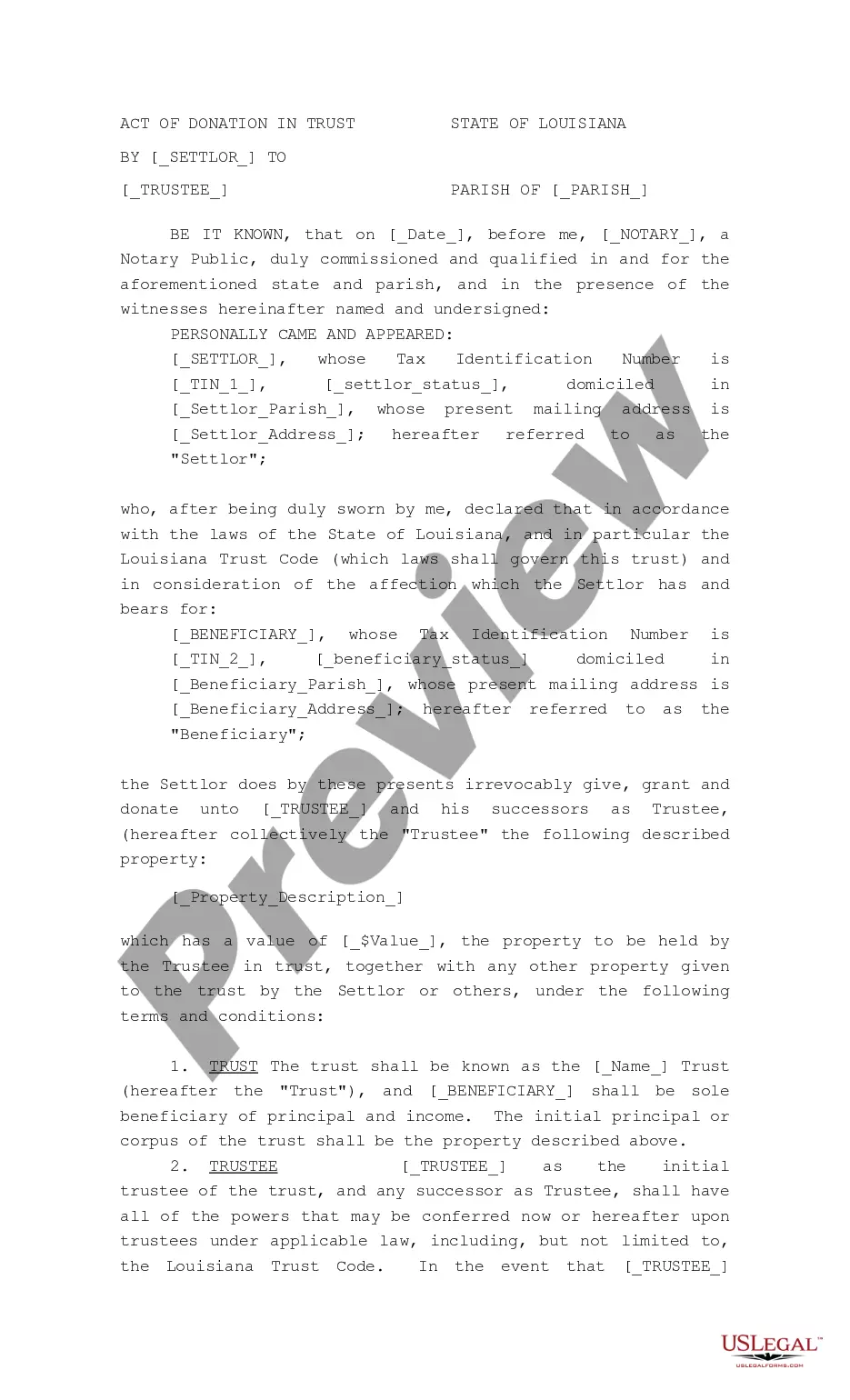

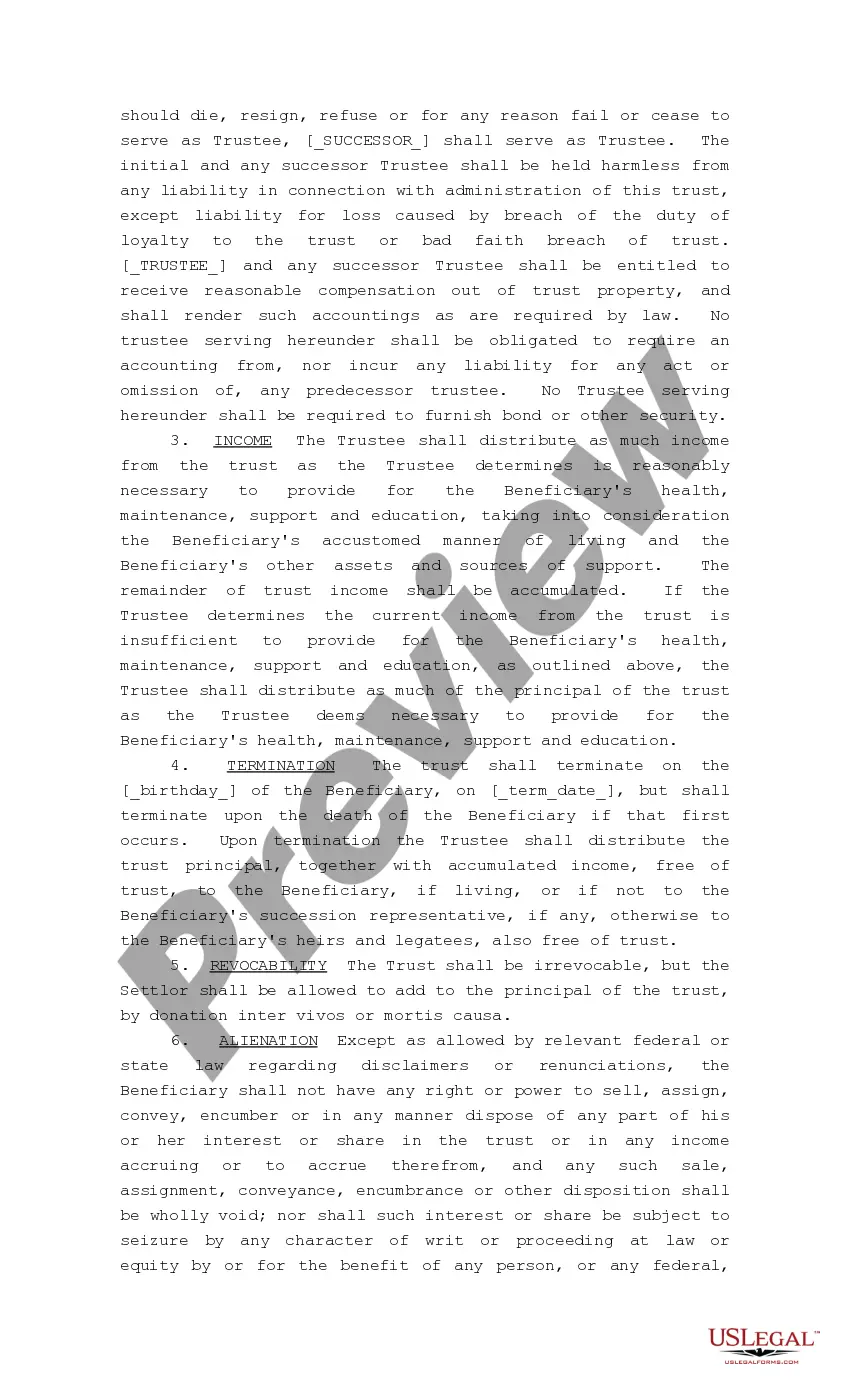

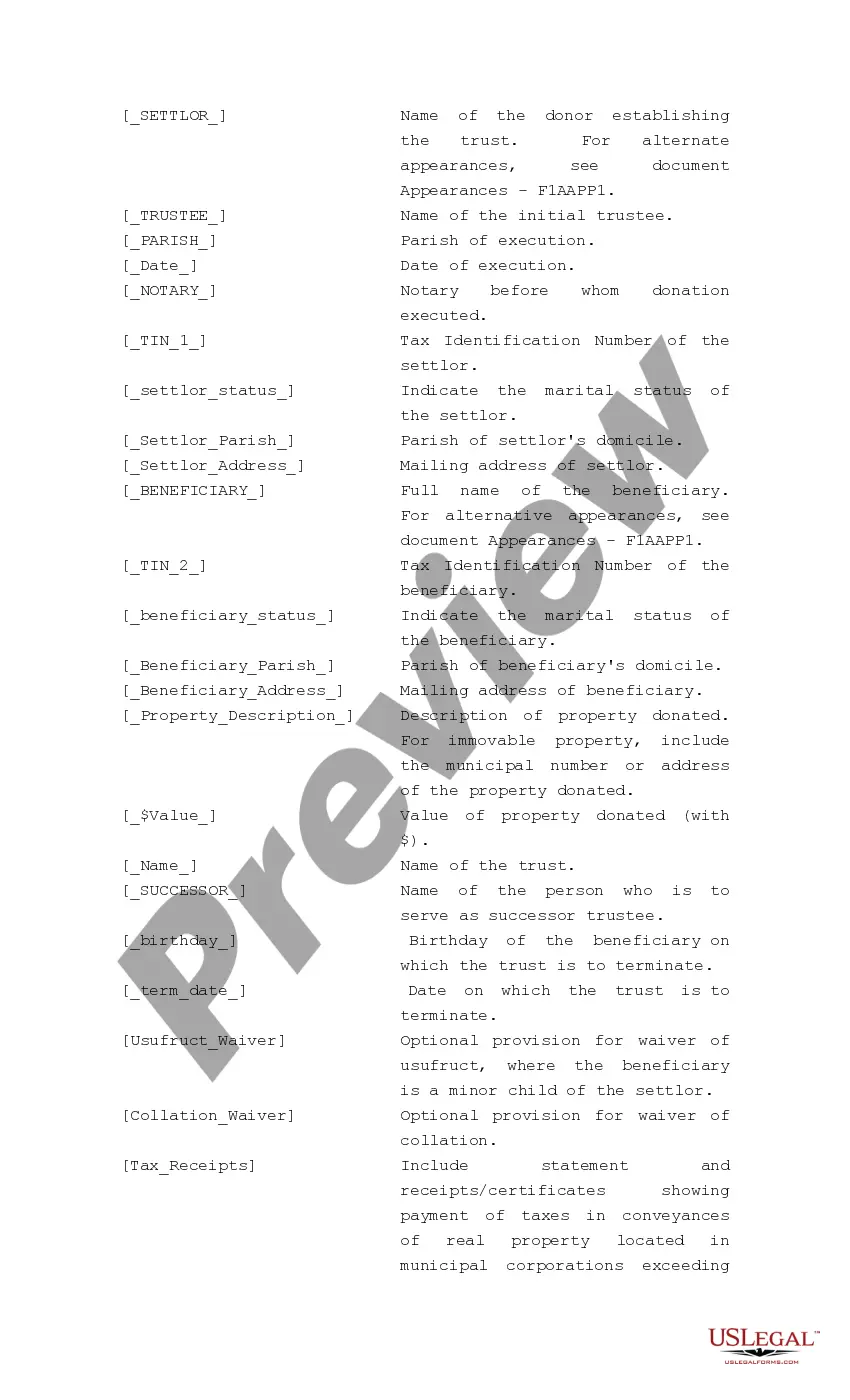

The Baton Rouge Louisiana Act of Donation in Trust by Settler to Trustee is a legally binding document that allows a person (the settler) to transfer ownership of their assets to a trustee for the benefit of one or more beneficiaries. This act creates a trust, which is a legal arrangement where the trustee holds and manages the assets on behalf of the beneficiaries. The Act of Donation in Trust is a comprehensive document that outlines the specific terms and conditions of the trust arrangement. It includes details such as: 1. Identifying Information: The act includes the full legal names and addresses of the settler, trustee, and beneficiaries. It is important to accurately identify all parties involved to ensure the validity of the trust. 2. Assets: The act specifies the assets being transferred to the trust. This can include real estate, cash, investments, personal property, or any other valuable item. Clarity and accuracy in listing the assets are essential to avoid any disputes in the future. 3. Purpose of the Trust: The act clearly states the purpose of the trust, which can be diverse. It could be for estate planning purposes, to provide for the education or care of minor children, or to ensure proper management of assets for future generations. 4. Powers and Duties of the Trustee: This section outlines the powers and duties of the trustee. It may include managing and investing assets, distributing income or principal to beneficiaries, and making decisions in the best interest of the trust. 5. Beneficiary Rights: The act defines the rights of the beneficiaries, including their entitlement to income or principal distributions and any conditions attached to those distributions. 6. Termination of the Trust: The act may include provisions for the termination of the trust under certain circumstances, such as the death of the settler, fulfillment of the trust's purpose, or the occurrence of a specific event. Different types of Baton Rouge Louisiana Acts of Donation in Trust by Settler to Trustee may include revocable trusts, irrevocable trusts, charitable trusts, special needs trusts, and more. Each type of trust serves specific purposes and has unique requirements as defined by Louisiana state laws. Legal advice from an attorney familiar with Louisiana trust laws is crucial in determining the most appropriate type of trust for individual circumstances. Overall, the Baton Rouge Louisiana Act of Donation in Trust by Settler to Trustee is a critical legal instrument that provides individuals with the ability to protect and manage their assets while ensuring the well-being of their beneficiaries. It is essential to consult an attorney with expertise in trust law to draft and execute this document accurately.

Baton Rouge Louisiana Act of Donation in Trust by Settlor to Trustee

Description

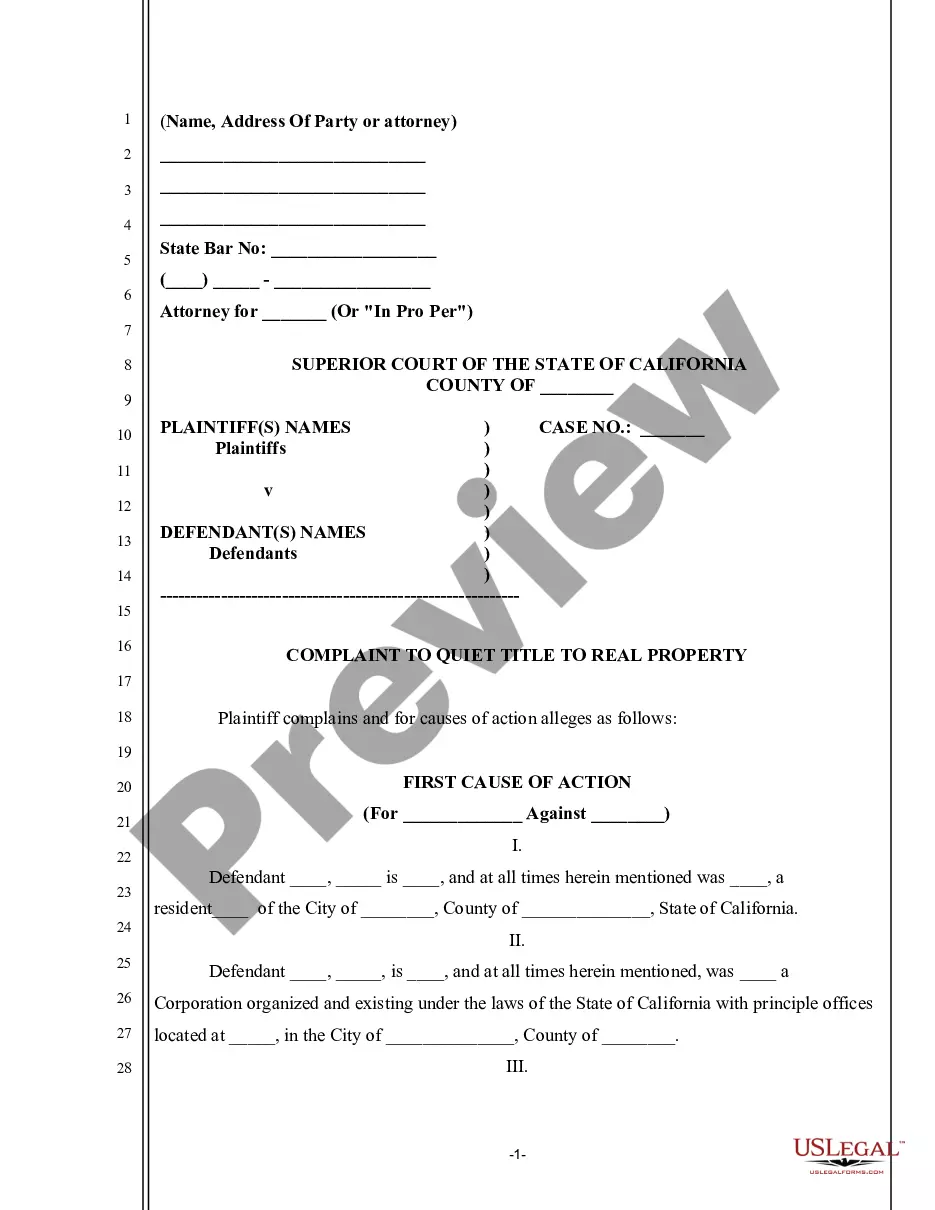

How to fill out Louisiana Act Of Donation In Trust By Settlor To Trustee?

Regardless of social or professional standing, completing law-related documents is a regrettable requirement in today’s society.

Frequently, it’s nearly impossible for someone without any legal experience to create such documents from scratch, primarily due to the complex terminology and legal nuances they involve.

This is where US Legal Forms proves to be useful.

Verify that the template you have found is tailored to your location, considering that the laws of one state or locality do not apply to another.

Preview the document and review a brief summary (if available) of situations the form can be utilized for.

- Our service provides an extensive collection of over 85,000 ready-to-use state-specific forms that cater to almost any legal circumstance.

- US Legal Forms is also a valuable resource for associates or legal advisors who wish to enhance their efficiency in terms of time by utilizing our DIY documents.

- Whether you require the Baton Rouge Louisiana Act of Donation in Trust from Settlor to Trustee or any other document that would be beneficial in your state or locality, with US Legal Forms, everything is readily available.

- Here’s how to obtain the Baton Rouge Louisiana Act of Donation in Trust from Settlor to Trustee in minutes using our reliable service.

- If you are already a customer, you can proceed to Log In to your account to acquire the necessary form.

- However, if you are new to our library, ensure to follow these steps before obtaining the Baton Rouge Louisiana Act of Donation in Trust from Settlor to Trustee.

Form popularity

FAQ

The three common types of trusts include revocable trusts, irrevocable trusts, and testamentary trusts. Each type has its own characteristics that affect how assets are handled under the Baton Rouge Louisiana Act of Donation in Trust by Settlor to Trustee. Understanding these differences can help you choose the right trust to meet your needs, so consider discussing this with a legal professional.

Whether a will or a trust is better for you in Louisiana depends on your specific situation and goals. Generally, a trust created under the Baton Rouge Louisiana Act of Donation in Trust by Settlor to Trustee allows for more control over asset distribution and can avoid probate. However, a will may be easier and less costly to create. Weigh these options carefully with a legal expert.

Setting up a trust fund in Louisiana requires careful planning and understanding of the Baton Rouge Louisiana Act of Donation in Trust by Settlor to Trustee. Begin by consulting an attorney who specializes in estate planning to create a tailored trust document. You’ll need to define the fund's purpose, choose a trustee, and establish the assets that will fund the trust.

In most cases, trustees have the authority to add beneficiaries to a trust, as long as it aligns with the terms of the Baton Rouge Louisiana Act of Donation in Trust by Settlor to Trustee. This flexibility can be beneficial as circumstances change over time. However, it's important to adhere to the trust guidelines and consult with legal professionals to ensure compliance.

Choosing the best bank for a trust account in Louisiana depends on your specific needs and the services you desire. Look for a bank with experience managing trust accounts and one that offers competitive fees. The Baton Rouge Louisiana Act of Donation in Trust by Settlor to Trustee can play a vital role, so ensure the bank understands trust management to meet your expectations.

Yes, an act of donation can generally be revoked in Louisiana, depending on the specific terms outlined in the Baton Rouge Louisiana Act of Donation in Trust by Settlor to Trustee. If the act has conditions for revocation, or if the donor has agreed to specific terms that allow for revocation, it can be undone. It's crucial to follow the legal protocols in place to ensure proper revocation.

In Louisiana, the Baton Rouge Louisiana Act of Donation in Trust by Settlor to Trustee generally does not require the trust to be recorded. However, it is advisable to document the trust and its terms in writing to establish clarity and prevent disputes. Additionally, some types of property may require separate handling, so consult a legal expert to understand your specific situation.

Dissolving a trust in Louisiana requires a few steps to ensure that everything is handled legally and appropriately. Begin by reviewing the trust document, particularly any provisions regarding termination. Once you confirm the terms, follow the protocols specified in the Baton Rouge Louisiana Act of Donation in Trust by Settlor to Trustee. It's often wise to consult legal professionals to guide you through this process, ensuring that assets are distributed as intended.

Determining whether a trust is better than a will in Louisiana often depends on your personal goals. The Baton Rouge Louisiana Act of Donation in Trust by Settlor to Trustee enables you to utilize a trust, which can provide quicker asset distribution, avoid probate, and maintain privacy about your estate's contents. Wills, while simple, undergo a public probate process. Thus, if privacy and efficiency are priorities for you, a trust could be the more beneficial option.

Transferring property into a living trust in Louisiana involves several straightforward steps. First, you need to create the trust document, incorporating the Baton Rouge Louisiana Act of Donation in Trust by Settlor to Trustee. Next, you'll formally retitle your property in the name of your trust, ensuring that it's legally recognized. This process helps avoid probate and facilitates the efficient management of your assets during your lifetime and after.