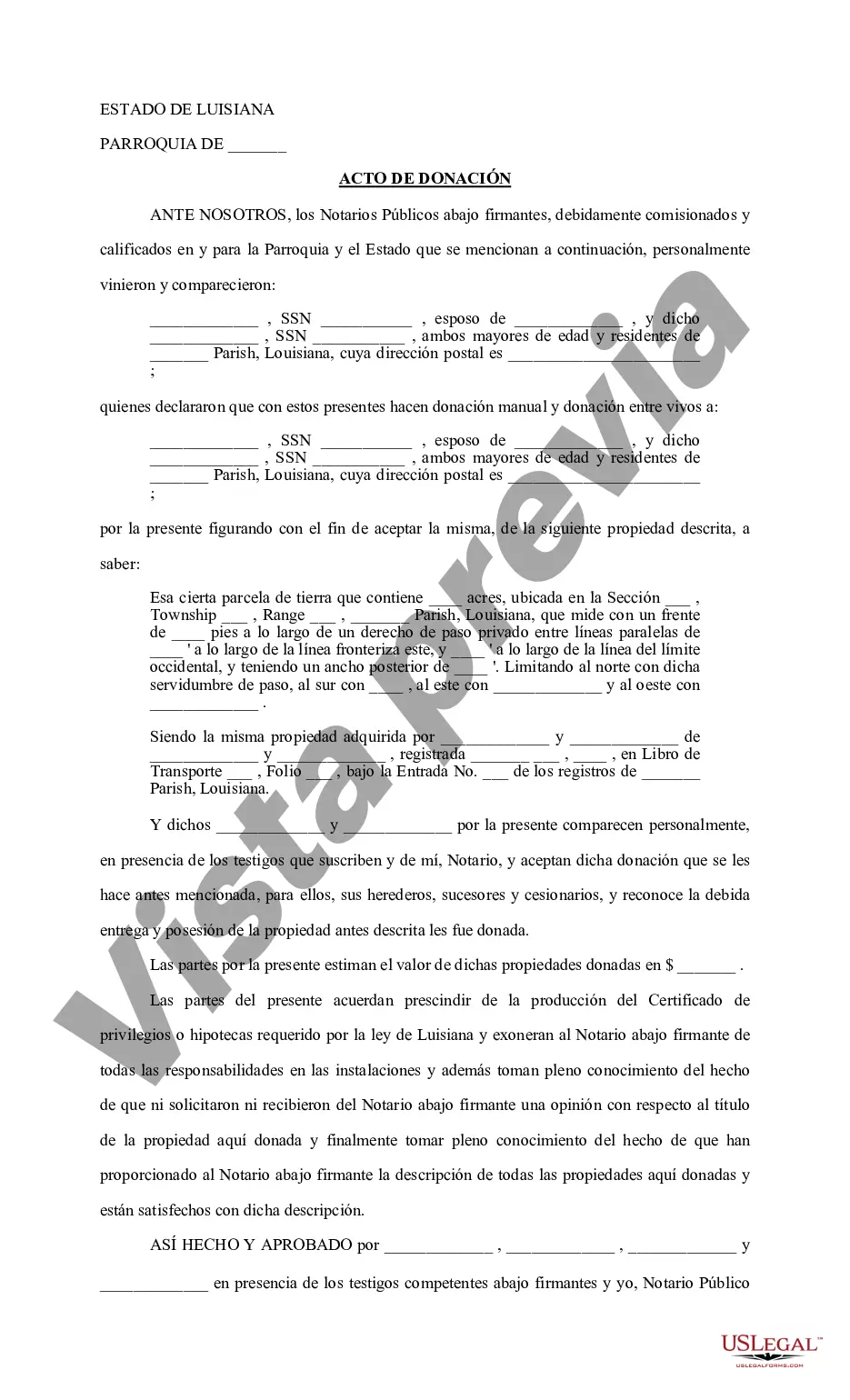

The Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Husband and Wife refers to a legally binding document that outlines the voluntary transfer of real estate property from one married couple to another in Shreveport, Louisiana. This act of donation is a common method for individuals to transfer ownership of property while ensuring a smooth and legal transition. Key elements of the Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Husband and Wife include the identification of the parties involved — both the husband and wife making the donation and the husband and wife receiving the property. It also includes a detailed description of the property being transferred, including its legal description, address, and any specific features or improvements it may possess. Furthermore, this document specifies the terms and conditions of the donation, such as any specific rights, limitations, or conditions attached to the transferred property. It may outline the intentions behind the donation, whether as a gift, family inheritance, or equitable division of assets. Additionally, this act may include provisions regarding any outstanding mortgages, liens, or encumbrances on the property and clarify how they will be handled during the transfer. While the Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Husband and Wife is a general term, there can be various specific types depending on the circumstances and goals of the parties involved. Some common types may include: 1. Simple Act of Donation: This type refers to a straightforward transfer of property ownership between spouses without any additional conditions or limitations attached. 2. Act of Donation with Reservation of Usufruct: In this case, the couple making the donation retains the right to use and enjoy the property for their lifetime, while transferring the underlying ownership to the receiving couple. 3. Conditional Act of Donation: This type involves certain conditions or criteria that must be met for the donation to take effect. For example, the transfer may be contingent upon the receiving couple using the property for a specific purpose or maintaining it in a certain condition. 4. Act of Donation with Community Property Waiver: If the property being donated is considered community property, this type of act includes a waiver of any rights or claims the receiving couple may have over the property as community property. 5. Act of Donation with Resolutely Condition: In this scenario, the transferred property reverts to the original donating couple if a specific condition outlined in the act is not fulfilled. For example, if the receiving couple fails to occupy the property within a certain timeframe, ownership may revert to the original donors. Overall, the Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Husband and Wife is a legal instrument that enables the voluntary transfer of property between married couples. It provides a comprehensive framework for ensuring a successful transfer while addressing any relevant considerations and conditions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Shreveport Louisiana Acta de Donación de Bienes Raíces de Esposo y Esposa a Esposo y Esposa - Louisiana Act of Donation Real Estate from Husband and Wife to Husband and Wife

Description

How to fill out Shreveport Louisiana Acta De Donación De Bienes Raíces De Esposo Y Esposa A Esposo Y Esposa?

Obtaining authenticated templates tailored to your local legislation can be challenging unless you utilize the US Legal Forms library.

This online repository comprises over 85,000 legal documents catering to both personal and professional requirements as well as various real-life scenarios.

All documents are systematically categorized by usage area and jurisdiction, enabling you to find the Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Husband and Wife swiftly and effortlessly.

Maintaining your paperwork organized and compliant with legal standards is crucial. Utilize the US Legal Forms library to always have vital document templates readily available for any requirements!

- For those already conversant with our catalog and have utilized it previously, acquiring the Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Husband and Wife requires only a few clicks.

- Simply Log In to your account, select the document, and hit Download to save it to your device.

- New users will have a few additional steps in the process.

- Review the Preview mode and document description. Ensure you’ve selected the correct version that aligns with your needs and fully adheres to your local jurisdiction standards.

- Look for an alternative template, if necessary. If you notice any discrepancies, make use of the Search tab above to identify the appropriate one. If it meets your criteria, proceed to the next step.

Form popularity

FAQ

The act of donation in Louisiana is a legal process where one party gifts property to another. Specifically, the Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Husband and Wife allows spouses to transfer their property to one another seamlessly. This act ensures clear documentation and protects the interests of both parties. For assistance in understanding this process, USLegalForms can provide useful resources and templates.

Yes, you can gift a house in Louisiana. This process often involves the Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Husband and Wife. By using this legal act, you can transfer ownership without the need for monetary exchange. For a smooth transaction, consider using USLegalForms for comprehensive guidance on executing the act properly.

Yes, an act of donation must be notarized in Louisiana to be valid. Specifically, for a Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Husband and Wife, it is vital that a notary public witnesses the signing of the document. This adds an extra layer of authenticity, ensuring that the transfer of property is recognized by authorities and safeguarding against disputes in the future.

In Louisiana, an act of donation involves creating a written document that adheres to state laws regarding property transfer. For a Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Husband and Wife, both parties must agree on the transfer and sign the document. Once executed, this act officially grants the donating spouse's rights to the receiving spouse, making the transaction legally binding and secure.

An act of donation in Louisiana property refers to a legal document that transfers ownership of real estate from one party to another without any payment or consideration. In the context of Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Husband and Wife, this means that a husband and wife can gift property to each other, reinforcing their legal rights. This act serves to clarify ownership and can eliminate confusion about property titles.

Yes, you can donate a house to a family member in Louisiana. The process involves creating a formal act of donation, which must be signed by both the donor and recipient in the presence of a notary. Post-signing, file the act with the local parish clerk of court to ensure the transfer is legally recognized. For those needing assistance, uslegalforms provides comprehensive resources for the Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Husband and Wife.

Donating property to a family member in Louisiana is straightforward. Begin by drafting an act of donation that includes property details and the beneficiary’s information. Ensure both parties sign the document in front of a notary and then file it with the clerk of court in your parish. The platform uslegalforms can guide you through this, offering resources for the Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Husband and Wife.

Yes, you can perform an act of donation on a house in Louisiana. The process requires a written agreement between the parties involved, clearly stating the transfer of ownership. Once the act is signed in front of a notary, it must be filed with the local parish clerk of court. For ease, consider using uslegalforms to assist with the Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Husband and Wife, providing the necessary documentation and support.

To perform an act of donation of property in Louisiana, start by preparing a formal written agreement detailing the property and conditions of the donation. Both the donor and recipient must sign the document in front of a notary. After notarization, submit the act to the local clerk of court for official recording. Utilizing uslegalforms can simplify this process by offering ready-made templates that cater to the Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Husband and Wife.

Filing an act of donation in Louisiana involves several steps. First, both parties must complete a written document outlining the terms of the donation. Next, you will need to sign the document in front of a notary, ensuring it's legally binding. Once signed, file the act with the parish clerk of court to finalize the donation. For those navigating the process, our platform provides templates and guidance for the Shreveport Louisiana Act of Donation Real Estate from Husband and Wife to Husband and Wife.