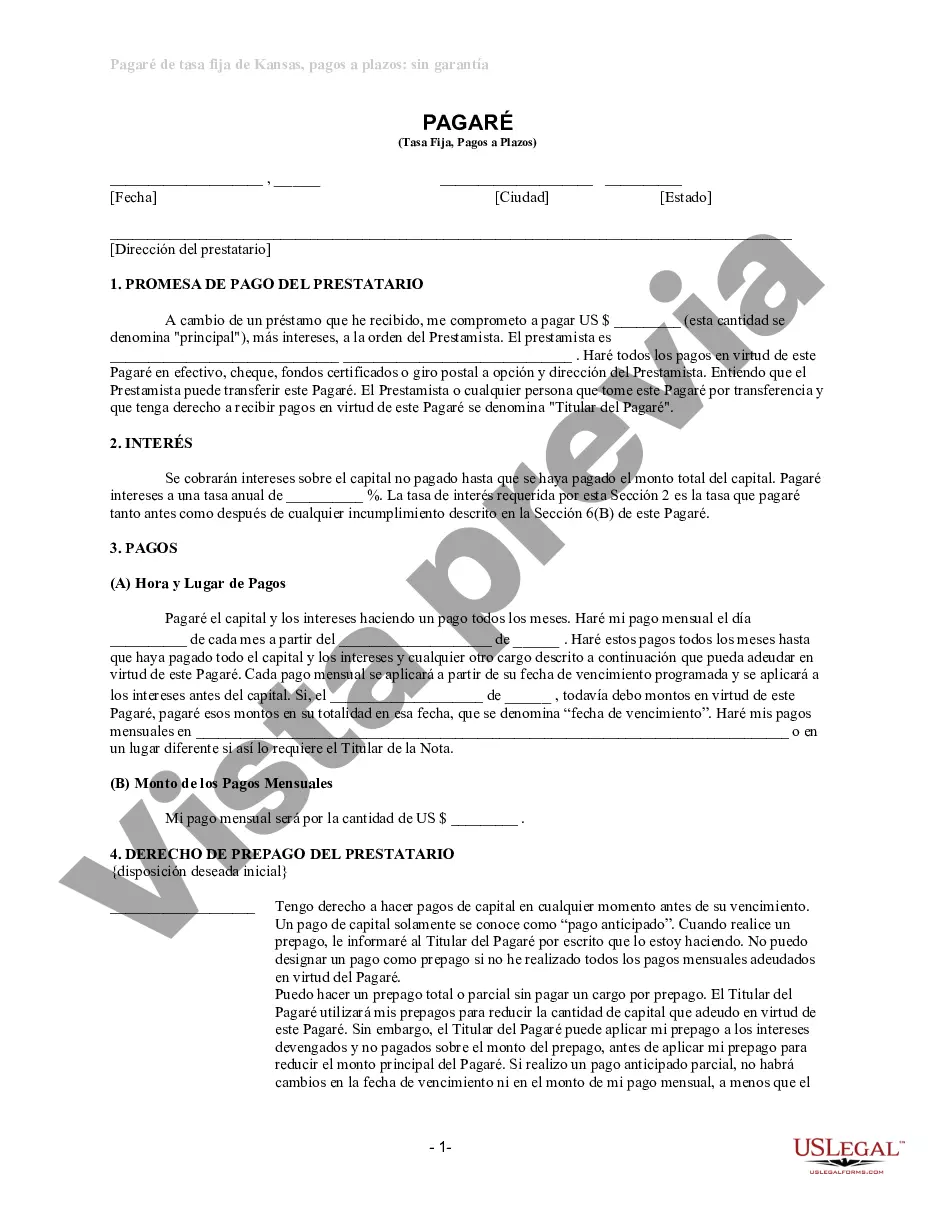

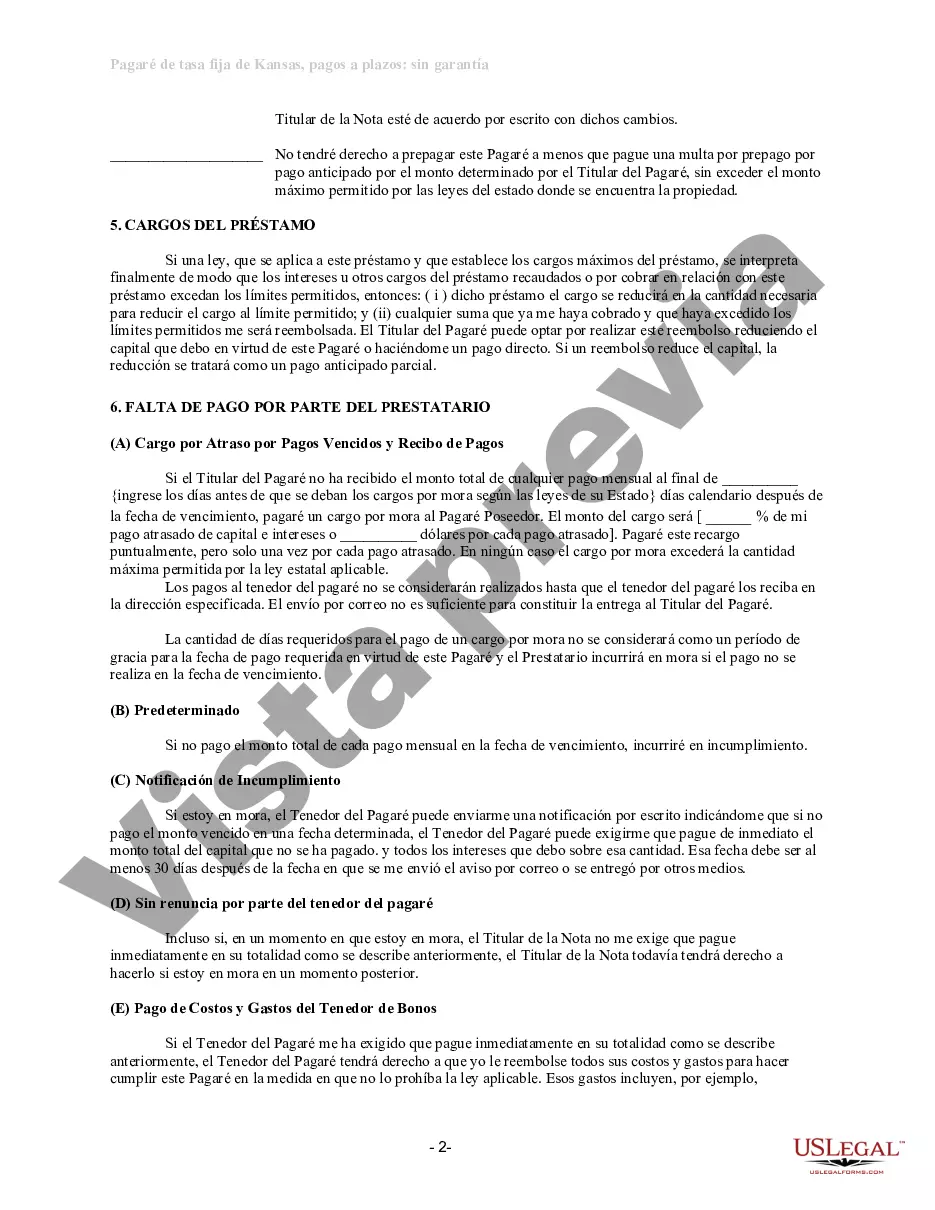

Overland Park Kansas Unsecured Installment Payment Promissory Note for Fixed Rate: A Comprehensive Guide Introduction: In Overland Park, Kansas, individuals and businesses often use Unsecured Installment Payment Promissory Notes for Fixed Rate to establish legally binding agreements for borrowing or lending money. These promissory notes help protect the rights and interests of both parties involved. This detailed description aims to provide insights into the features, benefits, and different types of unsecured installment payment promissory notes available in Overland Park, Kansas, highlighting relevant keywords throughout. Key Points: 1. Definition of an Unsecured Installment Payment Promissory Note: An unsecured installment payment promissory note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. It specifies the fixed interest rate, repayment schedule, and the promised amount to be paid by the borrower to the lender. 2. Features and Benefits: — Flexibility: Unsecured installment payment promissory notes allow for customized agreements to meet the specific needs of both parties. — Fixed Interest Rate: The promissory note explicitly states the fixed interest rate, ensuring clarity and stability throughout the repayment period. — Repayment Schedule: The note outlines the repayment schedule, including the frequency and amount of each payment, providing a clear understanding of obligations. — Legal Protection: By documenting the terms and conditions of the loan, an unsecured installment payment promissory note protects the rights and interests of both parties involved. Types of Unsecured Installment Payment Promissory Notes: 1. Personal Unsecured Installment Payment Promissory Note: This type of promissory note is used in personal loan agreements between individuals or friends/family who require financial assistance. It outlines the repayment terms, including the fixed interest rate and installment schedule. 2. Small Business Unsecured Installment Payment Promissory Note: This promissory note is designed for small businesses in Overland Park, Kansas, seeking loans from investors or lenders. It ensures a clear understanding of the terms, repayment schedule, and fixed interest rate for proper financial planning. 3. Commercial Unsecured Installment Payment Promissory Note: Commercial promissory notes are commonly used by companies or organizations to secure business loans from financial institutions, detailing the repayment plan and fixed interest rate of the loan. Conclusion: An Unsecured Installment Payment Promissory Note for a Fixed Rate is a crucial legal document for both lenders and borrowers in Overland Park, Kansas. It provides clarity, certainty, and legal protection regarding the terms, repayment plan, and fixed interest rate agreed upon. Whether for personal, small business, or commercial purposes, utilizing an unsecured installment payment promissory note ensures a mutually beneficial agreement while safeguarding the interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Overland Park Pagaré de pago a plazos no garantizado de Kansas para tasa fija - Kansas Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Overland Park Pagaré De Pago A Plazos No Garantizado De Kansas Para Tasa Fija?

Make use of the US Legal Forms and have immediate access to any form template you require. Our useful website with a huge number of documents simplifies the way to find and obtain virtually any document sample you want. You are able to save, complete, and certify the Overland Park Kansas Unsecured Installment Payment Promissory Note for Fixed Rate in just a couple of minutes instead of browsing the web for many hours attempting to find an appropriate template.

Using our collection is a superb way to improve the safety of your document submissions. Our experienced attorneys regularly review all the documents to make sure that the forms are appropriate for a particular state and compliant with new laws and polices.

How do you obtain the Overland Park Kansas Unsecured Installment Payment Promissory Note for Fixed Rate? If you already have a profile, just log in to the account. The Download button will be enabled on all the documents you look at. Additionally, you can get all the previously saved files in the My Forms menu.

If you don’t have a profile yet, stick to the tips listed below:

- Open the page with the template you require. Ensure that it is the form you were seeking: examine its headline and description, and utilize the Preview feature when it is available. Otherwise, make use of the Search field to find the appropriate one.

- Start the downloading procedure. Select Buy Now and choose the pricing plan you like. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Download the document. Pick the format to get the Overland Park Kansas Unsecured Installment Payment Promissory Note for Fixed Rate and modify and complete, or sign it according to your requirements.

US Legal Forms is among the most significant and trustworthy form libraries on the internet. Our company is always ready to help you in virtually any legal process, even if it is just downloading the Overland Park Kansas Unsecured Installment Payment Promissory Note for Fixed Rate.

Feel free to benefit from our service and make your document experience as convenient as possible!