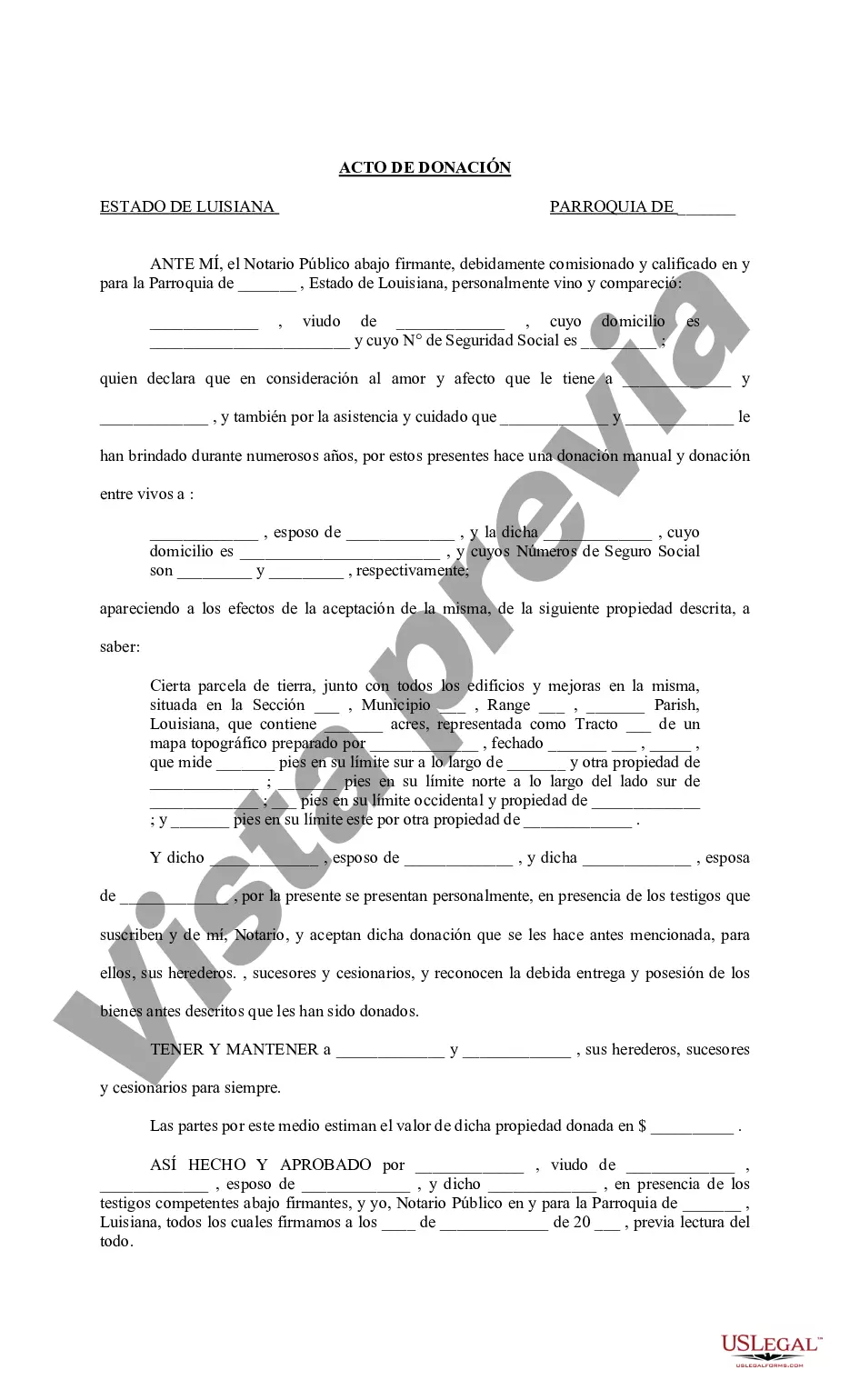

The Shreveport Louisiana Act of Donation Real Estate from Individual to Husband and Wife refers to a legal process through which ownership rights of a property are transferred from an individual to a married couple. This act allows an individual to make a generous donation of their property to their spouse and solidify joint ownership. Such acts are common in estate planning and aim to ensure seamless transfer of assets while providing various benefits. One of the types of Shreveport Louisiana Act of Donation Real Estate from Individual to Husband and Wife is the General Act of Donation. This type typically involves the transfer of general and unrestricted ownership rights from an individual donor to their spouse. It ensures that both parties have equal ownership and control over the donated property. Another type is the Conditional Act of Donation. This type involves the transfer of ownership rights with certain conditions attached. For example, the donor may specify that the spouse must maintain the property as their primary residence or use it for a specific purpose. Failure to meet these conditions may result in the property reverting to the original donor or their designated beneficiary. The Shreveport Louisiana Act of Donation Real Estate from Individual to Husband and Wife offers several advantages for both parties involved. Firstly, it simplifies the process of transferring property within a marriage, ensuring that the spouse automatically becomes the co-owner upon completion of the act. This avoids the need for complicated probate procedures in case of a donor's death. Additionally, this act may provide tax benefits for the donor, such as reducing their overall estate tax liability. By gifting the property while still alive, the donor can take advantage of applicable tax exemptions and effectively minimize the taxes imposed on their estate. From the perspective of the recipient spouse, the Act of Donation grants them immediate ownership rights over the property, which can be particularly advantageous if the donor becomes incapacitated. It also protects the recipient's interest if the marriage ends in divorce, ensuring that they have a legal claim to the property. Overall, the Shreveport Louisiana Act of Donation Real Estate from Individual to Husband and Wife is an essential legal tool for couples aiming to simplify property transfer, protect their assets, and mitigate tax implications. It is advisable to consult an experienced real estate attorney to understand the intricacies of this act and ensure compliance with all legal requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Shreveport Louisiana Acta de Donación de Bienes Inmuebles de Individuo a Esposo y Esposa - Louisiana Act of Donation Real Estate from Individual to Husband and Wife

Description

How to fill out Shreveport Louisiana Acta De Donación De Bienes Inmuebles De Individuo A Esposo Y Esposa?

Are you looking for a trustworthy and inexpensive legal forms provider to get the Shreveport Louisiana Act of Donation Real Estate from Individual to Husband and Wife? US Legal Forms is your go-to solution.

No matter if you need a simple arrangement to set regulations for cohabitating with your partner or a package of documents to advance your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and framed in accordance with the requirements of separate state and county.

To download the form, you need to log in account, locate the needed template, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Shreveport Louisiana Act of Donation Real Estate from Individual to Husband and Wife conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to learn who and what the form is good for.

- Restart the search if the template isn’t good for your specific situation.

Now you can create your account. Then select the subscription plan and proceed to payment. As soon as the payment is done, download the Shreveport Louisiana Act of Donation Real Estate from Individual to Husband and Wife in any provided format. You can return to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about wasting hours researching legal papers online once and for all.