Title: Understanding the Baton Rouge Louisiana Notice of Dishonored Check — Civil Introduction: The Baton Rouge Louisiana Notice of Dishonored Check — Civil serves as a legal notification issued to an individual or entity when a check they have issued has bounced or been declared invalid due to insufficient funds or other reasons. In this article, we will delve into the details of this notice, exploring the different types and implications of bad checks and bounced checks. 1. Definition and Types of Bad Checks: A bad check refers to a written instrument that is issued, knowing there are not sufficient funds or credit available to cover its value. Within Baton Rouge, there are different types of bad checks recognized under the law, including: a) NSF Check: NSF stands for "insufficient funds," and these checks are typically returned unpaid when there are insufficient funds in the issuer's bank account to cover the check's amount. b) Stop Payment Check: A stop payment check is one where the account holder instructs their bank to stop honoring a previously issued check. This may be due to various reasons, such as a lost check or a dispute with the payee. c) Account Closed Check: An account closed check is when the bank account tied to the issuer's check has been closed before the recipient can deposit or cash the check. d) Altered Check: An altered check refers to a situation where someone modifies the original details of a check, such as the payee name, check amount, or date, either with fraudulent intentions or by accident. 2. The Baton Rouge Louisiana Notice of Dishonored Check — Civil: When a check is dishonored or returned unpaid, the recipient can take legal action by filing a civil suit against the issuer. The Baton Rouge Louisiana Notice of Dishonored Check — Civil is a formal document issued to the check issuer, providing them with essential information about the dishonored check, legal consequences, and potential penalties. 3. Consequences and Penalties: The consequences of issuing a bad check or a bounced check in Baton Rouge can be severe. The Louisiana law imposes both civil and criminal penalties on individuals who engage in such practices. Here are a few outcomes an individual might face: a) Civil Penalties: The civil penalties for a bounced check can include the face value of the check, any bank fees incurred, and additional charges as allowed by law. If the recipient takes legal action and wins the case, the issuer may also be responsible for the recipient's attorney fees. b) Criminal Penalties: In addition to civil penalties, the issuance of bad checks can result in criminal charges. Depending on the circumstances and the value of the check, it may be classified as a misdemeanor or a felony offense. Criminal penalties can include fines, probation, or even imprisonment. Conclusion: Understanding the Baton Rouge Louisiana Notice of Dishonored Check — Civil is crucial for both the recipients of bounced checks and those issuing checks. It highlights the different types of bad checks, outlines the legal consequences, and emphasizes the potential civil and criminal penalties involved. By raising awareness about the importance of honoring financial obligations, we can contribute to a more transparent and responsible financial environment in Baton Rouge, Louisiana.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Baton Rouge Louisiana Aviso de cheque sin fondos - Civil - Palabras clave: cheque sin fondos, cheque sin fondos - Louisiana Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

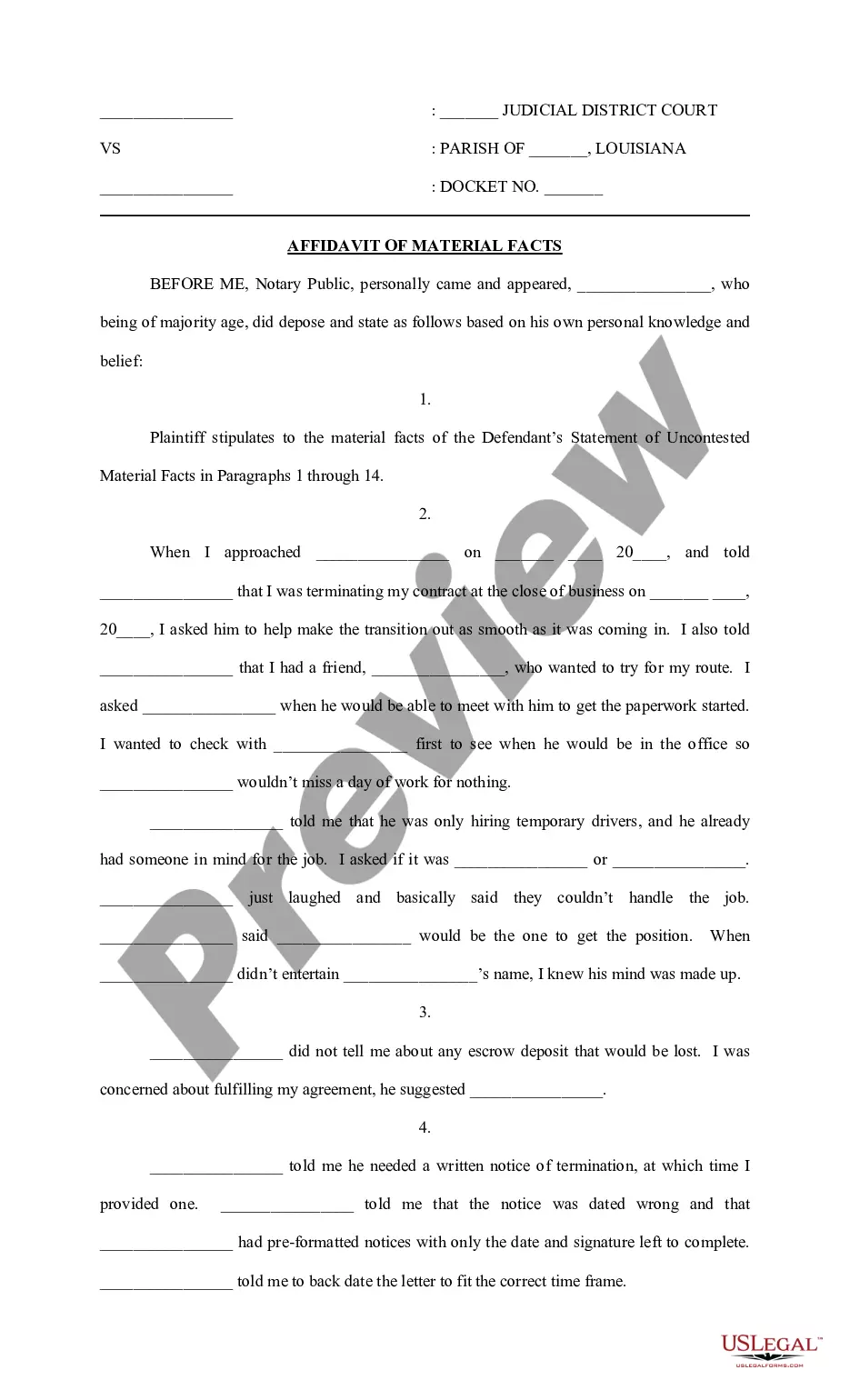

Description

How to fill out Baton Rouge Louisiana Aviso De Cheque Sin Fondos - Civil - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

Are you looking for a trustworthy and inexpensive legal forms supplier to buy the Baton Rouge Louisiana Notice of Dishonored Check - Civil - Keywords: bad check, bounced check? US Legal Forms is your go-to solution.

No matter if you need a basic arrangement to set regulations for cohabitating with your partner or a set of documents to advance your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and frameworked based on the requirements of separate state and area.

To download the document, you need to log in account, locate the needed template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Baton Rouge Louisiana Notice of Dishonored Check - Civil - Keywords: bad check, bounced check conforms to the laws of your state and local area.

- Go through the form’s details (if provided) to find out who and what the document is good for.

- Restart the search if the template isn’t good for your legal situation.

Now you can register your account. Then pick the subscription plan and proceed to payment. Once the payment is completed, download the Baton Rouge Louisiana Notice of Dishonored Check - Civil - Keywords: bad check, bounced check in any provided file format. You can return to the website at any time and redownload the document without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending your valuable time researching legal papers online once and for all.