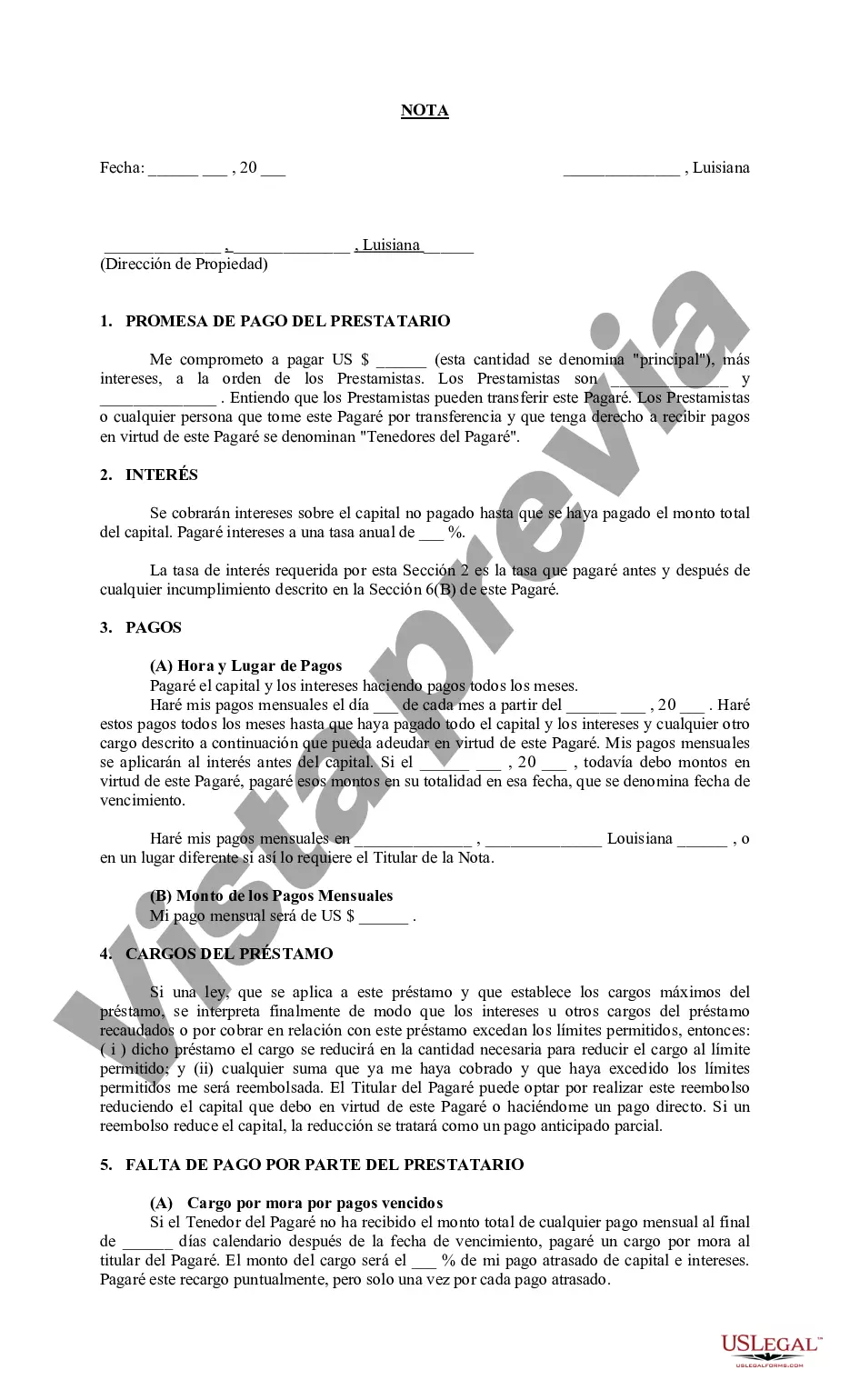

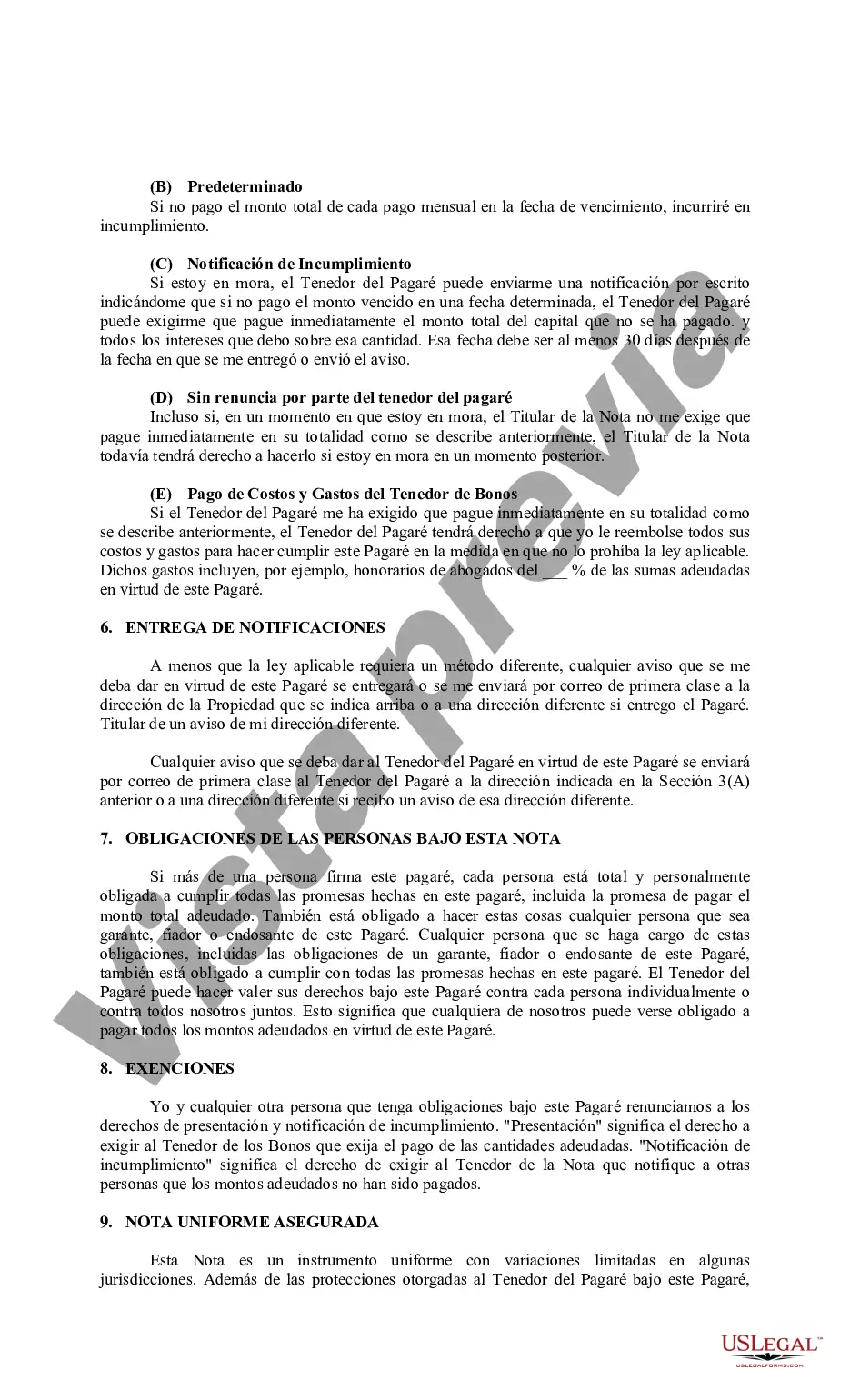

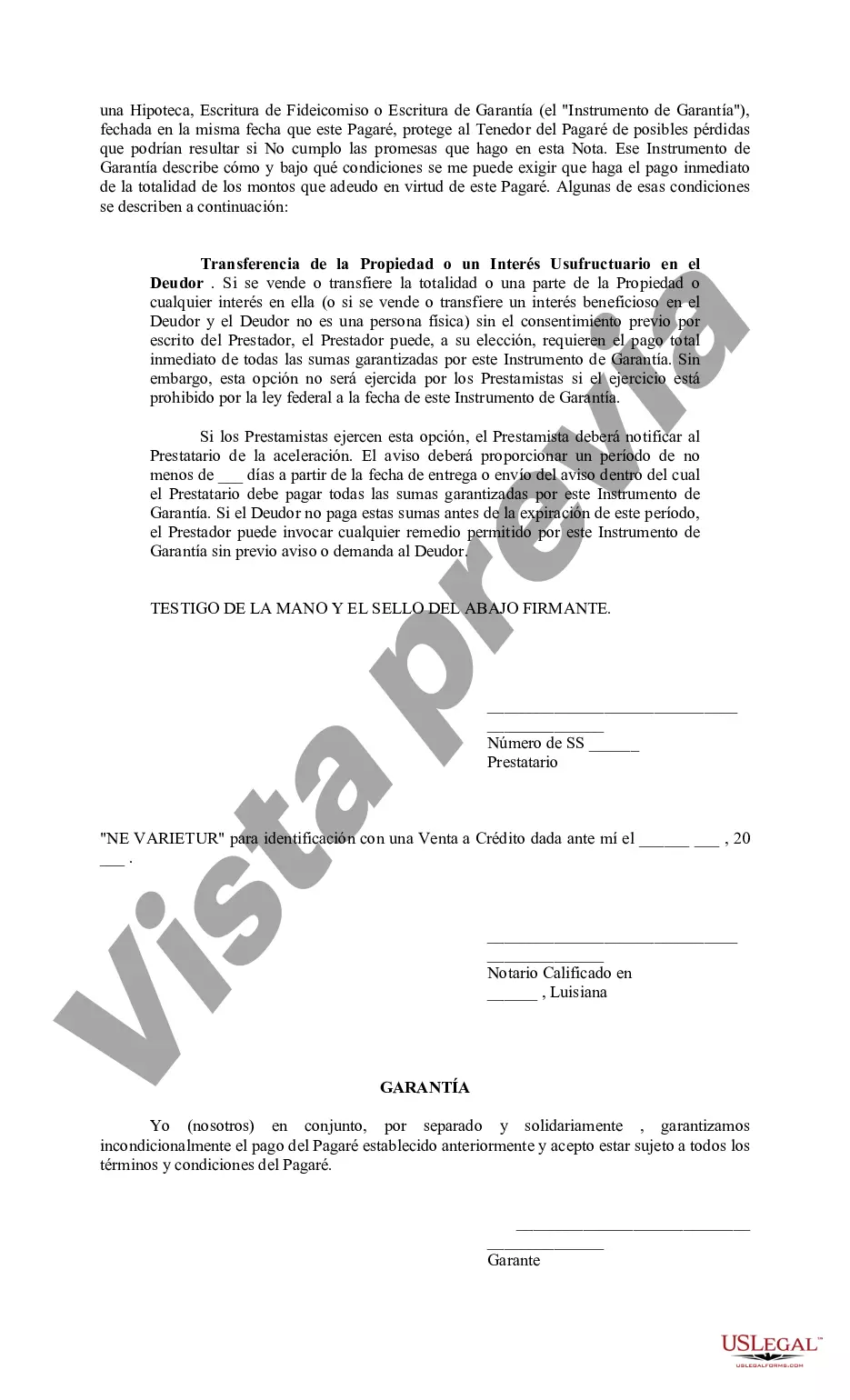

The Shreveport Louisiana Promissory Note is a legally binding document that outlines the terms and conditions of a loan agreement between two parties — the borrower and the lender. It serves as a written promise from the borrower to repay the lender a specific amount of money within a predetermined timeframe, typically with interest. In Shreveport, Louisiana, there are different types of Promissory Notes that cater to various loan scenarios and purposes. Some common types include: 1. Simple Promissory Note: This is the most basic form of a promissory note, stating the principal amount borrowed, the repayment schedule, and any applicable interest rate. 2. Secured Promissory Note: This type of promissory note includes collateral that the borrower pledges as security for the loan. If the borrower fails to repay the loan, the lender can claim the collateral. 3. Unsecured Promissory Note: Unlike the secured note, an unsecured promissory note does not require collateral. The lender relies solely on the borrower's creditworthiness to ensure repayment. 4. Demand Promissory Note: This note allows the lender to demand full repayment at any time, without specifying a fixed repayment schedule. It offers flexibility and convenience for both parties. 5. Installment Promissory Note: This note is utilized when the loan amount is repayable in regular installments over a specified period. It clearly outlines the amount and frequency of payments. 6. Balloon Promissory Note: A balloon note requires the borrower to make smaller regular payments throughout the loan term, with a final large payment, called the "balloon payment," due at the end. This note is useful when the borrower's cash flow is expected to improve significantly over time. Shreveport Louisiana Promissory Notes are essential financial instruments that protect the rights and obligations of lenders and borrowers. They should always be drafted with precision and reviewed by legal professionals to ensure compliance with applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Shreveport Louisiana Pagaré - Louisiana Promissory Note

Description

How to fill out Shreveport Louisiana Pagaré?

Locating verified templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms database.

It’s an online collection of over 85,000 legal documents for both personal and professional requirements and various real-world situations.

All the files are well organized by area of application and jurisdictional regions, making it as quick and straightforward as ABC to find the Shreveport Louisiana Promissory Note.

Maintaining documentation organized and in compliance with legal standards is extremely important. Leverage the US Legal Forms library to always have vital document templates for any needs at your fingertips!

- Examine the Preview mode and form description.

- Ensure you’ve selected the correct one that fulfills your needs and fully aligns with your local jurisdiction standards.

- Look for another template, if necessary.

- If you discover any discrepancies, utilize the Search tab above to locate the appropriate one.

- If it meets your requirements, proceed to the next step.

Form popularity

FAQ

To obtain your Shreveport Louisiana Promissory Note, you can start by visiting reliable legal platforms like USLegalForms. They offer a variety of templates tailored to your needs. Simply select the appropriate template, fill it out with your information, and customize it as necessary. Once completed, you can print or save the document for your records.

The Louisiana Supreme Court serves as the highest court in the state and has jurisdiction over significant legal matters. It primarily reviews cases from lower courts, ensuring the law is applied consistently. Understanding its jurisdiction is crucial if your case involving a Shreveport Louisiana Promissory Note escalates to this level.

In Louisiana, the limit for small claims court is generally set at $5,000. This court provides an efficient way to resolve certain disputes without extensive legal costs. If you are claiming an amount related to a Shreveport Louisiana Promissory Note, this court can be an effective platform for your case.

The UPC court, or Uniform Probate Code court, primarily deals with matters related to wills, estates, and guardianships. It is essential for cases involving probate issues. If your Shreveport Louisiana Promissory Note involves estate matters, you will likely need to consider the services offered by the UPC court.

City courts in Louisiana typically have jurisdiction over civil and criminal cases that occur within their city limits. These courts address small claims, misdemeanor offenses, and municipal violations. If your case involves a Shreveport Louisiana Promissory Note, knowing the jurisdictional boundaries of city courts can streamline your legal process.

To file a civil suit in Louisiana, you need to draft a petition and file it with the appropriate court. Make sure to include all relevant information regarding your case, such as details about the Shreveport Louisiana Promissory Note you’re dealing with. You may wish to consult uslegalforms to obtain templates and guidance through this process.

Local courts in Shreveport handle cases arising from local laws and ordinances. They have authority over various local civil issues, including small claims and traffic matters. If you have a Shreveport Louisiana Promissory Note issue, it may be worthwhile to review the local court's specific jurisdiction to prepare your filing.

The Shreveport City Court has jurisdiction over civil and criminal matters occurring within the city limits. This court often handles small claims, traffic violations, and misdemeanor cases. When dealing with a Shreveport Louisiana Promissory Note, understanding this jurisdiction can help you file your case accurately.

The requirements for a promissory note in Louisiana are straightforward yet vital. The document must clearly outline the amount owed, the interest rate, and repayment terms. Additionally, it should include signatures from both the borrower and lender to affirm their agreement. Familiarizing yourself with these requirements can prevent legal issues in Shreveport Louisiana.

In Louisiana, the statute of limitations for enforcing a promissory note is typically five years. This time frame begins from the date the payment was due. For residents in Shreveport Louisiana, understanding this timeline is crucial for both lenders and borrowers. This helps ensure that all obligations are fulfilled within the legal period.