A detailed description of the Louisville Kentucky Notice of Assessment Lien on Real Estate: In Louisville, Kentucky, the Notice of Assessment Lien on Real Estate is a key documentation used to enforce the collection of property taxes. When property owners fail to pay their property taxes, the local government has the right to place a lien on the real estate as a means of ensuring payment. The Notice of Assessment Lien on Real Estate serves as an official notice to the property owner that they are in arrears on their property taxes. The lien is filed with the County Clerk's office and attaches to the property in question, creating a legal claim against it. The purpose of this notice is to inform the property owner of the outstanding tax debt and to provide an opportunity for resolution. Once the lien is recorded, it becomes a matter of public record and may impact the property owner's creditworthiness and ability to sell or refinance the property. This type of lien can come in several forms, depending on the specific circumstances: 1. Liens for delinquent property taxes: This kind of lien arises when a property owner fails to make timely payments for their property taxes. The local government will issue a Notice of Assessment Lien on the real estate, outlining the amount owed and the actions required to resolve the debt. 2. liens for special assessments: In certain cases, the local government may impose special assessments on properties for specific improvements or infrastructure projects. If property owners fail to pay these assessments, the government can file a Notice of Assessment Lien on the real estate as a means of recovering the outstanding fees. 3. liens for unpaid fines or penalties: In some instances, property owners may incur fines or penalties due to violations of local ordinances or building codes. If these fines remain unpaid, the local government can initiate a Notice of Assessment Lien on the real estate. 4. liens for unpaid utilities: In rare cases, failure to pay utility bills, such as water or sewer charges, can result in the government filing a Notice of Assessment Lien on the real estate. This lien acts as a mechanism to recover the outstanding utility charges. It is important for property owners to address any Notice of Assessment Liens promptly. Failure to do so can lead to increased penalties, potential foreclosure, and negative credit repercussions. By resolving the outstanding tax debt, property owners can lift the lien and regain full ownership of their real estate. If you are a property owner in Louisville, Kentucky, and have received a Notice of Assessment Lien on your real estate, it is advisable to consult with a professional tax attorney or seek guidance from the local government's tax department. They can assist you in understanding the specific details of the lien and help you navigate the necessary steps to resolve the matter and prevent further complications.

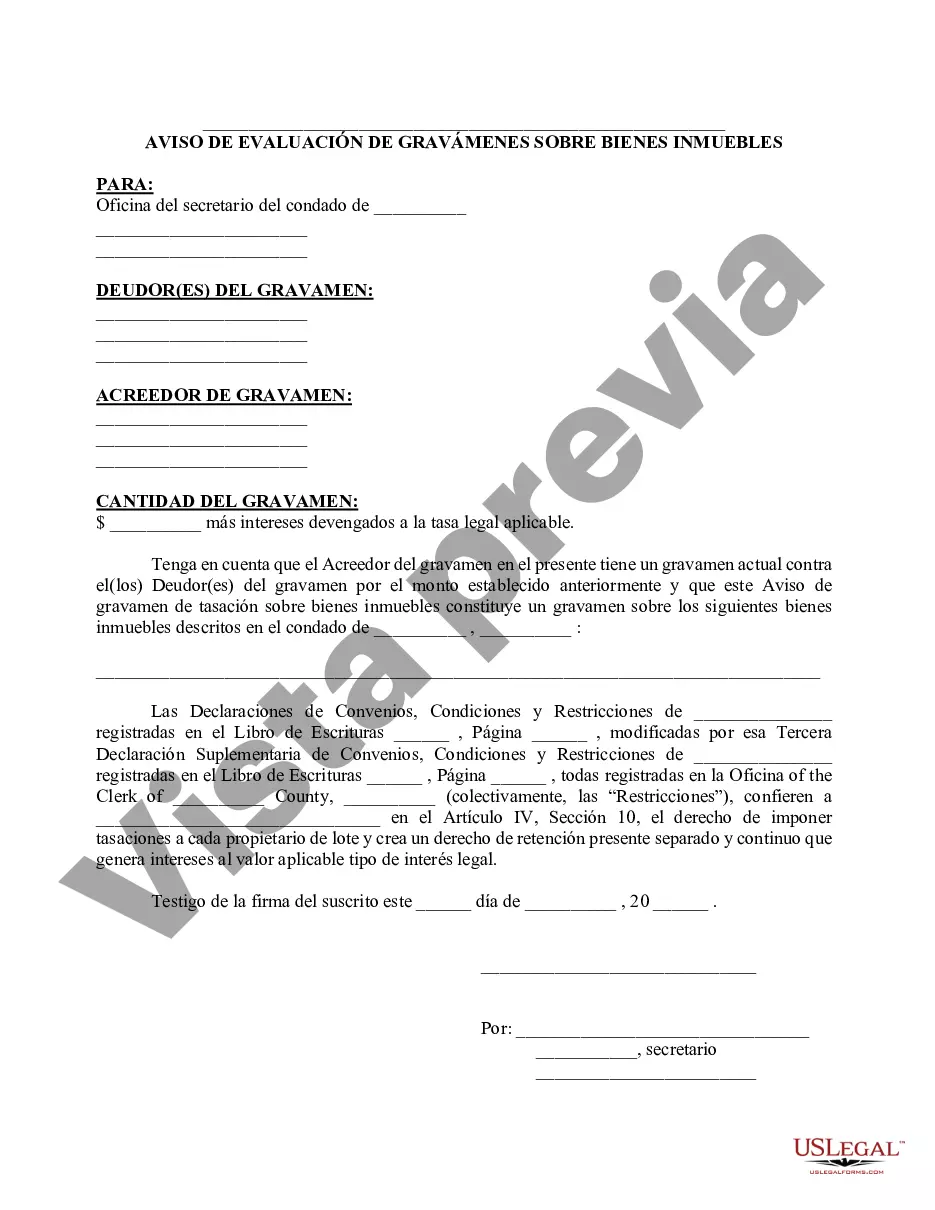

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Louisville Kentucky Aviso de gravamen de tasación sobre bienes inmuebles - Kentucky Notice of Assessment Lien on Real Estate

Description

How to fill out Louisville Kentucky Aviso De Gravamen De Tasación Sobre Bienes Inmuebles?

We always want to reduce or prevent legal issues when dealing with nuanced legal or financial matters. To accomplish this, we apply for attorney services that, as a rule, are extremely costly. However, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without turning to legal counsel. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Louisville Kentucky Notice of Assessment Lien on Real Estate or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again from within the My Forms tab.

The process is just as easy if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Louisville Kentucky Notice of Assessment Lien on Real Estate adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Louisville Kentucky Notice of Assessment Lien on Real Estate would work for you, you can choose the subscription plan and proceed to payment.

- Then you can download the form in any suitable file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!