A living trust is a legal document that allows individuals to protect and manage their assets during their lifetime and ensure a smooth transfer of assets upon their death. In Louisville, Kentucky, there are various types of living trusts designed specifically for a husband and wife with minor and/or adult children. 1. Revocable Living Trust: A revocable living trust is the most common type of living trust chosen by couples in Louisville, Kentucky. It allows the creators (husband and wife) to maintain control and ownership of their assets while alive, with the flexibility to make changes or revoke the trust at any time. With a revocable living trust, couples can avoid probate, a time-consuming and costly legal process, and provide for the smooth transfer of assets to their minor and/or adult children. 2. Irrevocable Living Trust: An irrevocable living trust is another option available to couples in Louisville, Kentucky. Unlike a revocable living trust, an irrevocable trust cannot be modified or revoked once established. This type of trust offers additional asset protection benefits as it removes the assets from the creator's estate, potentially reducing estate taxes, while providing for the beneficiaries, including minor and/or adult children. 3. Testamentary Trust: A testamentary trust can be established within a will and comes into effect upon the death of the creator, also known as a testator. This type of trust allows the husband and wife to appoint a trustee to manage their assets for the benefit of their minor and/or adult children. Testamentary trusts can be a suitable option for couples who prefer to maintain full control over their assets during their lifetime. 4. Special Needs Trust: A special needs trust is specifically designed to provide for the financial well-being of a disabled child or adult child. This trust allows parents to ensure that their child with special needs continues to receive the necessary care and support while preserving their eligibility for government assistance programs. In summary, Louisville, Kentucky offers various types of living trusts for husbands and wives who wish to protect their assets and provide for their minor and/or adult children. Depending on their specific goals and circumstances, couples can choose between a revocable or irrevocable living trust, a testamentary trust, or a special needs trust. Consulting with an experienced estate planning attorney is highly recommended customizing a living trust that meets the unique needs of each family.

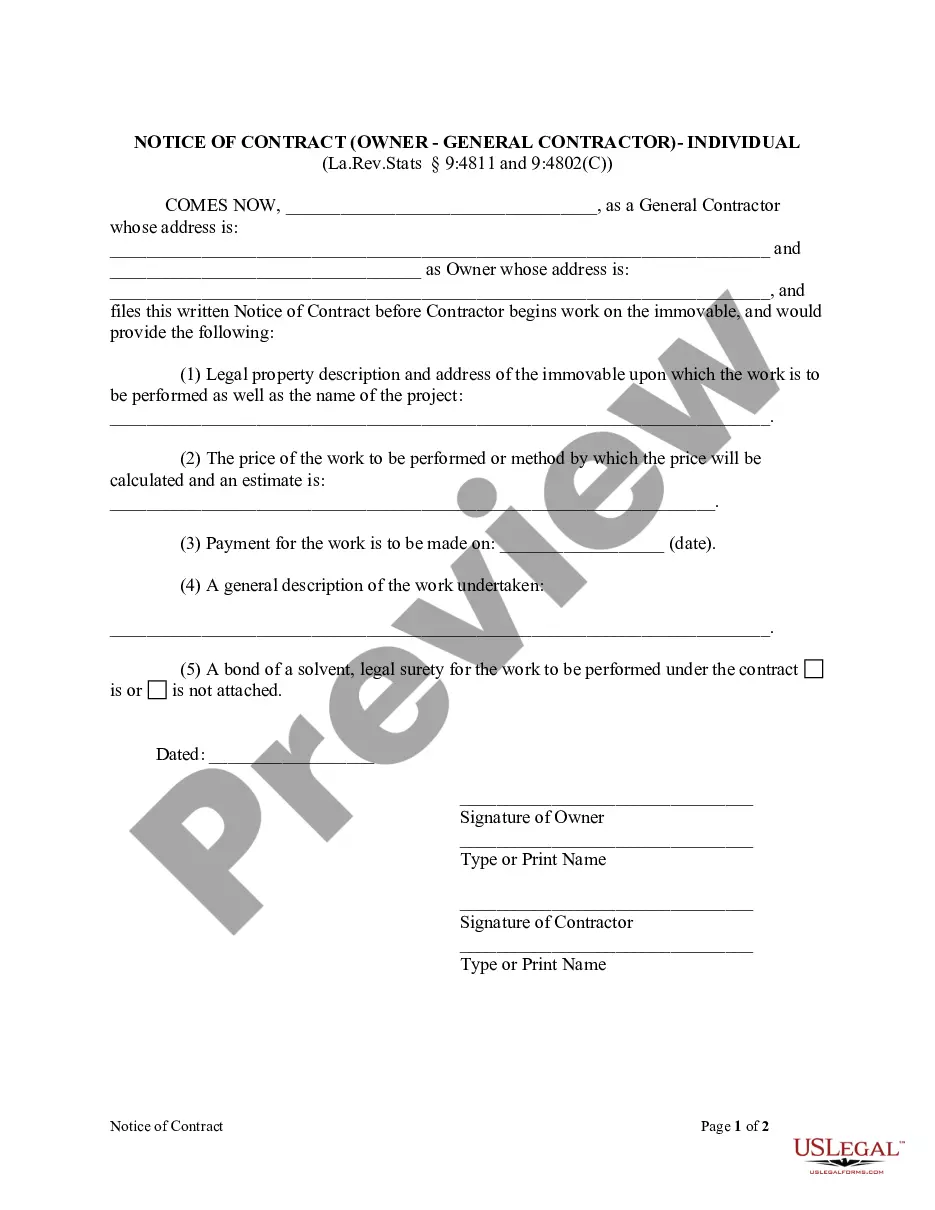

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Louisville Kentucky Fideicomiso en vida para esposo y esposa con hijos menores o adultos - Kentucky Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Louisville Kentucky Fideicomiso En Vida Para Esposo Y Esposa Con Hijos Menores O Adultos?

Acquiring authenticated templates tailored to your local regulations can be challenging unless you utilize the US Legal Forms database.

This is an online repository of over 85,000 legal documents catering to both personal and professional needs as well as various real-life situations.

All the files are aptly categorized by purpose and jurisdiction, making it straightforward to find the Louisville Kentucky Living Trust for Husband and Wife with Minor or Adult Children.

Maintaining organized paperwork that complies with legal standards is crucial. Utilize the US Legal Forms library to have vital document templates readily available for any requirements!

- Examine the Preview mode and form description.

- Ensure you've selected the correct one that fulfills your requirements and fully aligns with your local jurisdiction standards.

- Look for another template, if necessary.

- If you notice any discrepancies, use the Search tab above to locate the appropriate one.

- Proceed to purchase the document.

Form popularity

FAQ

Common Types of Trusts Inter vivos trusts or living trusts: created and active during the lifetime of the grantor. Testamentary trusts: trusts formed after the death of the grantor. Revocable trusts: can be changed or revoked entirely by the grantor.

The testator's marriage does not revoke a prior made will. KRS 394.090. When the testator dies before providing for his new spouse, the law assumes that he would prefer to die with a will that does not completely reflect his wishes than with no will at all.

To make a living trust in Maryland, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

Marriage invalidates a Will, unless it was written in contemplation of the union. This means that if you're getting married ? or you've recently said ?I do? ? you need to make a new Will. Otherwise, your estate will be distributed according to the rules of intestacy after your death.

Under Hindu law, a wife gets an equal share of the assets of the deceased husband divided between other Class I heirs, the children and mother. This applies only if the man dies intestate. If there are no children and other claimants, the wife is entitled to the total property.

Lawyers often use hourly fee schedules, and the price associated with creating a living trust is generally at least $1,000. Again, more complex estates may pay even more than that. In particular, make sure you're using an estate planning lawyer that has a specialty in trusts.

Spouses in Kentucky Inheritance Law They are essentially built to protect a surviving spouse in the event that his or her partner dies intestate. More specifically, a spouse is entitled to half of the decedent's real property and personal property in this situation, according to Kentucky inheritance laws.

Marriage automatically revokes a will that has been made previously, leaving it invalid. This means that if you have a will written out and have since married or remarried, you will need to revisit this document to ensure that your estate will still be passed on as you wish.

How Much Does a Trust Cost? If you hire an attorney to build your trust, you'll likely pay in the range of $1,500 to $2,500, depending on whether you are single or married, how complex the trust needs to be and what state you are in.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.