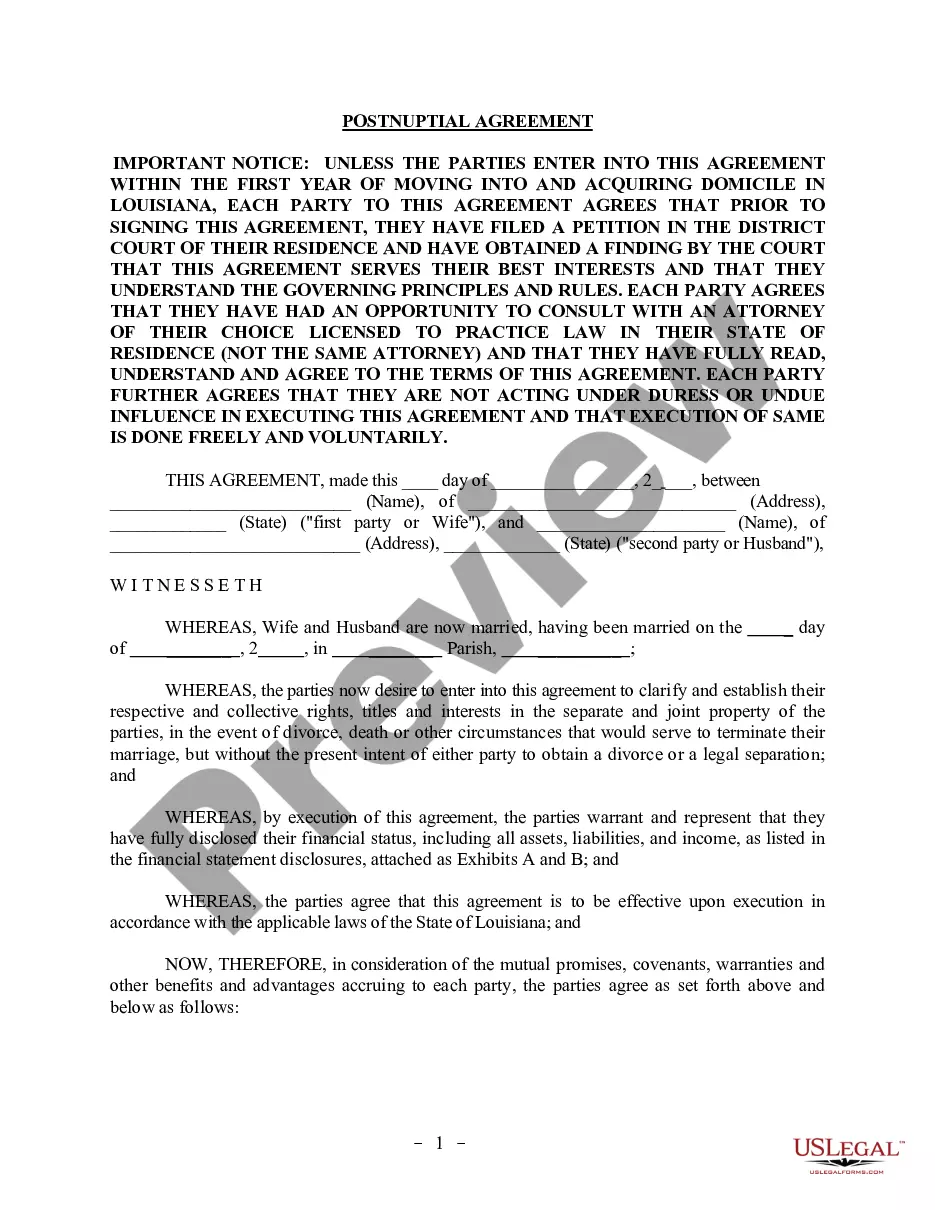

The New Orleans Amendment to Postnuptial Property Agreement in Louisiana is a legal arrangement made by married couples residing in New Orleans, Louisiana, to modify the terms of their existing postnuptial property agreement. This agreement allows couples to tailor the distribution of assets and liabilities in the event of separation, divorce, or death. In New Orleans, there can be various types of amendments to a postnuptial property agreement. Some commonly encountered types include: 1. Property Division Amendment: This type of amendment outlines how the couple's properties, both real estate and personal assets, will be divided between them if the marriage dissolves. It specifies which spouse will retain ownership or receive compensation for specific assets. 2. Debt Allocation Amendment: This kind of amendment defines how marital debts, including mortgages, loans, and credit card debts, will be allocated between the spouses in the event of separation or divorce. It specifies the responsibility of each spouse for the repayment of particular debts. 3. Business or Partnership Interest Amendment: In cases where one or both spouses own a business or have a partnership interest, this type of amendment determines the division or transfer of ownership in the event of divorce or death. It outlines the rights and obligations of each spouse regarding the business's assets, profits, and liabilities. 4. Retirement Account Amendment: Couples with retirement accounts, such as 401(k)s, IRAs, or pensions, may choose this type of amendment to establish how these funds will be distributed between them in the future. It can specify the amount, timing, and conditions for withdrawals or transfers. 5. Child Custody and Support Amendment: Although not strictly related to property division, couples may choose to include provisions regarding child custody and support in their New Orleans Amendment to Postnuptial Property Agreement. This amendment defines the rights and responsibilities of each spouse concerning the care, visitation, and financial support of their children. By drafting a detailed and comprehensive New Orleans Amendment to Postnuptial Property Agreement, couples can have greater control over the division of their assets and debts, ensuring a fair and mutually agreeable outcome in the event of a relationship breakdown. To create such an amendment, it is recommended to seek legal counsel to ensure compliance with Louisiana's state laws and regulations.

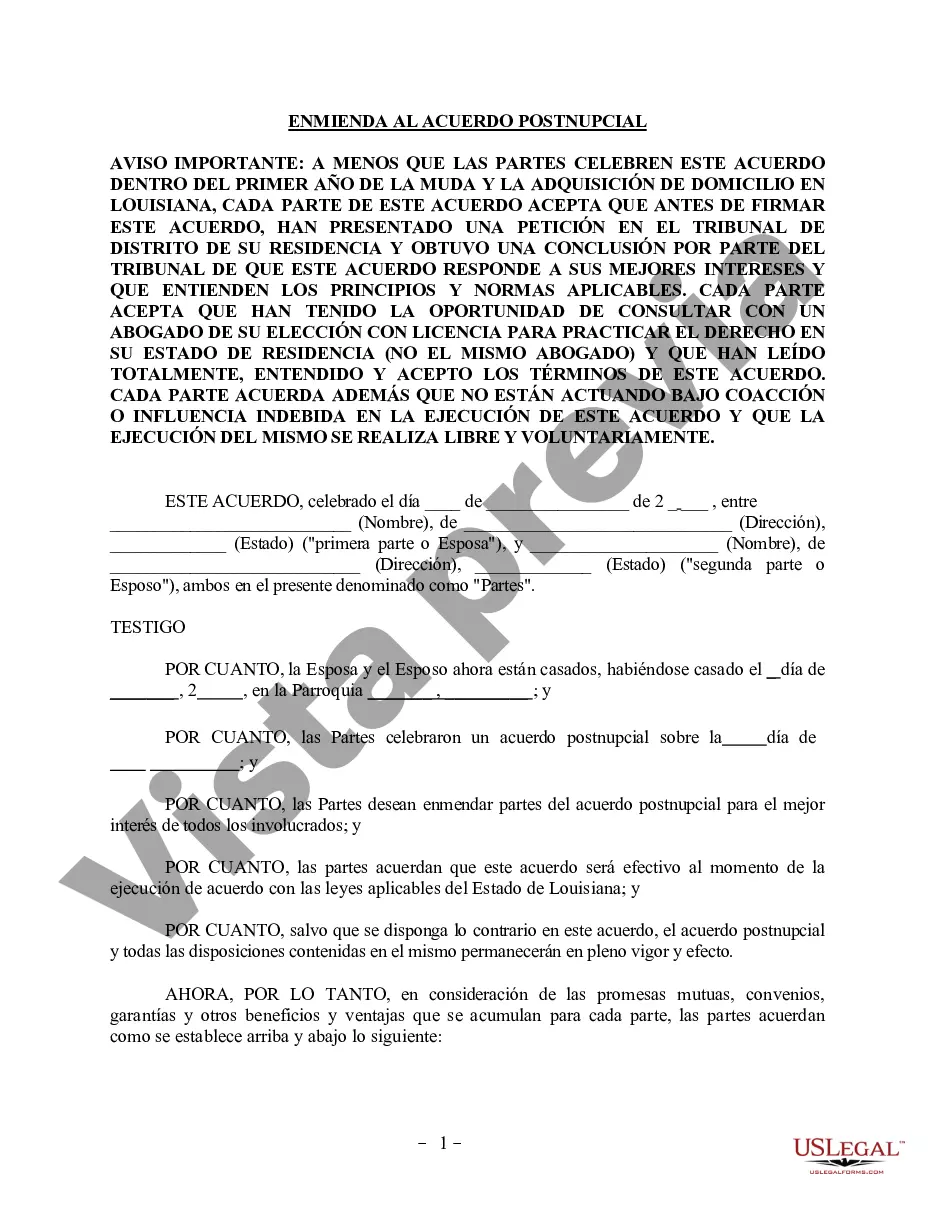

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Orleans Louisiana Enmienda al Acuerdo de propiedad posnupcial - Luisiana - Louisiana Amendment to Postnuptial Property Agreement

State:

Louisiana

City:

New Orleans

Control #:

LA-01715-AZ

Format:

Word

Instant download

Description

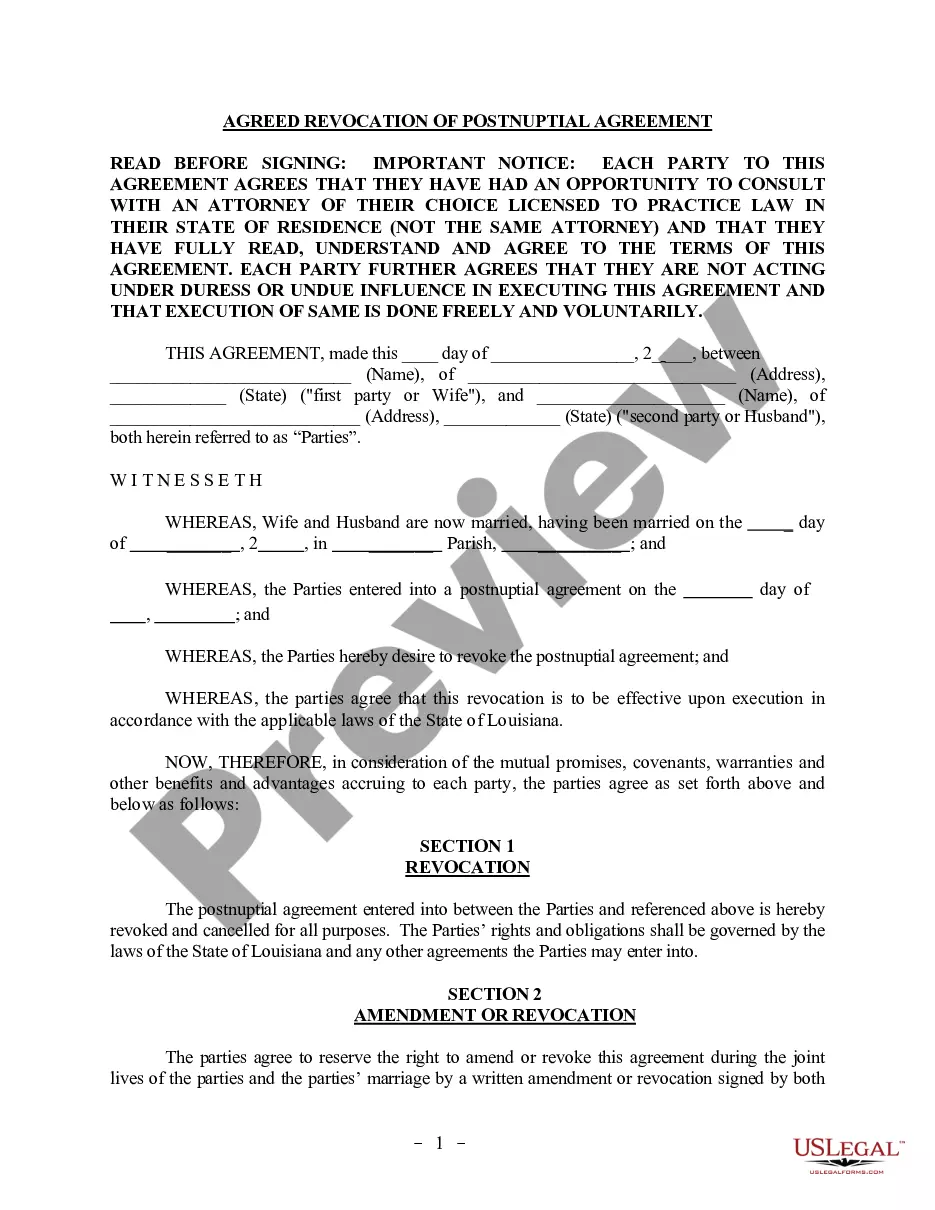

This Amendment to Postnuptial Property Agreement is for use by parties to make amendments or additions to an existing postnuptial agreement. Both parties are required to sign the amendment in the presence of a notary public. Parties may not use this amendment to renounce or alter either party's marital portion or to establish the order of inheritance.

The New Orleans Amendment to Postnuptial Property Agreement in Louisiana is a legal arrangement made by married couples residing in New Orleans, Louisiana, to modify the terms of their existing postnuptial property agreement. This agreement allows couples to tailor the distribution of assets and liabilities in the event of separation, divorce, or death. In New Orleans, there can be various types of amendments to a postnuptial property agreement. Some commonly encountered types include: 1. Property Division Amendment: This type of amendment outlines how the couple's properties, both real estate and personal assets, will be divided between them if the marriage dissolves. It specifies which spouse will retain ownership or receive compensation for specific assets. 2. Debt Allocation Amendment: This kind of amendment defines how marital debts, including mortgages, loans, and credit card debts, will be allocated between the spouses in the event of separation or divorce. It specifies the responsibility of each spouse for the repayment of particular debts. 3. Business or Partnership Interest Amendment: In cases where one or both spouses own a business or have a partnership interest, this type of amendment determines the division or transfer of ownership in the event of divorce or death. It outlines the rights and obligations of each spouse regarding the business's assets, profits, and liabilities. 4. Retirement Account Amendment: Couples with retirement accounts, such as 401(k)s, IRAs, or pensions, may choose this type of amendment to establish how these funds will be distributed between them in the future. It can specify the amount, timing, and conditions for withdrawals or transfers. 5. Child Custody and Support Amendment: Although not strictly related to property division, couples may choose to include provisions regarding child custody and support in their New Orleans Amendment to Postnuptial Property Agreement. This amendment defines the rights and responsibilities of each spouse concerning the care, visitation, and financial support of their children. By drafting a detailed and comprehensive New Orleans Amendment to Postnuptial Property Agreement, couples can have greater control over the division of their assets and debts, ensuring a fair and mutually agreeable outcome in the event of a relationship breakdown. To create such an amendment, it is recommended to seek legal counsel to ensure compliance with Louisiana's state laws and regulations.

Free preview

How to fill out New Orleans Louisiana Enmienda Al Acuerdo De Propiedad Posnupcial - Luisiana?

If you’ve already used our service before, log in to your account and download the New Orleans Amendment to Postnuptial Property Agreement - Louisiana on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Make sure you’ve found the right document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your New Orleans Amendment to Postnuptial Property Agreement - Louisiana. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!