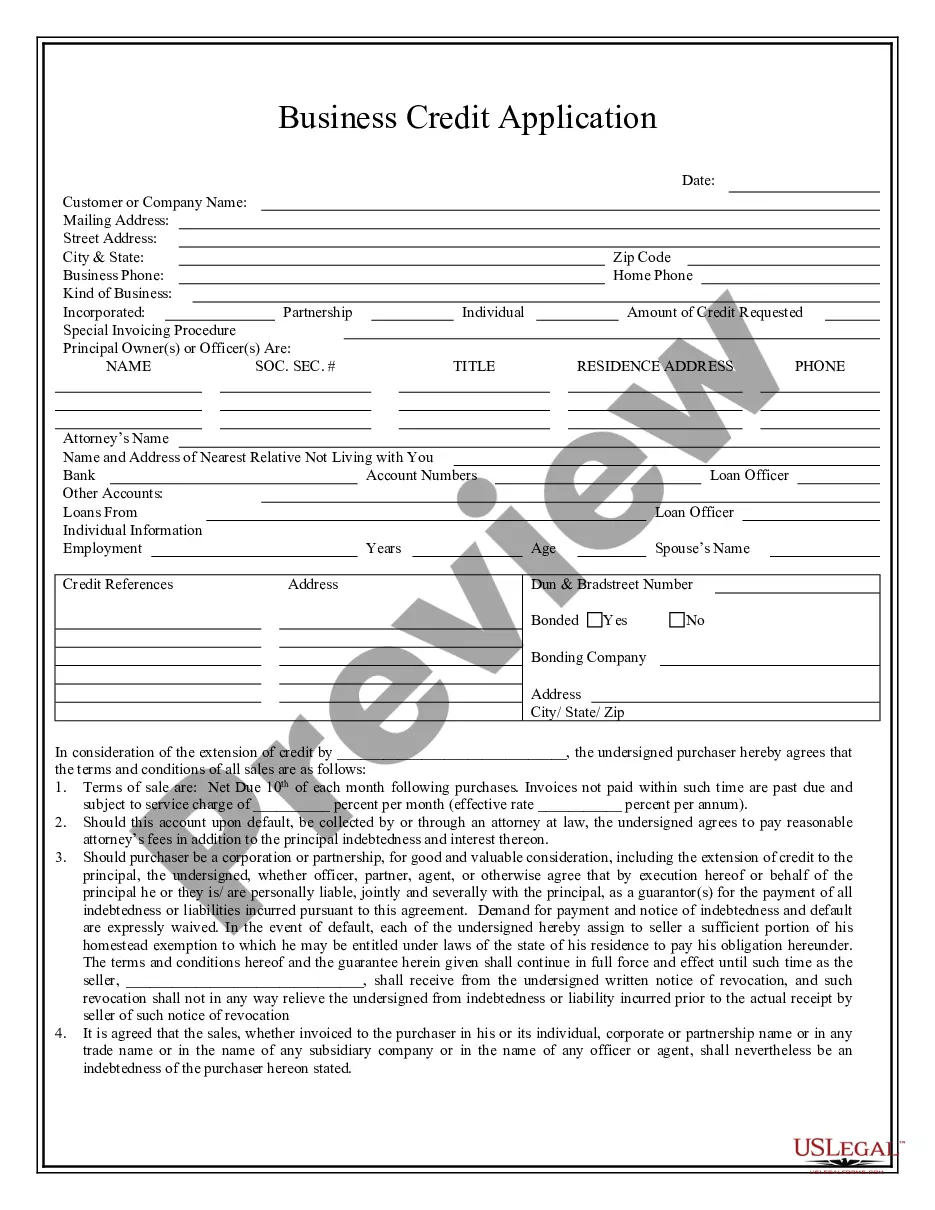

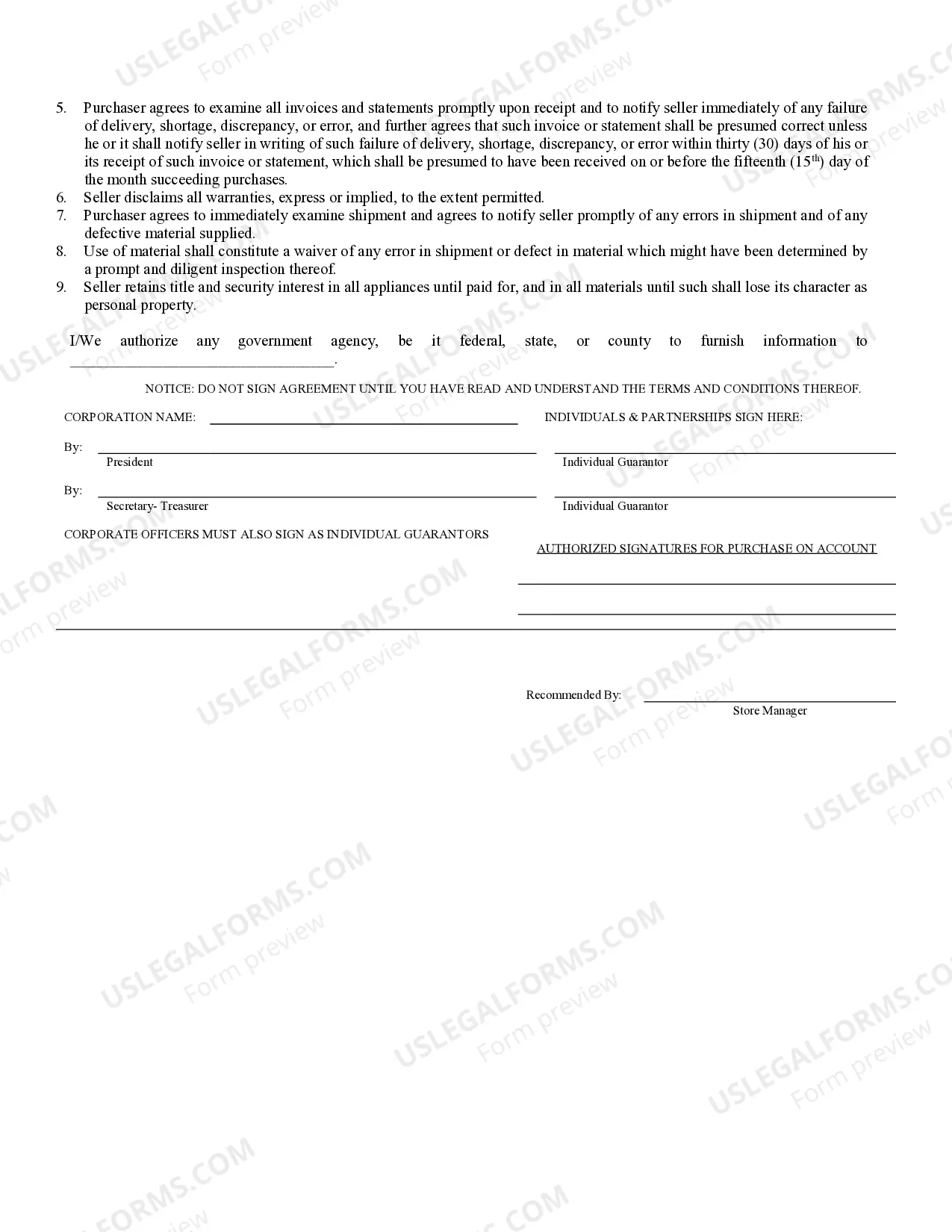

Overland Park, Kansas Business Credit Application is a vital process for local businesses looking to establish credit relationships with various financial institutions, lenders, or vendors. This comprehensive application requires businesses to provide detailed information about their financial history, operations, and creditworthiness. By completing this application, businesses in Overland Park can gain access to credit facilities, lines of credit, and funding options, essential for their growth and sustainability. Keywords: Overland Park, Kansas, business, credit application, financial institutions, lenders, vendors, creditworthiness, credit facilities, lines of credit, funding options, growth, sustainability. Different types of Overland Park, Kansas Business Credit Applications may include: 1. Traditional Credit Application: This is the standard form used by businesses seeking credit from banks, credit unions, or traditional lenders. It consists of sections requiring details such as legal business name, tax identification number, contact information, business structure, years in operation, ownership details, and financial statements. 2. Vendor Credit Application: Businesses seeking credit from suppliers or vendors often fill out this type of credit application. It typically includes similar sections as the traditional application but may emphasize information specific to the vendor relationship, such as details about the products/services purchased, terms of payment, and trade references. 3. Small Business Administration (SBA) Loan Application: The SBA offers various loan programs to support small businesses. These programs require businesses to complete an extensive credit application covering several aspects of their operations and finances. This may include descriptions of the business, financial projections, collateral information, personal financial statements, and other necessary documentation. 4. Business Line of Credit Application: Many banks and financial institutions offer business lines of credit to provide flexible funding options. This type of application focuses on the credit requirements, desired credit limit, intended use of funds, and the business's ability to repay according to the terms. 5. Business Credit Card Application: Obtaining a business credit card is essential for managing day-to-day expenses, making purchases, and building credit history. The application for a business credit card typically includes information about the company, owner's details, financials, and credit requirements. By filling out the appropriate Overland Park, Kansas Business Credit Application, local businesses can establish their creditworthiness, access necessary funds, build valuable relationships with financial institutions or vendors, and secure their future growth and success.

Overland Park Kansas Business Credit Application

Description

How to fill out Overland Park Kansas Business Credit Application?

Take advantage of the US Legal Forms and obtain immediate access to any form you require. Our useful website with a large number of documents simplifies the way to find and obtain virtually any document sample you need. You can save, complete, and certify the Overland Park Kansas Business Credit Application in just a couple of minutes instead of browsing the web for many hours looking for the right template.

Using our catalog is an excellent way to improve the safety of your form filing. Our experienced attorneys regularly review all the documents to make sure that the templates are relevant for a particular state and compliant with new acts and polices.

How do you get the Overland Park Kansas Business Credit Application? If you have a subscription, just log in to the account. The Download option will appear on all the documents you look at. In addition, you can get all the earlier saved documents in the My Forms menu.

If you haven’t registered a profile yet, stick to the tips below:

- Find the template you need. Ensure that it is the form you were seeking: verify its title and description, and take take advantage of the Preview function when it is available. Otherwise, make use of the Search field to find the needed one.

- Start the downloading process. Click Buy Now and select the pricing plan you prefer. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Download the file. Pick the format to obtain the Overland Park Kansas Business Credit Application and revise and complete, or sign it according to your requirements.

US Legal Forms is one of the most considerable and trustworthy form libraries on the web. We are always happy to help you in any legal procedure, even if it is just downloading the Overland Park Kansas Business Credit Application.

Feel free to take full advantage of our platform and make your document experience as convenient as possible!