Overland Park Kansas Revocation of Living Trust

Description

How to fill out Kansas Revocation Of Living Trust?

Regardless of one’s social or professional standing, completing law-related documents is an unfortunate obligation in today's workplace.

Frequently, it’s nearly impossible for an individual lacking legal education to create such paperwork from the ground up, primarily due to the intricate terminology and legal nuances involved.

This is where US Legal Forms comes to the aid.

Confirm the form you selected is appropriate for your area as the regulations of one state or region do not apply to another.

If the document you chose does not meet your requirements, you can restart and search for the necessary form.

- Our platform provides an extensive library with over 85,000 ready-to-use state-specific documents that cater to nearly any legal scenario.

- US Legal Forms is also a valuable resource for associates or legal advisors aiming to enhance their efficiency by utilizing our DYI papers.

- Whether you require the Overland Park Kansas Revocation of Living Trust or another document applicable in your jurisdiction, with US Legal Forms, everything is accessible.

- Here’s how to obtain the Overland Park Kansas Revocation of Living Trust in minutes using our reliable platform.

- If you’re an existing customer, feel free to Log In to your account to download the required form.

- However, if you're new to our library, ensure to follow these steps before acquiring the Overland Park Kansas Revocation of Living Trust.

Form popularity

FAQ

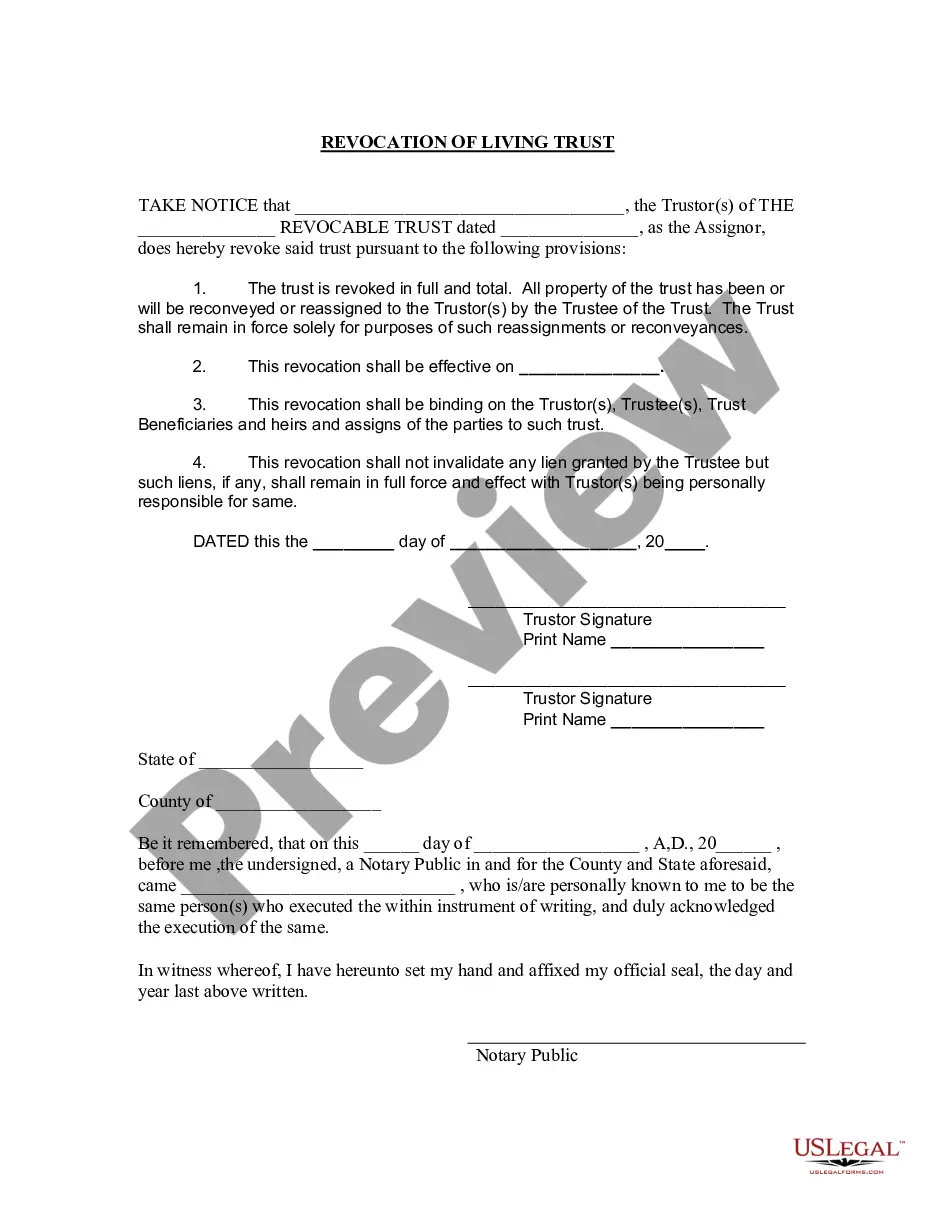

A common example of a trust revocation would be when the grantor decides to dissolve the trust entirely and transfer the assets back to themselves or to a new trust. This process involves creating a revocation document and executing it according to legal requirements. If this scenario applies to you, especially regarding the Overland Park Kansas Revocation of Living Trust, consider seeking legal assistance or reliable templates to ensure everything is done correctly.

An example of revocation includes a grantor issuing a written document that outlines their intent to cancel the trust. This document must be executed in accordance with state laws to stand as a valid revocation. If you are interested in the Overland Park Kansas Revocation of Living Trust, following proper protocols will ensure your revocation is recognized legally.

A trust can become null and void if it was created under duress, lacks proper signing or witnessing, or if the assets intended for the trust are not legally owned by the grantor. Additionally, if the trust's purpose is illegal or against public policy, it may be invalid. For those navigating the Overland Park Kansas Revocation of Living Trust, ensuring validity requires careful adherence to legal standards.

A notice of revocation typically includes a written statement that specifies the intent to revoke a trust or its provisions. This document should be signed and delivered according to state laws to be effective. In the context of the Overland Park Kansas Revocation of Living Trust, using a standardized template can streamline this process and ensure compliance.

A trust can be terminated in several ways, including the explicit terms laid out in the trust document, the death of the grantor if it is a revocable trust, or through court intervention. Each method has distinct implications for the assets held in the trust. Understanding these options is crucial for anyone considering an Overland Park Kansas Revocation of Living Trust.

To remove assets from a trust, you typically need to execute specific legal documents that formally transfer those assets out of the trust. It’s essential to follow the trust’s guidelines and ensure compliance with applicable laws in your state. If you are dealing with an Overland Park Kansas Revocation of Living Trust, consulting with a legal professional can guide you through this process safely.

A revocable trust, as the name suggests, allows you to change or revoke it during your lifetime. In contrast, an irrevocable trust cannot be altered or terminated once it is established. This distinction is crucial when considering the Overland Park Kansas Revocation of Living Trust, as it affects how assets are managed and distributed.

A revocable trust is a legal arrangement that allows you to manage your assets during your lifetime and specify how they should be distributed after your death. It can be altered or revoked at any time, giving you flexibility and control. In the context of Overland Park Kansas Revocation of Living Trust, understanding this concept is crucial for making informed decisions about your estate planning. Using platforms like USLegalForms can simplify the creation and modification of your revocable trust, ensuring it meets your needs effectively.

The key difference between a revocable and irrevocable trust lies in control and flexibility. A revocable trust allows you to modify or revoke the trust at any time, keeping you in command of your assets. An irrevocable trust, however, offers greater security by preventing alterations after its creation. Understanding these differences can help you choose the best option based on your financial objectives and personal needs.

The primary advantage of an irrevocable trust is the asset protection it provides. Once assets are transferred to an irrevocable trust, they are shielded from creditors and legal claims, ensuring that your beneficiaries receive the intended inheritance. This feature can be especially beneficial for individuals with significant assets or those concerned about potential legal challenges. It is crucial to weigh this benefit against the loss of control over your assets.