A demand letter is a formal document sent by one party to another, requesting the repayment of a promissory note. In the case of New Orleans, Louisiana, there are various types of demand letters related to the repayment of promissory notes. Each type corresponds to a specific situation or purpose. Here, we will explore the different types and provide a detailed description of what a New Orleans Louisiana Demand Letter — Repayment of Promissory Note entails. 1. New Orleans Louisiana Demand Letter — Defaulted Promissory Note: This type of demand letter is commonly used when the borrower of a promissory note has failed to make timely repayments as per the agreement. The lender, in this case, writes a detailed letter addressing the default and demanding immediate repayment of the outstanding balance. The letter may outline the consequences of non-payment and specify a deadline to settle the debt. 2. New Orleans Louisiana Demand Letter — Late Payment on Promissory Note: In situations where the borrower has made late payments on the promissory note, this type of demand letter can be used. The lender acknowledges the partial payment but emphasizes the importance of meeting the agreed-upon payment schedule. The letter may request the borrower to rectify the delay and commit to future payments being made on time. 3. New Orleans Louisiana Demand Letter — Acceleration of Promissory Note: If the borrower has violated the terms of the promissory note, such as by defaulting on other obligations, the lender may decide to demand the full amount due immediately. This demand letter stresses the acceleration of the debt, bypassing the agreed-upon payment schedule. It may also mention potential legal actions if the repayment demand is not met within a specified timeframe. 4. New Orleans Louisiana Demand Letter — Settlement of Promissory Note: In some cases, the lender and borrower may agree to negotiate a settlement of the promissory note. This type of demand letter sets forth the terms and conditions of the proposed settlement. It provides a detailed explanation of the reduced or altered payment structure and requests the borrower's agreement in writing. The letter may also outline the consequences of non-compliance with the settlement terms. Regardless of the specific type, a New Orleans Louisiana Demand Letter — Repayment of Promissory Note should always contain certain essential elements. These may include the names and addresses of both the lender and borrower, the date of the promissory note, a comprehensive account of the outstanding balance, interest accrued (if applicable), and a clear payment deadline. Additionally, the letter should maintain a professional tone while emphasizing the lender's intention to enforce their rights and seek legal remedies if the debt is not settled promptly. Note: It is crucial to consult with a legal professional or seek appropriate advice to ensure accuracy and adherence to applicable laws and regulations when drafting or responding to a demand letter.

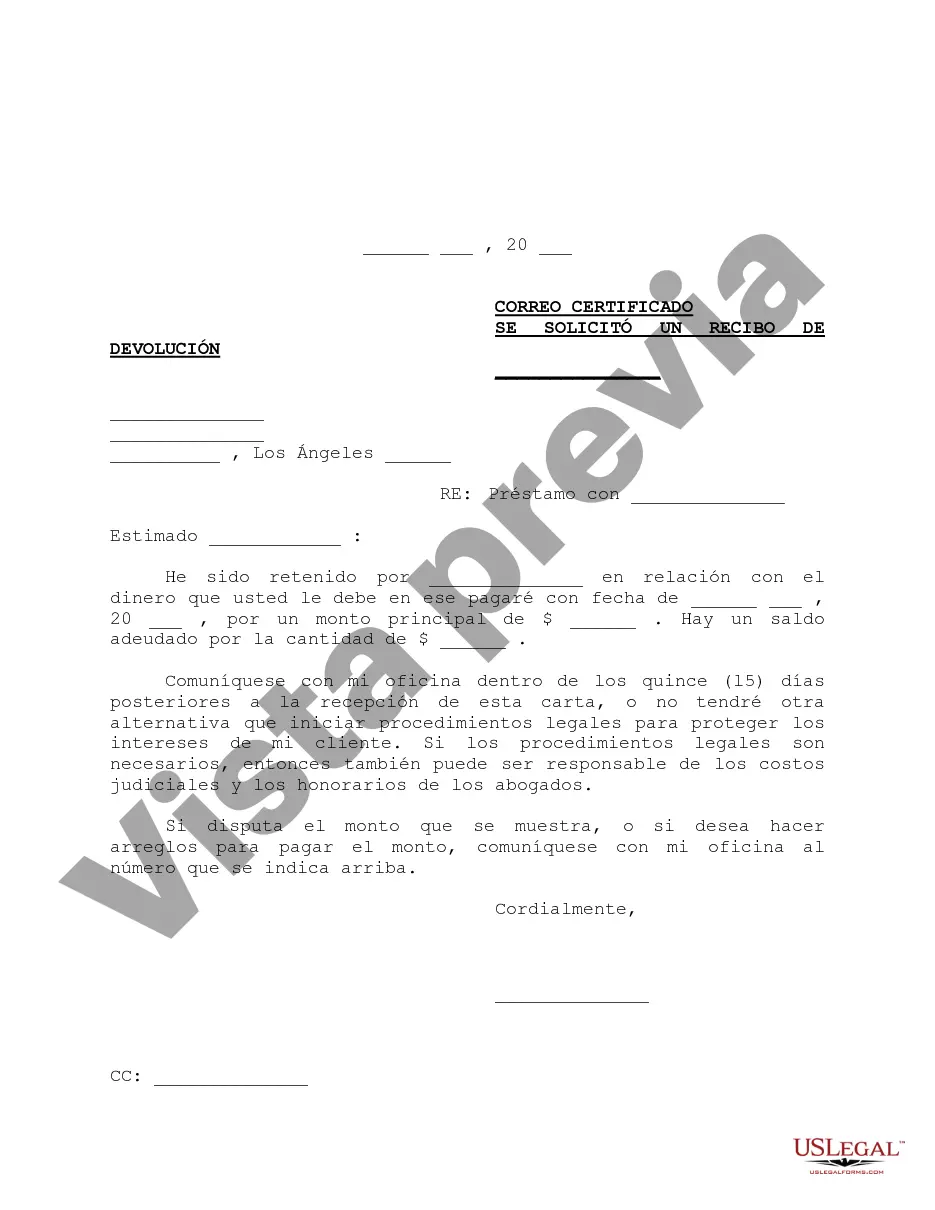

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Orleans Louisiana Carta de demanda - Reembolso del pagaré - Louisiana Demand Letter - Repayment of Promissory Note

Description

How to fill out New Orleans Louisiana Carta De Demanda - Reembolso Del Pagaré?

If you are looking for a relevant form, it’s impossible to choose a better place than the US Legal Forms website – probably the most comprehensive online libraries. Here you can find thousands of document samples for business and personal purposes by categories and regions, or keywords. Using our high-quality search feature, discovering the most recent New Orleans Louisiana Demand Letter - Repayment of Promissory Note is as easy as 1-2-3. Furthermore, the relevance of every record is proved by a group of skilled attorneys that regularly review the templates on our platform and revise them according to the newest state and county laws.

If you already know about our system and have an account, all you need to get the New Orleans Louisiana Demand Letter - Repayment of Promissory Note is to log in to your user profile and click the Download button.

If you make use of US Legal Forms the very first time, just refer to the instructions below:

- Make sure you have chosen the form you need. Look at its explanation and utilize the Preview option to explore its content. If it doesn’t suit your needs, use the Search field at the top of the screen to discover the needed document.

- Confirm your decision. Select the Buy now button. Following that, select the preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Use your credit card or PayPal account to finish the registration procedure.

- Receive the template. Pick the format and save it on your device.

- Make modifications. Fill out, edit, print, and sign the acquired New Orleans Louisiana Demand Letter - Repayment of Promissory Note.

Every single template you add to your user profile has no expiration date and is yours forever. It is possible to gain access to them using the My Forms menu, so if you need to have an extra duplicate for modifying or creating a hard copy, feel free to return and save it again anytime.

Take advantage of the US Legal Forms professional catalogue to gain access to the New Orleans Louisiana Demand Letter - Repayment of Promissory Note you were seeking and thousands of other professional and state-specific templates on a single website!