An Overland Park Kansas Installments Fixed Rate Promissory Note Secured by Personal Property is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in the city of Overland Park, Kansas. This promissory note serves as evidence of the borrower's promise to repay the loan amount in installments, over a specific period of time, at a fixed interest rate. The key features of an Overland Park Kansas Installments Fixed Rate Promissory Note Secured by Personal Property include the inclusion of personal property as collateral to secure the loan. This means that if the borrower fails to fulfill their repayment obligations, the lender has the right to claim and sell the borrower's personal property to recover the outstanding loan balance. Different types of Overland Park Kansas Installments Fixed Rate Promissory Notes Secured by Personal Property may include variations in the loan terms, repayment schedule, interest rates, and eligible personal property collateral. Some common variations may include: 1. Residential Property Secured Promissory Note: This type of promissory note specifically involves securing the loan against residential property owned by the borrower. The personal property included could be the borrower's home, condo, or any other residential property. 2. Automobile Secured Promissory Note: In this case, the personal property being offered as collateral is the borrower's vehicle. This type of promissory note is commonly used for auto loans, wherein the lender can repossess and sell the borrower's vehicle if the loan remains unpaid. 3. Jewelry or Luxury Item Secured Promissory Note: This type of promissory note involves using high-value personal property items such as jewelry, luxury watches, or collector's items as collateral. It provides an alternative option for borrowers who may not have real estate or vehicles to offer as collateral but possess valuable personal possessions. 4. Business Assets Secured Promissory Note: This variation of the promissory note involves securing the loan against the borrower's business assets, such as equipment, inventory, or accounts receivable. This type of promissory note is often used by small business owners to acquire financing for their operations. In conclusion, an Overland Park Kansas Installments Fixed Rate Promissory Note Secured by Personal Property is a legal document that establishes the terms and conditions of a loan agreement between a borrower and lender in Overland Park, Kansas. With various types available, borrowers can select the appropriate promissory note based on their personal property collateral and specific financial needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Overland Park Pagaré de Tasa Fija en Cuotas de Kansas Garantizado por Bienes Personales - Kansas Installments Fixed Rate Promissory Note Secured by Personal Property

Category:

State:

Kansas

City:

Overland Park

Control #:

KS-NOTESEC2

Format:

Word

Instant download

Description

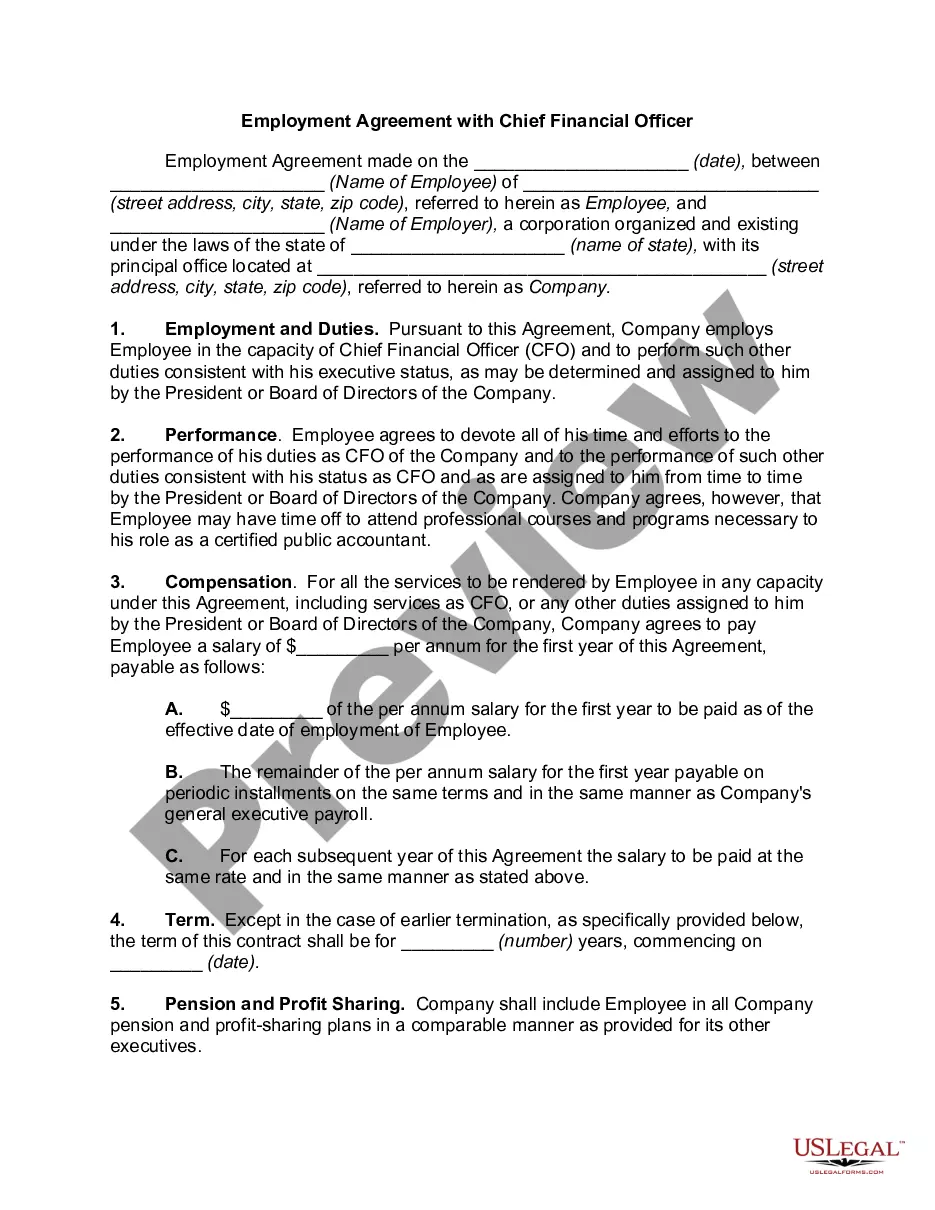

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

An Overland Park Kansas Installments Fixed Rate Promissory Note Secured by Personal Property is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in the city of Overland Park, Kansas. This promissory note serves as evidence of the borrower's promise to repay the loan amount in installments, over a specific period of time, at a fixed interest rate. The key features of an Overland Park Kansas Installments Fixed Rate Promissory Note Secured by Personal Property include the inclusion of personal property as collateral to secure the loan. This means that if the borrower fails to fulfill their repayment obligations, the lender has the right to claim and sell the borrower's personal property to recover the outstanding loan balance. Different types of Overland Park Kansas Installments Fixed Rate Promissory Notes Secured by Personal Property may include variations in the loan terms, repayment schedule, interest rates, and eligible personal property collateral. Some common variations may include: 1. Residential Property Secured Promissory Note: This type of promissory note specifically involves securing the loan against residential property owned by the borrower. The personal property included could be the borrower's home, condo, or any other residential property. 2. Automobile Secured Promissory Note: In this case, the personal property being offered as collateral is the borrower's vehicle. This type of promissory note is commonly used for auto loans, wherein the lender can repossess and sell the borrower's vehicle if the loan remains unpaid. 3. Jewelry or Luxury Item Secured Promissory Note: This type of promissory note involves using high-value personal property items such as jewelry, luxury watches, or collector's items as collateral. It provides an alternative option for borrowers who may not have real estate or vehicles to offer as collateral but possess valuable personal possessions. 4. Business Assets Secured Promissory Note: This variation of the promissory note involves securing the loan against the borrower's business assets, such as equipment, inventory, or accounts receivable. This type of promissory note is often used by small business owners to acquire financing for their operations. In conclusion, an Overland Park Kansas Installments Fixed Rate Promissory Note Secured by Personal Property is a legal document that establishes the terms and conditions of a loan agreement between a borrower and lender in Overland Park, Kansas. With various types available, borrowers can select the appropriate promissory note based on their personal property collateral and specific financial needs.

Free preview

How to fill out Overland Park Pagaré De Tasa Fija En Cuotas De Kansas Garantizado Por Bienes Personales?

If you’ve already utilized our service before, log in to your account and save the Overland Park Kansas Installments Fixed Rate Promissory Note Secured by Personal Property on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Make sure you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Overland Park Kansas Installments Fixed Rate Promissory Note Secured by Personal Property. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!