A Shreveport Louisiana Installment Promissory Note with Interest Accruing is a legally binding document that outlines the terms and conditions under which a borrower agrees to repay a loan or debt in regular installments, while also accruing interest. This type of promissory note is commonly used in Shreveport, Louisiana, to establish a clear repayment plan and protect the interests of both the lender and the borrower. The Shreveport Louisiana Installment Promissory Note with Interest Accruing includes important details such as the names of the borrower and lender, the principal loan amount, the interest rate, and the repayment schedule. It serves as a written agreement that ensures the borrower understands and acknowledges their obligation to make timely payments and cover the interest that accrues over time. There can be variations of Shreveport Louisiana Installment Promissory Notes with Interest Accruing, depending on the specific terms agreed upon by the parties involved. Some common types of installment promissory notes may include: 1. Fixed-Rate Installment Promissory Note: This type of note specifies a fixed interest rate that remains constant throughout the repayment period. Both the lender and borrower agree on this set rate, which usually does not change regardless of any market fluctuations. 2. Adjustable-Rate Installment Promissory Note: In this case, the interest rate on the loan fluctuates periodically, usually based on an index or benchmark rate. The interest rate can increase or decrease over time, affecting the borrower's monthly repayment amount. 3. Balloon Payment Installment Promissory Note: This note involves regular installments for a specific period, followed by a large lump sum (balloon payment) to be paid at the end of the term. The balloon payment typically covers the remaining principal balance and any outstanding interest. 4. Secured Installment Promissory Note: This type of note includes collateral pledged by the borrower to secure the loan. It ensures that if the borrower defaults on payments, the lender has the right to seize the collateral to recover their investment. Creating a Shreveport Louisiana Installment Promissory Note with Interest Accruing is crucial to protect both parties involved in a loan transaction. It provides clarity on repayment terms, interest calculation, and enforcement of the agreement. It is essential to consult with a legal professional or use pre-existing templates designed for Shreveport, Louisiana, to ensure compliance with local laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Shreveport Louisiana Pagaré a plazos con devengo de intereses - Louisiana Installment Promissory Note with Interest Accruing

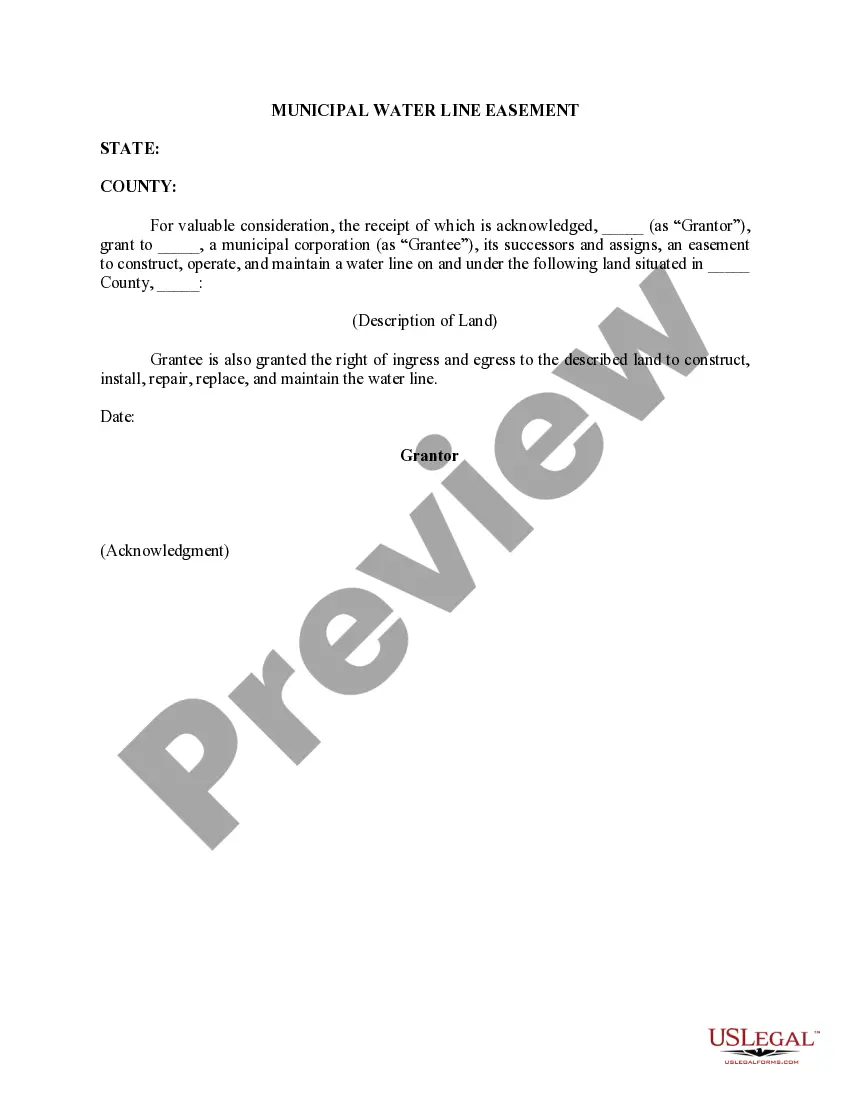

Description

How to fill out Shreveport Louisiana Pagaré A Plazos Con Devengo De Intereses?

Take advantage of the US Legal Forms and get immediate access to any form you need. Our beneficial platform with thousands of documents allows you to find and get almost any document sample you want. It is possible to download, fill, and sign the Shreveport Louisiana Installment Promissory Note with Interest Accruing in a couple of minutes instead of surfing the Net for hours searching for a proper template.

Using our catalog is a superb strategy to improve the safety of your record submissions. Our experienced lawyers regularly review all the records to make certain that the forms are appropriate for a particular region and compliant with new acts and regulations.

How can you get the Shreveport Louisiana Installment Promissory Note with Interest Accruing? If you have a profile, just log in to the account. The Download button will appear on all the documents you look at. Moreover, you can get all the previously saved documents in the My Forms menu.

If you don’t have an account yet, stick to the instructions listed below:

- Find the form you require. Ensure that it is the template you were hoping to find: check its headline and description, and make use of the Preview option if it is available. Otherwise, use the Search field to find the appropriate one.

- Launch the downloading procedure. Select Buy Now and choose the pricing plan you prefer. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Export the file. Select the format to get the Shreveport Louisiana Installment Promissory Note with Interest Accruing and change and fill, or sign it according to your requirements.

US Legal Forms is one of the most significant and trustworthy document libraries on the web. Our company is always ready to assist you in virtually any legal process, even if it is just downloading the Shreveport Louisiana Installment Promissory Note with Interest Accruing.

Feel free to take full advantage of our form catalog and make your document experience as convenient as possible!