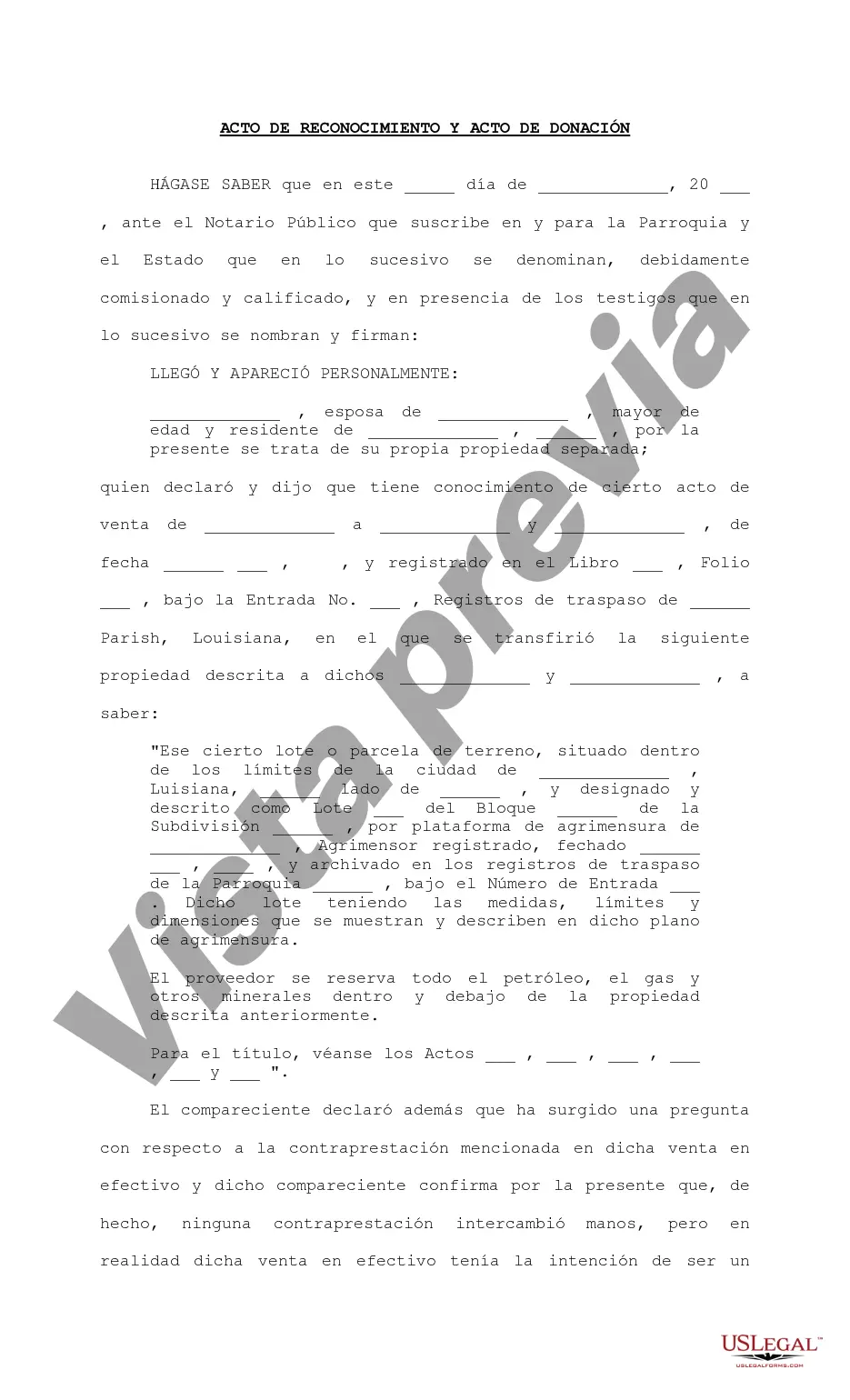

The Shreveport Louisiana Precognitive Act and Act of Donation are legal concepts that hold significant importance in the estate planning and property transfer processes. These acts outline the guidelines and procedures for recognizing and donating property, ensuring smooth transactions and proper distribution of assets. Let's delve into each act and understand its purpose and different types if applicable. The Shreveport Louisiana Precognitive Act is a state statute that governs the recognition of out-of-state acts, judgments, or legal proceedings in Shreveport, Louisiana. This act establishes the rules for acknowledging and validating foreign acts within the jurisdiction, allowing individuals to enforce their rights and obligations in Shreveport. It ensures that legal actions taken in other states are given proper weight and consideration by Louisiana courts. Under the Shreveport Louisiana Precognitive Act, individuals can enforce judgments, settlements, contracts, or other legal agreements that were previously issued or conducted outside of Louisiana. By recognizing these out-of-state acts, individuals can seek remedies, enforce contracts, or pursue financial claims in Shreveport, promoting a fair and consistent legal system. Moving on to the Act of Donation, this legal concept focuses on the transfer of property through voluntary donation or gifting. In Shreveport, Louisiana, an Act of Donation is a formal document outlining the intention of a donor to gift certain property or assets to a recipient, known as the done. This act ensures that the transfer is properly executed, documented, and legally recognized. The Act of Donation serves various purposes, including estate planning, tax optimization, and avoiding probate. Through this act, individuals can gift property during their lifetime, thus allowing them to control the distribution of their assets and potentially minimize tax liabilities. It also enables them to provide financial support or pass on property to loved ones, family members, charitable institutions, or other desired recipients. It should be noted that the Shreveport Louisiana Act of Donation may consist of several types, each having specific requirements and implications. These can include: 1. Donations Inter Vivos: Also known as "donations between the living," this type of Act of Donation involves transferring property while the donor is still alive. It requires the donor to fully relinquish ownership and control of the property to the recipient. 2. Donations Morris Cause: Commonly referred to as "donations in contemplation of death," this type entails transferring property with the condition that it will only take effect upon the donor's death. It is essentially a testamentary donation, allowing individuals to plan for the distribution of their assets after passing away. 3. Conditional Donations: In certain cases, donors may opt for conditional donations, where the transfer of property is contingent upon specific events or circumstances. These conditions must be clearly stipulated in the Act of Donation for it to be valid. 4. Revocable Donations: While most donations are considered irrevocable, in some instances, donors may create Act of Donation documents that grant them the ability to revoke or modify the gift under certain conditions. However, these documents must contain clear language outlining the revocable nature of the donation. In conclusion, the Shreveport Louisiana Precognitive Act and Act of Donation play crucial roles in ensuring legal recognition and orderly transfers of property. While the former deals with recognizing out-of-state acts, the latter focuses on facilitating voluntary gifting processes. Understanding the various types and implications of the Act of Donation can help individuals make informed decisions regarding their estate planning and asset distribution objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Shreveport Louisiana Acto de Reconocimiento y Acto de Donación - Louisiana Recognitive Act and Act of Donation

Description

How to fill out Shreveport Louisiana Acto De Reconocimiento Y Acto De Donación?

Getting verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Shreveport Louisiana Recognitive Act and Act of Donation becomes as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, getting the Shreveport Louisiana Recognitive Act and Act of Donation takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few more actions to make for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make certain you’ve chosen the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Shreveport Louisiana Recognitive Act and Act of Donation. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!