A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant. Olathe Kansas Letter from Landlord to Tenant Returning Security Deposit Less Deductions: A Comprehensive Guide Introduction: When it comes to the end of a tenancy, both landlords and tenants have certain rights and responsibilities regarding the return of the security deposit. In Olathe, Kansas, landlords are legally obligated to send a letter to tenants returning their security deposit, along with an itemized statement of deductions (if applicable). This detailed description aims to provide valuable information on how landlords can construct a clear and legally compliant letter, ensuring transparency in the process. 1. Purpose of the Letter: The Olathe Kansas Letter from Landlord to Tenant Returning Security Deposit Less Deductions serves as a formal communication channel between the landlord and the tenant regarding the return of the security deposit at the end of the lease term. Its purpose is to inform tenants of the refund amount they will receive, after any permissible deductions are applied. 2. Mandatory Information to Include: To ensure compliance with local laws and regulations, landlords must include the following key elements in their letter: a) Tenant and Landlord Information: Begin the letter by stating the full names of both the landlord and tenant, as well as their current addresses and contact details. b) Property Address and Lease Term: Clearly state the rental property's address and specify the lease term for which the security deposit was held. c) Security Deposit Amount: Indicate the original security deposit amount that the tenant initially provided, as mentioned in the lease agreement. d) Deductions: If there are any legitimate deductions from the security deposit, itemize them in detail. Deductions must be supported by receipts or invoices and should be reasonable and necessary. Common deductions may include unpaid rent, repair costs for damages beyond reasonable wear and tear, cleaning fees, or unpaid utility bills. e) Calculation of Refund: Provide a breakdown illustrating how the final refund amount was determined. Subtract the deductions from the original security deposit amount, and clearly state the resulting refund amount. f) Payment Method and Deadline: Inform the tenant of the preferred payment method for the refund, such as a check or direct deposit. Specify a reasonable timeframe within which the refund will be issued, ensuring compliance with local laws. g) Forwarding Address: Request the tenant to provide a forwarding address if different from the rental property, ensuring the refund can be delivered correctly. h) Dispute Resolution: Include information regarding how the tenant can dispute the deductions if they believe they are unjustified. Provide contact details or refer them to the appropriate resources within Olathe's local tenant/landlord laws. 3. Types of Olathe Kansas Letters from Landlord to Tenant Returning Security Deposit Less Deductions: While there might not be explicit categories of such letters, landlords may need to adapt the letter template based on certain circumstances, such as: a) Normal Return: In this scenario, the security deposit is returned to the tenant in full, without any deductions made. The letter should reflect this by omitting any deduction-related details. b) Deductions Made: If deductions are necessary, landlords must include a detailed explanation and itemized list of deductions, along with supporting documents. Conclusion: Crafting a thorough Olathe Kansas Letter from Landlord to Tenant Returning Security Deposit Less Deductions is crucial in maintaining transparency and fulfilling legal obligations. By following this comprehensive guide, landlords can ensure their letter complies with local laws, provides the necessary details, and creates a clear communication channel with tenants regarding their security deposit refund.

Olathe Kansas Letter from Landlord to Tenant Returning Security Deposit Less Deductions: A Comprehensive Guide Introduction: When it comes to the end of a tenancy, both landlords and tenants have certain rights and responsibilities regarding the return of the security deposit. In Olathe, Kansas, landlords are legally obligated to send a letter to tenants returning their security deposit, along with an itemized statement of deductions (if applicable). This detailed description aims to provide valuable information on how landlords can construct a clear and legally compliant letter, ensuring transparency in the process. 1. Purpose of the Letter: The Olathe Kansas Letter from Landlord to Tenant Returning Security Deposit Less Deductions serves as a formal communication channel between the landlord and the tenant regarding the return of the security deposit at the end of the lease term. Its purpose is to inform tenants of the refund amount they will receive, after any permissible deductions are applied. 2. Mandatory Information to Include: To ensure compliance with local laws and regulations, landlords must include the following key elements in their letter: a) Tenant and Landlord Information: Begin the letter by stating the full names of both the landlord and tenant, as well as their current addresses and contact details. b) Property Address and Lease Term: Clearly state the rental property's address and specify the lease term for which the security deposit was held. c) Security Deposit Amount: Indicate the original security deposit amount that the tenant initially provided, as mentioned in the lease agreement. d) Deductions: If there are any legitimate deductions from the security deposit, itemize them in detail. Deductions must be supported by receipts or invoices and should be reasonable and necessary. Common deductions may include unpaid rent, repair costs for damages beyond reasonable wear and tear, cleaning fees, or unpaid utility bills. e) Calculation of Refund: Provide a breakdown illustrating how the final refund amount was determined. Subtract the deductions from the original security deposit amount, and clearly state the resulting refund amount. f) Payment Method and Deadline: Inform the tenant of the preferred payment method for the refund, such as a check or direct deposit. Specify a reasonable timeframe within which the refund will be issued, ensuring compliance with local laws. g) Forwarding Address: Request the tenant to provide a forwarding address if different from the rental property, ensuring the refund can be delivered correctly. h) Dispute Resolution: Include information regarding how the tenant can dispute the deductions if they believe they are unjustified. Provide contact details or refer them to the appropriate resources within Olathe's local tenant/landlord laws. 3. Types of Olathe Kansas Letters from Landlord to Tenant Returning Security Deposit Less Deductions: While there might not be explicit categories of such letters, landlords may need to adapt the letter template based on certain circumstances, such as: a) Normal Return: In this scenario, the security deposit is returned to the tenant in full, without any deductions made. The letter should reflect this by omitting any deduction-related details. b) Deductions Made: If deductions are necessary, landlords must include a detailed explanation and itemized list of deductions, along with supporting documents. Conclusion: Crafting a thorough Olathe Kansas Letter from Landlord to Tenant Returning Security Deposit Less Deductions is crucial in maintaining transparency and fulfilling legal obligations. By following this comprehensive guide, landlords can ensure their letter complies with local laws, provides the necessary details, and creates a clear communication channel with tenants regarding their security deposit refund.

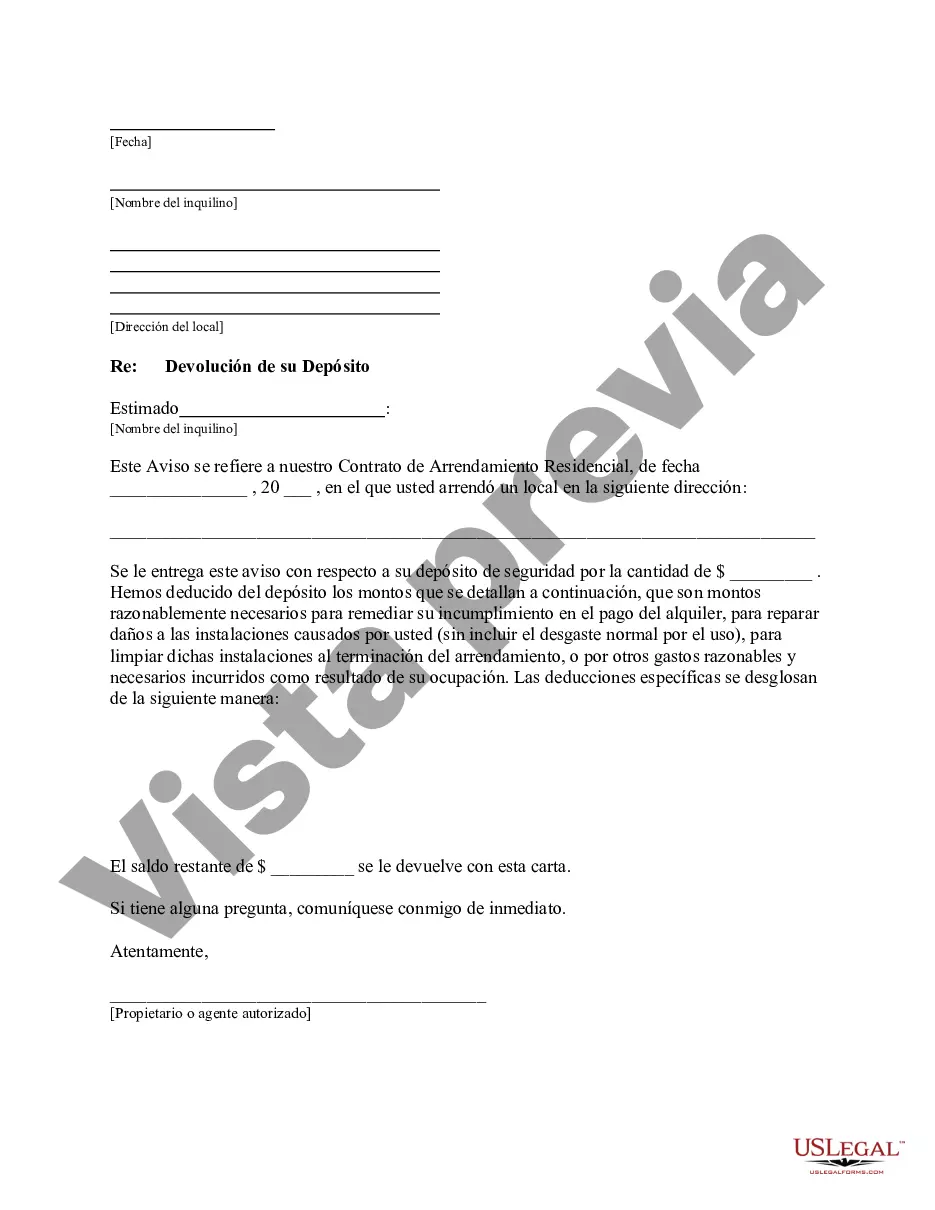

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.