucesión intestado - Kansas Renunciation and Disclaimer of Property received by Intestate Succession

Description

How to fill out Olathe Renuncia De Kansas Y Descargo De Responsabilidad De La Propiedad Recibida Por Sucesión Intestado?

No matter what social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for someone without any law education to draft such paperwork cfrom the ground up, mainly due to the convoluted terminology and legal nuances they come with. This is where US Legal Forms comes in handy. Our platform offers a massive collection with more than 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

No matter if you need the Olathe Kansas Renunciation and Disclaimer of Property received by Intestate Succession or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Olathe Kansas Renunciation and Disclaimer of Property received by Intestate Succession quickly employing our trusted platform. In case you are already an existing customer, you can go on and log in to your account to get the appropriate form.

However, if you are new to our library, ensure that you follow these steps before obtaining the Olathe Kansas Renunciation and Disclaimer of Property received by Intestate Succession:

- Be sure the form you have chosen is good for your location since the regulations of one state or county do not work for another state or county.

- Preview the form and go through a short description (if provided) of cases the paper can be used for.

- In case the form you chosen doesn’t meet your requirements, you can start again and look for the needed form.

- Click Buy now and choose the subscription option you prefer the best.

- Log in to your account login information or create one from scratch.

- Pick the payment method and proceed to download the Olathe Kansas Renunciation and Disclaimer of Property received by Intestate Succession as soon as the payment is done.

You’re good to go! Now you can go on and print the form or fill it out online. Should you have any issues locating your purchased documents, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.