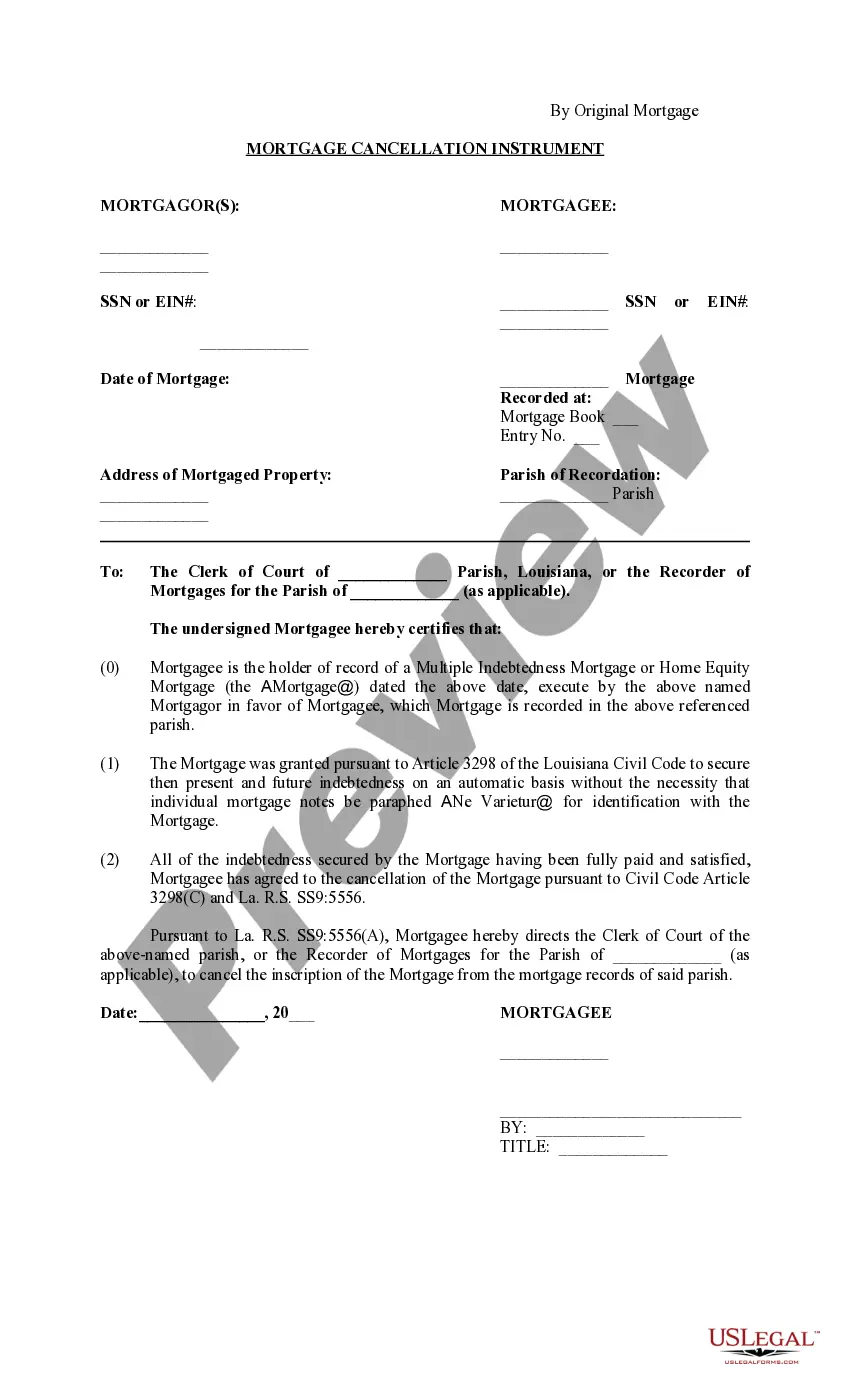

Shreveport Louisiana Mortgage Cancellation Instrument, also known as a mortgage release or satisfaction of mortgage, is a legal document that declares a mortgage obligation fulfilled and terminates the lien on property in Shreveport, Louisiana. This instrument signifies the successful completion of mortgage payments and grants the homeowner full ownership of the property, free from any encumbrances. The Shreveport Louisiana Mortgage Cancellation Instrument is an essential document for homeowners who have paid off their mortgage and wish to have the lien removed from their property's title records. By filing this instrument with the appropriate authorities, the mortgage lender acknowledges that the debt has been fully satisfied, releasing their claim to the property. In Shreveport, there are two primary types of Mortgage Cancellation Instruments that homeowners may encounter: 1. Full Satisfaction of Mortgage: This type of instrument is used when the entire mortgage balance has been paid in full, and all related obligations, including interest and fees, have been satisfied. It confirms that the homeowner has met all financial obligations and has no remaining obligations to the lender. 2. Partial Satisfaction of Mortgage: This instrument is used when the homeowner has made partial payments towards the mortgage balance, resulting in a reduced principal amount owed. It acknowledges the partial payment made and reduces the lien on the property accordingly. This type of instrument is commonly used when refinancing a mortgage or in cases where a portion of the mortgage debt has been forgiven or paid off. To obtain a Shreveport Louisiana Mortgage Cancellation Instrument, homeowners typically work closely with their mortgage lender or a legal professional experienced in real estate transactions. They will guide the homeowner through the necessary paperwork, including drafting and executing the document. It is important for homeowners in Shreveport to understand the significance of obtaining a Mortgage Cancellation Instrument as it serves as proof of the debt being fully satisfied, ensuring a clear title and offering peace of mind.

Shreveport Louisiana Mortgage Cancellation Instrument

Description

How to fill out Shreveport Louisiana Mortgage Cancellation Instrument?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Shreveport Louisiana Mortgage Cancellation Instrument gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Shreveport Louisiana Mortgage Cancellation Instrument takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a couple of additional steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make certain you’ve selected the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Shreveport Louisiana Mortgage Cancellation Instrument. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!